North America Online Gambling Market Size, Share, and COVID-19 Impact Analysis, By Type (Sports Betting, Casinos, Poker, Bingo, and Others), By Device (Desktop, Mobile, and Others), and North America Online Gambling Market Insights, Industry Trend, Forecasts to 2033.

Industry: Information & TechnologyNorth America Online Gambling Market Insights Forecasts to 2033

- The North America Online Gambling Market Size is expected to hold a significant share by 2023.

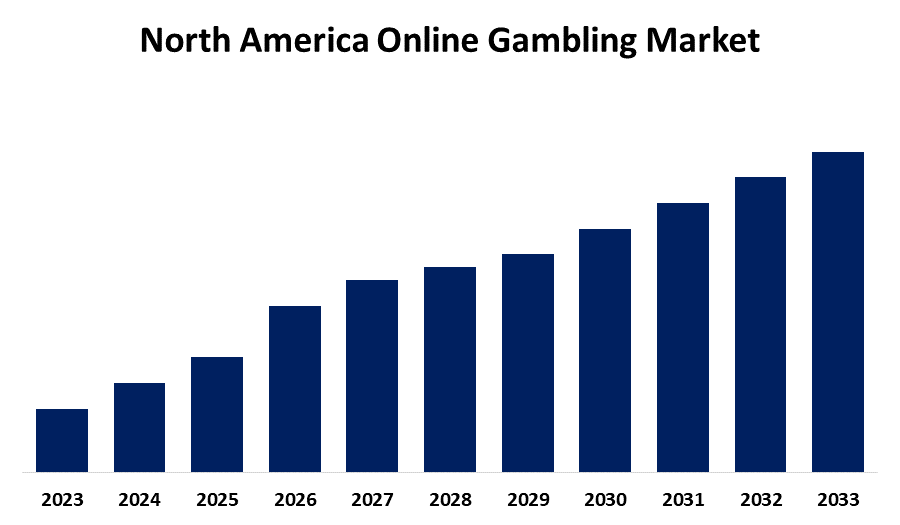

- The Market is Growing at a CAGR of 11.91% from 2023 to 2033

- The North America Online Gambling Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The North America Online Gambling Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 11.91% from 2023 to 2033.

Market Overview

Online gambling refers to gambling activities in which players wager something of value on an uncertain event or game in the hope of winning something else of value. These activities take place over the internet, with users participating via mobile devices, desktop computers, and others. The online gambling market encompasses a variety of internet-based gaming activities, including online casinos, sports betting, poker, and lotteries. This sector is defined by the digitization of traditional gambling operations, which use advanced technologies to provide users with immersive and accessible gaming experiences all over the world. The necessity of online gambling stems from its convenience and widespread availability, catering to a tech-savvy audience that values simplicity and variety. It integrates with mobile and web platforms, creating significant opportunities for app development and digital marketing. End-use scopes include not only individual consumers but also collaborations with sports leagues and entertainment companies looking to capitalize on this growing market. The current legislative framework for online betting in the United States allows only bookmakers licensed in Nevada, Pennsylvania, Delaware, and New Jersey to operate legally, as these are the four states that regulate online betting. Custom slot types are the most popular in the market because they allow for greater consumer innovation and personalization. Also, live casinos have grown in popularity in recent years because they feature a diverse range of live dealers and real-time feedback, which enhances the real-world casino experience.

Report Coverage

This research report categorizes for the North America online gambling market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America online gambling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America online gambling market.

North America Online Gambling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.91% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Device |

| Companies covered:: | 888 Holding PLC, DraftKings (Golden Nugget, MGM Resorts International (Borgata Hotel Casino & Spa), Flutter Entertainment PLC, Caesars Entertainment Corporation, Wild Casino, El Royale Casino, Slots Empire Casino, The Stars Group Inc, BoVegas, Cherry Gold Casino, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for cost-effective payment mechanisms is driving up investments in the online gambling market. Another important factor encouraging investments in online gambling is the introduction of virtual and augmented reality. There are numerous investment opportunities in the market, which has prompted professional players to invest in sports betting and the stocks of some of the most important online gambling companies. Several new entrants and investors are contacting stakeholders in the online gambling market, including operators, suppliers, regulators, and industry-specific legal/financial advisors. Continuous technological advancements are also helping to expand the market significantly. Commercial models such as virtual currency and social casinos, game formats, in-play sports betting, and mobile locations have all seen significant advancements. AI-based facial recognition software and cryptocurrency are attracting investment. Also, market players' growing use of Virtual Reality (VR) to provide real-life gaming experiences will have a positive impact on the market space.

Restraining Factors

Cybercriminals can also control the apps by releasing bogus versions containing malware. Nowadays, many casinos use standard 128-bit encryption and keep a remote backup of their customers' information. As a result, the data would be secure even if the site was subjected to a Denial-of-Service (DoS) attack.

Market Segmentation

The North America online gambling market share is classified into type and device

- The sports betting segment is expected to hold the largest market share through the forecast period.

The North America online gambling market is segmented by type into sports betting, casinos, poker, bingo, and others. Among these, the sports betting segment is expected to hold the largest market share through the forecast period. The increased popularity of sports betting gambling on games like rugby and soccer, combined with high internet penetration, has accelerated market growth. Partnerships between gambling software developers and private companies to create user-friendly UI gaming solutions have increased market share.

- The desktop segment is expected to dominate the North America online gambling market during the forecast period.

Based on the device, the North America online gambling market is divided into desktop, mobile, and others. Among these, the desktop segment is expected to dominate the North America online gambling market during the forecast period. The desktop provides a larger screen size than handheld devices and other devices, allowing gamblers to enjoy the game's details and graphics. Additionally, desktops' performance features, such as audio and image quality, as well as customizable storage capacity, improve the gaming experience. These factors have contributed to the expansion of the desktop-type segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America online gambling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 888 Holding PLC

- DraftKings (Golden Nugget

- MGM Resorts International (Borgata Hotel Casino & Spa)

- Flutter Entertainment PLC

- Caesars Entertainment Corporation

- Wild Casino

- El Royale Casino

- Slots Empire Casino

- The Stars Group Inc

- BoVegas

- Cherry Gold Casino

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, 888 Holdings purchased William Hill's non-US operations from Caesars Entertainment. William Hill is a well-known online gambling platform brand.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America online gambling market based on the below-mentioned segments:

North America Online Gambling Market, By Type

- Sports Betting

- Casinos

- Poker

- Bingo

- Others

North America Online Gambling Market, By Device

- Desktop

- Mobile

- Others

Need help to buy this report?