North America Opioids Market Size, Share, and COVID-19 Impact Analysis, By Product (Immediate Release (IR)/Short-Acting and Extended Release (ER)/Long-Acting), By Application (Anesthesia, Cough Suppression, and Pain Relief), and North America Opioids Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareNorth America Opioids Market Insights Forecasts to 2033

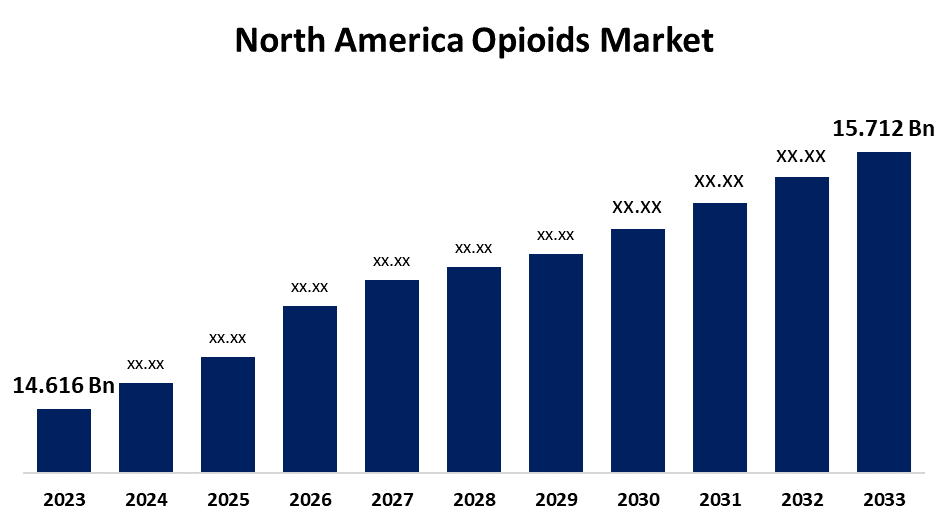

- The North America Opioids Market Size was valued at USD 14.616 Billion in 2023.

- The Market Size is Growing at a CAGR of 0.73% from 2023 to 2033

- The North America Opioids Market Size is Expected to Reach USD 15.712 Billion by 2033

Get more details on this report -

The North America Opioids Market is Anticipated to Reach USD 15.712 Billion by 2033, growing at a CAGR of 0.73% from 2023 to 2033. The market growth is driven by the increasing prevalence of chronic pain conditions such as lower back pain, gout, and arthritis, rising need for opioids for the management of post-surgical treatment pain, and increasing proportion of the geriatric population.

Market Overview

The North America opioids market encompasses the development, production, and commercialization of the opioid drugs that are used in the management of pain. Opioids are referred to as narcotic analgesics. Opioids are drugs that are derived from the opium poppy plant and used to alleviate moderate to severe pain. They block pain signals by binding to opioid receptors in the brain, spinal cord, and gastrointestinal tract. Some opioids may also be used for cough and diarrhea. These drugs are generally safe when taken short term and prescribed by a healthcare provider. Examples of opioids are morphine, codeine, oxycodone, hydrocodone, etc. The marketed products of the opioids are the Percocet, OxyContin, Palladone, Vicodin, etc.

The rising cases of chronic pain conditions among the United States population escalates the need for narcotic analgesics resulting the market growth. For instance, the data provided by the National Health Interview Survey (NHIS) states that chronic pain is the most prevalent condition among the U.S. population and it is reported that in 2023, 8.5% of adults had high-impact chronic pain, while 24.3% of adults experienced chronic pain overall. The prevalence of high-impact chronic pain (9.6%) and chronic pain (25.4%) was higher in women than in males (23.2% and 7.3%) respectively.

Opioids are most commonly used in pain relief and anesthesia. Strong drug pipelines with improved and efficacious drugs awaiting FDA approvals are expected to further enhance the adoption of opioid-based medications. Implementing measures to promote safer opioid use results in market expansion.

Report Coverage

This research report categorizes the North America opioids market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America opioids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America opioids market.

North America Opioids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.616 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 0.73% |

| 2033 Value Projection: | USD 15.712 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Sanofi, Pfizer Inc., Hikma Pharmaceuticals PLC, Janssen Global Services LLC, Teva Pharmaceuticals Industries, Mallinckrodt Pharmaceuticals, AbbVie Inc., Purdue Pharma L.P., Sun Pharmaceutical Industries Ltd., Endo Pharmaceuticals and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing geriatric population and the rising incidence of chronic pain diseases including arthritis, cancer, and lower back pain are driving the opioid market in North America. The increase in orthopedic disorders and surgical treatments has significantly raised the need for post-operative pain management. Major competitors and an increase in financial resources have contributed to market growth. Innovations in medication delivery system efficacy and safety have fueled market expansion.

Emphasis on palliative care for life-threatening illnesses, sports-related injuries, and workplace injuries has also driven demand. Increased healthcare spending and insurance coverage for pain management therapies support the growth of the opioid market in North America. Greater patient awareness and availability of opioid medications have also contributed to the demand.

Restraining Factors

The side effects associated with opioid drugs vomiting, nausea, and constipation restrict the growth of the market.

Market Segmentation

The North America opioids market share is classified into product and application.

- The extended-release (ER)/long-acting segment accounted for the largest market share of 49.84% in 2023 and is expected to grow at a significant CAGR during the forecast period.

The North America opioids market is segmented by product into the immediate-release (IR)/short-acting and extended-release (er)/long-acting. Among these, the extended-release (ER)/long-acting segment accounted for the largest market share of 49.84% in 2023 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is driven by higher safety, minimal side effects, rapid onset of action, ease of administration, robust drug development process, reduced risk of drug accumulation, enhanced patient compliance, improved patient quality of life, and increased blood drug concentration leading to greater efficacy, consistency in the drug plasma concentration, and prolonged therapeutic effect.

- The pain relief segment held the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period.

The North America opioids market is segmented by anesthesia, cough suppression, and pain relief. Among these, the pain relief segment held the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period. The segment growth is attributed to the increasing occurrence of post-surgical pain escalates the need for opioid drugs for the management of pain, the rising prevalence of orthopedic diseases such as rheumatoid arthritis, and osteoarthritis fuel the demand for narcotic analgesics for pain relief, and the increasing proportion of the geriatric population in North America escalates the need of opioids for the pain management occurred due to weaken muscle strengths.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America opioids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi

- Pfizer Inc.

- Hikma Pharmaceuticals PLC

- Janssen Global Services LLC

- Teva Pharmaceuticals Industries

- Mallinckrodt Pharmaceuticals

- AbbVie Inc.

- Purdue Pharma L.P.

- Sun Pharmaceutical Industries Ltd.

- Endo Pharmaceuticals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, Hikma Pharmaceuticals partnered with Emergent BioSolutions for the commercialization of KLOXXADO® naloxone HCl nasal spray 8 mg in the U.S. and Canada. KLOXXADO®, approved by the FDA, is used for emergency treatment of opioid overdose in adults and pediatrics. Emergent distributes NARCAN® Nasal Spray 4 mg, the first FDA-approved over-the-counter naloxone product for opioid overdose emergency treatment.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the North America opioids market based on the below-mentioned segments:

North America Opioids Market, By Product

- Immediate Release (IR)/Short-Acting

- Extended Release (ER)/Long-Acting

North America Opioids Market, By Application

- Anesthesia

- Cough Suppression

- Pain Relief

Need help to buy this report?