North America Osteoporosis Treatment Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Bisphosphonate, Hormone Replacement Therapy, Selective Estrogen Receptor Modulator (SERMs), RANK ligand (RANKL) Inhibitor, and Others), By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Stores, and Online Pharmacies), By Country (United States, Canada, Mexico, and Rest of North America) and North America Osteoporosis Treatment Market Insights, Industry Trend, Forecasts to 2032.

Industry: HealthcareNorth America Osteoporosis Treatment Market Insights Forecasts to 2032

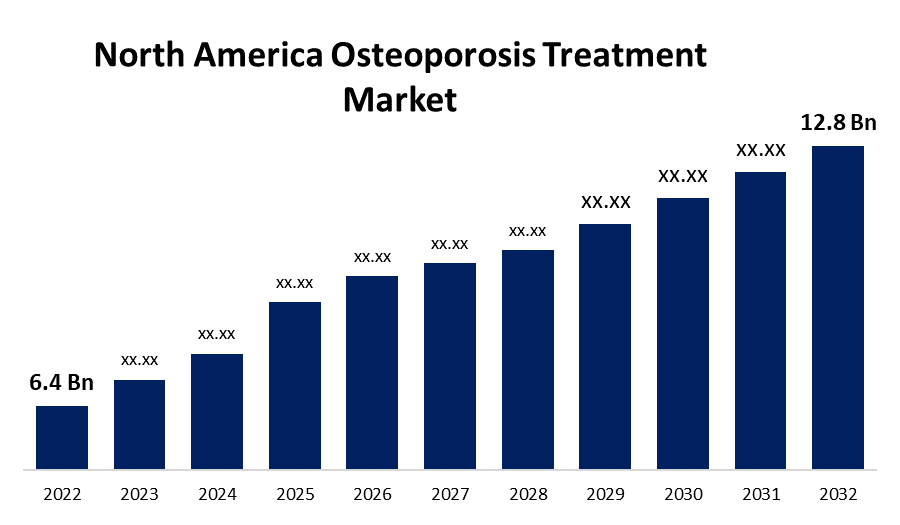

- The North America Osteoporosis Treatment Market Size was valued at USD 6.4 Billion in 2022.

- The Market is Growing at a CAGR of 7.1% from 2022 to 2032.

- The North America Osteoporosis Treatment Market size is expected to reach USD 12.8 Billion by 2032.

Get more details on this report -

The North America Osteoporosis Treatment Market Size was valued at USD 6.4 Billion in 2022 to USD 12.8 Billion by 2032 at a CAGR of 7.1% during the forecast period (2022-2032).

Market Overview

Osteoporosis is a medical disorder that develops when bone synthesis is halted and, if left untreated, leads to fractures. This disorder causes bones to weaken and lose density, making them fragile. In the aged population, particularly in women, low bone density is prevalent. For instance, the population over 65 in the U.S. has climbed by more than 13.7 million people in the past ten years, according to data from the U.S. Census Bureau. Osteoporosis is becoming more common due to the aging population. This has prompted several market participants in the sector to create a patient treatment plan that is both affordable and effective. The demand for advanced and new medicines is anticipated to be influenced by the growing public awareness of cutting-edge treatments like hormone therapy for osteoporosis, which is expected to drive the market's expansion throughout the projected period. The U.S. FDA has approved these medications as a result of well-established clinical research showing the effectiveness of new pharmaceuticals for the treatment of osteoporosis. During the projected period, this is anticipated to fuel the uptake and demand for these medications.

Report Coverage

This research report categorizes the market of the North America osteoporosis treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America osteoporosis treatment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America osteoporosis treatment market.

North America Osteoporosis Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 6.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.1% |

| 2032 Value Projection: | USD 12.8 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Drug Class, By Route of Administration, By Distribution Channel, By Country, and COVID-19 Impact Analysis |

| Companies covered:: | AbbVie Inc., Eli Lilly and Company, Amgen Inc., F. Hoffmann-La Roche Ltd, Novartis AG, Sanofi, Pfizer Inc., Merck & Co., Inc., GlaxoSmithKline plc, Alcon |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

It is projected that the need for effective therapy would rise as the number of patients rises. Consequently, the market for osteoporosis treatments in North America is going to grow faster than expected through the forecast period. The simultaneous deployment of technologically improved therapeutics by important players is anticipated to increase demand for new medications. Also, In the U.S. and Canada, cases of osteoporosis have significantly increased in recent years due to the growing elderly population, which has resulted in an increase in osteoporosis cases among people of all ages, which is one of the main causes of osteoporosis. It has been found that older people have a higher chance of developing osteoporosis than the general population.

Restraining Factors

The risks and negative effects of osteoporosis therapy. Leg cramps, diarrhea, vomiting, hot flushes, and other medical issues restrict market expansion. Additional issues limiting market expansion include restricted reimbursement practices and expensive treatment prices. Additionally, the launch of alternative medicines for treating osteoporosis by other market participants may impede market expansion shortly.

Market Segment

- In 2022, the RANK ligand (RANKL) inhibitor segment is dominating the market with a higher growth rate during the forecast period

Based on the drug class, the North America osteoporosis treatment market is segmented into bisphosphonate, hormone replacement therapy, selective estrogen receptor modulator (SERMs), RANK ligand (RANKL) inhibitor, and others. Among these, the RANK ligand (RANKL) inhibitor segment is expected to have a higher market share value over the forecast period, owing to the increasing use of RANK ligand (RANKL) inhibitors to treat osteoporosis in the U.S. and the increased prevalence of osteoporosis. Furthermore, due to the rising popularity of hormone replacement treatment and new introductions of products associated with the therapy, the market for this therapy is expected to experience significant expansion.

- In 2022, the parenteral segment is leading the largest market share over the forecast period.

On the basis of the route of administration, the North America osteoporosis treatment market is segmented into oral and parenteral. Among these, the parenteral segment held the largest market share over the forecast period owing to an increase in R&D by market participants, which has resulted in the development of novel medications and clinically validated parenteral drug efficacy in treating osteoporosis. Moreover, a relatively smaller percentage of the market was made up of the oral sector. But among the factors that are anticipated to favorably impact the segment's growth are the rising patient population in the U.S., the growing use of bisphosphonate medications to treat osteoporosis, and the affordability of oral medications in comparison to parent therapeutics.

- In 2022, the hospital pharmacies segment is influencing the largest market share over the forecast period.

Based on the distribution channel, the North America osteoporosis treatment market is divided into hospital pharmacies, retail pharmacies & stores, and online pharmacies. Among these, the hospital pharmacies segment influences the largest market share during the forecast period due to one of the main drivers of the growth of this market is the rising number of hospital inpatient admissions for the treatment of osteoporosis. This is responsible for the rising demand for new and innovative pharmaceuticals from hospital pharmacies. Moreover, considering the rising number of giants of e-commerce joining this market in the U.S., it is predicted that the online pharmacies segment will rise at a rapid rate and new internet pharmacies opening up in increasing numbers,

The United States segment is dominating the largest market growth over the projection period

Based on the country, the North America handbag market is classified into the United States, Canada, Mexico, and the Rest of North America. Among these, the United States segment holds the largest market growth during the forecast period, because the factors like rising osteoporosis prevalence, increased awareness of the availability of treatment options, and the presence of significant players in the region. The Centers for Disease Control and Prevention (CDC) estimate that around 5.1% of males in the United States over 65 have femoral and cervical osteoporosis. Furthermore, hip osteoporosis affects more than 10 million Americans over the age of 50.

Canada is expected to have a sizable market share during the forecast period owing to the rising incidence of osteoporosis, the expanding healthcare industry, and the growing number of government programs to combat the disease are all responsible for this expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America osteoporosis treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Eli Lilly and Company

- Amgen Inc.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Sanofi

- Pfizer Inc.

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Alcon

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2020, in a survey on the management of osteoporosis with oral parathyroid hormone (PTH), Entera Bio Ltd. reported encouraging findings. The survey's findings indicate that many practitioners will likely advocate for PTH use shortly.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the North America Osteoporosis Treatment Market based on the below-mentioned segments:

North America Osteoporosis Treatment Market, By Drug Class

- Bisphosphonate

- Hormone Replacement Therapy

- Selective Estrogen Receptor Modulator (SERMs)

- RANK ligand (RANKL) Inhibitor

- Others

North America Osteoporosis Treatment Market, By Route of Administration

- Oral

- Parenteral

North America Osteoporosis Treatment Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies & Stores

- Online Pharmacies

North America Osteoporosis Treatment Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?