North America Railway Automated Inspection Equipment Market Size, Share, and COVID-19 Impact Analysis, By Inspection System (Rail Profile Measurement System, Track Geometry Measurement System, Third-Rail Measurement System, Others), By Offering (Solution or Equipment, Services), By Inspection Vehicle (Hi-rail Vehicles, Self-propelled Vehicle, Towed Coaches), By Country (United States, Canada, Mexico, Rest of North America), and North America Railway Automated Inspection Equipment Market Insights Forecasts to 2032

Industry: Machinery & EquipmentNorth America Railway Automated Inspection Equipment Market Insights Forecasts to 2032

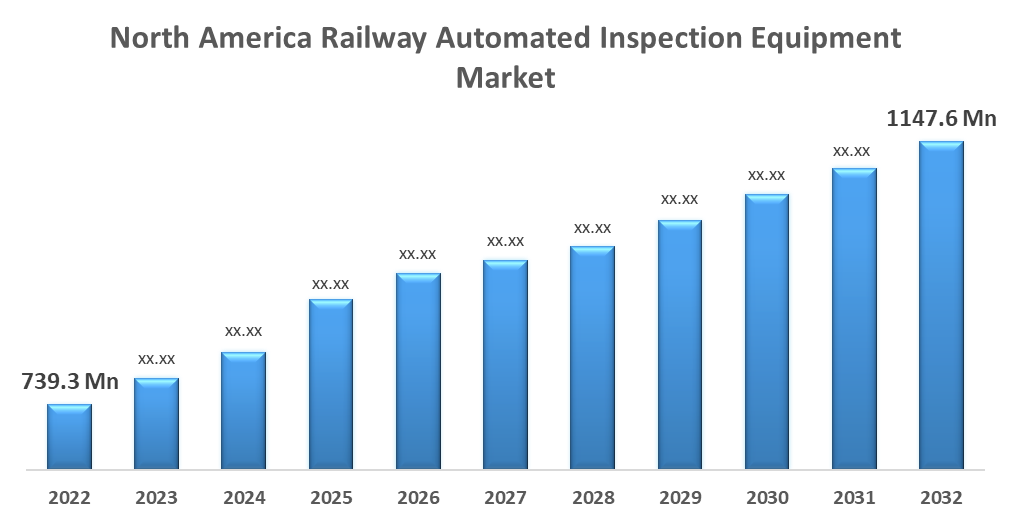

- The North America Railway Automated Inspection Equipment Market Size was valued at USD 739.3 Million in 2022.

- The Market Size is growing at a CAGR of 4.50% from 2022 to 2032.

- The North America Railway Automated Inspection Equipment Market Size is expected to reach USD 1147.6 Million by 2032.

Get more details on this report -

The North America Railway Automated Inspection Equipment Market Size is expected to reach USD 1147.6 million by 2032, at a CAGR of 4.50% during the forecast period 2022 to 2032.

Market Overview

While the train passes through the system, the Assess software module records images of it. The system records all required images for all required components automatically. Analytics detection software analyzes and displays the results of the recordings. Consumer increased concern for railroad & maintenance activities is forecast to act as a key driver of the market. The factors such as the growing invasion of autonomous technology and skilled workforce to operate the railway inspection equipment. North America invests in the modernization of its railway infrastructure to enhance efficiency and capacity, such factors drive demand for railway automated inspection equipment, as it plays a vital role in assessing the condition of the existing infrastructure. Furthermore, drones are used to monitor vital railway infrastructures such as high-voltage power lines, railway catenary lines, and even tracks and switching points. With the help of drone technology, extensive drone imagery is obtained to quickly magnify the process of defect detection, crack detection, and other dangers. The greater the frequency of inspections, the greater the railway security, dependability, and scheduled performance. Higher productivity would, in turn, reduce expenses and increase overall industry productivity, such factors boost the market growth during forecast period.

Report Coverage

This research report categorizes the market for North America railway automated inspection equipment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North American railway automated inspection equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America railway automated inspection equipment market.

North America Railway Automated Inspection Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 739.3 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.50% |

| 2032 Value Projection: | USD 1147.6 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Inspection System, By Inspection System, By Offering, By Country |

| Companies covered:: | Ensco inc, Geismar Corporation, Nordco, Inc., Pavemetrics Systems, Sperry Rail Inc, Loram Maintenance of Way, Inc., Holland LP, Harsco Corporation and Other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the railway automated inspection equipment market is expected to be driven by an increase in demand for passenger and freight capacity, as well as an increase in the number of railway projects across North America. Furthermore, an increase in concern for railroad inspection and maintenance activities is expected to be a key market driver. However, strategic partnerships with rail operators to gain a competitive advantage and technological innovation in railway transportation are expected to provide market participants with lucrative growth opportunities. Moreover, advanced inspection technologies like AI-powered inspection systems are becoming highly developed for enabling rail operations. This automated inspection equipment ensures safety regulations and ensures safety regulations, minimizes the risk of accidents & enhances overall rail network safety.

Restraining Factors

Factors such as the increasing penetration of autonomous inspection technology and the need for skilled labour to operate inspection equipment limit market growth.

Market Segment

- In 2022, the track geometry measurement systems segment accounted for the largest revenue share over the forecast period.

Based on the inspection system, the North America railway automated inspection equipment market is segmented into rail profile measurement systems, track geometry measurement systems, third-rail measurement systems, and others. Among these, the track geometry measurement systems segment has the largest revenue share over the forecast period. Track geometry measurement is the most important method for assessing track safety and planning maintenance in the rail industry. Regularly measuring and analyzing track geometry has been shown to prevent track-related derailments, which can cause catastrophic damage.

- In 2022, the services segment accounted for the largest revenue share over the forecast period.

Based on offering, the North America railway automated inspection equipment market is segmented into solutions or equipment, and services. Among these, the services segment has the largest revenue share over the forecast period. Services offering regular inspection of railways are an important factor for safety concerns about passengers. Also, regular inspections will be done by these services.

- In 2022, the self-propelled vehicles segment is expected to hold the largest share of the North America railway automated inspection equipment market during the forecast period.

Based on the inspection vehicle, the North America railway automated inspection equipment market is classified into Hi-rail vehicles, self-propelled vehicles, and towed coaches. Among these, the self-propelled vehicles segment is expected to hold the largest share of the North America railway automated inspection equipment market during the forecast period. Self-propelled vehicles are computer-controlled motor units that are used in a variety of applications for material handling and transportation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America railway automated inspection equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ensco inc

- Geismar Corporation

- Nordco, Inc.

- Pavemetrics Systems

- Sperry Rail Inc

- Loram Maintenance of Way, Inc.

- Holland LP

- Harsco Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America railway automated inspection equipment market based on the below-mentioned segments:

North America Railway Automated Inspection Equipment Market, By Inspection Type

- Rail Profile Measurement System

- Track Geometry Measurement System

- Third-Rail Measurement System

- Others

North America Railway Automated Inspection Equipment Market, By Offering

- Solution or Equipment

- Services

North America Railway Automated Inspection Equipment Market, By Inspection Vehicle

- Hi-rail Vehicles

- Self-propelled Vehicle

- Towed Coaches

North America Railway Automated Inspection Equipment Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?