North America Security and Vulnerability Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services), By Type (Cloud Security and Network Security), and North America Security and Vulnerability Management Market Insights, Industry Trend, Forecasts to 2033

Industry: Electronics, ICT & MediaNorth America Security and Vulnerability Management Market Insights Forecasts to 2033

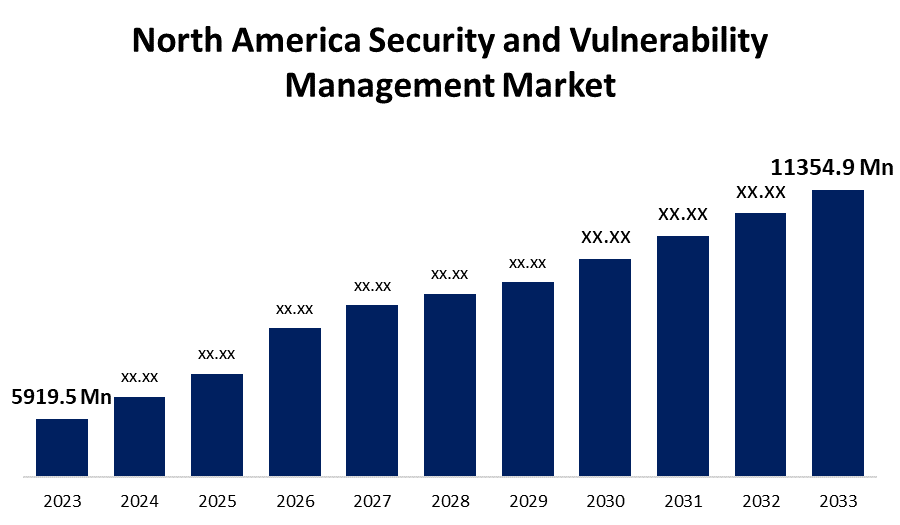

- North America Security and Vulnerability Management Market Size was valued at USD 5,919.5 Million in 2023.

- The Market is growing at a CAGR of 6.73% from 2023 to 2033

- North America Security and Vulnerability Management Market Size is expected to reach USD 11,354.9 Million by 2033

Get more details on this report -

North America Security and Vulnerability Management Market is anticipated to exceed USD 11,354.9 Million by 2033, growing at a CAGR of 6.73% from 2023 to 2033.

Market Overview

The North America security and vulnerability management market encompasses solutions, technologies, and services designed to identify, assess, and mitigate security risks across digital and physical infrastructures. These solutions play a crucial role in protecting organizations from cyber threats, data breaches, and compliance violations by providing real-time risk assessment, threat intelligence, and automated remediation. The increasing adoption of cloud computing, Internet of Things (IoT) devices, and artificial intelligence (AI) in cybersecurity has further enhanced the efficiency and effectiveness of security and vulnerability management systems. The market is driven by the rising frequency and sophistication of cyberattacks, prompting organizations to invest in robust security frameworks. The expansion of digital transformation initiatives, remote work adoption, and stringent regulatory requirements have further accelerated market growth. Additionally, the proliferation of endpoint devices and the growing adoption of zero-trust security models are contributing to the demand for advanced vulnerability management solutions. Government initiatives play a critical role in shaping the market. Regulatory frameworks such as the Cybersecurity Information Sharing Act (CISA) and industry-specific compliance standards mandate stringent security measures. Federal investments in cybersecurity infrastructure, public-private partnerships, and funding programs for threat intelligence and risk management further support market expansion across the region.

Report Coverage

This research report categorizes the North America security and vulnerability management market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the North America security and vulnerability management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America security and vulnerability management market.

North America Security and Vulnerability Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5,919.5 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | CAGR of 6.73% |

| 023 – 2033 Value Projection: | USD 11,354.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Type |

| Companies covered:: | AT&T Intellectual Property. CrowdStrike Cisco Systems, Inc. Fortra, LLC IMB Corporation Microsoft Qualys, Inc. Rapid7 RSI Security. Tenable, Inc. Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North America security and vulnerability management market is driven by the increasing frequency and sophistication of cyber threats, compelling organizations to strengthen their security posture. The rapid adoption of cloud computing, Internet of Things (IoT) devices, and remote work models has expanded the attack surface, necessitating advanced vulnerability management solutions. Stringent regulatory frameworks, including data protection laws and industry-specific compliance standards, are further driving market demand. The growing implementation of artificial intelligence (AI) and machine learning (ML) in cybersecurity enhances threat detection and response capabilities. Additionally, rising investments in cybersecurity infrastructure and the adoption of zero-trust security frameworks are fueling market growth.

Restraining Factors

The market faces challenges due to the high costs of advanced security solutions, complexity in managing diverse IT environments, shortage of skilled cybersecurity professionals, and difficulties in integrating security solutions with existing systems.

Market segmentation

The North America security and vulnerability management market share is classified into components and types.

- The software segment is expected to hold the largest market share through the forecast period.

The North America security and vulnerability management market is segmented by component into software and services. Among these, the software segment is expected to hold the largest market share through the forecast period. The increasing adoption of advanced security solutions, automated threat detection, and real-time risk assessment is driving demand for software-based vulnerability management tools. Organizations are prioritizing cloud-based security platforms, endpoint protection software, and AI-driven threat intelligence solutions to enhance their cybersecurity posture.

- The cloud security segment is expected to hold the largest market share through the forecast period.

The North America security and vulnerability management market is segmented by type into cloud security and network security. Among these, the cloud security segment is expected to hold the largest market share through the forecast period. The increasing adoption of cloud computing, hybrid work models, and Software-as-a-Service (SaaS) applications has heightened the demand for robust cloud security solutions. Organizations are prioritizing cloud-based threat detection, identity and access management (IAM), and encryption technologies to protect sensitive data from cyber threats.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America security and vulnerability management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ATandT Intellectual Property.

- CrowdStrike

- Cisco Systems, Inc.

- Fortra, LLC

- IMB Corporation

- Microsoft

- Qualys, Inc.

- Rapid7

- RSI Security.

- Tenable, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America security and vulnerability management market based on the below-mentioned segments:

North America Security and Vulnerability Management Market, By Component

- Software

- Services

North America Security and Vulnerability Management Market, By Type

- Cloud Security

- Network Security

Need help to buy this report?