North America SGLT2 Inhibitors Market Size, Share, and COVID-19 Impact Analysis, By Drugs (Invokana (Canagliflozin), Farxiga (Dapagliflozin), Qtern (Saxagliptin/Dapagliflozin), Inpefa (Sotagliflozin), Jardiance (Empagliflozin), and Others), By Indications (Chronic Kidney Disease (CKD), Type-II Diabetes Mellitus, Cardiovascular Disease, and Others), and North America SGLT2 Inhibitors Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareNorth America SGLT2 Inhibitors Market Insights Forecasts to 2033

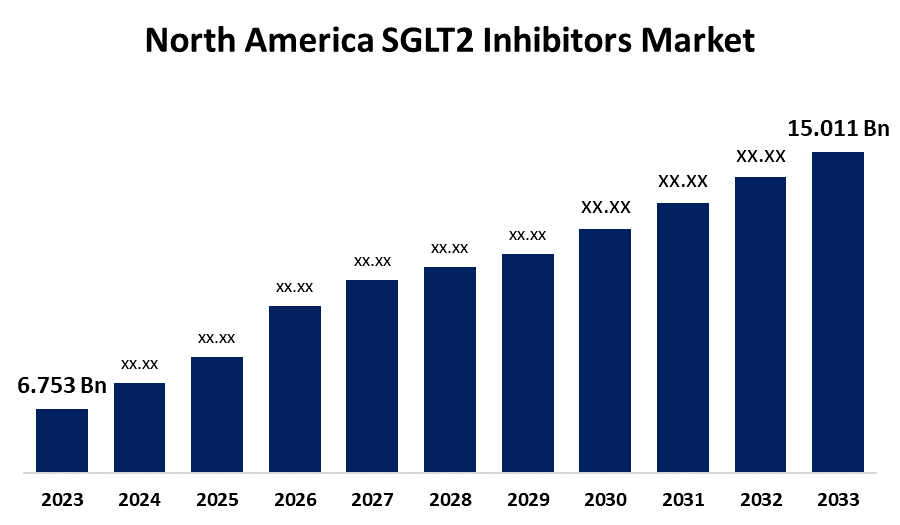

- The North America SGLT2 Inhibitors Market Size was valued at USD 6.753 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.32% from 2023 to 2033

- The North America SGLT2 Inhibitors Market Size is expected to reach USD 15.011 Billion by 2033

Get more details on this report -

The North America SGLT2 Inhibitors Market is predicted to reach USD 15.011 billion by 2033, growing at a CAGR of 8.32% from 2023 to 2033

Market Overview

The market of sodium-glucose cotransporter-2 (SGLT2) inhibitors comprises the development, production, and commercialization of SGLT2 inhibitor medications used to manage type II diabetes mellitus. SGLT2 inhibitors are the anti-diabetic class of drugs that lower the blood glucose level by inhibiting the glucose reabsorption in the kidney and alleviates the urinary glucose excretion. Examples of SGLT2 inhibitors are canagliflozin, Empagliflozin, Dapagliflozin, Bexagliflozin, etc. Canagliflozin, the first SGLT-2 inhibitor approved by the FDA, is used in adult patients with type 2 diabetes to improve blood glucose control, reduce cardiovascular adverse events, and minimize end-stage renal disease, CV mortality, heart failure hospitalization, and albuminuria in diabetic nephropathy patients, in addition to diet and exercise. The marketed products of the SGLT2 inhibitors are Jardiance, forxiga, xigduo, OXRA, Remo-Zen, etc.

Several government initiatives are establishing the diabetes control program, which accelerates the need for oral hypoglycaemic medications for the management of diabetes, resulting in market growth. For instance, the Centers for Disease Control and Prevention (CDC), a federal agency of the United States Government, launched the National Diabetes Prevention Program (National DPP). The National Diabetes Prevention Program (NDPP) aims to mitigate the rise of prediabetes and type 2 diabetes in the US. It combines public and private organizations, with support from the American Medical Association, to offer evidence-based, cost-effective interventions. A key component is the lifestyle change program, which emphasizes healthy eating and increased physical activity. The AMA supports the program, raising awareness and promoting its benefits.

The increasing prevalence of diabetes among the American population escalates the demand for anti-diabetic medications, which drives the market expansion. For instance, the data provided by the National Institute of Diabetes and Digestive and Kidney Diseases reported that in 2021, 11.6% of the population had diabetes, with 38.4 million people affected, including 38.1 million adults aged 18 and older. Of these, 8.7 million had diabetes but were undiagnosed, accounting for 22.8% of adults with the condition.

SGLT2 inhibitors were initially developed to treat hyperglycaemia in type 2 diabetes patients; researchers’ focus has now shifted to their cardiovascular and kidney protective effects. Cardiovascular outcome trials have shown that SGLT2 inhibitors can reduce chronic kidney disease progression in type 2 diabetes mellitus patients. Randomized controlled trials have investigated their safety and efficacy in CKD patients. In 2020, canagliflozin was approved by the FDA to reduce end-stage kidney disease risk, cardiovascular death, and hospitalization in adults with type 2 diabetes mellitus and diabetic kidney disease with albuminuria.

The rising incidence of chronic kidney disease (CKD) among North Americans is driving the market growth. For example, kidney disease affects 35.5 million Americans, with 815,000 living with kidney failure and 555,000 on dialysis. The disease is growing rapidly, affecting 14% of American adults, with people of color at higher risk. In 2022, 131,000 Americans were newly diagnosed with kidney failure. However, 9 out of 10 people with kidney disease are unaware, and 1 in 3 of those with severely reduced kidney function are unaware. Therefore, contemplating the effective therapeutic effects of the SGLT2 inhibitors.

Report Coverage

This research report categorizes the North America SGLT2 inhibitors market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the North America SGLT2 inhibitors market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America SGLT2 inhibitors market.

North America SGLT2 Inhibitors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 6.753 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.32% |

| 023 – 2033 Value Projection: | USD 15.011 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Drugs, By Indications |

| Companies covered:: | Glenmark Pharmaceuticals Ltd., Johnson & Johnson Services, Inc., Pfizer Inc., AstraZeneca, Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Lexicon Pharmaceuticals Ltd., Sanofi, Elli Lilly Company, Merck 7Co., Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

- Increasing cases of corpulence (obesity) among the US population:

Obesity is a chronic condition that promotes the risk of type 2 diabetes mellitus. Obesity is caused by a low intake of fiber, lack of physical activity, poor diet, consuming more calories and ultra-processed foods, etc. The increasing cases of obesity among US citizens escalates the need for blood glucose lowering drugs such as SGLT2 inhibitors, resulting in market growth. For instance, from 2021 to 2023, in the United States, adult obesity prevalence was 40.3%, with no significant differences between men and women. Obesity was higher in adults aged 40-59 than 20-39 and 60+. Adults with a bachelor's degree or more had lower obesity prevalence. Severe obesity was 9.4%, higher in women than men for each age group.

- Proliferation in R&D activities and Exploration of the digital health and telemedicine:

Pharmaceutical companies are investing in SGLT2 Inhibitors to improve diabetic management and advance drug development. Pharmaceutical companies and distributors are collaborating and signing Memorandums of Understanding (MOUs) with online pharmacies and are leveraging technology, particularly digital health platforms and telemedicine, to overcome geographical and linguistic barriers. The emergence of digital therapeutics is promoting the adoption of telemedicine as it is convenient and boosts market growth.

Restraining Factors

The availability of alternative medicines for the management of the diabetes, side effects associated with SGLT2 inhibitors such as ketoacidosis, urinary tract infection (UTI), genital infections, lack of awareness of the oral hypoglycaemic medications in low-middle-income countries, and financial hurdles may impede the market growth.

Market Segmentation

The North America SGLT2 inhibitors market share is classified into drugs and indications.

- The jardiance (empagliflozin) segment held the largest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The North America SGLT2 Inhibitors market is segmented by drugs into invokana (canagliflozin), farxiga (dapagliflozin), qtern (saxagliptin/dapagliflozin), inpefa (sotagliflozin), jardiance (empagliflozin), and others. Among these, the jardiance (empagliflozin) segment held the largest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment's growth is attributed to improvements in glycemic control, reduction of the risk of cardiovascular disease, greater stability, effectiveness in the management of type 2 diabetes mellitus, use in the management of chronic kidney diseases, and rapid absorption rate.

- The type-II diabetes mellitus segment accounted for the fastest growth rate in 2023.

The North America SGLT2 Inhibitors market is segmented by indications into chronic kidney disease (CKD), type-II diabetes mellitus, cardiovascular disease, and others. Among these, the type-II diabetes mellitus segment accounted for the fastest growth rate in 2023. The segmental expansion is attributed to increasing cases of type 2 diabetes mellitus among North Americans, increasing the proportion of the geriatric population, rising cases of obesity, and insulin resistance. SGLT2 inhibitors are popular for managing type 2 diabetes owing to their ability to control blood sugar levels and provide cardiovascular protection. Clinical evidence and FDA endorsement have led to widespread acceptance and further expansion of therapeutic use for this condition, addressing common comorbidities in diabetic patients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America SGLT2 inhibitors market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Glenmark Pharmaceuticals Ltd.

- Johnson & Johnson Services, Inc.

- Pfizer Inc.

- AstraZeneca

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Lexicon Pharmaceuticals Ltd.

- Sanofi

- Elli Lilly Company

- Merck 7Co., Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, AstraZeneca's FARXIGA (dapagliflozin) received USFDA approval, and it is used to enhance glycemic control in pediatric patients with type-2 diabetes aged 10 and above, based on positive results from the pediatric T2NOW Phase III trial. FARXIGA was previously approved in adults for glycemic control enhancement.

Market Segment

- This study forecasts revenue at North America, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the North America SGLT2 inhibitors market based on the below-mentioned segments

North America SGLT2 Inhibitors Market, By Drugs

- Invokana (Canagliflozin)

- Farxiga (Dapagliflozin)

- Qtern (Saxagliptin/Dapagliflozin)

- Inpefa (Sotagliflozin)

- Jardiance (Empagliflozin)

- Others

North America SGLT2 Inhibitors Market, By Indications

- Chronic Kidney Disease (CKD)

- Type-II Diabetes Mellitus

- Cardiovascular Diseases

- Others

Need help to buy this report?