North America Soup Market Size, Share, and COVID-19 Impact Analysis, By Type (Canned/Preserved, Chilled, Dehydrated/Instant, Others), By Distribution Channels (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, and Others), and North America Soup Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesNorth America Soup Market Insights Forecasts to 2033

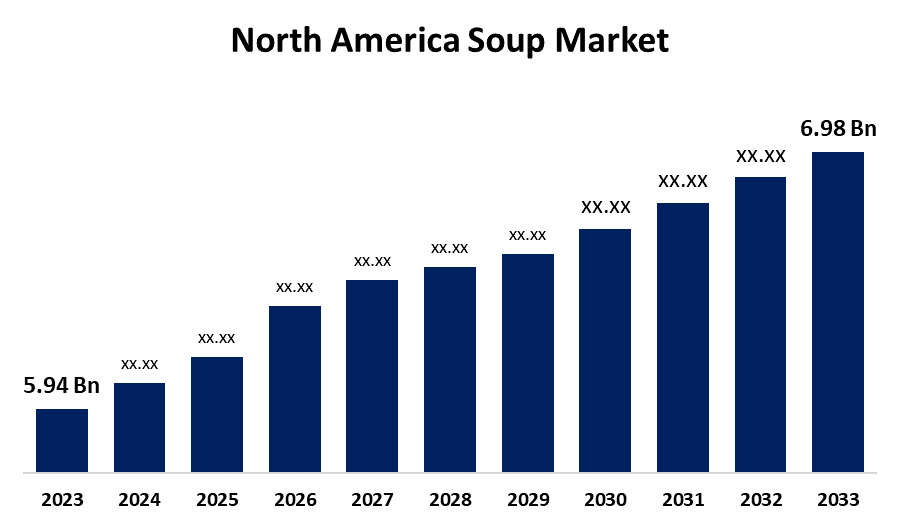

- The North America Soup Market Size was Valued at USD 5.94 Billion in 2023.

- The North America Soup Market is Growing at a CAGR of 1.63% from 2023 to 2033

- The North America Soup Market Size is Expected to Reach USD 6.98 Billion by 2033

Get more details on this report -

The North America soup market is Anticipated to reach USD 6.98 Billion by 2033, Growing at a CAGR of 1.63% from 2023 to 2033. The North American soup market is driven by increasing consumer demand for convenient, ready-to-consume meals, health-focused options, and premium, organic, and plant-based offerings. Moreover, hectic lifestyles, online retail growth, greater emphasis on comfort foods, and flavor and packaging innovations also drive market growth in the region.

Market Overview

The North America soup market defines the business that manufactures, distributes, and retails different types of soups in the North American region, such as the United States, Canada, and Mexico. A soup is a liquid dish usually made by boiling or simmering fish, meat, or vegetables in stock or water and served hot. Soups can be had as an appetizer or as a full course, providing both nourishment and comfort. Consumer behavior has shifted notably toward ready-to-cook food, where working adults and urban residents want fast foods that match their fast-paced lives. Additionally, consumers are increasingly demanding diverse and gourmet tastes, such as ethnic and international cuisines. Higher-end products with organic ingredients, eco-sustainable sourcing, and distinct flavors are increasingly in demand. Online sales have impacted soup sales, with increased customers purchasing their preferred soups online for convenience. Companies are increasingly providing direct-to-consumer subscription-based services for soup delivery, especially during the cold winter months when consumers tend to stock up on comfort foods.

Report Coverage

This research report categorizes the market for the North America soup market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America soup market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North American soup market.

North America Soup Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.94 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.63% |

| 2033 Value Projection: | USD 6.98 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Distribution Channels and COVID-19 Impact Analysis. |

| Companies covered:: | Campbell Soup Company, General Mills Inc., Unilever PLC, Loblaw Companies Limited, Blount Fine Foods Corp and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Soups tend to be comfort food, providing a feeling of warmth and nostalgia. In North America, this is particularly true during winter months or in areas that experience harsh winters. The emotional appeal of classic soup types, including tomato soup, chicken noodle soup, and clam chowder, fuels demand. Additionally, producers continue to innovate to address changing consumer preferences. This encompasses the addition of new flavors, regional styles, and ethnic-inspired soups. For instance, the increase in demand for ethnic foods has resulted in soups with ingredients such as sriracha, curry, or Miso. New product introductions, including high-end gourmet soups and specialty flavors, make the market new and draw a larger crowd.

Restraining Factors

Most soups, especially processed and canned soups, have high sodium content, which is associated with elevated risks of hypertension and other cardiovascular disorders. With consumers becoming increasingly health-aware, there is increased concern regarding the adverse health effects of preservatives and sodium in soups. In addition, consumers tend to get saturated with known flavors and might not be attracted by brands that lack something unique or different. This can lead to slower development for some soup segments, particularly in an environment that increasingly hungers for novelty and variety.

Market Segmentation

The North America soup market share is classified by type and distribution channel.

- The canned/preserved segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the North America soup market is segmented into canned/preserved, chilled, dehydrated/instant, and others. Among these, the canned/preserved segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to canned and preserved soups having a long shelf life, sometimes months or even years before they spoil. This renders them very convenient for consumers who wish to stock up and have a meal at hand without having to worry about constant spoilage. Shoppers like the convenience of purchasing in bulk and keeping soups for a long time, making canned soups good for stocking pantries and utilizing them as emergency food or fast dinners.

- The supermarkets/hypermarkets segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the North America soup market is divided into supermarkets/hypermarkets, convenience stores, online stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to supermarkets and hypermarkets providing a wide and diverse array of soups, from instant and canned soups to fresh and chilled soups. They also provide premium, organic, gluten-free, and vegan soups to meet a large number of consumer tastes and dietary requirements. The extensive variety guarantees customers with different tastes, dietary limitations, and preferences can find a suitable option, making supermarkets the preferred destination for shopping for soups.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America soup market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Campbell Soup Company

- General Mills Inc.

- Unilever PLC

- Loblaw Companies Limited

- Blount Fine Foods Corp

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, Progresso Soup Drops introduced a new, convenient on-the-go soup solution for cold and flu season. The drops are portable, with a comforting, easy-to-swallow formula for consumers who want to feel comforted during winter without requiring a whole meal.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America soup market based on the below-mentioned segments:

North America Soup Market, By Type

- Canned/Preserved

- Chilled

- Dehydrated/Instant

- Others

North America Soup Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

Need help to buy this report?