North America Swine Feed Market Size, Share, and COVID-19 Impact Analysis, By Type (Sow Feed, Starter Feed, and Grower Feed), By Form (Crumbles, Mash, and Pellets), By Additives (Antibiotics, Vitamins, Enzymes, Amino Acids, and Others), and North America Swine Feed Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureNorth America Swine Feed Market Insights Forecasts to 2033

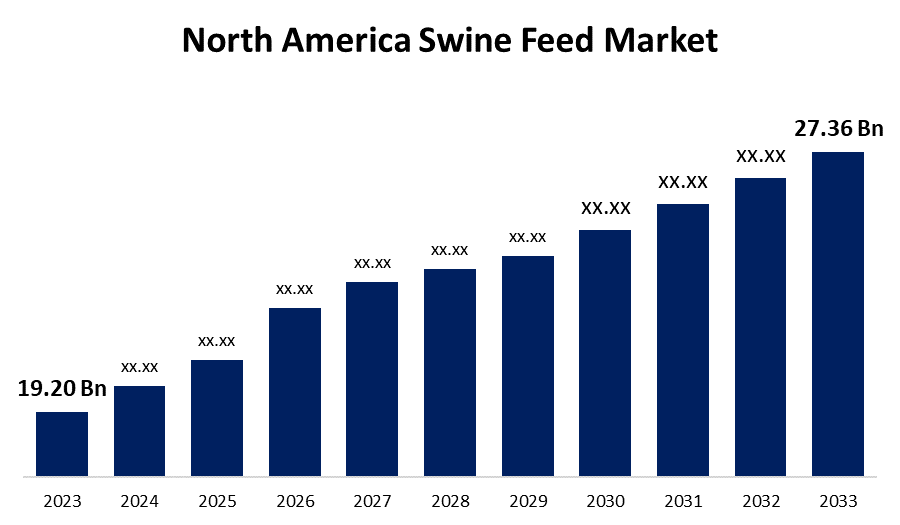

- The North America Swine Feed Market Size was valued at USD 19.20 Billion in 2023.

- The Market is growing at a CAGR of 3.61% from 2023 to 2033

- The North America Swine Feed Market Size is expected to reach USD 27.36 Billion by 2033

Get more details on this report -

The North America Swine Feed Market is anticipated to reach USD 27.36 billion by 2033, growing at a CAGR of 3.61% from 2023 to 2033

Market Overview

The North America swine feed market is a sector that produces and supplies feed specifically formulated for swine in the North American region. Swine are commonly referred to as pigs. Swine feed is produced to satisfy the nutritional requirements of swine at various phases of growth and development. It blends components that provide the right ratio of nutrients, supporting the pigs' general well-being, development, reproduction, and output. The North America swine feed market is driven by factors such as the growth of quick service restaurants, nutrient-related diseases, and consumer demand for quality live products. The market is also driven by rising pork consumption, demand for high-quality feed, advancements in feed technology, and an emphasis on animal nutrition. Population growth and income levels are also key drivers. Swine feed is a specialized nutrition formulation designed to optimize pigs' growth, health, and reproduction. It consists of grains, protein sources, vitamins, and minerals and is tailored to meet specific nutritional requirements for various life stages. Tailoring swine feed promotes efficient growth, optimal body condition, and overall well-being, contributing to the sustainability and productivity of pig farming operations.

Report Coverage

This research report categorizes the North America swine feed market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the North America swine feed market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America swine feed market.

North America Swine Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.20 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.61% |

| 023 – 2033 Value Projection: | USD 27.36 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Form, By Additives |

| Companies covered:: | Novus International, Inc. Land O’Lakes, Inc. Cargill, Inc. Lallemand Inc. ForFarmers N.V. Alltech, Inc. Kent Nutrition Group BASF SE Archer Daniels Midland Company Chr. Hansen Holding A/S Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers' growing need for high-quality livelihood products:

Pork is a prominent meat source in North America because of its low cost and high consumption. The need for swine feed and feed additives in the area is being driven by the middle-class population, rising disposable income, and shifting consumer tastes. The population's nutrition and eating habits depend on the production of pork, which fuels the expansion of the swine feed industry in North America.

Growing industrial livestock production and advancements in technology:

Technological advancements and greater industrial livestock production are driving the North America swine feed market. There are several nutritional advantages to the feed because it is high in vitamins, fiber, and minerals. Improved swine feed is in demand to maximize pig health due to the growing consumption of pork meat in new markets. In addition to consumer concerns about pig health, pig producers are now required to utilize feed items that guard against enzootic diseases.

Restraining Factors

The high cost of feed, volatility in the prices of the raw material, changes in the environmental factors, growing geopolitical tensions, and alternative sources of nutrition may impede the market growth.

Market Segmentation

The North America swine feed market share is classified into type, form, and additives.

- The grower feed segment held the largest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The North America swine feed market is segmented by type into sow feed, starter feed, and grower feed. Among these, the grower feed segment held the largest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. This is attributed to the increasing quantity of piglets and their high consumption. Grower feed's market share is fueled by the vital nutrients it offers for the best possible piglet growth. The market is being driven by the need for high-quality beginning meals for pigs that are 5 to 6 weeks old. To ensure healthy growth, manufacturers are concentrating on safe, contaminant-free beginning meals.

- The pellets segment accounted for the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period.

The North America swine feed market is segmented by form into crumbles, mash, and pellets. Among these, the pellets segment accounted for the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period. The segment growth is attributed to the easy to handle, greater stability, digestible, palatability, highly durable, availability and accessibility, extensive usage by farmers, lower cost, uniformity, and enhanced nutrition.

The amino acids segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The North America swine feed market is segmented by additives into antibiotics, vitamins, enzymes, amino acids, and others. Among these, the amino acids segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR during the forecast period. This is because they serve important roles in swine hormone metabolic processes, milk-derived muscle protein, enzymes for digestion, and other processes. The most often added amino acids in diets are lysine, methionine, and valine.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America swine feed market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novus International, Inc.

- Land O’Lakes, Inc.

- Cargill, Inc.

- Lallemand Inc.

- ForFarmers N.V.

- Alltech, Inc.

- Kent Nutrition Group

- BASF SE

- Archer Daniels Midland Company

- Chr. Hansen Holding A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Kemin Industries, a global ingredient manufacturer, introduced FORMYL, an innovative feed additive for swine health and productivity in the US. The innovative solution, developed by the Kemin Animal Nutrition and Health – North America business unit, uses a proprietary blend of encapsulated calcium formate and citric acid for optimal delivery and efficacy.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the North America swine feed market based on the below-mentioned segments:

North America Swine Feed Market, By Type

- Sow Feed

- Starter Feed

- Grower Feed

North America Swine Feed Market, By Form

- Crumbles

- Mash

- Pellets

North America Swine Feed Market, By Additives

- Antibiotics

- Vitamins

- Enzymes

- Amino Acids

- Others

Need help to buy this report?