North America Varicose Veins Treatment Market Size, Share, and COVID-19 Impact Analysis, By Products (Venous Closure Products, Ablation Devices, Surgical Products), By Treatment Mode (Endovenous Ablation, Injection Sclerotherapy, Surgical Ligation/Stripping), and North America Varicose Veins Treatment Market Insights, Industry Trend, Forecasts to 2032

Industry: HealthcareNorth America Varicose Veins Treatment Market Insights Forecasts to 2032

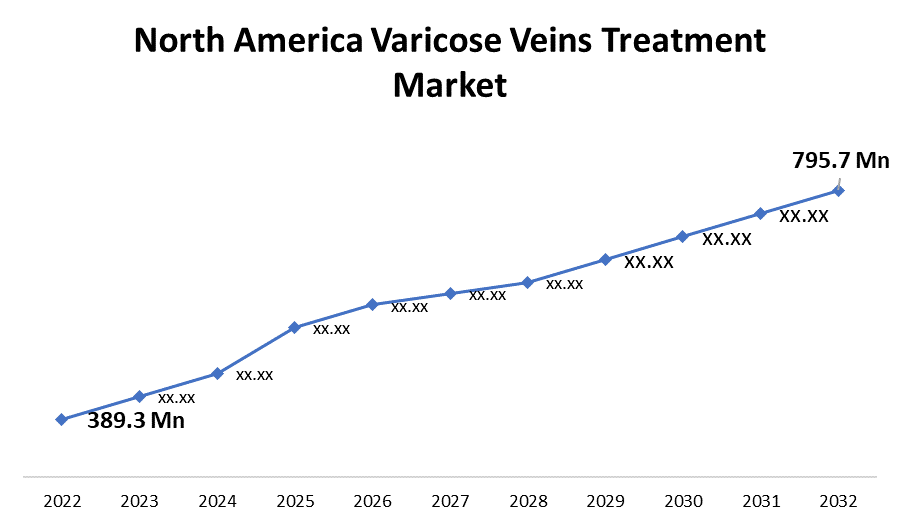

- The North America Varicose Veins Treatment Market Size was valued at USD 389.3 Million in 2022.

- The Market Size is Growing at a CAGR of 7.4% from 2022 to 2032

- The North America Varicose Veins Treatment Market is expected to reach USD 795.7 Million by 2032

Get more details on this report -

The North America Varicose Veins Treatment Market size was valued at USD 389.3 Million in 2022. The North America Varicose Veins Treatment Market is projected to exceed USD 795.7 Million by 2032, Growing at a CAGR of 7.4% from 2022 to 2032.

Market Overview

Varicose veins are abnormally dilated blood vessels caused by deterioration of the vessel walls. Under the skin, these veins appeared to be a twisted, bloated cluster of blue or purple veins. There is currently no medically accepted treatment for varicose veins. Instead of treating a varicose vein, the entire vein is collapsed and blood is diverted to another vein. The vein is still present, but it is dormant. The injured vein may be removed by the doctors in some cases. The varicose veins treatment market in North America is constantly changing as key players pursue growth strategies such as mergers and acquisitions, new product launches, and partnerships. The rise in prevalence and awareness of varicose veins, combined with favorable reimbursement policies, can be attributed to the growth of the North American varicose veins treatment market. Compression devices, stockings, and garments are becoming more popular for varicose vein treatment. By applying gentle pressure to the legs, these devices help reduce symptoms of venous insufficiency and improve blood circulation. In the near future, venture funding and geographical expansions are likely to create significant opportunities for both existing market participants and new market entrants.

Report Coverage

This research report categorizes the market for North America varicose veins treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America varicose veins treatment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America varicose veins treatment market.

North America Varicose Veins Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 389.3 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.4% |

| 2032 Value Projection: | USD 795.7 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Products, By Treatment Mode and COVID-19 Impact Analysis |

| Companies covered:: | AngioDynamics, Inc., Vascular Solutions, Inc., Sciton, Inc., Merz Aesthetics, Candela Medical, Teleflex Incorporated, Sciton Inc., Merit Medical Systems, Boston Scientific Corporation, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Varicose veins are becoming more common in North America, so medical companies and research institutions are stepping up their research and development efforts to provide more effective and widely available treatment options. For example, the FDA has approved an experimental device exemption (IDE) application for the VEINRESET multicenter pivotal trial, which will evaluate Sonovein's high-intensity focused ultrasound (HIFU) therapy for varicose veins. VVT Medical's ScleroSafe platform for the treatment of varicose veins has been approved by the US Food and Drug Administration (FDA).

Restraining Factors

Many treatments for severe varicose veins can cost thousands of dollars. Two of the most expensive treatment methods are Varithena foam injection, which can cost between USD 2,000 and USD 3,000, and ClosureFast Radiofrequency Ablation (RFA), which can cost between USD 3,000 and USD 5,000. The price is also affected by the number and size of veins that need to be treated. As a result of the high cost and lack of adequate reimbursement policies, the market for varicose vein therapy in North America is severely constrained.

Market Segment

The North America Varicose Veins Treatment Market share is segmented into products and treatment mode.

- The ablation devices segment is expected to hold a significant share of the North America varicose veins treatment market during the forecast period.

The North America varicose veins treatment market is divided by products into venous closure products, ablation devices, surgical products. Among these, the ablation devices segment is expected to hold a significant share of the North America varicose veins treatment market during the forecast period. The growth can be attributed to their minimal invasive nature and quick recovery. Venous closure products are expected to grow at the fastest CAGR due to their effectiveness in treating the disease and rising demand for such products.

- The surgical ligation/stripping segment is expected to hold the largest share of the North America varicose veins treatment market during the forecast period.

Based on the treatment mode, the North America varicose veins treatment market is classified into endovenous ablation, injection sclerotherapy, surgical ligation/stripping. Among these, the surgical ligation/stripping segment is expected to hold the largest share of the North America varicose veins treatment market during the forecast period. According to Hopkins Medicine, surgical ligation surgeries close and shrink varicose veins. The vein is then closed off, and blood is routed through neighboring veins in its place. It is a minor surgery that improves blood flow and alleviates symptoms such as pain and swelling, which contributes to its rising market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America varicose veins treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AngioDynamics, Inc.

- Vascular Solutions, Inc.

- Sciton, Inc.

- Merz Aesthetics

- Candela Medical

- Teleflex Incorporated

- Sciton Inc.

- Merit Medical Systems

- Boston Scientific Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the North America Varicose Veins Treatment Market based on the below-mentioned segments:

North America Varicose Veins Treatment Market, By Products

- Venous Closure Products

- Ablation Devices

- Surgical Products

North America Varicose Veins Treatment Market, By Treatment Mode

- Endovenous Ablation

- Injection Sclerotherapy

- Surgical Ligation/Stripping

Need help to buy this report?