North America Window and Door Manufacturing Tapes Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Double-Sided Adhesive and Single-Sided Adhesive), By Material Type (Foam-based Tapes, Film-based Tapes, Acrylic-based Tapes, Butyl Rubber Tapes, Silicone-based Tapes, PVC Tapes, Cloth Tapes, and Others), By Application (Sealing, Mounting, Insulation, Protection, Masking, and Others), By End-User (Original Equipment Manufacturers and MROs & Installers), and North America Window and Door Manufacturing Tapes Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsNorth America Window and Door Manufacturing Tapes Market Insights Forecasts to 2033

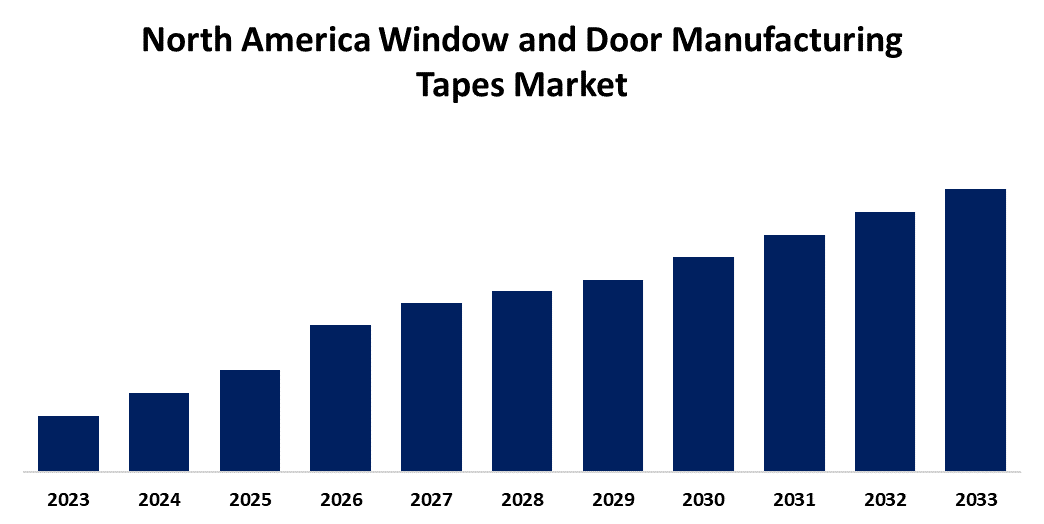

- The Market is Growing at a CAGR of 4.2% from 2023 to 2033

- The North America Window and Door Manufacturing Tapes Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The North America Window and Door Manufacturing Tapes Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 4.2% from 2023 to 2033.

Market Overview

Windows and doors production specialized adhesive tapes known as tapes are used in the manufacturing and building of doors and windows. These tapes are useful for a number of tasks, including securing glass panels to frames, caulking gaps, offering insulation, and guaranteeing a tight seal. They are crucial for making safe and long-lasting window and door installations because of their excellent adhesion, durability, and weather resistance. Additionally, the International Energy Conservation Code (IECC) and ENERGY STAR requirements, among other strict energy efficiency laws and building norms, have a big impact on the windows and doors business in the United States. The market is being pushed toward high-performance windows and doors as a result of these restrictions, which encourage manufacturers to develop and create products that meet or beyond energy efficiency standards. Furthermore, in North America, the number of construction projects has increased due to rapid urbanization and economic expansion. In order to maintain structural integrity and energy efficiency, this extension calls for the usage of specialty tapes for window and door sealing, bonding, and insulation.

Report Coverage

This research report categorizes the market for the North America window and door manufacturing tapes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America window and door manufacturing tapes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America window and door manufacturing tapes market.

North America Window and Door Manufacturing Tapes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Material Type, By Application, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Tesa Tape, Inc., Adchem, Shurtape Technologies, H-O products, Scapa Group, CS Hyde, 3M Company, Pennsylvania, and Other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In the production of windows and doors, adhesive tapes are increasingly being used for assembly, masking, and sealing. Adhesive tapes offer a clean, peel-and-stick application with shorter adhesive cure times than conventional caulking and silicone beading. Adhesion to difficult-to-bond substrates and adhesive tape bond strength are improving, which enhances lead times, performance, and output. Additionally, there were over 919,000 construction establishments in the US in the first quarter of 2023, indicating the industry's significant economic impact. The demand for window and door manufacturing tapes in North America is rising as a result of the growing number of construction projects in the United States. It is anticipated that important programs in the U.S., like the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), will update vital infrastructure, promote clean energy projects, and strengthen domestic manufacturing capacities, setting up the sector for long-term growth. The demand for high-quality manufacturing tapes in the North American windows and doors manufacturing tapes market is predicted to increase dramatically as a result of the IRA and IIJA's planned infrastructure and clean energy projects.

Restraining Factors

Window and door manufacturing tapes in North America face competition from other sealing and bonding techniques including liquid adhesives and mechanical fasteners.

Market Segmentation

The North America window and door manufacturing tapes market share is classified into product type, material type, application, and end-user.

- The double-sided adhesive segment is expected to hold a significant market share through the forecast period.

The North America window and door manufacturing tapes market is segmented by product type into double-sided adhesive and single-sided adhesive. Among these, double-sided adhesive segment is expected to hold a significant market share through the forecast period. Great bonding power and endurance, appropriate leveling of various thermal elongations, and increased flexibility are some advantages of employing double-sided tapes for glass element bonding in door manufacture.

- The foam-based tapes segment is expected to hold a significant market share through the forecast period.

The North America window and door manufacturing tapes market is segmented by material type into foam-based tapes, film-based tapes, acrylic-based tapes, butyl rubber tapes, silicone-based tapes, PVC tapes, cloth tapes, and others. Among these, foam-based tapes segment is expected to hold a significant market share through the forecast period. The superior sealing qualities, flexibility, and adaptability to surface flaws of foam-based tapes make them popular. In window and door installations, these tapes are frequently employed to seal seams and gaps, offering acoustic and thermal insulation.

- The sealing segment is expected to hold a significant market share through the forecast period.

The North America window and door manufacturing tapes market is segmented by application into sealing, mounting, insulation, protection, masking, and others. Among these, sealing segment is expected to hold a significant market share through the forecast period. Sealing tapes are crucial for forming airtight and waterproof barriers, which improve energy efficiency and stop moisture incursion. For window and door installations to be durable and functional, this application is essential.

- The original equipment manufacturers segment is expected to hold a significant market share through the forecast period.

The North America window and door manufacturing tapes market is segmented by end-user into original equipment manufacturers and MROs & installers. Among these, original equipment manufacturers segment is expected to hold a significant market share through the forecast period. These tapes are used by OEMs to guarantee adequate sealing, insulation, and structural integrity when windows and doors are being produced. The requirement for long-lasting, high-quality, and energy-efficient products in the building and remodeling industries is what drives OEM demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America window and door manufacturing tapes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tesa Tape, Inc.

- Adchem

- Shurtape Technologies

- H-O products

- Scapa Group

- CS Hyde

- 3M Company

- Pennsylvania

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America Window and Door Manufacturing Tapes Market based on the below-mentioned segments:

North America Window and Door Manufacturing Tapes Market, By Product Type

- Double-Sided Adhesive

- Single-Sided Adhesive

North America Window and Door Manufacturing Tapes Market, By Material Type

- Foam-based Tapes

- Film-based Tapes

- Acrylic-based Tapes

- Butyl Rubber Tapes

- Silicone-based Tapes

- PVC Tapes

- Cloth Tapes

- Others

North America Window and Door Manufacturing Tapes Market, By Application

- Sealing

- Mounting

- Insulation

- Protection

- Masking

- Others

North America Window and Door Manufacturing Tapes Market, By End-User

- Original Equipment Manufacturers

- MROs & Installers

Need help to buy this report?