North America Workplace Wellness Market Size, Share, and COVID-19 Impact Analysis, By Type (Weight Management & Fitness Services, Nutrition & Dietary Plan, Stress Management Services, Health Screening & Assessment, Smoking Cessation), By Delivery Model (Onsite ,Offsite), By End-User (Small Scale organizations, Medium Scale Organizations, Large Scale Organizations), By Country (United States, Canada, Mexico, Rest of North America), and North America Workplace Wellness Market Insights Forecasts 2022 - 2032

Industry: HealthcareNorth America Workplace Wellness Market Insights Forecasts to 2032

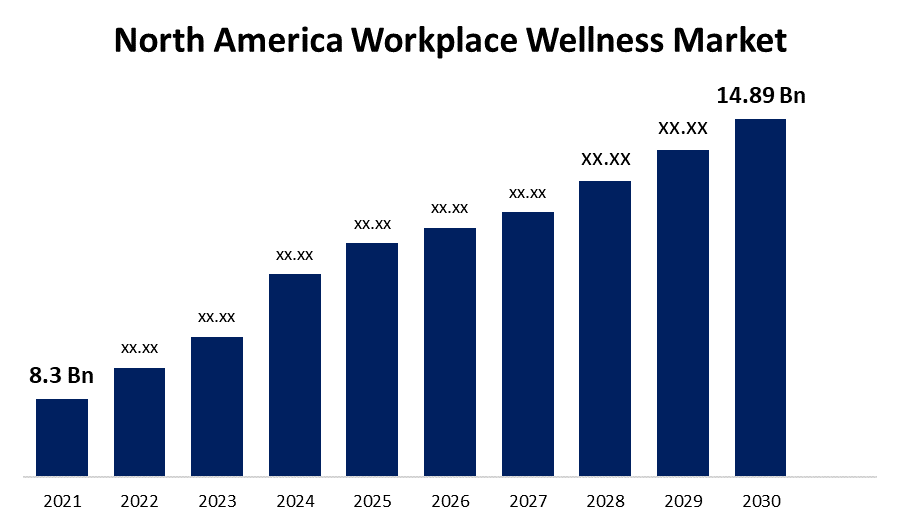

- The North America Workplace Wellness Market Size was valued at USD 8.3 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.2% from 2022 to 2032.

- The North America Workplace Wellness Market Size is expected to reach USD 14.89 Billion by 2032.

Get more details on this report -

The North America Workplace Wellness Market Size is Expected To Reach USD 14.89 Billion by 2032, at a CAGR of 6.2% during the forecast period 2022 to 2032.

Market Overview

Workplace wellness refers to health promotion activities or policies that promote healthy employee behavior. There are numerous ways for businesses to foster a healthy culture, ranging from medical screenings and health education fairs to fitness programmes and healthcare memberships. Companies that invest in human capital understand the benefits of workplace wellness. Employees who are happy tend to perform better, take on more work initiatives, increases productivity, and manage their time more effectively. The rising prevalence of chronic diseases and mental health issues is also a major factor driving market growth in North America. The most common health problems in North America are chronic diseases such as arthritis, cancer, and cardiovascular disease. Companies are now tracking and monitoring employee health through various workplace wellness programs. Furthermore, corporate wellness market growth in North America is being fueled by an increase in the population of salaried employees and a favourable regulatory environment for businesses. The United States is expected to be the largest market share in the North American corporate wellness market. The growing adoption of corporate wellness programmes by employers in the United States, technology-powered corporate wellness solutions, and the increasing burden of chronic lifestyle disease and mental health problems in organisations are driving market growth

Report Coverage

This research report categorizes the market for North America workplace wellness market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America workplace wellness market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America workplace wellness market.

North America Workplace Wellness Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 14.89 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Delivery Model, By Country, By End-User, By Country and COVID-19 Impact Analysis. |

| Companies covered:: | ComPsych Corporation, Virgin Pulse, quest diagnostics, Marino Wellness LLC, Fitbit Inc, Exos, Limeade, Privia Health LLC, LabCorp Employer Services, ComPsych Corporation, Novant Health, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Workplace wellness discussions have shifted away from health screenings, ergonomic furniture, free gym memberships, and other preventive health offerings and towards broader issues of stress management and maximising engagement, joy, and flow at work. Some organization are focusing on creating a culture of health and wellbeing, incorporating features such as healthy workplace design, less hierarchical organisation and management, flexible and remote work. and some focusing on increased vacation time and personal leave, minimum pay increases, and company-sponsored community service, with the goal of improving employees' engagement, work-life balance, and overall satisfaction and happiness at work. Furthermore, employers are concerned about both productivity and healthcare costs. The United States has the world's largest workplace wellness market including traditional preventive measures and a focus on physical health are becoming obsolete all these factors are boosting the market growth in North America.

Restraining Factors

In workplace various organizations prefer the wellness services for employees such as gyms, clubs, and so on, in order to live a balanced and healthy life, as their concerns about total wellness and changes in their way of life have increased. However, these services are expensive and can only be afforded by people earning minimum wage, which is expected to hamper the market.

Market Segment

- In 2022, the health screening & assessment segment accounted for the largest revenue share over the forecast period.

Based on the type, the North America workplace wellness market is segmented into weight management & fitness services, nutrition & dietary plan, stress management services, health screening & assessment, and smoking cessation. Among these, the health screening & assessment segment has the largest revenue share over the forecast period. This is due to an increased focus among employers on maintaining their employees' health in order to boost productivity and reduce losses. Furthermore, health screening and assessment includes examines such as overall cholesterol levels, lipoproteins with a low density (LDL), high-density cholesterol (HDL), fatty acids, glucose, and body composition.

- In 2022, the onsite segment accounted for the largest revenue share over the forecast period.

On the basis of delivery model, the North America workplace wellness market is segmented into onsite and offsite. Among these, the onsite segment has the largest revenue share over the forecast period. Onsite initiatives add a personal touch to employee well-being, as well as the opportunity to exercise under the supervision of fitness consultants and coaches to meet their individual health needs.

- In 2022, the large-scale organizations segment is expected to hold the largest share of the North America workplace wellness market during the forecast period.

Based on the end user, the North America workplace wellness market is classified into small scale organizations, medium scale organizations, large scale organizations. Among these, the large-scale organizations segment is expected to hold the largest share of the North America workplace wellness market during the forecast period. The availability of capital for investing in wellbeing services and sufficient space for providing onsite health services for employees. Onsite services provided by large organization’s include physicians, therapists, and chiropractors. This ultimately saves employees time and increases their productivity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America workplace wellness market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ComPsych Corporation

- Virgin Pulse

- quest diagnostics

- Marino Wellness LLC

- Fitbit Inc

- Exos

- Limeade

- Privia Health LLC

- LabCorp Employer Services

- ComPsych Corporation

- Novant Health

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On May 2023, Herbalife Ltd., a leading health and wellness company and community, announced changes to its senior executive leadership.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America workplace wellness market based on the below-mentioned segments:

North America Workplace Wellness Market, By Type

- Weight Management & Fitness Services

- Nutrition & Dietary Plan

- Stress Management Services

- Health Screening & Assessment

- Smoking Cessation

North America Workplace Wellness Market, By Delivery Model

- Onsite

- Offsite

North America Workplace Wellness Market, By End User

- Small Scale organizations

- Medium Scale Organizations

- Large Scale Organizations

North America Workplace Wellness Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?