North America Xenon Gas Market Size, Share, and COVID-19 Impact Analysis, By Type (N3, N4.5, N5), By Application (Imaging & Lighting, Satellite, Electronics & Semiconductors, Medical, Others), By Country (US, Canada, Mexico), and North America Xenon Gas Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsNorth America Xenon Gas Market Insights Forecasts to 2033

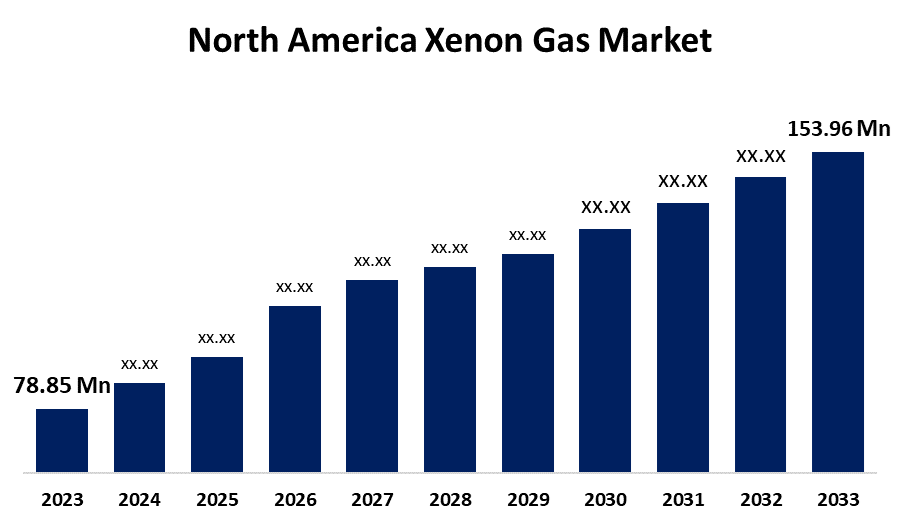

- The North America Xenon Gas Market Size was valued at USD 78.85 Million in 2023.

- The Market Size is Growing at a CAGR of 6.92% from 2023 to 2033.

- The North America Xenon Gas Market Size is Expected to Reach USD 153.96 Million by 2033.

Get more details on this report -

The North America Xenon Gas Market Size is Expected to Reach USD 153.96 Million by 2033, at a CAGR of 6.92% during the forecast period 2023 to 2033.

Market Overview

Xenon (Xe) is a fully inert gas that emits blue light when subjected to an electrical discharge. Despite having very little commercial use, because of its exceptional qualities, it is thought to be preferred. Due to its versatility and purity, this noble gas finds widespread use in a variety of industries, including electronics, medical, satellites, imaging, lighting, and others. Over the course of the projection period, there will likely be a rise in the demand for xenon gas due to the positive expansion of these applications in both established and developing economies. For instance, xenon gas is used in the semiconductor manufacturing process by memory chip manufacturers like Samsung Electronics Co. Starting in 2024, Samsung Electronics Co. intends to employ POSCO Holdings Inc.'s xenon gas production. In addition, xenon gas is becoming more significant in the manufacturing of advanced semiconductor devices like three-dimensional V-NAND. Many tablets, USB drives, enterprise-grade SSDs, flash drives, and other storage devices use this sophisticated semiconductor technology. In North America, the demand for xenon gas is driven by all of these causes together. The increased use of this noble gas by North American semiconductor chip manufacturers is the cause of the surge in demand for xenon gas.

North America Xenon Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 78.85 Million |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 6.92% |

| 2033 Value Projection: | USD 153.96 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application, By Country and COVID-19 Impact Analysis |

| Companies covered:: | Linde plc, Middlesex Gases, Electronic Fluorocarbons LLC, Air Liquide, Messer Canada Inc., Nova Gas Technologies, American Gas Products, Air Products and Chemicals Inc., Isoflex USA, WestAir Gases and Equipment Inc., and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for North America xenon gas market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America xenon gas market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America xenon gas market.

Driving Factors

The semiconductor end-use industry's substantial demand propels the xenon gas market in North America. In the semiconductor industry, high purity xenon gas is most frequently used for etching, deposition, and memory chip production. The main trend in the industry is the use of xenon gas for etching, or the removal of material from thin layers of memory chips. Furthermore, it is used in the deposition of microchips during semiconductor manufacturing, which propels the market for xenon gas expansion.

Restraining Factors

The gas is categorized as an asphyxiant, which indicates that inhaling an excessive quantity of it can cause nausea, dizziness, vomiting, and, in extreme cases, death. Low oxygen levels can cause sudden death in a matter of seconds. In addition to the above-mentioned symptoms, the person may experience mental sickness, exhaustion, depression, and emotional instability with 75% oxygen and 25% of this gas.

Market Segment

- In 2023, the N5 segment accounted for the largest revenue share over the forecast period.

Based on the type, the North America xenon gas market is segmented into N3, N4.5, and N5. Among these, the N5 segment has the largest revenue share over the forecast period. With a purity level of 99.999%, the N5 segment also referred to as research-grade is very expensive but valuable for applications in the imaging, lighting, satellite, electronics and semiconductor, and medical fields. The need for N5 type is anticipated to increase during the course of the xenon industry forecast period as a number of significant private companies, such as SpaceX, Lockheed Martin, and Boeing, have plans to launch satellites and conduct space exploration operations in the near future.

- In 2023, the satellite segment accounted for the largest revenue share over the forecast period.

On the basis of application, the North America xenon gas market is segmented into imaging & lighting, satellite, electronics & semiconductors, medical, and others. Among these, the satellite segment has the largest revenue share over the forecast period. Xe gas demand is predicted to rise in conjunction with the number of electric-propelled satellites and spacecraft. Shortly, a number of satellites are slated to be launched, and many more will probably be announced afterwards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America xenon gas market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Linde plc

- Middlesex Gases

- Electronic Fluorocarbons LLC

- Air Liquide

- Messer Canada Inc.

- Nova Gas Technologies

- American Gas Products

- Air Products and Chemicals Inc.

- Isoflex USA

- WestAir Gases and Equipment Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, using its experience in extreme cryogenics, the Paris-based Air Liquide started building a state-of-the-art purification plant for krypton and xenon in Cheonan, Chungnam Province. The project, which is expected to be completed in 2025, will use cutting-edge technologies from Air Liquide to generate ultra-high purity gases for use in the semiconductor and space industries.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America xenon gas market based on the below-mentioned segments:

North America Xenon Gas Market, By Type

- N3

- N4.5

- N5

North America Xenon Gas Market, By Application

- Imaging & Lighting

- Satellite

- Electronics & Semiconductors

- Medical

- Others

North America Xenon Gas Market, By Country

- US

- Canada

- Mexico

Need help to buy this report?