Global Nutraceutical Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Product (Probiotics, Prebiotics, Vitamins, Amino Acids, Carotenoids, Phytochemicals & Plant Extracts, Protein, EPA/DHA, Minerals, Fiber & Carbohydrates, and Others), By Application (Functional Food, Functional Beverages, Dietary Supplements, Personal Care, and Animal Nutrition), By Form (Dry Form and Liquid Form), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032

Industry: Food & BeveragesGlobal Nutraceutical Ingredients Market Insights Forecasts to 2032

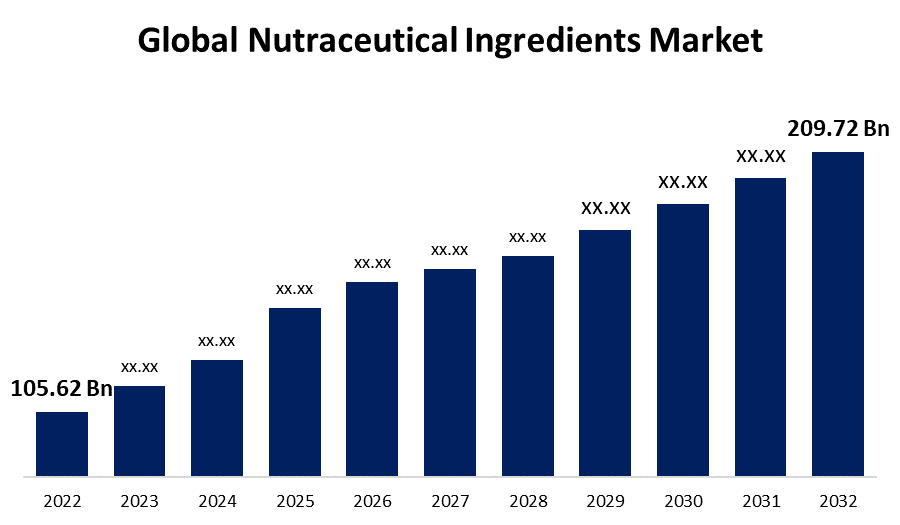

- The Nutraceutical Ingredients Market was valued at USD 105.62 Billion in 2022.

- The Market is growing at a CAGR of 7.1% from 2023 to 2032

- The Worldwide Nutraceutical Ingredients Market is expected to reach USD 209.72 Billion by 2032

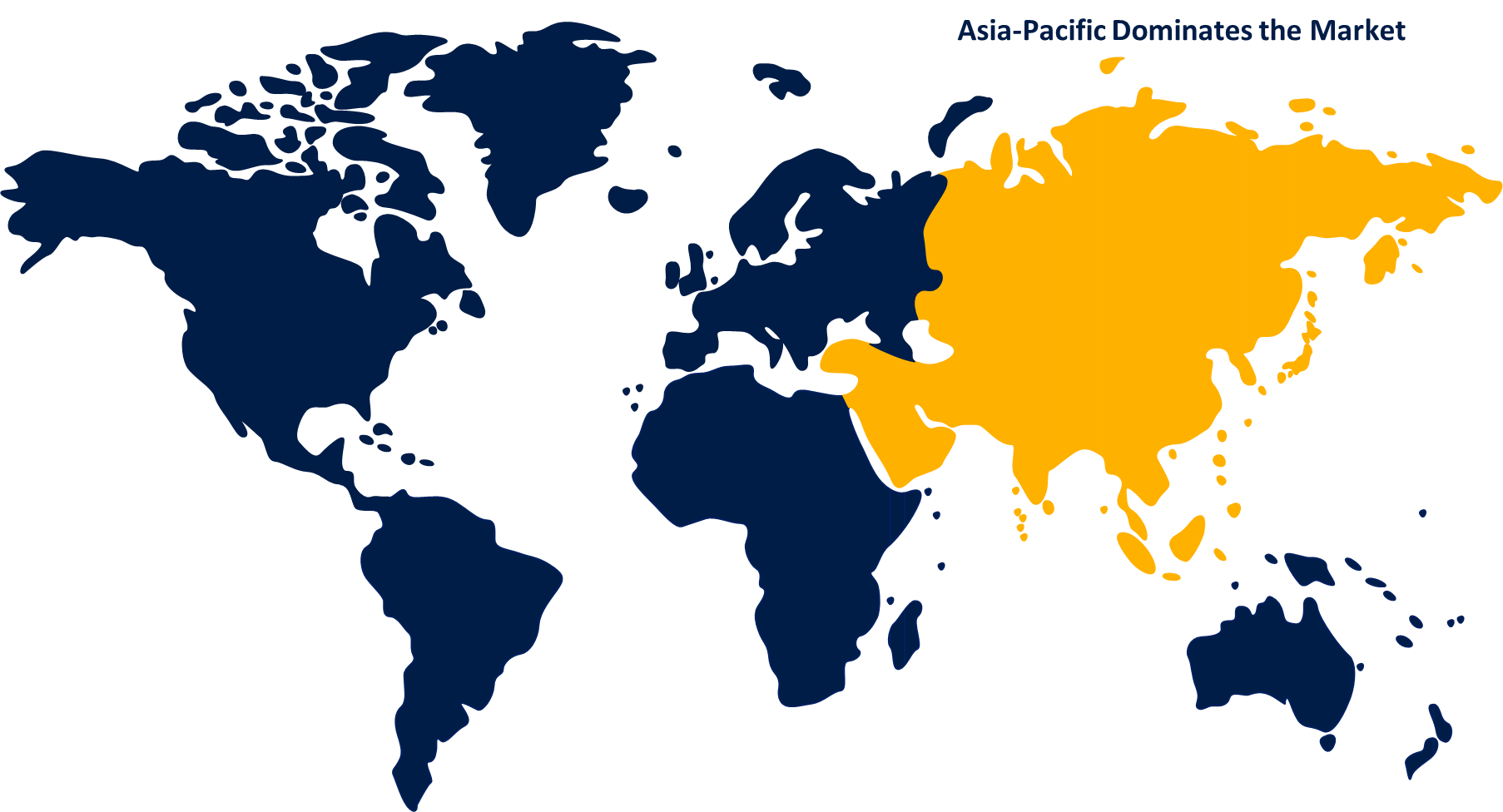

- Asia-Pacific is expected to grow the highest during the forecast period

Get more details on this report -

The Global Nutraceutical Ingredients Market is expected to reach USD 209.72 Billion by 2032, at a CAGR of 7.1% during the forecast period 2023 to 2032.

Market Overview

Nutraceutical ingredients refer to bioactive compounds that provide health benefits when consumed as part of a balanced diet or as a dietary supplement. These ingredients are derived from various natural sources, including plants, animals, and microorganisms. Nutraceutical ingredients are known for their potential to enhance overall well-being and prevent certain diseases. They often contain essential nutrients such as vitamins, minerals, amino acids, fatty acids, and dietary fibers, which play crucial roles in supporting bodily functions. Additionally, nutraceutical ingredients may possess antioxidant, anti-inflammatory, immune-boosting, or other therapeutic properties. Popular examples include omega-3 fatty acids from fish oil, probiotics for gut health, polyphenols from fruits and vegetables, and herbal extracts like turmeric and ginseng. Nutraceutical ingredients are gaining significant attention in the field of nutrition and are being extensively studied for their potential applications in promoting optimal health and preventing chronic diseases.

Report Coverage

This research report categorizes the market for nutraceutical ingredients market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the nutraceutical ingredients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the nutraceutical ingredients market.

Global Nutraceutical Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 105.62 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.1% |

| 2032 Value Projection: | USD 209.72 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application, By Form, By Region and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, ADM, Ingredion, DSM NV, Cargill, Tate & Lyle, Ajinomoto, Roquette Freres, Arla Food Ingredients, Divis Laboratories, Cosucra Groupe Warcoing SA, Prinova Group, LLC, Ambe Phytoextracts Pvt. Ltd., Nutra Food Ingredients, Aurobindo Pharma Ltd., Associated British Foods PLC, Aurea Biolabs, AVT Natural Products Ltd., and others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The nutraceutical ingredients market is driven by several factors that contribute to its growth and development due to increasing consumer awareness and the desire for healthier lifestyles and preventive healthcare are major drivers. Consumers are seeking natural and functional food products that offer nutritional benefits and support overall well-being. Additionally, the rising prevalence of chronic diseases and the aging population are driving the demand for nutraceutical ingredients with potential therapeutic properties. Moreover, advancements in food processing technologies and innovations in ingredient extraction and formulation techniques have expanded the range of nutraceutical ingredients available in the market. Furthermore, the growing trend of personalized nutrition and the increasing adoption of nutraceutical ingredients in sports nutrition and weight management products are also fueling the market growth. Overall, supportive government regulations and initiatives promoting health and wellness are creating a favorable environment for the nutraceutical ingredients market to thrive.

Restraining Factors

The nutraceutical ingredients market faces certain restraints that hinder its growth and potential. The high cost associated with the production and extraction of these ingredients poses a challenge, making the final products more expensive for consumers. Moreover, regulatory complexities and stringent approval processes for new ingredients and health claims can limit innovation and product development in the market. Additionally, limited consumer awareness and skepticism regarding the efficacy and safety of nutraceutical ingredients can deter their adoption. Furthermore, the lack of standardized definitions and regulations for nutraceutical products in different regions can create confusion and hinder market growth. Overall, the availability of counterfeit and adulterated ingredients in the market raises concerns about product quality and safety, impacting consumer trust.

Market Segmentation

- In 2022, the probiotics segment accounted for around 35.4% market share

On the basis of the product type, the global nutraceutical ingredients market is segmented into probiotics, prebiotics, vitamins, amino acids, carotenoids, phytochemicals & plant extracts, protein, EPA/DHA, minerals, fiber & carbohydrates, and others. The probiotics segment currently dominates the market share in the nutraceutical ingredients industry for several reasons because probiotics have gained immense popularity due to their potential health benefits, particularly for digestive health and immune system support. The increasing consumer awareness about the importance of gut health has led to a surge in demand for probiotic products. Extensive research and clinical studies have provided scientific evidence supporting the efficacy of probiotics, further boosting their market dominance. Moreover, the widespread availability of probiotic-rich food and beverage products, such as yogurt and fermented drinks, has facilitated consumer accessibility and acceptance. Additionally, the use of probiotics in dietary supplements and functional foods has expanded their reach, catering to a broader consumer base. Overall, the combination of consumer demand, scientific backing, and product availability has positioned the probiotics segment as a dominant force in the market.

- The functional food segment is expected to grow at a CAGR of around 7.5% during the forecast period

Based on the type of application, the global nutraceutical ingredients market is segmented into functional food, functional beverages, dietary supplements, personal care, and animal nutrition. The functional food segment is poised for significant growth in the forecast period. There are several factors driving this anticipated expansion due to growing awareness among consumers regarding the link between diet and health, leading to an increased preference for functional foods that offer specific health benefits. Functional foods are fortified with nutraceutical ingredients such as vitamins, minerals, probiotics, and antioxidants, which contribute to their therapeutic properties. The rising prevalence of chronic diseases, such as cardiovascular diseases, obesity, and diabetes, has fueled the demand for functional foods that can help manage or prevent these conditions. Furthermore, advancements in food processing technologies and ingredient formulations have led to the development of a wide range of innovative functional food products, appealing to a broader consumer base. Additionally, changing consumer lifestyles, including busy schedules and a desire for convenience, have driven the demand for functional foods that offer both nutrition and health benefits in a single package. Collectively, these factors are expected to drive the growth of the functional food segment in the forecast period.

Regional Segment Analysis of the Nutraceutical Ingredients Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 43.7% revenue share in 2022.

Get more details on this report -

Based on region, North America emerges as a dominant force in the nutraceutical ingredients market for several reasons because this region has a robust healthcare infrastructure and a well-established dietary supplement industry, fostering a favorable environment for market growth. North America has a large population actively seeking health and wellness products, with a growing awareness of preventive healthcare. Moreover, the region's affluent consumer base is willing to invest in premium nutraceutical ingredients to support their well-being. Additionally, North America has a strong network of research institutions and pharmaceutical companies conducting extensive research on nutraceutical ingredients, leading to innovation and product development. Furthermore, supportive regulatory frameworks, stringent quality standards, and safety regulations ensure consumer confidence in the market. Overall, these factors contribute to North America's dominance in the nutraceutical ingredients market.

Recent Development

- In February 2023, ADM announced the construction of a new manufacturing facility in Valencia, Spain, with an investment of USD 30 million to speed up its post- and probiotic production to meet an estimated three-fold increase in product demand over the next five years. The action will enable ADM to grow its goods while five-folding output, resulting in an annual capacity of 50 metric tonnes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global nutraceutical ingredients market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- BASF SE

- ADM

- Ingredion

- DSM NV

- Cargill

- Tate & Lyle

- Ajinomoto

- Roquette Freres

- Arla Food Ingredients

- Divis Laboratories

- Cosucra Groupe Warcoing SA

- Prinova Group, LLC

- Ambe Phytoextracts Pvt. Ltd.

- Nutra Food Ingredients

- Aurobindo Pharma Ltd.

- Associated British Foods PLC

- Aurea Biolabs

- AVT Natural Products Ltd.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global nutraceutical ingredients market based on the below-mentioned segments:

Nutraceutical Ingredients Market, By Product

- Prebiotics

- Vitamins

- Amino Acids

- Carotenoids

- Phytochemicals & Plant Extracts

- Protein

- EPA/DHA

- Minerals

- Fiber & Carbohydrates

- Others

Nutraceutical Ingredients Market, By Application

- Functional Food

- Functional Beverages

- Dietary Supplements

- Personal Care

- Animal Nutrition

Nutraceutical Ingredients Market, By Form

- Dry Form

- Liquid Form

Nutraceutical Ingredients Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?