Global Nutraceutical Packaging Market Size By Product Type (Bottles, Cans And Jars, Bags And Pouches, Cartons, Stick Packs, Blister Packs), By Material Type (Metal, Plastic, Glass, Paper And Paperboard), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 to 2032

Industry: Consumer GoodsGlobal Nutraceutical Packaging Market Insights Forecasts to 2032

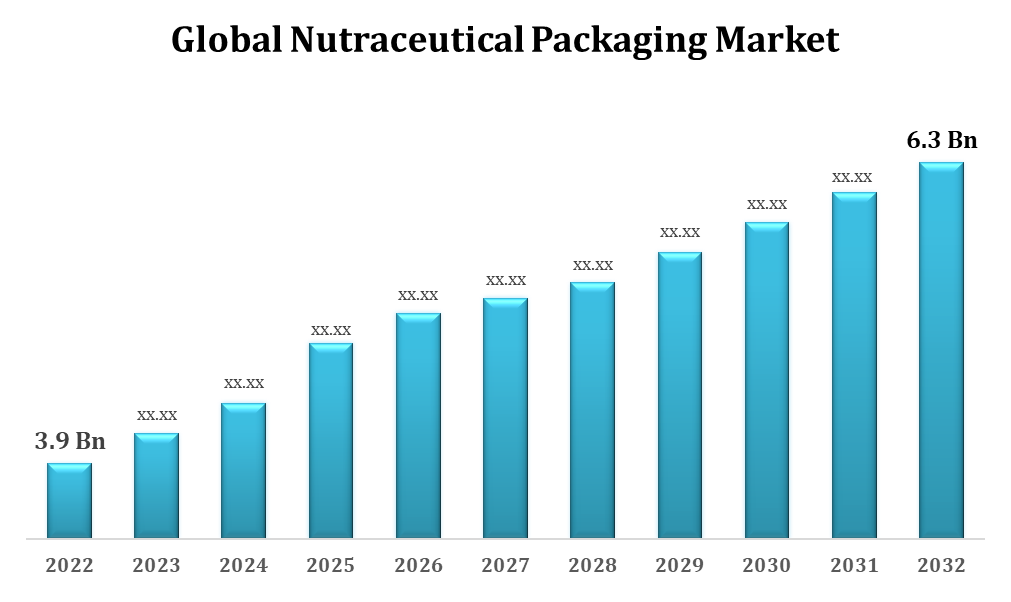

- The Global Nutraceutical Packaging Market Size was valued at USD 3.9 Billion in 2022

- The Market Size is Growing at a CAGR of 5.2% from 2022 to 2032

- The Worldwide Nutraceutical Packaging Market Size is expected to reach USD 6.3 Billion by 2032

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Nutraceutical Packaging Market Size is expected to reach USD 6.3 Billion by 2032, at a CAGR of 5.2% during the forecast period 2022 to 2032.

The nutraceutical packaging market is thriving as a result of the expanding health-conscious population and increased demand for functional foods. People want their vitamins, and they want them packaged well. There is a trend towards the use of innovative materials that not only preserve the goods but also correspond to consumer desires. Biodegradable and recyclable materials are increasing popularity, answering the demand for environmentally friendly and sustainable packaging. Because of the nature of the products involved, the industry is strictly regulated. Compliance with severe requirements is critical for packaging producers, influencing material selection and labelling. Dietary supplements, functional meals, and beverages are among the products available in the market. Each of these has distinct packing needs. Supplements, for example, may necessitate packaging that protects the efficacy of active components. Incorporating technology into packaging is becoming more popular. Smart packaging options, such as QR codes, NFC tags, and freshness indicators, deliver additional information to consumers.

Nutraceutical Packaging Market Value Chain Analysis

Raw material providers are critical in laying the groundwork for the packaging business. These are the people who take raw materials and convert them into finished packaging. Packaging producers are the industry's artisans, whether it's moulding plastics, sculpting glass, or developing revolutionary eco-friendly materials. When the packing is finished, it must appear excellent on the shelf. Label and package design firms step in to develop visually appealing labels and packaging designs. The industry's nuts and bolts (pun intended). Packaging machinery makers create the equipment required to efficiently fill, seal, label, and pack products. The supplements, functional meals, or beverages that go within the packaging are developed and manufactured by nutraceutical companies. A complicated logistics and distribution network is required to get packaged nutraceuticals from the manufacturing facility to stores or directly to customers. The last stop before it gets to you! Retailers are critical in showing and selling nutraceutical products. Packaging protects the product while also acting as a marketing element on store shelves.

Nutraceutical Packaging Market Opportunity Analysis

The number of tech-savvy consumers is growing. Consumer involvement and trust can be increased by incorporating smart packaging technology like as interactive labels, QR codes for product information, and freshness indicators. Brands are constantly looking for new methods to differentiate themselves. Offering distinctive forms, colours, and patterns for packaging can be a lucrative opportunity. A market opportunity exists for packaging that is simple to open, close, and dispense. Single-dose or portion-controlled supplement packaging, for example, caters to the on-the-go lifestyle. As more people shop online, there is a greater demand for packaging that can survive transportation issues. Robust, safe, and visually appealing e-commerce packaging could be a huge opportunity. The nutraceutical market is not geographically restricted. Exploring global expansion opportunities, recognising regional preferences, and adapting packaging solutions to diverse markets can all lead to new chances.

Global Nutraceutical Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.9 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.2% |

| 2032 Value Projection: | USD 6.3 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Material Type, By Region, By Geographic Scope |

| Companies covered:: | Amcor plc (Switzerland), Bemis Manufacturing Company. (U.S.), AptarGroup, Inc. (U.S.), Berry Global Inc. (U.S.), Gerresheimer AG (Germany), Schott AG (Germany), Mondi (Austria), WestRock Company (U.S.), TricorBraun (U.S.), CCL Industries (Canada), Sonoco Products Company (U.S.), RPC Group (U.K.), Constantia Flexibles (Austria), Bormioli Pharma S.p.A. (Italy), Graham Packaging Company (U.S.), Alphapackaging.co (U.S.), Tekni-Plex, Inc. (U.S.), and Other Key Vendors. |

| Growth Drivers: | Increased demand for nutraceutical foods from consumers |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Nutraceutical Packaging Market Dynamics

Increased demand for nutraceutical foods from consumers

As more individuals become health-conscious, there is a trend towards selecting foods that not only fulfil hunger but also have nutritional value. Nutraceutical foods, which are high in vitamins, minerals, and other bioactive substances, are ideal. Consumers are searching for more than just basic nutrients. They desire food that helps digestion, promotes immunity, and increases energy levels. Nutraceutical foods provide functional benefits that typical snacking may not provide. Nutraceutical foods frequently have explicit labelling that lists the beneficial elements. Packaging that emphasises transparency is more likely to attract customers. The era of one-size-fits-all is coming to an end. Consumers want personalised nutrition, and nutraceutical foods provide that option.

Restraints & Challenges

Balancing the quest for innovative and sustainable packaging with financial considerations is a tightrope act. Eco-friendly materials and cutting-edge designs are wonderful, but they are frequently more expensive. The nutraceutical sector frequently involves a complicated network of suppliers, manufacturers, and distributors. Coordination of this complex supply chain, especially on a worldwide basis, is difficult. Nutraceuticals have particular health claims and benefits. Educating customers about these benefits and how packaging contributes to product efficacy can be difficult. It's not just about selling a product; it's about selling a way of life. Embracing new technology, such as smart packaging, has its own set of obstacles. Integrating these technologies seamlessly and ensuring they add real value to the consumer can be a learning curve.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Nutraceutical Packaging Market from 2023 to 2032. Packaging innovation is thriving in North America. Smart packaging innovations, interactive designs, and new materials frequently have their origins in US and Canadian labs and studios. Because online commerce is thriving, packaging must adapt. Packaging that is secure, visually appealing, and efficient for the e-commerce experience is an important factor for the North American market. Transparency is important to North American consumers. Packaging that clearly communicates the health benefits, ingredients, and source information corresponds with informed buyer preferences. The fast-paced North American lifestyle necessitates packaging designed for on-the-go consumption. Snack-sized portions, resealable pouches, and portable designs are popular.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia Pacific region is experiencing an increase in health consciousness. As people's lifestyles change, so does the need for nutraceuticals and, as a result, their packaging. The Asia Pacific market is varied, with a wide range of cultures and tastes. Packaging must accommodate a wide range of preferences, from conventional to modern and minimalist styles. Consumer habits are changing as a result of the advent of e-commerce. Packaging that protects the product throughout shipment and allows for a smooth online unboxing experience is an important factor. Traditional medicine and herbal cures are popular in parts of Asia. Consumers wanting the best of both worlds may be drawn to packaging that displays a balanced blend of modernism and traditional values.

Segmentation Analysis

Insights by Product Type

Bags and pouches segment accounted for the largest market share over the forecast period 2023 to 2032. The adaptability of bags and pouches allows for endless possibilities. Manufacturers can get inventive with designs that improve both practicality and aesthetic appeal, from stand-up pouches to spouted pouches. Flexible packaging shines with the rise of internet purchasing. When compared to rigid packaging, it is lightweight, takes up less room, and is less prone to breakage during transit, making it suitable for the e-commerce journey. Bag and pouch manufacture can be less expensive than rigid packaging manufacturing. Manufacturers trying to optimise their production processes may find this cost efficiency enticing. Packaging is frequently the first point of contact for consumers. Bags and pouches offer plenty of opportunity for branding, narrative, and product information, allowing products to stand out on the shelf.

Insights by Material Type

Plastic segment accounted for the largest market share over the forecast period 2023 to 2032. Plastic packaging's lightweight nature is important, especially for products that people frequently carry on the go. It's light on the shelves, in your suitcase and in transit, which helps you save money. Plastic has great barrier characteristics, preventing light, air, and moisture from entering the container. This is critical for keeping nutraceutical items potent and fresh over their shelf life. Plastic packaging is a fertile environment for creativity. Plastic offers for a wide range of creative and useful designs that fulfil the special needs of nutraceutical products, from squeezable bottles to child-resistant closures. Plastic packaging is ideal for the needs of e-commerce. Its resilience and flexibility aid in the protection of products during transportation, ensuring that they reach consumers in pristine shape.

Recent Market Developments

- In April 2023, Berry Global had a spectacular inauguration ceremony to commemorate the completion of its new state-of-the-art healthcare manufacturing facility and Global Centre of Excellence in Bangalore, India.

Competitive Landscape

Major players in the market

- Amcor plc (Switzerland)

- Bemis Manufacturing Company. (U.S.)

- AptarGroup, Inc. (U.S.)

- Berry Global Inc. (U.S.)

- Gerresheimer AG (Germany)

- Schott AG (Germany)

- Mondi (Austria)

- WestRock Company (U.S.)

- TricorBraun (U.S.)

- CCL Industries (Canada)

- Sonoco Products Company (U.S.)

- RPC Group (U.K.)

- Constantia Flexibles (Austria)

- Bormioli Pharma S.p.A. (Italy)

- Graham Packaging Company (U.S.)

- Alphapackaging.co (U.S.)

- Tekni-Plex, Inc. (U.S.)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Nutraceutical Packaging Market, Product Type Analysis

- Bottles

- Cans And Jars

- Bags And Pouches

- Cartons

- Stick Packs

- Blister Packs

Nutraceutical Packaging Market, Material Type Analysis

- Metal

- Plastic

- Glass

- Paper And Paperboard

Nutraceutical Packaging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?