Global Offshore Wind Energy Market Size, Share, and COVID-19 Impact Analysis, By Components (Turbines, Electrical Infrastructure, Substructure, and Others), By Location (Shallow Water, Transitional Water, and Deep Water), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Offshore Wind Energy Market Insights Forecasts to 2033

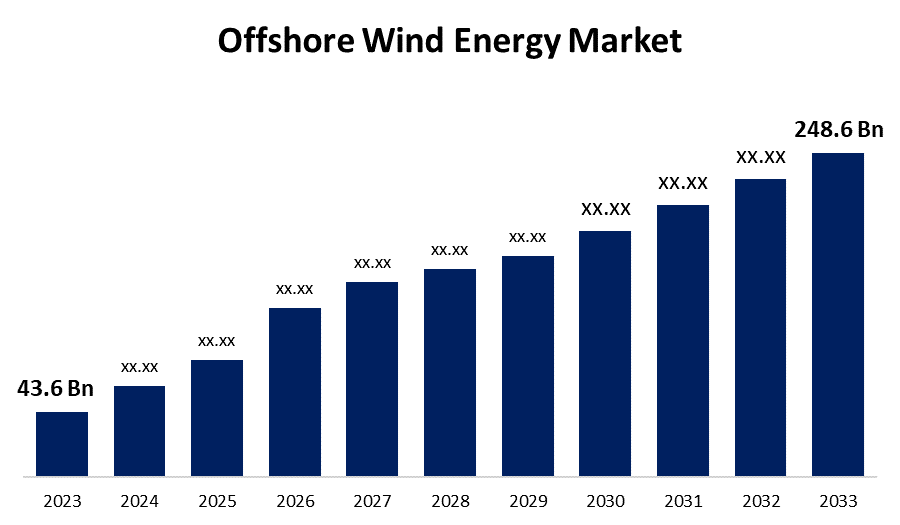

- The Global Offshore Wind Energy Market Size was Valued at USD 43.6 Billion in 2023

- The Market Size is Growing at a CAGR of 19.01% from 2023 to 2033

- The Worldwide Offshore Wind Energy Market Size is Expected to Reach USD 248.6 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Offshore Wind Energy Market Size is Anticipated to Exceed USD 248.6 Billion by 2033, Growing at a CAGR of 19.01% from 2023 to 2033.

Market Overview

Offshore wind energy is a process for the generation of electricity from wind blowing over the sea. These winds are harnessed at sea, which is faster and more reliable compared to wind on land because of the lack of barriers. Such electricity is supplied to the onshore electricity network. It is considered that offshore wind farms are more efficient than on-shore ones because of the higher wind speeds, greater consistency, and lack of physical interference. Even the size of the offshore wind turbines is much larger than that of the onshore wind turbines, with 5-10 MW per turbine, while onshore turbines were only 2-3 MW. The U.S. Department of Energy states that offshore wind has the potential to deliver huge amounts of clean, renewable energy to meet cities' electrical demands along the U.S. coastlines. The National Renewable Energy Laboratory assumes that, under supportive conditions for the utilization of offshore wind, the technical resource potential for U.S. offshore wind is in excess of 4,200 Gw of capacity or 13,500 TWh of generation, which is three times the electricity consumed annually in the United States.

According to the U.S. Department of Energy, the potential generating capacity of the U.S. offshore wind project in terms of its project development and operational pipeline grew by 53% from last year to 80,523 megawatts (MW). This is in large part thanks to notable additions from eight proposed leasing areas in the Gulf of Maine providing 15,702 MW of pipeline growth, two proposed leasing areas in the Mid-Atlantic with 4,499 MW, and two proposed leasing areas off the coast of Oregon with 3,156 MW.

Report Coverage

This research report categorizes the market for offshore wind energy based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the offshore wind energy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the offshore wind energy market.

Global Offshore Wind Energy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 43.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 19.01% |

| 2033 Value Projection: | USD 248.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 276 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Components, By Location, By Region |

| Companies covered:: | WEG, Goldwind, Suzlon Energy Limited, ENESSERE S.r.l., FURUKAWA ELECTRIC CO., LTD, General Electric, Global Energy (Group) Limited, IMPSA, LS Cable & System Ltd., Nexans, Nordex SE, Prysmian Group, Siemens Gamesa Renewable Energy, Sumitomo Electric Industries, Ltd., Southwire Company, LLC, Vestas, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Governments in many countries are making efforts to get carbon either way down after announcing the targets. Elevating governments to invest in renewable power sources such as wind and solar. Thus, the activeness is seen to rise and reach enormous volumes of electricity generated in recent years using wind energy. MNRE or the Indian Union Ministry of New and Renewable Energy wants to set up 5 GW and 30 GW of offshore capacities with targets for the years 2022 and 2030. The World Economic Forum Reports that the market for offshore wind will reach $1 trillion in 2040. This will be driven by reducing technology costs, an increase in the need to cut CO2 emissions, and an increase in energy consumption by developing and undeveloped countries. The International Renewable Energy Agency (IRENA) argues that the share of renewables in annual global energy production needs to increase from the current 25% to 86% by 2050 to meet the goals of the Paris Agreement. This would only be realized if the global economy will plow in $110 trillion in investment into the industry by 2050, way higher than the already ambitious target of $95 trillion that the industry can expect to receive in investments by 2030. This shall, however, be visible as the globe seeks to veer away from fossil-based energy and into renewable sources of energy.

Restraining Factors

While having a high capacity factor compared to related technologies, including solar and onshore wind, huge capital costs deter its execution. Offshore wind turbines are prone to erosion since they operate for several decades in harsh marine environments. With the growing size of offshore wind farms over time, challenges related to construction, transportation, installation, and operation have also increased. Challenges associated with logistics in general are a greater task in an offshore wind farm. Other restraining factors in offshore wind power deployment relate to resource characterization, grid interconnection and operation, and development of transmission infrastructure, which are much simpler in other technologies, such as solar and onshore wind. Thus, the high capital costs and issues associated with the operations, maintenance, transportation, and logistics restrain the global offshore wind energy market.

Market Segmentation

The offshore wind energy market share is classified into component and location.

- The turbines segment is estimated to hold the highest market revenue share through the projected period.

Based on the component, the offshore wind energy market is classified into turbines, electrical infrastructure, substructure, and others. Among these, the turbines segment is estimated to hold the highest market revenue share through the projected period. This is due to wind turbines can capture more wind energy and are more efficient, reducing the cost per megawatt-hour (MWh) of electricity generated. Further longer blades and taller towers allow them to capture more wind energy, especially at higher altitudes where wind speeds are greater and more consistent, thereby contributing to industry landscape. They are typically much larger than onshore wind turbines, ranging from 5–10 MW per turbine, compared to 2–3 MW for onshore turbines. They are around with blades are 600 feet high and weigh almost 30 tons each. According to the U.S. Office of Energy Efficiency & Renewable Energy, wind turbine towers are 60-75% domestically sourced, blade and hub components are 30-50% domestic, and nacelle assemblies are over 85% domestically sourced. However, many internal parts such as pitch and yaw systems, bearings, bolts, and controllers are typically imported. Moreover, the use of advanced composite materials makes the blades lighter and more durable, enhancing their performance and longevity and strengthening the product demand.

- The shallow water segment is anticipated to hold the largest market share through the forecast period.

Based on the location, the offshore wind energy market is divided into shallow water, transitional water, and deep water. Among these, the shallow water segment is anticipated to hold the largest market share through the forecast period. Shallow water, typically defined as areas with water depths of up to 60 meters, is the most accessible and cost-effective location for offshore wind farm development. It's like having prime real estate with a great view and easy access - that's what the shallow water sites offer to wind farm developers. The lower construction and installation costs, as well as the availability of established infrastructure and supply chains, make shallow water sites the preferred choice for many offshore wind projects. Additionally, the technological advancements in foundation designs and turbine sizes have further enhanced the feasibility and competitiveness of shallow water offshore wind farms. It's like having the latest and greatest tools in your toolbox, making the job much easier and more efficient. As a result, the shallow water segment is anticipated to account for the largest market share in the overall offshore wind energy market during the forecast period. It's the low-hanging fruit, the sweet spot, and the go-to option for wind farm developers who want to maximize their returns while minimizing their risks.

Regional Segment Analysis of the Offshore Wind Energy Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

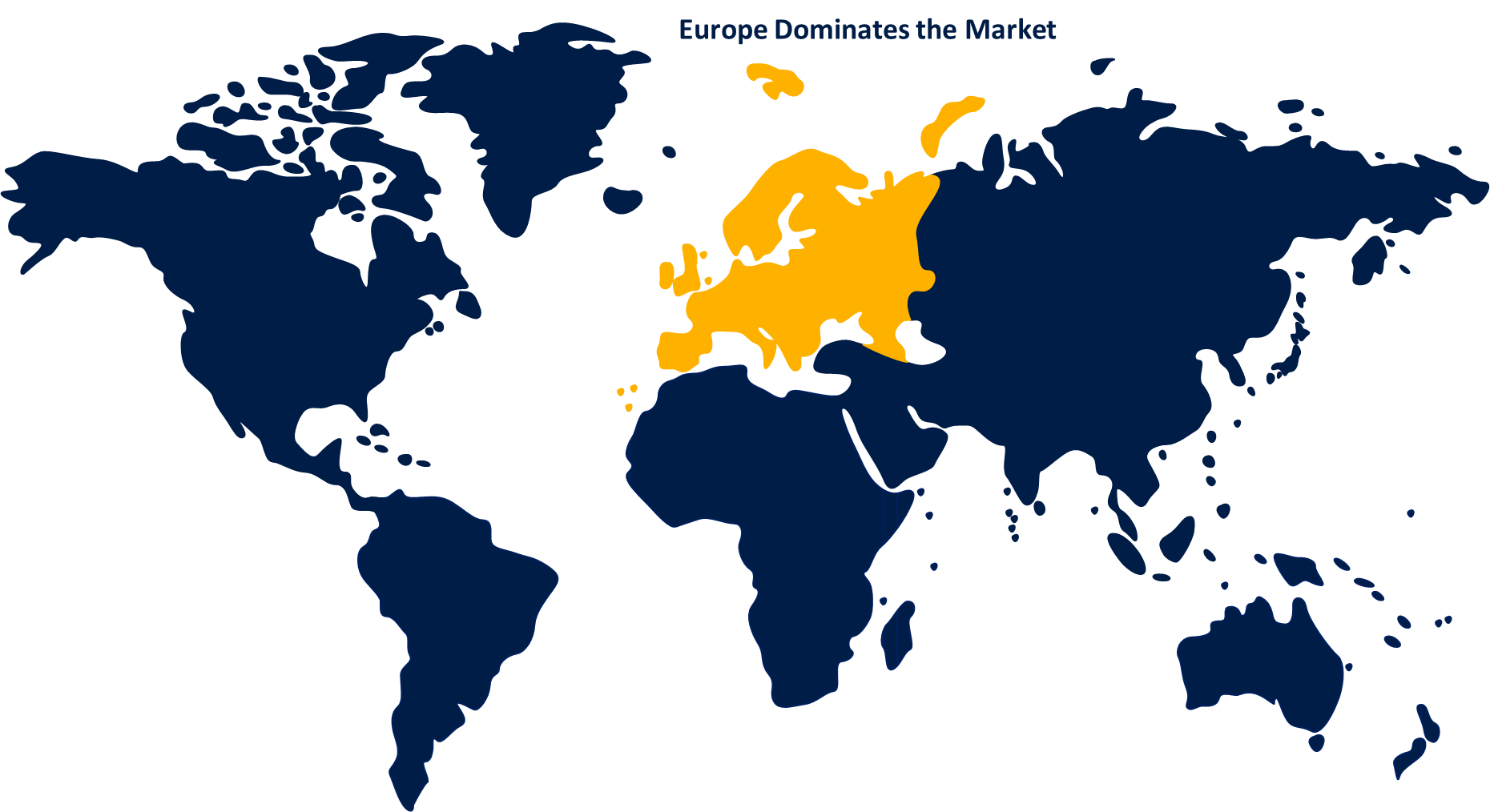

Europe is anticipated to hold the largest share of the offshore wind energy market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the offshore wind energy market over the predicted timeframe. This can be attributed to the growing investments in renewable energy coupled with favorable government policies. Various key offshore renewable power companies in Europe, such as Vestas, ABB, Siemens, and Nordex SE, are anticipated to boost the market's growth. Furthermore, EWI supports offshore wind energy market development and a research & development program for renewable power. Additionally, various countries across Europe are increasing their focus on upgrading their electrical infrastructure, and the governments in these nations are promoting the use of renewable energy for power generation. Thus, this is driving the growth of the market. Europe’s offshore capacity is sufficiently large enough to supply the electricity demand in Europe which will only continue to grow within the upcoming years. Europe requires major investment in infrastructure and increase installation rates if it aims to deliver its climate targets. European Governments targets and ambitions together pledge to deliver up to 160 GW of wind capacity by 2030. Huge investments are needed in offshore grid, And ports need €6.5bn of investments over the decade to prepare for the 2030 installations and beyond.

Asia Pacific is expected to grow at the fastest CAGR growth of the offshore wind energy market during the forecast period. This is because the offshore wind energy market is driven in Asia Pacific region by the rapid rise of offshore wind energy projects in the region including a continually rising demand for green energy sources, extensive coastlines, and rich wind resources. According to the Global Wind Energy Council, the global offshore wind industry is expected to add 380GW of capacity across 32 markets by 2032, with nearly half of that growth predicted to come from the APAC region. The long coastlines and high offshore wind speeds create great opportunities for offshore wind energy development. Therefore, countries here are investing substantially in renewable energy sources and implementing government policies to support industry growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the offshore wind energy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- WEG

- Goldwind

- Suzlon Energy Limited

- ENESSERE S.r.l.

- FURUKAWA ELECTRIC CO., LTD

- General Electric

- Global Energy (Group) Limited

- IMPSA

- LS Cable & System Ltd.

- Nexans

- Nordex SE

- Prysmian Group

- Siemens Gamesa Renewable Energy

- Sumitomo Electric Industries, Ltd.

- Southwire Company, LLC

- Vestas

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Fugro (Dutch geo-data specialist), has been awarded a long-term contract to provide construction support to its compatriot Van Oord for offshore wind farms across Europe for three years, with an option to extend.

- In August 2024, Japan’s Sumitomo Corporation acquired an equity stake in EEW Offshore Wind Holding to improve its monopile manufacturing capabilities.

- In August 2024, Réseau de Transport Electricite (RTE) French transmission system operator (TSO) awarded a contract to a consortium comprising Hitachi Energy and Chantiers de l’Atlantique for the offshore substations and the onshore converter stations for the Centre Manche 1, Centre Manche 2, and Oléron offshore wind projects.

- In August 2024, the Bureau of Ocean Energy Management (BOEM), the United States Ocean Energy Agency, has approved the state of Maine as the first floating offshore wind energy research lease in the United States.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the offshore wind energy market based on the below-mentioned segments:

Global Offshore Wind Energy Market, By Component

- Turbines

- Electrical Infrastructure

- Substructure

- Others

Global Offshore Wind Energy Market, By Location

- Shallow Water

- Transitional Water

- Deep Water

Global Offshore Wind Energy Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the offshore wind energy market over the forecast period?The offshore wind energy market is projected to expand at a CAGR of 19.01% during the forecast period.

-

2. What is the market size of the offshore wind energy market?The Global Offshore Wind Energy Market Size is Expected to Grow from USD 43.6 Billion in 2023 to USD 248.6 Billion by 2033, at a CAGR of 19.01% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the offshore wind energy market?Europe is anticipated to hold the largest share of the offshore wind energy market over the predicted timeframe.

Need help to buy this report?