Global Oil Condition Monitoring (OCM) Market Size, Share, and COVID-19 Impact Analysis, By Sampling Type (On-Site, Off-Site), By Product Type (Turbine, Compressor, Transformers, Engine, Gear Systems, Hydraulic Systems, Others), By End-Use Industry (Transportation, Industrial, Oil & Gas, Power Generation, Mining, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Machinery & EquipmentGlobal Oil Condition Monitoring (OCM) Market Size Insights Forecasts to 2032

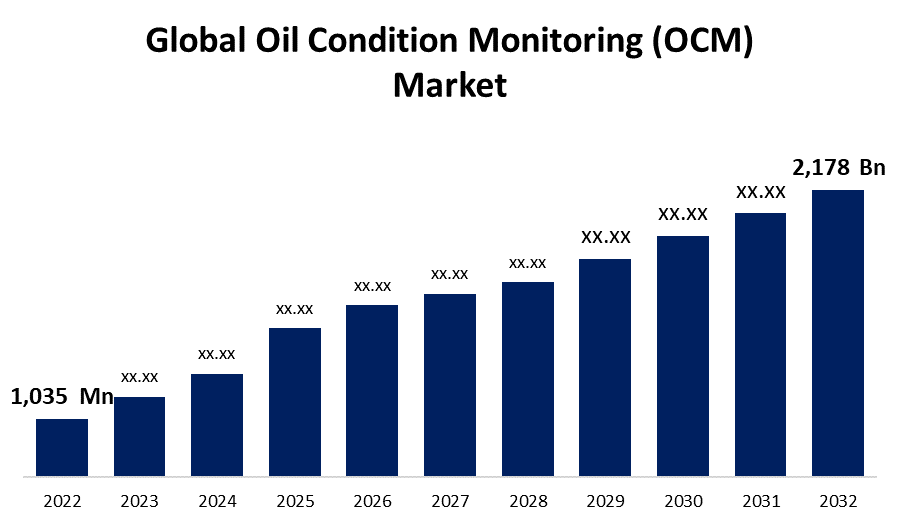

- The Global Oil Condition Monitoring (OCM) Market Size was valued at USD 1,035 Millionin 2022.

- The Market Size is growing at a CAGR of 7.7% from 2022 to 2032

- The Worldwide Oil Condition Monitoring (OCM) Market Size is expected to reach USD 2,178 Millionby 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Oil Condition Monitoring (OCM) Market Size is expected to reach USD 2,178 Million by 2032, at a CAGR of 7.7% during the forecast period 2022 to 2032.

Oil Condition Monitoring (OCM) or Used Oil Analysis (UOA) is an essential component of any predictive maintenance system. OCM entails measuring, tracking, and analyzing variations in lubricant and fuel oil for contamination and chemical composition, as well as observing oil quality decline from new through the end of its lifespan. By tracking changes in machinery lubricant quality, clients are able to prevent costly machinery, engine, and power-train breakdowns. This data can also be used to develop an effective maintenance program by providing information on challenges impeding performance and dependability. Oil condition monitoring has a wide range of applications, including lubricating the moving components that power wind turbines, maintaining conveyer belts functioning smoothly at food processing plants, preventing premature wear of heavy duty mining machinery, and many others. Furthermore, oil analysis has become standard across numerous commercial and military institutions, and efforts have been made to extend typical oil analysis processes into the domain of real-time analysis. Real-time monitoring is a critical tool for maximizing the use of lubricants while avoiding machinery delays, resulting in improved savings and efficiency.

Oil Condition Monitoring (OCM) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1,035 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.7% |

| 2032 Value Projection: | USD 2,178 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Sampling Type, By Product Type, By End-Use Industry, and By Region |

| Companies covered:: | SGS SA, BP plc, Shell plc, General Electric, Eaton Corporation, Chevron Corporation, TotalEnergies, Intertek Group plc, Celanese Corporation, Parker-Hannifin Corporation, and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The most significant factors driving the steady expansion of the oil condition monitoring market are rising demand for low-cost alternatives for preserving machinery health, increased industry knowledge of the need for oil condition monitoring, and a rising emphasis on lowering maintenance expenditures. In addition, growing consumer knowledge about prolonging the functional lifespan of machines and equipment, as well as an increase in the expenditure on predictive maintenance, are expected to boost the oil condition monitoring market's expansion throughout the period of forecasting. Companies can use predictive maintenance technologies such as oil condition monitoring to identify the oil condition of their machines. As a result, industries have avoided redundant machine breakdowns.

The development in big data analytics as well as data storage technologies is anticipated to give rise to a lucrative opportunity in the oil condition monitoring market. Big data analytics provides benefits involving better benchmarking of oil quality, improved data transparency, and efficient collaboration of diverse oil quality testing findings. The application of big data analytics allows for the efficient processing of massive amounts of data. This aids in the proper examination of data from oil quality sensors. Furthermore, the introduction of real-time measuring sensors for oil condition monitoring that are more cost-effective than standard sampling and laboratory techniques is propelling market expansion.

Market Segmentation

By Sampling Type Insights

The off-site segment is dominating the market with the largest revenue share over the forecast period.

On the basis of technology, the global oil condition monitoring (OCM) market is segmented into the on-site and off-site. Among these, the off-site segment is dominating the market with the largest revenue share of 58.6% over the forecast period. Off-site oil condition monitoring operates at service stations that have advanced analytical instruments. A team of qualified professionals performs the study at these service facilities to check the machine's condition. Off-site oil sampling procedures are widely utilized in a variety of industries, including transportation, industrial, oil and gas, power production, and mining. Furthermore, industries that operate in harsh climatic circumstances, such as arctic natural gas extraction plants and damp mining sites, use off-site sample methods for oil condition analysis. These are expected to be the primary variables driving the extent of the oil condition monitoring market during the projected period.

By Product Type Insights

The engine segment is expected to hold the largest share of the Global Oil Condition Monitoring (OCM) Market during the forecast period.

Based on the product type, the global oil condition monitoring (OCM) market is classified into turbine, compressor, transformers, engine, gear systems, hydraulic systems, and others. Among these, the engine segment is expected to hold the largest share of the Oil Condition Monitoring (OCM) market during the forecast period. This is due to the large number of cars and industrial equipment that require engine lubricants. Engine oil monitoring is an important market because of its wide range of uses, which range from transportation to construction and agriculture. Monitoring the engine oil state helps to avoid wear and corrosion while also maintaining efficient combustion.

By End-Use Industry Insights

The transportation segment accounted for the largest revenue share of more than 32.7% over the forecast period.

On the basis of end-use industry, the global oil condition monitoring (OCM) market is segmented into transportation, industrial, oil & gas, power generation, mining, and others. Among these, the transportation segment is dominating the market with the largest revenue share of 32.7% over the forecast period. Oil condition monitoring is widely used in the transportation industry for engines in vehicles such as cars, trucks, buses, airplanes, and ships. It maintains engine lifespan and productivity by monitoring oil degradation and pollution. Given the vast number of vehicles on the road worldwide and the dire repercussions of an engine breakdown, keeping proper oil condition is critical. It also helps with energy savings and emissions reduction.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. Oil condition monitoring has been rapidly adopted by companies operating in the region due to its tangible advantages in preventive maintenance and performance. Additionally, with a widely recognized industrial base covering manufacturing, oil and gas, transportation, and other industries, North America has a wide range of oil condition monitoring applications. Integration with technology such as the Internet of Things (IoT), artificial intelligence (AI), and data analytics has improved the North American oil condition monitoring environment, enabling more complex and predictive maintenance methods. Furthermore, the region's wide energy mix, ranging from fossil fuels to renewables, as well as its extensive industrial sector, adds to the oil condition monitoring market.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. Because of its massive manufacturing boom and increasing technological usage, the Asia Pacific area continues to experience rapid growth and might potentially hold the largest share. With a broad industrial landscape, the region employs oil condition monitoring in a variety of industries, including manufacturing, transportation, and power generation. Oil condition monitoring is becoming more popular in Asia Pacific industries as they rely increasingly on preventive maintenance and productivity. The massive energy requirements of the region, as well as the expanding renewable energy installations, boost the market, particularly in power generation equipment maintenance.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. European companies established a high priority on sustainability, which has resulted in the introduction of technology such as oil condition monitoring to reduce greenhouse gas emissions and ensure the optimum use of resources. Furthermore, the region has severe environmental, energy consumption, and industrial standards regulations, forcing enterprises to implement oil condition monitoring systems.

List of Key Market Players

- SGS SA

- BP plc

- Shell plc

- General Electric

- Eaton Corporation

- Chevron Corporation

- TotalEnergies

- Intertek Group plc

- Celanese Corporation

- Parker-Hannifin Corporation

Key Market Developments

- On May 2023, Mitsui O.S.K. Lines, Ltd. announced that it has completed the joint research and development with Asahi Kasei Engineering on “Predictive Detection of Marine Motor Anomalies by Vibration Sensors” and it has realized to commercialize V-MO, a monitoring service for marine motors. V-MO enables the detection of motor abnormalities, diagnosis of their causes, and continuous condition monitoring of motors installed on a vessel and analyzing the measured data.

- On June 2022, HydraForce, a leading manufacturer of hydraulic valves and manifolds, has partnered with Tan Delta Systems, the world’s leading manufacturer of real-time oil quality monitoring sensors and systems, to provide valuable real-time data about machine oil quality and expand its capabilities within the telematics market. This application will visualize data and provide customized alerts to inform the operator or owner when hydraulic fluids require maintenance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Oil Condition Monitoring (OCM) Market based on the below-mentioned segments:

Oil Condition Monitoring (OCM) Market, Sampling Type Analysis

- On-Site

- Off-Site

Oil Condition Monitoring (OCM) Market, Product Type Analysis

- Turbine

- Compressor

- Transformers

- Engine

- Gear Systems

- Hydraulic Systems

- Others

Oil Condition Monitoring (OCM) Market, End-Use Industry Analysis

- Transportation

- Industrial

- Oil & Gas

- Power Generation

- Mining

- Others

Oil Condition Monitoring (OCM) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Oil Condition Monitoring (OCM) market?The Global Oil Condition Monitoring (OCM) Market is expected to grow from USD 1,035 million in 2022 to USD 2,178 million by 2032, at a CAGR of 7.7% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?SGS SA, BP plc, Shell plc, General Electric, Eaton Corporation, Chevron Corporation, TotalEnergies, Intertek Group plc, Celanese Corporation, Parker-Hannifin Corporation

-

3. Which segment dominated the Oil Condition Monitoring (OCM) market share?The transportation segment in end-use industry dominated the Oil Condition Monitoring (OCM) market in 2022 and accounted for a revenue share of over 32.7%.

-

4. Which region is dominating the Oil Condition Monitoring (OCM) market?North America is dominating the Oil Condition Monitoring (OCM) market with more than 38.7% market share.

-

5. Which segment holds the largest market share of the Oil Condition Monitoring (OCM) market?The off-site segment based on sampling type holds the maximum market share of the Oil Condition Monitoring (OCM) market.

Need help to buy this report?