Global Oil Country Tubular Goods (OCTG) Market Size, Share, and COVID-19 Impact Analysis, By Process (Seamless and Welded), By Product (Well Casing, Production Tubing, Drill Pipe, and Others), By Application (Onshore and Offshore), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Oil Country Tubular Goods Market Insights Forecasts to 2033

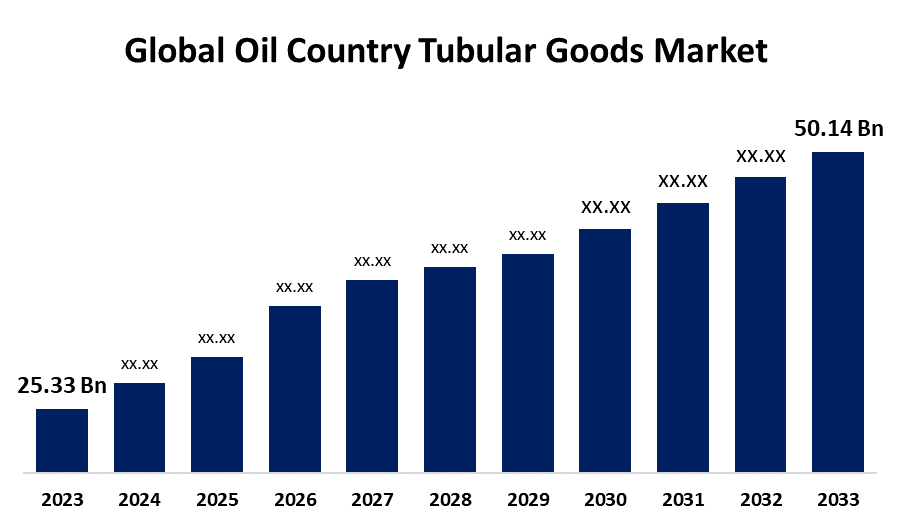

- The Global Oil Country Tubular Goods Market Size was Valued at USD 25.33 Billion in 2023

- The Market Size is Growing at a CAGR of 7.07% from 2023 to 2033

- The Worldwide Oil Country Tubular Goods Market Size is Expected to Reach USD 50.14 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Oil Country Tubular Goods Market Size is Anticipated to Exceed USD 50.14 Billion by 2033, Growing at a CAGR of 7.07% from 2023 to 2033.

Market Overview

Oil country tubular goods (OCTG) are pipeline materials used in the oil and gas industry, such as drill pipe, steel casing, and tubing. The current oil and gas sector is based on oil-country tubular goods. They serve as the fundamental materials needed to capture one of the most important sources of energy in the world as they are used in the discovery and manufacture of petroleum-based products. Additionally, they are involved in the safe and effective delivery of oil and gas products to their destinations. The American Petroleum Institute (API) specifications, the International Specifications Organization (ISO), and other sources provide definitions that oil country tubular goods have identified. Every component has a specific purpose and is essential to the exploration, production, and transportation of oil and gas market goods. The oil country tubular goods market is being driven by the rising demand for these products in the gas and oil sector for extraction, drilling, exploration and production, and other uses. The market is growing due to an increase in exploration and production (E&P) as well as the execution of several government programs to encourage the finding and extraction of oil and gas.

Report Coverage

This research report categorizes the market for the global oil country tubular goods market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global oil country tubular goods market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global oil country tubular goods market.

Global Oil Country Tubular Goods (OCTG) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.33 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.07% |

| 2033 Value Projection: | USD 50.14 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Process, By Product, By Application, By Region |

| Companies covered:: | ArcelorMittal, EVRAZ plc, ILJIN STEEL CO. LTD., JFE Steel Corporation, National Oilwell Varco, NIPPON STEEL CORPORATION, NOV Inc., Schlumberger, Tenergy Equipment & Service Ltd, Oil Country Tubular Limited, Sumitomo Corporation, Zekelman Industries, Tenaris, SB International, Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The global economic recovery caused an increase in energy use in several areas. In the global energy picture, gas and oil are the primary energy sources. Hydrocarbons find widespread application in many activities such as processing, manufacturing, and energy generation. Exploration and production activities are receiving exponential investments from oilfield service providers and operators in an attempt to meet the massive demand for gas and oil. This is one of the most important developments in the oil country tubular goods market. Due to the industry's steady expansion and the significant rise in drilling operations across the globe, the prospect for the oil country tubular goods market is probably going to be improved.

Restraining Factors

The high cost of the initial stages of material purchase and development is expected to restrict the oil country tubular goods (OCTG) market. In addition, OCTG has extremely high operating costs. The producers of OCTG have significant difficulties due to the dynamic nature of the economy and the varying demand for oil across different regions.

Market Segmentation

The global oil country tubular goods market share is classified into process, product, and application.

- The seamless segment is expected to hold the largest share of the global oil country tubular goods market during the forecast period.

Based on the process, the global oil country tubular goods market is divided into seamless and welded. Among these, the seamless segment is expected to hold the largest share of the global oil country tubular goods market during the forecast period. In the global energy scenario, conventional energy resources play a significant role, particularly hydrocarbons, which are commonly used for a variety of operations in a wide range of industries. The seamless pipes can endure exceptionally high pressure without cracking, they are chosen over welded ones. They also provide shape homogeneity and eliminate the chance of a weak seam, which makes them appropriate for high-pressure uses the production and exploration of hydrocarbons.

- The well-casing segment is expected to hold the largest share of the global oil country tubular goods market during the forecast period.

Based on the product, the global oil country tubular goods market is divided into well casing, production tubing, drill pipe, and others. Among these, the well-casing segment is expected to hold the largest share of the global oil country tubular goods market during the forecast period. It stabilizes the drill bit and helps prevent groundwater pollution, well casing is an integral part of the drilling process. Additionally, it stabilizes the well's wall to prevent unconsolidated sand or rock pieces that could otherwise collapse into the well shaft. The protective casing of electrical wires, pull cables, and water tubing or piping attached to submersible pumps is crucial.

- The offshore segment is expected to hold the largest share of the global oil country tubular goods market during the forecast period.

Based on the application, the global oil country tubular goods market is divided onshore and offshore. Among these, the offshore segment is expected to hold the largest share of the global oil country tubular goods market during the forecast period. Comparing oilfield equipment shipping to offshore applications, the former is significantly simpler. Additionally, because labor is easily obtained and there is great planning flexibility, land-based drilling is far less expensive than offshore operations. The offshore drilling market is expected to increase steadily because of the significant potential for hydrocarbon recovery.

Regional Segment Analysis of the Global Oil Country Tubular Goods Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global oil country tubular goods market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global oil country tubular goods market over the predicted timeframe. The world's top producer of crude oil was the United States. The United States shale drilling regions have increased their utilization of directional and horizontal drilling operations during the last decade. The relaxed regulations of the oil and gas sector in Canada and Mexico resulted in a rise in foreign investment, which in turn driving the market growth. One of the largest offshore deep-water reserves is Mexico, whose production is anticipated to increase over the projection period.

Asia Pacific is expected to grow at the fastest pace in the global Oil Country Tubular Goods market during the forecast period. The Asia Pacific region is seeing extraordinary economic growth, accompanied by rising urbanization and a growing middle class. This results in an increase in the need for energy, especially gas and oil. The oil and gas industries in Asian nations, including China, India, Indonesia, Malaysia, and Thailand, are expanding quickly as a result of increased energy demands driven by population growth and industrialization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global oil country tubular goods market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ArcelorMittal

- EVRAZ plc

- ILJIN STEEL CO. LTD.

- JFE Steel Corporation

- National Oilwell Varco

- NIPPON STEEL CORPORATION

- NOV Inc.

- Schlumberger

- Tenergy Equipment & Service Ltd

- Oil Country Tubular Limited

- Sumitomo Corporation

- Zekelman Industries

- Tenaris

- SB International, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, The Japan EPD Program run by the Sustainable Management Promotion Organization (SuMPO), Nippon Steel Corporation achieved EcoLeaf Environmental Product announcements for three different types of high-alloy OCTG and line pipe products. These are Japan's first EPDs for products made of stainless steel.

- In March 2023, ArcelorMittal has successfully acquired CSP in Brazil. Along with the possibility for future expansions, such as the ability to add primary steelmaking capacity (including direct reduction iron) and rolling and finishing capacity, the acquisition offers considerable operational and financial synergies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global oil country tubular goods market based on the below-mentioned segments:

Global Oil Country Tubular Goods Market, By Process

- Seamless

- Welded

Global Oil Country Tubular Goods Market, By Product

- Well Casing

- Production Tubing

- Drill Pipe

- Others

Global Oil Country Tubular Goods Market, By Application

- Onshore

- Offshore

Global Oil Country Tubular Goods Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?ArcelorMittal, EVRAZ plc, ILJIN STEEL CO. LTD., JFE Steel Corporation, National Oilwell Varco, NIPPON STEEL CORPORATION, NOV Inc., Schlumberger, Tenergy Equipment & Service Ltd, Oil Country Tubular Limited, Sumitomo Corporation, Zekelman Industries, Tenaris, SB International, Inc., and Others.

-

2. What is the size of the global Oil Country Tubular Goods market?The global oil country tubular goods market is expected to grow from USD 25.33 Billion in 2023 to USD 50.14 Billion by 2033, at a CAGR of 7.07% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global oil country tubular goods market over the predicted timeframe.

Need help to buy this report?