Global Oilfield Chemicals Market Size, Share, Growth, and Industry Analysis, By Type (Demulsifiers, Corrosion Inhibitors, Water Clarifiers, Biocides), By Product (Rheology Modifiers, Inhibitors, Others) By Application (Drilling, Production, Cementing, Workover & Completion), and Regional Oilfield Chemicals and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Oilfield Chemicals Market Insights Forecasts to 2033

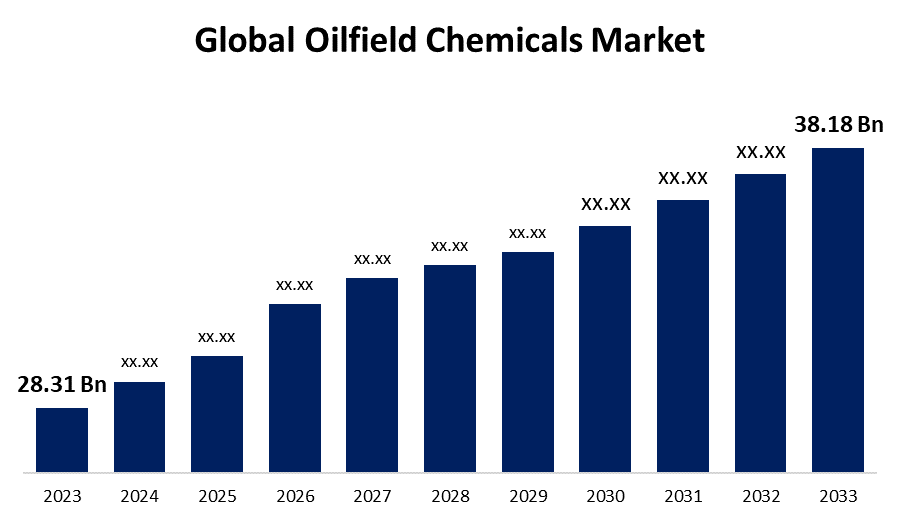

- The Global Oilfield Chemicals Market Size was Valued at USD 28.31 Billion in 2023

- The Market Size is Growing at a CAGR of 3.04 % from 2023 to 2033

- The Worldwide Oilfield Chemicals Market Size is Expected to Reach USD 38.18 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Oilfield Chemicals Market Size is Anticipated to Exceed USD 38.18 Billion by 2033, Growing at a CAGR of 3.04 % from 2023 to 2033.

OILFIELD CHEMICALS MARKET REPORT OVERVIEW

Oilfield chemicals are employed at oilfield sites to increase productivity and effectiveness. Chemicals are employed in the oilfield for a number of tasks, including drilling, production, and completion. Oilfield chemicals are also employed in the purification of machinery oil and oil sites. These chemicals help keep an oilfield operating smoothly, which reduces costs associated with drilling delays and stoppages. The demand for the use of oilfield chemicals rises as a result of these chemicals' ability to stop the formation of metal scales and reduce the amount of water put into oil wells during exploration and drilling. The oilfield chemicals market is expected to increase as a result of rising product demand in different petroleum operations such as enhanced oil recovery, drilling, cementing, well stimulation, and production. to improve oil recovery polyacrylamide can be added to drilling fluid, fracturing fluid, and polymer flooding, among other oilfield oil production applications. The sensible design and selection of its component structure, such as molecular morphology, is crucial to the application of oil extraction. The rising shale gas development and the transportation industry's growing need for petroleum-based fuel are expected to drive the oilfield chemicals market share. Production of oilfield chemicals is expected to rise in proportion to the growing trajectory of oil consumption and production. New commercial and production prospects, especially those associated with deep-water drilling activities in developing nations, are anticipated to contribute to this increase. The government's initiatives to foster the expansion of the chemicals and petrochemicals industries are in line with India's ambition to build its GDP to USD 5 trillion.

Report Coverage

This research report categorizes the market for the global oilfield chemicals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global oilfield chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global oilfield chemicals market.

Global Oilfield Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 28.31 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.04% |

| 2033 Value Projection: | USD 38.18 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Product, By Application |

| Companies covered:: | NOV Inc., Geo, KRATON CORPORATION, Thermax Limited, Oleon N.V., Ashland, PureChem Service, Stepan Company, Elementis plc, Kemira, Huntsman International LLC, Croda plc, Albermarle Corporation, Chevron Philips Chemical Company LLC, Innospec, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

DRIVING FACTORS:

Petrochemicals would drive up worldwide oil production and provide market growth.

It provides several financial advantages and can help with resource optimization, which is essential to the development of emerging nations. Petrochemicals are anticipated to be the main driver of oil consumption during the projection period due to the rise in demand for petrochemical products. Recognizing this tendency, major oil-producing nations are building petrochemical complexes to take advantage of the inexpensive raw resources at their disposal. The demand for petrochemicals is anticipated to expand in tandem with the improvement in people's spending power and standard of living in emerging nations.

RESTRAINING FACTORS

Switching to renewable energy sources would restrain market expansion.

The advancements in fuel efficiency, a significant increase in the adoption of electric vehicles, and new regulations limiting oil usage in the power sector are expected to lower overall oil demand during the projected period. These elements are predicted to lower crude oil demand, which impedes market growth.

Market Segmentation

The oilfield chemicals market share is classified into type, product, and application.

The demulsifiers segment has the highest share of the market over the forecast period.

Based on type, the oilfield chemicals are classified into demulsifiers, corrosion inhibitors, water clarifiers, and biocides. Demulsifiers play a crucial role in the oil and gas sector by increasing the productivity of oil production operations and making the process of separating oil from water simpler. The correct handling, transportation, and processing of crude oil depend on this separation. Demulsifiers are also useful in other sectors of the economy that require the breaking of emulsions, including food processing, chemical manufacture, and wastewater treatment. When pure demulsifiers are used as oilfield chemicals, they are injected either in batches on the manifold or down the hole. Demulsifiers have the effect of bringing water droplets closer together by weakening or eliminating the electrostatic forces of repulsion between them once they come into touch with the water-in-oil emulsion. Additionally, they aid by altering the solid microparticles' ability to get wet at the substance-to-substance interface. This aids in the oilfields' process of separating oil from water and other materials.

The rheology modifiers segment owing to the largest market share throughout the forecast period.

Based on product, the oilfield chemicals are classified into rheology modifiers, inhibitors, others. The role of rheology modifiers in altering the rheological characteristics of oil wells. They are added to water and oil emulsions, as well as synthetic-based drilling fluids. The deformation and flow of materials under applied stress or force are the subject of rheology. Oil-based muds' low shear viscosity can be changed with rheology modifiers. Drilling fluid systems are one major application that is manufactured and maintained. In addition to lubricating, cooling, and supporting the drilling assembly, these drilling fluids also help manage formation pressure, eliminate cuttings from the wellbore, and preserve wellbore stability.

The workover & completion segment is expected to boost the market growth during the forecast period.

Based on application, the oilfield chemicals are classified into drilling, production, cementing, workover & completion. The considerable market share was held by the workover and completion category. The reason for this domination is that oil firms use completion and workover chemicals after they extract oil from wells. These substances, which are frequently used as solid-free drilling fluids, are essential for a number of operations, such as perforations, acid stimulation, packing gravel, water shut-off, fracture stimulation, and wax cleanout. The drilling market is anticipated to increase at an enormous pace. These substances are essential for a number of drilling operations, such as the extraction of oil and water and the defense against corrosion in pipes and other project equipment.

Regional Segment Analysis of the Global Oilfield Chemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America has the biggest share of the oilfield chemicals market throughout the forecast period.

Get more details on this report -

North America is anticipated to hold a dominant position in the worldwide oilfield chemicals market. This is explained by the rise in oil and gas activities brought about by the advancement of drilling and hydraulic fracturing techniques. Additionally, it is anticipated that technology advancements and an increase in drilling activity will boost regional growth. Oil-based chemicals are predicted to rise as a result of the United States expanding shale gas production and exploration. The United States, Canada, and Mexico are three of the world's largest oil-producing economies, making North America a major producer of oil and related products. These businesses use mergers and acquisitions as a tactic to increase their market share.

The Europe is fastest growing region over the projected timeframe.

The size of the oilfield chemicals market in Europe is anticipated to rise at a notable rate. The primary cause of these markets is the rise in oil exploration and drilling operations to fulfill the world's demand for crude oil and natural gas. The rise in shale gas production and development is credited to the expanding need for petroleum-based fuel from the transportation and automobile sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global oilfield chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NOV Inc.

- Geo

- KRATON CORPORATION

- Thermax Limited

- Oleon N.V.

- Ashland

- PureChem Service

- Stepan Company

- Elementis plc

- Kemira

- Huntsman International LLC

- Croda plc

- Albermarle Corporation

- Chevron Philips Chemical Company LLC

- Innospec

- Others

Key Market Developments

- In May 2024, at its facility in Tarragona, Spain, BASF intends to increase the capacity for producing its Basoflux line of paraffin inhibitors worldwide. With this investment, BASF's Oilfield Chemicals division will be able to supply the oil and gas industry's demand for innovative paraffin inhibitors both now and in the future.

- In November 2023, the biocide expert Vink Chemicals began building the chemical facility, with an investment of more than €30 million planned for the Schwerin location. The family-run business is still concentrating on using Germany as a production site. Before early planning clearance was given, over three years of arduous effort before the start of construction.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global oilfield chemicals market based on the below-mentioned segments:

Global Oilfield Chemicals Market, By Type

- Demulsifiers

- Corrosion Inhibitors

- Water Clarifiers

- Biocides

Global Oilfield Chemicals Market, By Product

- Rheology Modifiers

- Inhibitors

- Others

Global Oilfield Chemicals Market, By Application

- Drilling

- Production

- Cementing

- Workover & Completion

Global Oilfield Chemicals Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global oilfield chemicals market over the forecast period?The global oilfield chemicals market size is expected to grow from USD 28.31 Billion in 2023 to USD 38.18 Billion by 2033, at a CAGR of 3.04 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global oilfield chemicals market?North America is projected to hold the largest share of the global oilfield chemicals market over the forecast period.

-

3. Who are the top key players in the oilfield chemicals market?NOV Inc, Geo, KRATON CORPORATION, Thermax Limited, Oleon N.V Ashland, PureChem Service, Stepan Company, Elementis plc, Kemira, Huntsman International LLC, Croda plc, Albermarle Corporation, Chevron Philips Chemical Company LLC, Innospec, and Others.

Need help to buy this report?