Global Oilseeds Market Size, Share, and COVID-19 Impact Analysis, By Type (Soybean, Rapeseed, Sunflower, Cottonseed), By Category (Conventional and Genetically Modified), By Application (Oilseed Meal and Vegetable Oils), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Oilseeds Market Insights Forecasts to 2033

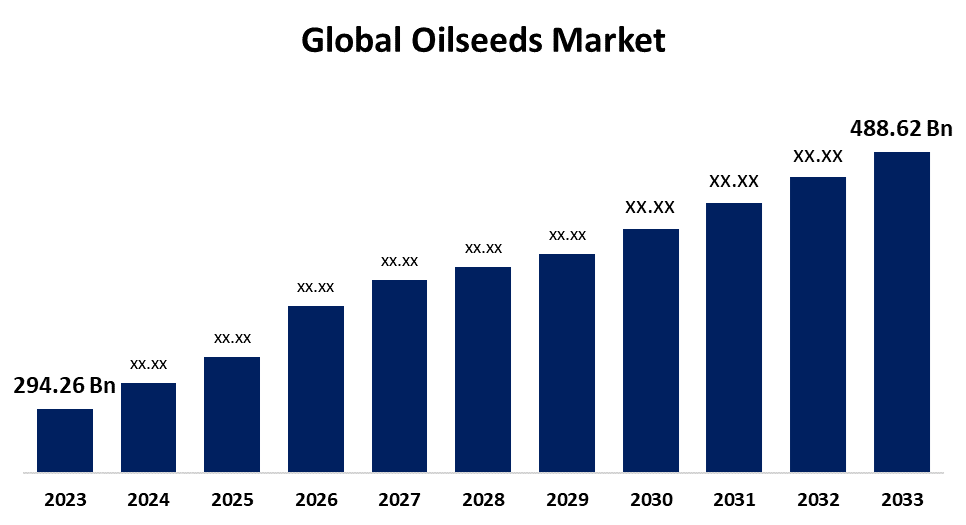

- The Global Oilseeds Market Size was Valued at USD 294.26 Billion in 2023

- The Market Size is Growing at a CAGR of 5.20% from 2023 to 2033

- The Worldwide Oilseeds Market Size is Expected to Reach USD 488.62 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Oilseeds Market Size is Anticipated to Exceed USD 488.62 Billion by 2033, Growing at a CAGR of 5.20% from 2023 to 2033.

Market Overview

Oilseeds are the seeds that are used to grow oil crops including canola, sunflower, soybean, and cotton. These oil crops' seeds, nuts, or fruits are either consumed as food or crushed to extract oil for use in biofuel, oleochemicals, food, and other sectors. Farmers are investing more in producing oil crops with high-quality oilseeds as demand for oilseed extracts continues to increase. Moreover, the global oilseed market is predicted to increase significantly, primarily due to rising demand for vegetable oil from the biodiesel industry. The shift in the trend toward reduced reliance on conventional fuel has led to the expansion of the biodiesel business, which has been serving as one of the key factors driving the demand for vegetable oil and other oilseeds. Furthermore, growing government initiatives are a prominent trend that is gaining traction in the oilseeds industry. Governments around the world are launching programs to enhance oilseed production and reduce pricey vegetable oil imports. For instance, the Indian government announced a National Mission on oilseeds and oil Palm in August 2021. This plan aims to become self-sufficient in edible oil and increase local oilseed productivity.

Report Coverage

This research report categorizes the market for the global oilseeds market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global oilseeds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global oilseeds market.

Global Oilseeds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 294.26 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.20% |

| 2033 Value Projection: | USD 488.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Category, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Archer Daniels Midland Company, BASF SE, Bayer AG, Burrus Seed Farms, Inc, Cargill Incorporated, Corteva Agriscience, Gansu Dunhuang Seed Industry Group Co., Ltd., KWS SAAT SE & Co., DuPont, Mahyco Seeds Ltd, Syngenta Crop Protection AG., Seed Co Limited, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing global population and rising disposable incomes are raising the demand for edible oils and animal proteins, which is driving the demand for oilseeds. Furthermore, advances in agricultural technologies and practices are increasing oilseed yields and quality, boosting market development. Moreover, government regulations supporting biofuels as part of sustainable energy projects are also helping to increase demand for oilseeds. The growing usage of oilseeds in animal feed, cosmetics, and industrial applications such as coatings and lubricants are driving the global oilseeds market expansion, due to their nutritional value and versatility across industries.

Restraining Factors

The market faces hurdles because of decreased planting densities and an increasing reliance on advanced plant biotechnology, which can hinder mainstream adoption. Furthermore, fluctuating regulatory rules and variable climate conditions impede long-term growth.

Market Segmentation

The global oilseeds market share is classified into type, category, and application.

- The soybean segment is expected to hold the largest share of the global oilseeds market during the forecast period.

Based on type, the global oilseeds market is categorized into soybean, rapeseed, sunflower, and cottonseed. Among these, the soybean segment is expected to hold the largest share of the global oilseeds market during the forecast period. Soybean have numerous applications in both the food and non-food industries. Soybeans are a key source of plant-based protein and are used to make tofu, edible oils, soy milk, and other products. Soybean's protein level ranges between 35-40%, making it a good option for meat and dairy products. Rising demand for plant-based meat and dairy alternatives is directly increasing worldwide soybean consumption.

- The genetically modified segment is expected to grow at the fastest CAGR during the forecast period.

Based on the category, the global oilseeds market is categorized as conventional and genetically modified. Among these, the genetically modified segment is expected to grow at the fastest CAGR during the forecast period. Increasing the productivity of oilseed crops is one of the primary goals of genetic modification. Increased tolerance to environmental conditions such as drought, and also resilience to pests, diseases, and herbicides, result in higher per-acre yields. Genes that confer pest resistance may also be included in genetically modified oilseed crops.

- The vegetable oils segment is expected to hold the largest share of the global oilseeds market during the forecast period.

Based on application, the global oilseeds market is categorized oilseed meal and vegetable oils. Among these, the smart segment is expected to hold the largest share of the global oilseeds market during the forecast period. Strong demand for fats and oils from the baking and confectionery industries, along with their rising use in sauces, spreads, dressings, meat products, RTE, and snacks and savoury goods. Vegetable oil continues in high demand in the industrial sector due to its expanding use in the manufacture of adhesives, antiknock additives, disinfectants, inks and paints, plastics and resins, glycerols, and fatty acids.

Regional Segment Analysis of the Global Oilseeds Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global oilseeds market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global oilseeds market over the forecast period. The region has a strong agricultural infrastructure, innovative farming gadgets, and considerable R&D skills, which contribute to consistently excellent yields of key oilseed crops including soybeans, canola, and sunflower. Furthermore, North America has a great climate for oilseed agriculture, ensuring consistent production levels year-round. Furthermore, Canada is also a prominent contributor, particularly in the production of canola seeds, which are highly valued for their oil content. Government programs and subsidies in both nations encourage oilseed production and processing, strengthening North America's dominant market position.

Aisa-Pacific is expected to grow at the fastest CAGR growth of the global oilseeds market during the forecast period. China is the world's largest soybean importer, owing to its strong need for oilseeds in food and animal feed. India, with its growing population and rising meat consumption, is also strengthening its oilseed production and processing capacities. The region is rapidly industrializing and urbanizing, increasing the need for oilseeds in a variety of applications. Government programs in nations such as China and India seek to boost domestic oilseed production and minimize reliance on imports.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Oilseeds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company

- BASF SE

- Bayer AG

- Burrus Seed Farms, Inc

- Cargill Incorporated

- Corteva Agriscience

- Gansu Dunhuang Seed Industry Group Co., Ltd.

- KWS SAAT SE & Co.

- DuPont

- Mahyco Seeds Ltd

- Syngenta Crop Protection AG.

- Seed Co Limited

- Others

Key Market Developments

- In July 2022, Corteva Agriscience, BASF, and MS Technologies entered into an agreement to collaborate on the development of advanced Enlist E3 soybeans containing a soybean trait that is resistant to nematodes. This collaboration aims to benefit farmers in the United States and Canada.

- In May 2022, Syngenta Canada introduced the Pelta seed pelleting technology for canola, designed to enhance seed size and uniformity, thus improving singulation planter performance.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global oilseeds market based on the below-mentioned segments:

Global Oilseeds Market, By Type

- Soybean

- Rapeseed

- Sunflower

- Cottonseed

Global Oilseeds Market, By Category

- Conventional

- Genetically Modified

Global Oilseeds Market, By Application

- Oilseed Meal

- Vegetable Oils

Global Oilseeds Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global oilseeds market over the forecast period?The global oilseeds market size is expected to grow from USD 294.26 billion in 2023 to USD 488.62 billion by 2033, at a CAGR of 5.20% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global oilseeds market?North America is projected to hold the largest share of the global oilseeds market over the forecast period.

-

3. Who are the top key players in the global oilseeds market?Archer Daniels Midland Company, BASF SE, Bayer AG, Burrus Seed Farms, Inc, Cargill Incorporated, Corteva Agriscience, Gansu Dunhuang Seed Industry Group Co., Ltd., KWS SAAT SE & Co., DuPont, Mahyco Seeds Ltd, Syngenta Crop Protection AG., Seed Co Limited, Others.

Need help to buy this report?