Global On-Orbit Satellite Servicing Market Size, Share, and COVID-19 Impact Analysis, By Type (Small Satellites, Medium Satellites, and Large Satellites), By Service (Active Debris Removal (ADR) and Orbit Adjustment, Robotic Servicing, Refueling, Assembly), By End User (Military & Government, Commercial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Aerospace & DefenseGlobal On-Orbit Satellite Servicing Market Insights Forecasts to 2032

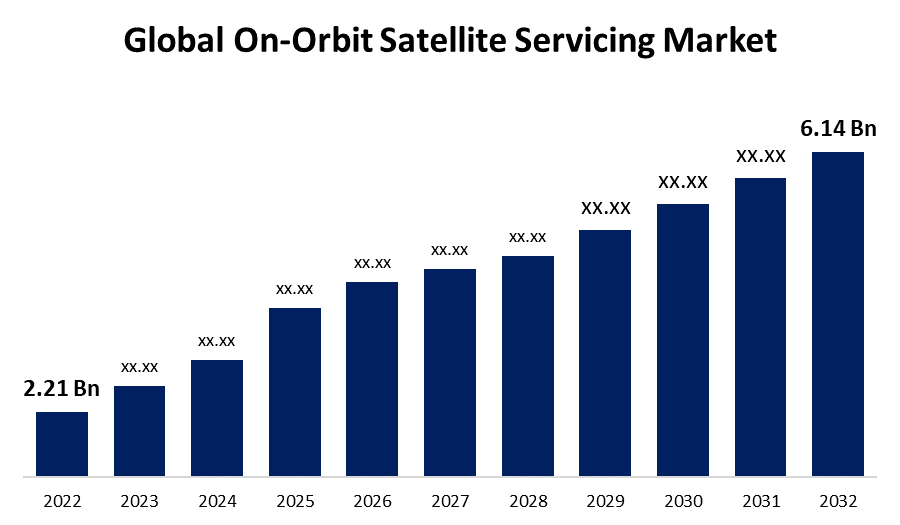

- The Global On-Orbit Satellite Servicing Market Size was valued at USD 2.21 Billion in 2022.

- The Market is growing at a CAGR of 10.7% from 2022 to 2032.

- The Worldwide On-Orbit Satellite Servicing Market Size is expected to reach USD 6.14 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global On-Orbit Satellite Servicing Market Size is anticipated to exceed USD 6.14 Billion by 2032, growing at a CAGR of 10.7% from 2022 to 2032. In the rapidly evolving space industry, the global on-orbit satellite servicing market offers exciting opportunities for improving satellite performance, reducing space debris, and promoting long-term sustainability. As technology advances, this industry is expected to play an important role in shaping the future of satellite operations and maintenance.

Market Overview

The global on-orbit satellite servicing market is a growing sector of the space industry that focuses on providing satellites in space with maintenance, repair, refueling, and other critical services. The need for efficient and cost-effective solutions to address technical issues, extend satellite lifespan, and ensure optimal performance grows as the number of satellites in orbit grows. The growing deployment of satellites for communication, Earth observation, navigation, scientific research, and defense purposes is driving the on-orbit satellite servicing market. Many of these satellites are launched into orbit with limited or no servicing capabilities, making them prone to malfunctions or inefficiencies over time. With the advent of advanced robotics, artificial intelligence, and sophisticated spacecraft technologies, on-orbit servicing capabilities have been developed. Companies in this market aim to improve operational efficiency and lifespan by providing on-orbit repairs, upgrades, payload swaps, and even satellite relocation.

Report Coverage

This research report categorizes the market for the global on-orbit satellite servicing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the on-orbit satellite servicing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the on-orbit satellite servicing market.

Global On-Orbit Satellite Servicing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.21 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 10.7% |

| 022 – 2032 Value Projection: | USD 6.14 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Service, By End User and By Region. |

| Companies covered:: | Maxar Technologies, Astroscale Holdings Inc., SpaceLogistics LLC, Airbus SE, Thales Alenia Space and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary drivers of the on-orbit satellite servicing market is the aging satellite population. Many satellites in orbit are nearing the end of their operational lives and will need maintenance or replacement to keep operating. Satellites are typically designed to operate for a set period of time, after which they may experience technical issues or performance degradation. The increasing demand for satellite-based services such as communication, Earth observation, remote sensing, and navigation has resulted in an increase in satellite deployment. As the number of satellites in orbit increases, so does the need for on-orbit servicing, as these valuable assets require maintenance, repairs, and upgrades over time to ensure optimal performance and a longer lifespan.

Restraining Factors

The industry of on-orbit satellite servicing operates in a highly regulated environment. International, national, and regional laws, treaties, and guidelines govern space activities. Uncertainty in legal frameworks, as well as concerns about liability, can stymie the development and deployment of on-orbit servicing missions.

Market Segmentation

The Global On-Orbit Satellite Servicing Market share is classified into type, service, and end user.

- The small satellites segment is expected to grow at the fastest pace in the global on-orbit satellite servicing market during the forecast period.

The global on-orbit satellite servicing market is categorized by type into small satellites, medium satellites, and large satellites. Among these, the small satellites segment is expected to grow at the fastest pace in the global on-orbit satellite servicing market during the forecast period. Small satellites were becoming increasingly popular due to their versatility and low cost. As a result, the small satellites segment was expected to account for a significant share of the on-orbit satellite servicing market.

- The active debris removal (ADR) and orbit adjustment segment is expected to hold the largest share of the global on-orbit satellite servicing market during the forecast period.

Based on the service, the global on-orbit satellite servicing market is divided into active debris removal (ADR) and orbit adjustment, robotic servicing, refueling, and assembly. Among these, the active debris removal (ADR) and orbit adjustment segment is expected to hold the largest share of the global on-orbit satellite servicing market during the forecast period. In the global on-orbit satellite servicing market, the Active Debris Removal (ADR) and Orbit Adjustment segment focuses on addressing the growing issue of space debris and optimizing satellite orbits. ADR missions involve capturing and removing defunct satellites or large space debris objects from critical orbits, either by safely deorbiting them into the Earth's atmosphere for controlled re-entry or moving them to a graveyard orbit.

- The commercial segment is expected to hold the largest share of the global on-orbit satellite servicing market during the forecast period.

Based on the end user, the global on-orbit satellite servicing market is divided into military & government and commercial. Among these, the commercial segment is expected to hold the largest share of the global on-orbit satellite servicing market during the forecast period. In recent years, the commercial space industry has seen significant growth and investment, resulting in an increase in the deployment of commercial satellites for a variety of applications. Commercial operators are exploring on-orbit servicing to maintain and improve their satellite fleets due to the need for cost-effective solutions, sustainability, and optimal performance.

Regional Segment Analysis of the Global On-Orbit Satellite Servicing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America accounted for the largest share of the global on-orbit satellite servicing market in 2022.

Get more details on this report -

North America accounted for the largest share of the global on-orbit satellite servicing market in 2022. North America has long been a dominant force in the space industry, with the United States leading in the field in satellite technology and operations. Several major satellite operators, government space agencies (NASA, DoD), and private space companies are based in the region. North America is a prominent market for on-orbit satellite servicing due to the presence of a robust space ecosystem and significant investments in space technology.

Asia Pacific is expected to grow at the fastest pace in the global on-orbit satellite servicing market during the forecast period. The Asia-Pacific region's space industry is rapidly expanding, with countries such as China and India expanding their space capabilities. Japan developed robotic satellite servicing missions. The increasing deployment of communication, Earth observation, and navigation satellites in the Asia-Pacific region creates opportunities for on-orbit servicing providers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global on-orbit satellite servicing along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Maxar Technologies

- Astroscale Holdings Inc.

- SpaceLogistics LLC

- Airbus SE

- Thales Alenia Space

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Gilmour Space Technologies and Atomos Space announced the signing of an MOU to look into the possibility of a multi-year contract for Gilmour and Atomos to mutually purchase launching and in-space transportation services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global On-Orbit Satellite Servicing Market based on the below-mentioned segments:

Global On-Orbit Satellite Servicing Market, By Type

- Small Satellites

- Medium Satellites

- Large Satellites

Global On-Orbit Satellite Servicing Market, By Service

- Active Debris Removal (ADR) and Orbit Adjustment

- Robotic Servicing

- Refueling

- Assembly

Global On-Orbit Satellite Servicing Market, By End User

- Military & Government

- Commercial

Global On-Orbit Satellite Servicing Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?