Global Oncology Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drugs Type (Cytotoxic Drugs, Targeted Drugs, and Others ), By Cancer Type (Lung Cancer, Breast Cancer, Colorectal Cancer, Prostate Cancer, Blood Cancer, Bladder Cancer, and Others), By Therapy (Chemotherapy, Targeted Therapy, Immunotherapy, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Oncology Drugs Market Insights Forecasts to 2033

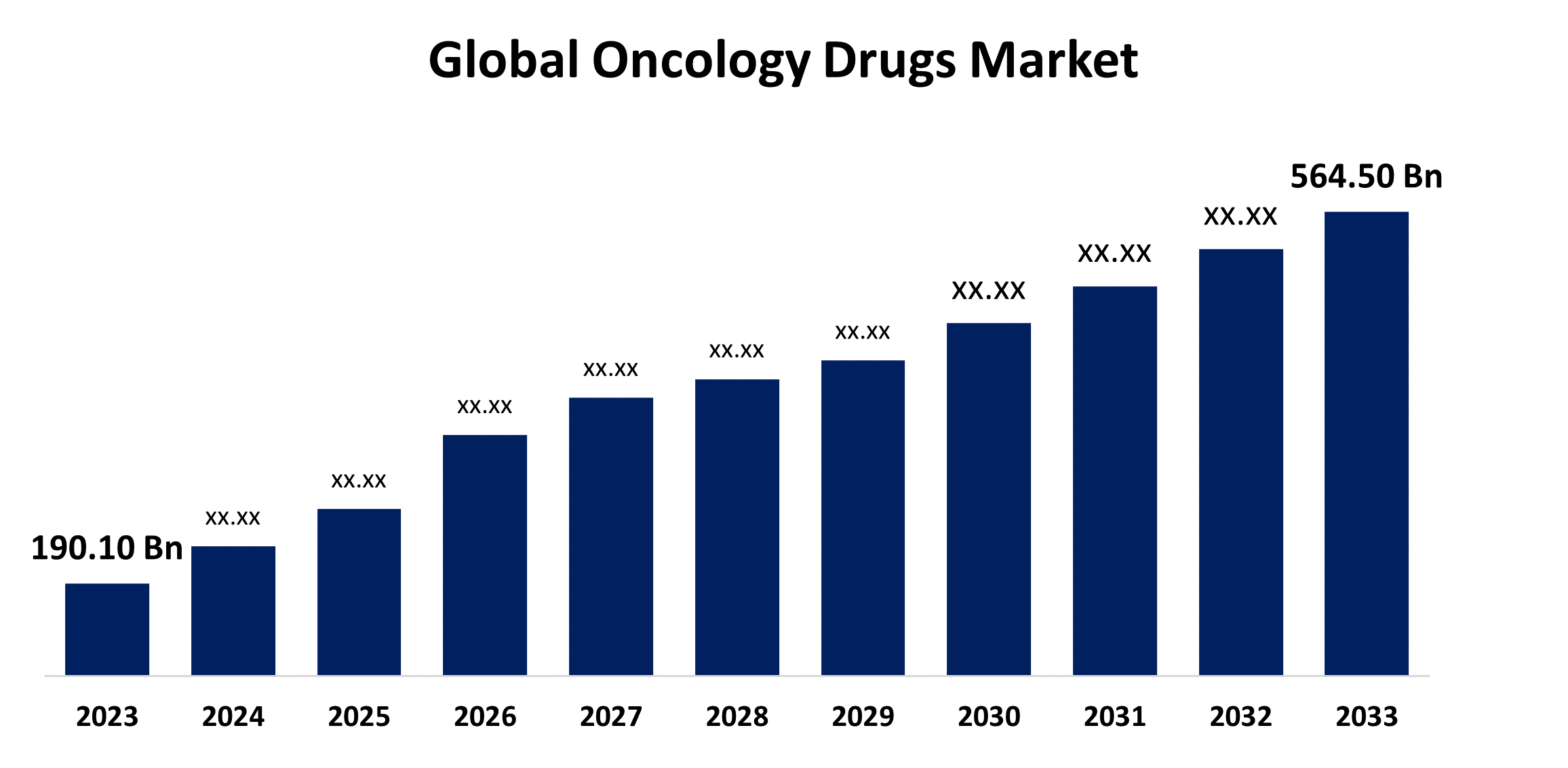

- The Global Oncology Drugs Market Size was Valued at USD 190.10 Billion in 2023

- The Market Size is Growing at a CAGR of 11.50% from 2023 to 2033

- The Worldwide Oncology Drugs Market Size is Expected to Reach USD 564.50 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Oncology Drugs Market Size is Anticipated to Exceed USD 564.50 Billion by 2033, Growing at a CAGR of 11.50% from 2023 to 2033.

Market Overview

Oncology drugs are medications used to treat cancer, a category of disorders caused by the uncontrolled development and division of abnormal cells. Oncology pharmaceuticals encompass a wide spectrum of medications, including chemotherapeutic agents, targeted therapies, immunotherapies, and hormone therapies. The oncology medications industry includes pharmaceutical drugs used to treat cancer patients. It includes chemotherapeutic drugs that prevent cell division or inhibit specific enzymes and substances involved in tumor growth and progression. The most important pharmaceuticals in the oncology drugs market are targeted therapies, immunotherapy drugs, hormonal therapy, and various supportive care drugs. Major market companies are concentrating on developing novel targeted medicines, combination therapies, and personalized medicine techniques to improve cancer patient outcomes. According to the National Cancer Institute, in 2024, an estimated 2,001,140 new cancer cases will be diagnosed and 611,720 cancer deaths will occur in the United States. According to the International Agency for Research on Cancer (IARC) 2022 report, an estimated 20 million new cancer cases and 9.7 million deaths occurred globally. The IARC report stated that lung cancer was the most commonly occurring cancer worldwide estimated with 2.5 million new cases diagnosed and 1.8 million deaths. Female breast cancer with 2.3 million cases and 670,000 deaths, followed by colorectal cancer is estimated at 1.9 million cases and 900,000 deaths, prostate cancer with 1.5 million cases, and stomach cancer with 970,000 cases and 660,000 deaths.

Report Coverage

This research report categorizes the market for the global oncology drugs market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global oncology drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global oncology drugs market.

Global Oncology Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 190.10 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.50% |

| 2033 Value Projection: | USD 564.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drugs Type, By Cancer Type, By Therapy, By Distribution Channel, By Region |

| Companies covered:: | Pfizer Inc, Amgen Inc., Novartis AG, GSK plc, Eli Lilly and Company, AstraZeneca PLC, AbbVie Inc., Ono Pharmaceutical Company, Johnson and Johnson, Astellas Pharma Inc, Bayer Healthcare, Hoffmann-La Roche Ltd., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global oncology drugs market is experiencing robust growth, driven by several factors. These include the increasing incidence of cancer worldwide, advancements in research and development leading to the introduction of new therapies, and technological innovations such as targeted therapies and immunotherapies. Government initiatives and healthcare expenditures, along with rising public awareness and proactive screening programs, also contribute significantly to market expansion. Additionally, pharmaceutical companies' continued investment in oncology drug development, lifestyle changes affecting cancer rates, and the emergence of personalized medicine all play crucial roles in shaping the market's trajectory.

Restraining Factors

The global oncology drugs market faces several restraining factors that hinder its growth. These include stringent regulatory approval processes, high costs of drug development, patent expirations leading to generic competition, reimbursement challenges, the emergence of biosimilars, drug resistance, safety concerns, limited access to healthcare services, cancer complexity, and global economic uncertainties.

Market Segmentation

The global oncology drugs market share is classified into drugs type, cancer type, therapy, and distribution channel.

- The targeted drugs segment dominates the market with the largest market share through the forecast period.

On the basis of drug type, the global oncology drugs market is divided into cytotoxic drugs, targeted drugs, and others. Among these, the targeted drugs segment dominates the market with the largest market share through the forecast period. The targeted drugs segment dominates the global oncology drugs market due to their precision in attacking cancer cells while sparing healthy ones, advancements in molecular biology enabling the development of targeted therapies, and the potential for personalized treatment based on individual genetic profiles. Targeted therapies interfere with specific molecules involved in cancer progression, offering fewer side effects than traditional chemotherapy. Recent breakthroughs include immunotherapies, PARP inhibitors for ovarian and breast cancers, BCR-ABL inhibitors for leukemia, and drugs targeting EGFR and ALK mutations in lung cancer.

- The breast cancer segment is anticipated to hold the largest market share through the forecast period.

The global oncology drug market is classified by cancer type, including lung cancer, breast cancer, colorectal cancer, prostate cancer, blood cancer, bladder cancer, and others. Among these, breast cancer is expected to hold the largest market share through the forecast period. Breast cancer is the most often diagnosed cancer in women globally, accounting for more than 2.3 million new cases each year. Breast cancer is poised to dominate the global oncology pharmaceuticals market due to its high prevalence, ongoing research, and development efforts, as well as advancements in early detection methods. With various treatment options available and increasing awareness, breast cancer is expected to maintain its leading position within the market.

- The chemotherapy segment accounted for the largest revenue share through the forecast period.

On the basis of therapy, the global oncology drugs market is categorized into chemotherapy, targeted therapy, immunotherapy, and others. Among these, the chemotherapy segment accounted for the largest revenue share through the forecast period. Chemotherapy remains widely used due to its proven effectiveness across a broad spectrum of cancers. It's often the first-line treatment for many types of cancer, and despite its side effects, it continues to play a crucial role in the global oncology drugs market.

- The hospital pharmacies segment accounted for the highest share through the projected time period.

On the basis of distribution channel, the global oncology drugs market is categorized into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment accounted for the highest share through the forecast period. The dominance of hospital pharmacies in revenue highlights the critical role hospitals play in providing comprehensive cancer care. These pharmacies are often equipped to handle complex therapies and ensure patients receive proper medication management and support during their treatment journey. Hospital pharmacies have well-established procurement procedures that can supply a wide range of high-cost cancer pharmaceuticals required by departments such as medical oncology, radiation oncology, and surgical oncology. They also have specialist compounding facilities that follow rigorous safety guidelines for preparing parenteral chemotherapy regimens.

Regional Segment Analysis of the Global Oncology Drugs Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global oncology drugs market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global oncology drugs market over the predicted timeframe. North America has become an innovation hotspot for new and improved oncology medications, owing to the presence of key industry players and their broad distribution networks across the area. North American players make significant efforts in R&D, driving the creation and introduction of innovative and technologically sophisticated products in this market. North America is expected to continue holding the largest share of the global oncology drugs market due to factors like advanced healthcare infrastructure, high cancer prevalence, substantial R&D investments, and a favorable regulatory environment. Major pharmaceutical companies and academic research institutions in the region further reinforce its leading position in this sector.

The Asia-Pacific region has emerged as the fastest-expanding market for oncology drugs market. Improving access to healthcare, combined with rising disposable incomes in countries such as China and India, is driving market growth. These countries also have cheaper manufacturing and R&D expenses, which entice biopharmaceutical companies to increase local production of generics and biosimilars through collaboration with local players. This is improving the affordability of oncology treatment. Furthermore, increased patient awareness of cancer screening and treatment shows long-term market potential. Japan also has a prominent position due to its universal health coverage, which ensures extensive access. However, pricing constraints remain rigid, requiring new reimbursement and access solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global oncology drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc

- Amgen Inc.

- Novartis AG

- GSK plc

- Eli Lilly and Company

- AstraZeneca PLC

- AbbVie Inc.

- Ono Pharmaceutical Company

- Johnson and Johnson

- Astellas Pharma Inc

- Bayer Healthcare

- Hoffmann-La Roche Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, the FDA approved lisocabtagene maraleucel (Breyanzi, Juno Therapeutics, Inc.) for adult patients with relapsed or refractory mantle cell lymphoma (MCL) who have received at least two lines of systemic therapy, including a Bruton tyrosine kinase inhibitor (BTKi).

- In May 2024, Tarlatamab-dlle (Imdelltra, Amgen, Inc.) received accelerated approval from the Food and Drug Administration, for extended-stage small cell lung cancer (ES-SCLC) with disease progression during or following platinum-based chemotherapy.

- In April 2024, India launched its first domestically developed gene therapy for cancer, specifically CAR-T cell therapy.

- In April 2024, the Food and Drug Administration approved tisotumab vedotin-tftv (Tivdak, Seagen Inc. [now a part of Pfizer Inc.]) for recurrent or metastatic cervical cancer with disease progression during or after chemotherapy. Tisotumab vedotin-tftv was previously granted expedited clearance for this indication.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global oncology drugs market based on the below-mentioned segments:

Global Oncology Drugs Market, By Drugs Types

- Cytotoxic Drugs

- Targeted Drugs

- Others

Global Oncology Drugs Market, By Cancer Type

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

- Blood Cancer

- Bladder Cancer

- Others

Global Oncology Drugs Market, By Therapy

- Chemotherapy

- Targeted Therapy

- Immunotherapy

- Others

Global Oncology Drugs, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Global Oncology Drugs Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?