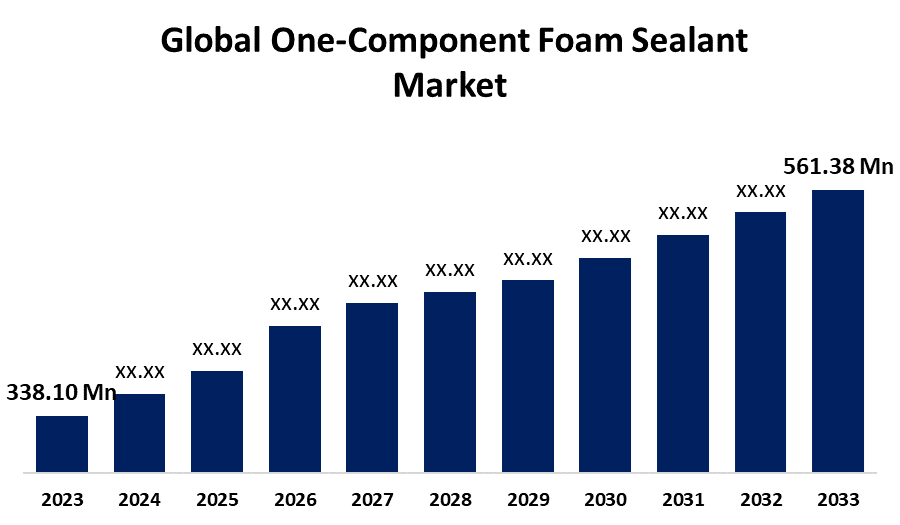

Global One-Component Foam Sealant Market Size is Expected to Grow from USD 338.10 Million in 2023 to USD 561.38 Million by 2033, at a CAGR of 5.20% during the forecast period 2023-2033

Industry: Advanced MaterialsGlobal One-Component Foam Sealant Market Insights Forecasts to 2033

- The Global One-Component Foam Sealant Market Size was Valued at USD 338.10 Million in 2023

- The Market Size is Growing at a CAGR of 5.20% from 2023 to 2033

- The Worldwide One-Component Foam Sealant Market Size is Expected to Reach USD 561.38 Million by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global One-Component Foam Sealant Market Size is Anticipated to Exceed USD 561.38 Million by 2033, Growing at a CAGR of 5.20% from 2023 to 2033.

Market Overview

One-component foam sealant is a type of polyurethane-based sealant used primarily for sealing gaps, joints, and cracks in construction and home repair projects. One-component foam sealants are convenient, easy to use, and effective for sealing gaps and voids. They are treated by reacting with moisture, providing thermal insulation and soundproofing, and are durable, cost-effective, and popular in construction and repair tasks.

The one-component foam sealant market is a crucial segment in the construction and industrial adhesives industry, providing efficient sealing and insulation solutions. These versatile products, also known as polyurethane foam sealants, fill gaps, cracks, and voids in construction and DIY projects. The market has grown steadily due to increasing demand, energy conservation, and cost-effectiveness.

For Instance, In February 2024, Huntsman Building Solutions (HBS), the global leader in high-performance, energy-efficient, and robust building envelope solutions, announced the introduction of its all-new Icynene Series spray polyurethane foam insulation product line. The spray foam system collection provides the best performance currently available in the industry, as well as significant product certifications.

Report Coverage

This research report categorizes the market for one-component foam sealant based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the one-component foam sealant market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the one-component foam sealant market.

One-Component Foam Sealant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 338.10 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.20% |

| 2033 Value Projection: | USD 561.38 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application, By Region, COVID-19 Empact, Challenges, Future, Growth, & Analysis |

| Companies covered:: | Huntsman Corporation, H. B. Fuller Company, Arkema Group, Polypag AG, Henkel AG & Co., Den Braven, Dow Inc., BASF SE, Soudal Group, Akkim Construction Chemicals, Selena Group, Tremco Incorporated, Hamil Selena, and Other Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The one-component foam sealant market is propelled due to a global focus on energy efficiency and sustainable construction practices. These sealants offer excellent thermal insulation, reducing heat loss and improving energy efficiency. Technological advancements in foam formulations have expanded their applications, making them suitable for more demanding environments and specialized uses. The growing DIY trend in home improvement and renovation projects has also driven the market, with products being ideal for DIY projects. Environmental concerns and regulatory pressures have also driven innovation in the market, with research and development efforts focusing on eco-friendly alternatives, low-VOC formulations, renewable raw materials, and products with reduced global warming potential has driven the market growth worldwide.

Restraining Factors

The one-component foam sealant market faces several challenges, including environmental concerns, volatile raw material prices, product performance limitations, regulatory hurdles, and competition from alternative sealing and insulation technologies. One-component foam sealants face environmental challenges due to harmful chemicals, disposal issues, price fluctuations, and performance limitations. Regulatory hurdles and varying standards can be costly for manufacturers, while competition from alternative technologies like caulks and spray-applied insulation systems also hinders market growth.

Market Segmentation

The one-component foam sealant market share is classified into product and application.

- The polyether polyol segment is estimated to hold the highest market revenue share through the projected period.

Based on the product, the one-component foam sealant market is classified into methylene diphenyl diisocyanate, polyether polyol, and polyester polyol. Among these, the polyether polyol segment is estimated to hold the highest market revenue share through the projected period. Polyether polyol-based foam sealants offer various advantages, including good adhesion, flexibility, and moisture resistance, making them ideal for a variety of sealing and insulating applications in the construction, automotive, and manufacturing sectors. Polyester polyol-based foam sealants are gaining popularity due to their unique properties and expanding applications. Polyester polyol formulations have characteristics such as high tensile strength, durability, and chemical and abrasion resistance, making them ideal for specialized sealing and insulating needs, particularly in demanding industrial and maritime applications.

- The door & window frame jambs segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the one-component foam sealant market is divided into door & window frame jambs, ceiling & floor joints, partition walls, water pipes, and others. Among these, the door & window frame jambs segment is anticipated to hold the largest market share through the forecast period. Door & window frame jambs are essential for reducing air leaks, water infiltration, and energy loss in residential, commercial, and industrial structures. Foam sealants offer thermal insulation, moisture resistance, and soundproofing qualities. As construction techniques focus on energy efficiency, sustainability, and building performance, the demand for high-quality foam sealants in construction areas grows. Ceiling and floor joints are also becoming increasingly important for air sealing, thermal insulation, and soundproofing.

Regional Segment Analysis of the One-Component Foam Sealant Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

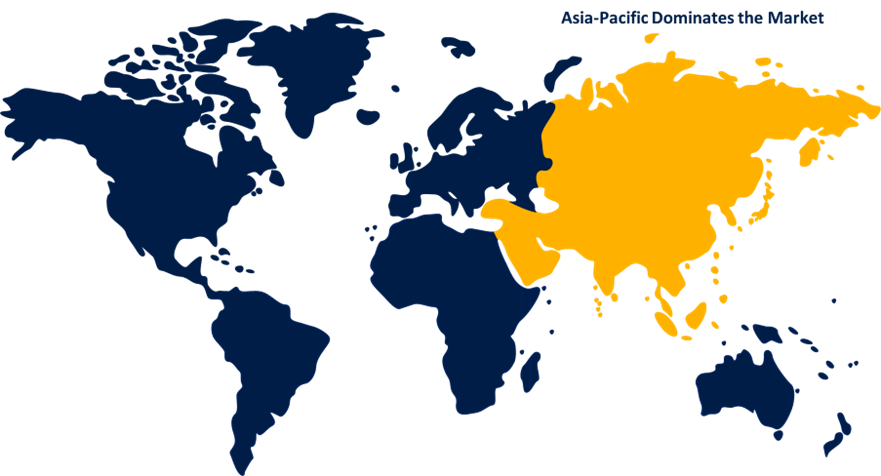

Asia Pacific is anticipated to hold the largest share of the one-component foam sealant market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the one-component foam sealant market over the predicted timeframe. Asia-Pacific is a rapidly expanding one-component foam sealant market, fueled by urbanization, industrialization, infrastructure development, and construction activity in emerging nations such as China, India, and Southeast Asian countries. Rising disposable incomes, urban migration, and government measures to provide cheap housing drive demand for residential development, resulting in the adoption of one-component foam sealant products. The automotive, electronics, and packaging industries all contribute to market growth, as one-component foam sealant is increasingly used in car production, electronics assembly, and packaging sealing applications.

Manufacturers in the region prioritize product innovation, customization, and cost-effective solutions to meet the different demands contributing to the expansion of the one-component foam sealant market in the Asia Pacific region.

North America is expected to grow at the fastest CAGR growth of the one-component foam sealant market during the forecast period. North America dominates the one-component foam sealant market due to robust construction activity, urbanization, infrastructure development, and stringent energy efficiency regulations. Growth opportunities exist in the automotive, aerospace, and marine sectors, where one-component foam sealant is used for insulation, bonding, and sealing. The region's high levels of residential, commercial, and industrial building projects, along with increased awareness of the benefits of high-performance sealants for insulation and energy savings, contribute to this expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the one-component foam sealant market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Huntsman Corporation

- H. B. Fuller Company

- Arkema Group

- Polypag AG

- Henkel AG & Co.

- Den Braven

- Dow Inc.

- BASF SE

- Soudal Group

- Akkim Construction Chemicals

- Selena Group

- Tremco Incorporated

- Hamil Selena

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, L&L Products launched its unique InsituCore foaming materials for lightweight composite fabrication. These novel materials simplify production procedures, producing a finished lightweight net-shape part or performing with desired density and strength.

- In April 2024, Huntsman introduces innovative SHOKLESS polyurethane solutions to safeguard electric vehicle batteries.

- In March 2022, Dow launched its VORASURF Silicone Surfactants product line to meet the growing demand for energy-efficient and sustainable rigid polyurethane foam solutions, particularly for spray and construction applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the one-component foam sealant market based on the below-mentioned segments:

Global One-Component Foam Sealant Market, By Product

- Methylene Diphenyl Diisocyanate

- Polyether Polyol

- Polyester Polyol

Global One-Component Foam Sealant Market, By Application

- Door & Window Frame Jambs

- Ceiling & Floor Joints

- Partition Walls

- Water Pipes

- Others

Global One-Component Foam Sealant Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the one-component foam sealant market over the forecast period?The one-component foam sealant market is projected to expand at a CAGR of 5.20% during the forecast period.

-

What is the market size of the one-component foam sealant market?The Global One-Component Foam Sealant Market Size is Expected to Grow from USD 338.10 Million in 2023 to USD 561.38 Million by 2033, at a CAGR of 5.20% during the forecast period 2023-2033.

-

Which region holds the largest share of the one-component foam sealant market?Asia Pacific is anticipated to hold the largest share of the one-component foam sealant market over the predicted timeframe.

Need help to buy this report?