Global One-Component Polyurethane Foam Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (MDI, Polyether Polyols, Polyester Polyols), By Application (Residential, Commercial), By End-User (Door & Window, Frame Jambs, Ceiling & Floor Joints, Partition Walls), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal One-Component Polyurethane Foam Market Insights Forecasts to 2033

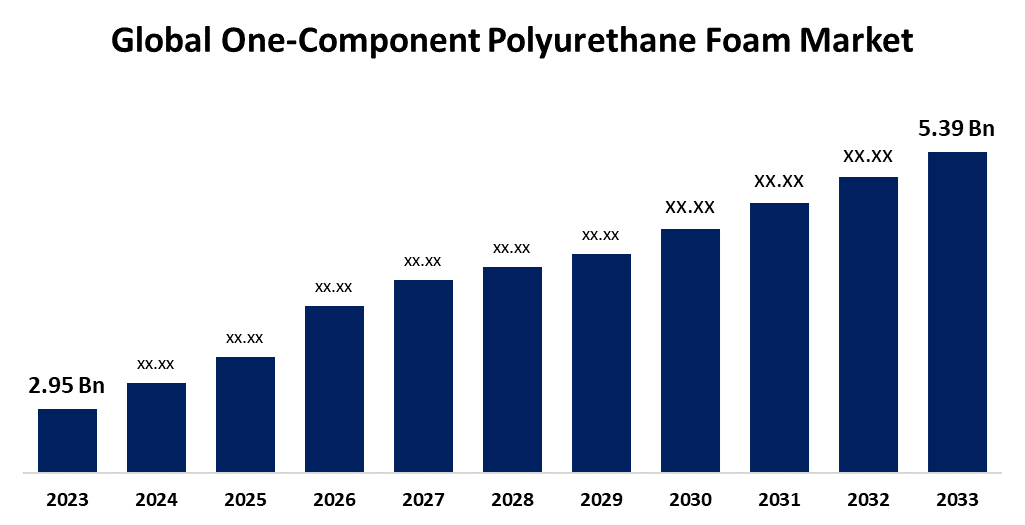

- The Global One-Component Polyurethane Foam Market Size was Valued at USD 2.95 Billion in 2023

- The Market Size is Growing at a CAGR of 6.21% from 2023 to 2033

- The Worldwide One-Component Polyurethane Foam Market Size is Expected to Reach USD 5.39 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global One-Component Polyurethane Foam Market Size is Anticipated to Exceed USD 5.39 Billion by 2033, Growing at a CAGR of 6.21% from 2023 to 2033.

Market Overview

One-component polyurethane foam is a type of foam sealant that consists of a single component, typically in an aerosol can. OCF is commonly used for sealing gaps, cracks, and joints in construction and home improvement projects, providing excellent thermal insulation, soundproofing, and air-sealing properties. One-component polyurethane foam is a user-friendly sealant with excellent thermal insulation properties, making it popular for improving energy efficiency in buildings. It adheres well to surfaces, provides moisture resistance, and is cost-effective for both professionals and DIY enthusiasts. One-component polyurethane foam is a versatile material used for sealing gaps, enhancing thermal insulation, soundproofing, and bonding materials in construction applications.

Report Coverage

This research report categorizes the market for one-component polyurethane foam based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the one-component polyurethane foam market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the one-component polyurethane foam market.

Global One-Component Polyurethane Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.95 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.21% |

| 2033 Value Projection: | USD 5.39 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Raw Material, By Application, By End-User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Sika AG, Henkel AG & Co. KGaA, Tremco Illbruck Group, Selena Group, Den Braven, Soudal N.V., Hanno-Werk GmbH & Co. KG, Akkim Construction Chemicals, Krimelte OÜ, Proffair Industria Chimica SRL, Biochem Paints & Sealants GmbH & Co. KG, Polyset Company Group, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The one-component polyurethane foam market is propelled by the growth of the construction industry, as it provides excellent thermal and acoustic insulation, which is increasingly sought after due to stricter energy efficiency regulations. Its user-friendly application makes it appealing to both professionals and DIY enthusiasts, while its versatility allows for various uses, including sealing gaps and soundproofing. Furthermore, rising awareness of sustainable materials and technological advancements in formulation enhances its market appeal. The expanding automotive sector and the trend toward home improvement further contribute to the demand for one-component polyurethane foam.

Restraining Factors

The one-component polyurethane foam market faces several restraining factors that could impede its growth including health and safety concerns related to the chemicals used, such as respiratory issues and skin irritation, which might deter users and attract regulatory scrutiny. Price volatility in raw materials can lead to increased costs, while competition from alternative insulation materials might draw customers away.

Market Segmentation

The one-component polyurethane foam market share is classified into raw material, application, and end-user.

- The MDI segment is estimated to hold the highest market revenue share through the projected period.

Based on the raw material, the one-component polyurethane foam market is classified into MDI, polyether polyols, and polyester polyols. Among these, the MDI segment is estimated to hold the highest market revenue share through the projected period. MDI is often favored for its excellent mechanical properties, thermal stability, and versatility in applications including insulation, construction, and automotive industries.

- The commercial segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the one-component polyurethane foam market is divided into residential, and commercial. Among these, the commercial segment is anticipated to hold the largest market share through the forecast period. The commercial segment's prominence is primarily due to the increasing demand for insulation, construction, and renovation projects in commercial buildings, which often require high-performance materials. Factors such as energy efficiency regulations, the need for soundproofing, and the rising trend of sustainable construction are driving the growth of the commercial segment.

- The ceiling & floor joints segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the end-user, the one-component polyurethane foam market is categorized into door & window, frame jambs, ceiling & floor joints, and partition walls. Among these, the ceiling & floor joints segment is anticipated to grow at the fastest CAGR growth through the forecast period. The rapid expansion is propelled by increasing construction activities, rising demand for energy-efficient insulation solutions, and the ease of application for both professionals and DIY users. Furthermore, regulatory support promoting energy efficiency and compliance with building codes is expected to further boost adoption in the ceiling & floor joints segment.

Regional Segment Analysis of the One-Component Polyurethane Foam Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the one-component polyurethane foam market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the one-component polyurethane foam market over the predicted timeframe. The region's rapid industrialization, growing construction activities, and increasing demand for insulation materials are driving the market. Countries like China and India are major contributors, fueled by rising infrastructure projects and urbanization. Furthermore, the automotive and furniture sectors are also expanding, further boosting the demand for one-component polyurethane foams.

North America is expected to grow at the fastest CAGR growth of the one-component polyurethane foam market during the forecast period. The region's rapid expansion is due to increasing demand from the construction industry, where the foam is used for insulation and sealing, as well as growing applications in the automotive, furniture, and packaging sectors. The region's focus on energy efficiency and sustainability is also propelling the adoption of polyurethane foams, which offer excellent thermal insulation properties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the one-component polyurethane foam market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sika AG

- Henkel AG & Co. KGaA

- Tremco Illbruck Group

- Selena Group

- Den Braven

- Soudal N.V.

- Hanno-Werk GmbH & Co. KG

- Akkim Construction Chemicals

- Krimelte OÜ

- Proffair Industria Chimica SRL

- Biochem Paints & Sealants GmbH & Co. KG

- Polyset Company Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Huntsman launched new SHOKLES polyurethane systems that have been developed for the potting and fixation of cells mounted in electric vehicle (EV) batteries.

- In September 2023, Selena introduced Covestro's bio-attributed methylene diphenyl diisocyanate (MDI) into an upgraded version of their Ultra-Fast 70 one-component foam, which is principally used in the installation of windows and doors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the one-component polyurethane foam market based on the below-mentioned segments:

Global One-Component Polyurethane Foam Market, By Raw Material

- MDI

- Polyether Polyols

- Polyester Polyols

Global One-Component Polyurethane Foam Market, By Application

- Residential

- Commercial

Global One-Component Polyurethane Foam Market, By End-User

- Door & Window

- Frame Jambs

- Ceiling & Floor Joints

- Partition Walls

Global One-Component Polyurethane Foam Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the one-component polyurethane foam market over the forecast period?The one-component polyurethane foam market is projected to expand at a CAGR of 6.21% during the forecast period.

-

2. What is the market size of the one-component polyurethane foam market?The Global One-Component Polyurethane Foam Market Size is Expected to Grow from USD 2.95 Billion in 2023 to USD 5.39 Billion by 2033, Growing at a CAGR of 6.21% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the one-component polyurethane foam market?Asia Pacific is anticipated to hold the largest share of the one-component polyurethane foam market over the predicted timeframe.

Need help to buy this report?