Global Online Banking Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Payments, Processing Services, Customer & Channel Management, Wealth Management, and Others), By Banking Type (Retail Banking, Corporate Banking, and Investment Banking), By Technology (Cloud Computing, AI and Machine Learning, Blockchain, and Biometrics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Online Banking Market Insights Forecasts to 2033

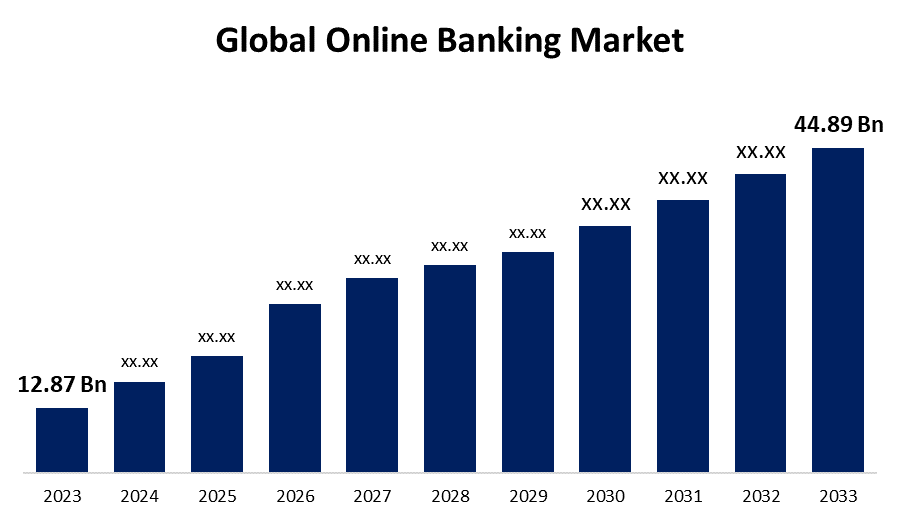

- The Global Online Banking Market Size was Valued at USD 12.87 Billion in 2023

- The Market Size is Growing at a CAGR of 13.31% from 2023 to 2033

- The Worldwide Online Banking Market Size is Expected to Reach USD 44.89 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Online Banking Market Size is Anticipated to Exceed USD 44.89 Billion by 2033, Growing at a CAGR of 13.31% from 2023 to 2033.

Market Overview

A payment service that enables consumers to make financial transactions online is called online banking. It is often referred to as web banking or internet banking, and its convenience is its primary attraction. It offers real-time problem-solving services and a banking experience that saves time. Banks should work to meet customer demand, wants, and preferences by accelerating customer engagement and achieving a more seamless experience across online and mobile platforms. The rise in online banking is a reaction to changing consumer demands for quick, safe, and effective financial services available via digital platforms. The market's expansion highlights its critical role in transforming the future of banking and how people manage their money internationally, as financial institutions and customers continue to embrace online banking platforms for transactions, payments, and various financial services. Banks are currently moving toward the Internet by incorporating technology in response to altering consumer demands, lifestyles, and banking expectations. Furthermore, key technologies driving the expansion of the online banking market include blockchain, chatbots, robotic process automation (RPA), cloud computing, application programming interfaces (APIs), and machine learning. Thus, the primary drivers of the market expansion are the growing need for better client experiences as well as the widespread adoption of cloud-based solutions by financial institutions and banks.

Report Coverage

This research report categorizes the market for the global online banking market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global online banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global online banking market.

Global Online Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.87 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.31% |

| 2033 Value Projection: | USD 44.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Service Type, By Banking Type, By Region, By Technology |

| Companies covered:: | Temenos, Tata Consultancy Services Limited, Sopra Steria, SAP SE, Oracle, Microsoft, Intellect Design Arena Limited, Infosys Limited, I-flex Solutions, Fiserv, Inc., First Source Bank, Finastra, EdgeVerve Systems Limited, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

A more responsive and seamless customer experience is provided via high-speed internet. Customers might gradually transfer money, pay bills, and monitor their records, which enhances the overall efficacy of online banking services. Faster internet makes online banking services more accessible everywhere. Customers who live far away can connect more effectively, increasing the number of users on online banking platforms and propelling the expansion of the global industry. Large amounts of information might be transmitted much more quickly owing to improved internet rates. This feature can be used by online banking platforms for real-time data analytics, which will assist financial institutions in understanding client behavior, making well-informed decisions, and providing more specialized services. Faster internet connections are a major factor in the digital revolution of the banking sector.

Restraining Factors

The expansion of the market is hampered by customers' awareness of the risks involved in sharing private information and account information online. In addition, customers have serious security and privacy concerns due to the potential for hackers to access user accounts using compromised login credentials. Moreover, users who unintentionally enable cookies to enter their system through intrusive web adverts and unapproved popup windows expose personal data.

Market Segmentation

The global online banking market share is segmented into service type, banking type, and technology.

- The payments segment dominates the market with the largest market share through the forecast period.

Based on the service type, the global online banking market is segmented into payments, processing services, customer & channel management, wealth management, and others. Among these, the payments segment dominates the market with the largest market share through the forecast period. Due to its ease and time-saving benefits over traditional methods, consumers are increasingly making payments through Internet channels. As a result, this has emerged as one of the major market trends. Additionally, vendors including media & multiplexes, entertainment, and utility service providers have cooperated with online banking solution providers. This enables users to make numerous other regular payments using online banking services.

- The corporate banking segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the banking type, the global online banking market is segmented into retail banking, corporate banking, and investment banking. Among these, the corporate banking segment is anticipated to grow at the fastest CAGR growth through the forecast period. Aspects of banking that are specifically related to business clients are referred to as corporate banking. These online banks operate to a broad spectrum of customers, including small, medium, and large businesses with billion-dollar sales and global office locations. Services include loans and credit products, equipment leasing, trade finance, commercial real estate, treasury and cash management, and employer services offered by the corporate banking section. Corporate banks have shifted to internet-based services as a result of the trend toward digitalization, which has driven businesses and corporations to widely use linked equipment and services.

- The cloud computing segment accounted for the largest revenue share through the forecast period.

Based on the technology, the global online banking market is segmented into cloud computing, AI and machine learning, blockchain, and biometrics. Among these, the cloud computing segment accounted for the largest revenue share through the forecast period. Cloud computing offers scalable and affordable options for processing, storing, and managing enormous volumes of financial data, it has completely changed online banking. Banks use cloud infrastructure to lower IT expenses, improve operational efficiency, and increase the speed at which they may introduce new services. Cloud solutions support real-time data analytics for customized customer experiences and allow seamless integration across various banking channels. Furthermore, cloud-based solutions are crucial for contemporary online banking operations due to their providing excellent security and compliance with regulatory regulations.

Regional Segment Analysis of the Global Online Banking Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global online banking market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global online banking market over the predicted timeframe. Online banking services have been widely used in North America by a variety of demographic groups. Digital banking has become more and more popular among individuals and businesses due to its efficiency, transparency, and ease of use. North American banks, who aim to expand their customer base and compete with fintech and non-financial firms, acknowledge that innovation will have a long-term impact on their sector. In North America, a lot of banks are concentrating on technology developments. This will let banks make changes to their back-office procedures and key frameworks more quickly. Furthermore, sustaining flexibility and competitiveness requires collaboration with fintech and other technology suppliers.

Asia Pacific is expected to grow at the fastest CAGR growth of the global online banking market during the forecast period. Owing to the growing use of digital technologies and the increased need for easily accessible banking services. The usage of digital banking services has increased throughout the region, which is home to some of the most developed economies in the world, including South Korea, Japan, and China. The number of fintech businesses, that offer innovative offerings to the financial industry, is also rising in the region. To give clients more effective and safe financial services, these firms are utilizing modern technologies like blockchain and artificial intelligence.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global online banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Temenos

- Tata Consultancy Services Limited

- Sopra Steria

- SAP SE

- Oracle

- Microsoft

- Intellect Design Arena Limited

- Infosys Limited

- I-flex Solutions

- Fiserv, Inc.

- First Source Bank

- Finastra

- EdgeVerve Systems Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, The industry leader in mission-critical real-time payment software is ACI Worldwide. ACI Worldwide announced that its online banking products had been bought by middle market private equity firm One Equity Partners ("OEP"). The primary innovation step, dubbed ACI Computerized Commercial Banking, uses a programming interface to respond to commercial and business banking clients.

- In September 2021, An enterprise-grade multi-channel, multilingual communication suite was made available to the Banking Service Bureau in Israel through a partnership between Newgen Software and Tata Consultancy Services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global online banking market based on the below-mentioned segments:

Global Online Banking Market, By Service Type

- Payments

- Processing Services

- Customer & Channel Management

- Wealth Management

- Others

Global Online Banking Market, By Banking Type

- Retail Banking

- Corporate Banking

- Investment Banking

Global Online Banking Market, By Technology

- Cloud Computing

- AI and Machine Learning

- Blockchain

- Biometrics

Global Online Banking Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?