Global Online Gambling Market Size, Share, Growth, and Industry Analysis, By Game Type (Sports Batting, and Casino), By Device Type (Mobile, Desktop, and Tablets), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) and Forecast to 2033

Industry: Consumer GoodsGlobal Online Gambling Market Insights Forecasts to 2033

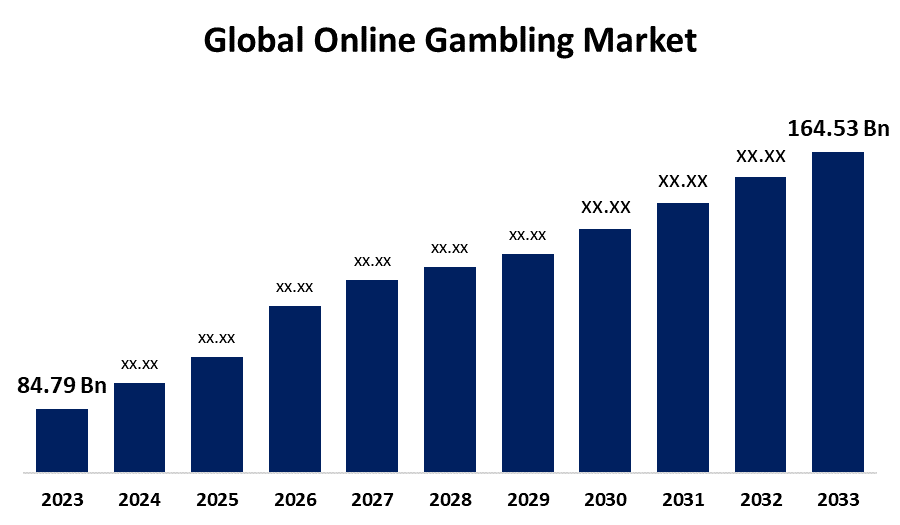

- The Global Online Gambling Market Size was Valued at USD 84.79 Billion in 2023

- The Market Size is Growing at a CAGR of 6.85% from 2023 to 2033

- The Worldwide Online Gambling Market Size is Expected to Reach USD 164.53 Billion By 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Online Gambling Market Size is Anticipated to Exceed USD 164.53 Billion by 2033, Growing at a CAGR of 6.85% from 2023 to 2033. The rising proliferation of smartphones leads to a surge in the number of mobile application-driven jackpot games, which give end users the ease and convenience of gambling in their own homes.

ONLINE GAMBLING MARKET REPORT OVERVIEW

Online gambling is an activity conducted over the Internet or mobile devices, where participants use actual cash to play imaginary gambling games. The market for online gambling is increasing as people utilize the internet more and use mobile devices to play online games. Celebrity endorsements, commercial advertising, easy access to drive the growth of online gambling, and legalization all help to grow the industry.

The increase in online payment gateways, as well as the global use of digital money, are projected to boost industry growth. Operators of various digital platforms are developing a diverse range of promotions and tournaments that quickly pique the interest of a new audience, presenting enormous growth potential for the online gambling business. The shifting legislative environment for virtual betting, as well as the market's legalization in rising nations, are expected to boost industry expansion. For example, online gaming has recently been legal in Goa and Sikkim. Increased global credibility is projected to drive market expansion. An expanding variety of low-cost mobile applications for playing various online gambling games on smartphones additionally contribute to the global growth of the online gambling business. The convenience of sports betting on a portable connected device like a smartphone, laptop, or tablet has boosted the number of players in the online gambling sector.

India's gambling rules are complex and vary by state. Some states allow real-money internet gaming, while others strictly prohibit it and any related activities. India's gambling rules are complex and vary by state. The state of Sikkim allows the offering of casino games such as roulette and blackjack by acquiring a license under the requirements of the Sikkim Online Gaming (Regulation) Act, 2008 ("Sikkim Act"), with the proviso that the games be supplied solely over intranet terminals.

Report Coverage

This research report categorizes the market for the global online gambling market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global online gambling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global online gambling market.

Global Online Gambling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 84.79 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.85% |

| 2033 Value Projection: | USD 164.53 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Game Type, By Device Type, By Region |

| Companies covered:: | Sky Betting and Gaming, Betsson AB, Française des Jeux, Aristocrat, 888 Holdings PLC, The Stars Group Inc., William Hill PLC, Light & Wonder, Kindred Group PLC, Paddy Power Betfair PLC, Las Vegas Sands, Ladbrokes Coral Group PLC, Evolution Gaming, DraftKings, Gaming and Leisure Properties, VGC Holdings PLC, Boyd Gaming, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

DRIVING FACTORS:

The rising investment in online gaming can boost market growth.

The growing demand for cost-effective payment systems is driving up investments in the online gambling business. Another important element encouraging investments in online gambling is the introduction of virtual and augmented reality. There are several investment opportunities in the sector, which has prompted professional players to invest in sports betting and the stocks of some of the most important online gambling organizations. Several new entrants and investors are contacting stakeholders in the online gaming market, including operators, suppliers, regulators, and industry-specific legal/financial advisors.

RESTRAINING FACTORS

The increased rate of cybercrime can restrict market growth.

The manufacturers utilize third-party apps to protect their websites and enable secure online payments. Federal legislation prohibits the use of wire communication facilities in gambling or sports betting because the facilities include the Internet. However, the internet allows gamblers to maintain an anonymous identity and quickly abandon gambling sites, making it impossible to trace their gambling behavior.

Market Segmentation

The online gambling market share is classified into game type and device type.

The sports betting segment accounted for 65% of the market in 2023.

Based on game type share, the online gambling market is classified into sports betting and casinos. Among these, the sports betting segment accounted for 65% of the market in 2023. With the country's growing interest in sports, there is a high demand for sports betting in the online gambling market among US customers. Furthermore, in the sector of sports betting, customers are focusing on sports in which they have a certain level of knowledge, which allows them to grasp the current game and moves them one step closer to profitability. Eventually, new security standards will force customers to enter their licenses and other documents before starting to play any game on an online platform. As an outcome, consumers can ensure the safety of their money, which is one of the reasons they favor online gaming. Furthermore, with sports betting, the user fully understands the outcome of the game. One such element that has prompted them to investigate the sports betting portion of the United States online gambling business is the possibility of making a large profit while taking on little risk.

With an 87% market share, the mobile segment dominated the global online gambling industry in 2023.

Based on device type share, the online gambling market is classified into mobile, desktop, and tablets. The mobile segment led the worldwide online gambling market with an 87% share in 2023. Mobile allows gamblers to appreciate the game's features and graphics. Furthermore, mobile performance features such as high-definition audio and video and expandable storage options improve the gaming experience. These factors have contributed to the growth of the mobile-type market. The sophisticated gaming pictures on smartphones, due to better mobile technology, have made online gambling more accessible. The segment is expanding as a result of the broad availability of low-cost mobile phones and modern features such as improved graphics and more storage. Mobile gambling users can take advantage of a range of advantages, including remote play, loyalty points, extra deposit methods, and multiplayer games.

Regional Segment Analysis of the Global Online Gambling Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

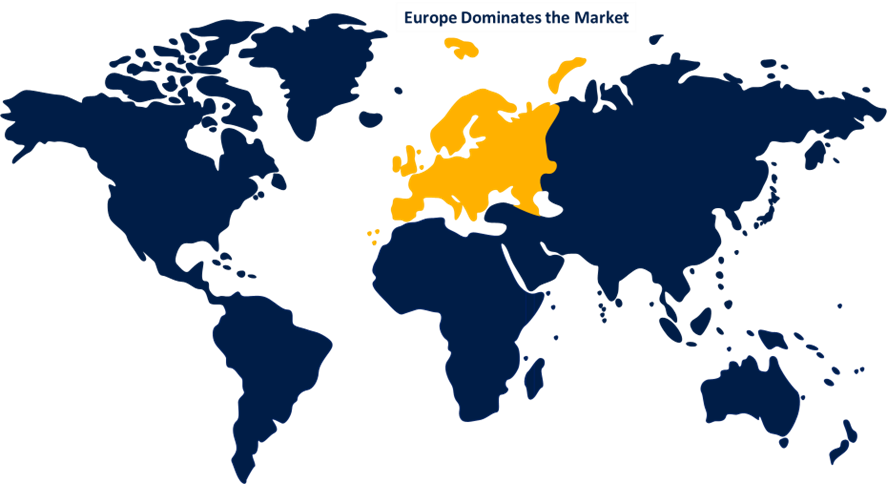

Europe has had the biggest share of the online gambling market throughout the forecast period.

Get more details on this report -

The legalization of gambling in various European countries, including Italy, Spain, France, and Germany, is to blame for the trend. Other factors fuelling business expansion include the availability of high-speed broadband internet, the increasing popularity of online casinos, and the growing usage of smartphones. According to a poll conducted by the European Gaming & Betting Association, sports betting accounted for the majority of online gambling in 2022. Furthermore, the German online gambling industry had the biggest market share, while the United Kingdom's online gambling market was the fastest expanding in Europe.

The Asia-Pacific is the fastest-growing region during the projected timeframe.

The Asia Pacific online gambling market is predicted to increase significantly throughout the forecast period. The market's growth is expected to be boosted by increased internet usage and improvements to rules governing online gambling and betting. Furthermore, China's online gambling industry had the highest market share, while India's online gambling market was the fastest expanding in the Asia-Pacific area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global online gambling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sky Betting and Gaming

- Betsson AB

- Française des Jeux

- Aristocrat

- 888 Holdings PLC

- The Stars Group Inc.

- William Hill PLC

- Light & Wonder

- Kindred Group PLC

- Paddy Power Betfair PLC

- Las Vegas Sands

- Ladbrokes Coral Group PLC

- Evolution Gaming

- DraftKings

- Gaming and Leisure Properties

- VGC Holdings PLC

- Boyd Gaming

- Others

Key Market Developments

- In April 2024, Caesars Entertainment, Inc. announced a major revamp to the Caesars Palace Online Casino mobile app for iOS and Android. The new Caesars Palace Online Casino app is now live, and it features an industry-first multi-lobby navigation architecture that transforms the online casino experience with curated lobbies dedicated to popular gaming categories like as slots, table games, and Live Dealer.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global online gambling market based on the below-mentioned segments:

Global Online Gambling Market, By Game Type

- Sports Batting

- Casino

Global Online Gambling Market, By Device Type

- Mobile

- Desktop

- Tablets

Global Online Gambling Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global online gambling market over the forecast period?The global online gambling market size is expected to grow from USD 2.6 Billion in 2023 to USD 5.98 Billion by 2033, at a CAGR of 8.69% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global online gambling market?Europe is projected to hold the largest share of the global online gambling market over the forecast period.

-

3.Who are the top key players in the online gambling market?Sky Betting and Gaming, Betsson AB, Française des Jeux, Aristocrat, 888 Holdings PLC, The Stars Group Inc., William Hill PLC, Light & Wonder, Kindred Group PLC, Paddy Power Betfair PLC, Las Vegas Sands, Ladbrokes Coral Group PLC, Evolution Gaming, DraftKings, Gaming and Leisure Properties, VGC Holdings PLC, Boyd Gaming, and Others.

Need help to buy this report?