Global Online Gaming Market Size, Share, and COVID-19 Impact Analysis, By Type (Action, Adventure, Arcade, Sports, Puzzle, and Others), By Platform (PC, Console, Mobile, and Others), By Player Count (Single-Player, Multiplayer, MMO, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Electronics, ICT & MediaGlobal Online Gaming Market Insights Forecasts to 2033

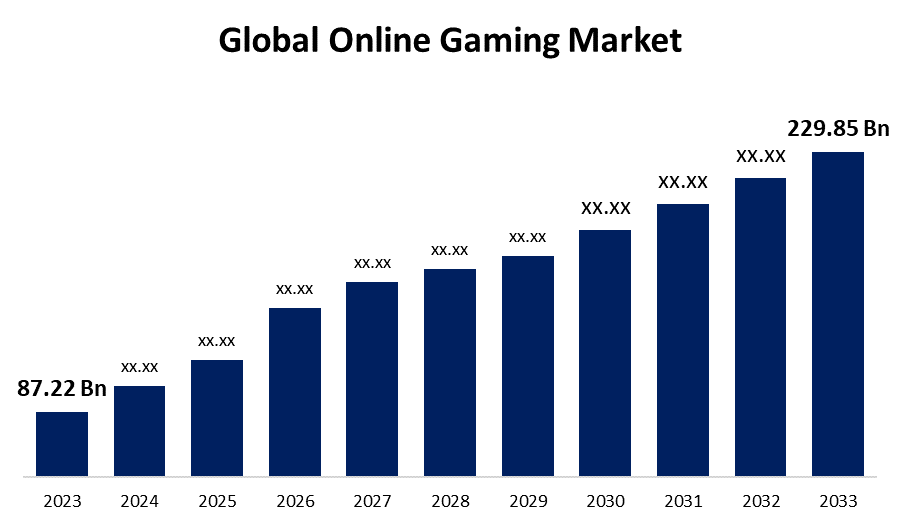

- The Global Online Gaming Market Size was Valued at USD 87.22 Billion in 2023

- The Market Size is Growing at a CAGR of 10.17% from 2023 to 2033

- The Worldwide Online Gaming Market Size is Expected to Reach USD 229.85 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Online Gaming Market Size is Anticipated to Exceed USD 229.85 Billion by 2033, Growing at a CAGR of 10.17% from 2023 to 2033.

Market Overview

Online gaming is simply the playing of a video game over the internet, usually single-player or multiplayer. Online games can be played on any number of devices from dedicated video game consoles such as PlayStations, Xboxes, and Nintendo Switches, to PCs, laptops, and mobile phones. Due to the rise in esports popularity, internet access, and technological improvements, the online gaming sector has grown exponentially. Market trends point to a shift in favor of mobile gaming, explained by smartphones' ease of online games refer to games that are played over some form of computer network, most often the use and accessibility. In-app purchases, subscription services, and game downloads are the industry's revenue sources. Microtransactions in free-to-play games are a major source of cash for these titles. This increase can be attributed to both the rising use of smartphones and tablets and the rising cost of online gaming. The availability of reliable connectivity and high-speed internet access is another important aspect driving the demand for online gaming services and solutions. These businesses take advantage of the market for customized gaming experiences and visual upgrades by charging gamers for virtual products, skins, and extra content. In addition to increasing profitability, this marketing approach promotes player engagement and retention. Companies provide a dynamic ecosystem where players might personalize their gaming experiences and support the ongoing expansion of the online gaming business by carefully curating in-game economies within their games.

Report Coverage

This research report categorizes the market for the global online gaming market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global online gaming market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global online gaming market.

Global Online Gaming Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 87.22 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 10.17% |

| 023 – 2033 Value Projection: | USD 229.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 264 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Platform, By Player Count, By Region |

| Companies covered:: | Sony Group Corp., Alphabet Inc., Tencent Holdings Ltd., Sega Corp., PopReach Corp., Bandai Namco Holdings Inc., Nintendo Co. Ltd., Square Enix Holdings Co. Ltd., Ubisoft Entertainment, GungHo Online Entertainment Inc., Electronic Arts Inc., Capcom Co. Ltd., Zeptolab Ltd, Microsoft Corp., NEXON Co Ltd., Apple Inc., Take Two Interactive Software Inc., GREE Inc., NetEase Inc., Others, and |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The integration of advanced technologies like virtual reality (VR) and augmented realities (AR), which provide immersive gaming experiences, is driving the market's expansion. Governments in several kinds of countries are beginning to see the potential and popularity of online games, and as a result, they are offering incentives to gaming companies to invest in retaining their local employees, workers, and creative assets in addition to initiatives aimed at drawing in talent from abroad. The market is expected to grow over the forecast period due to the growth of AI in online gaming. Due to these benefits, artificial intelligence is being used in online gaming at a far higher rate. AI techniques have been used by several gaming sectors in their online games to reduce the possibility of cheating and promote a trend toward fair gaming. In a similar vein, AI interprets player behavior in games and makes appropriate decisions. Mobile gaming has taken the lead in the online gaming sector, influencing its dynamics and providing developers and other stakeholders with significant potential. To drive the market during the forecast period.

Restraining Factors

The difficulty of online gambling raising the possibility of cybercrime has an impact on industry growth. Cybercriminals are coming up with new ways to take advantage of gamers as more and more video games are being made available online via platforms like Xbox Live, PlayStation Network, and others. To obtain information about credit and debit cards, which are recorded as cookies, cybercriminals might attempt to communicate with online gamers and force them to share details about their banking and gaming accounts. In addition, gold-farming refers to the practice of cybercriminals creating in-game assets like gold, coins, or jewels using botnets and then trying to sell them to other players for a lower price. Therefore, during the projection period, such a threat might hamper the market growth.

Market Segmentation

The global online gaming market share is segmented into type, platform, and player count.

- The adventure segment dominates the market with the largest market share through the forecast period.

Based on the type, the global online gaming market is segmented into action, adventure, arcade, sports, puzzle, and others. Among these, the adventure segment dominates the market with the largest market share through the forecast period. The popularity of adventure games has greatly increased due to the development of immersive gaming experiences, which are powered by advances in visuals and storylines. These games draw in a broad range of gamers looking for captivating, story-driven entertainment since they often have intricate plots and complex settings. Furthermore, the adventure genre has undergone a revolution owing to the integration of augmented and virtual reality technology, which provides more immersive and engaging experiences. This technology integration has drawn new viewers looking for unique entertainment experiences in addition to typical gamers. Sales of games and in-game purchases have both contributed significantly to the adventure gaming segment dominating the market, indicating a higher level of player engagement with these products.

- The mobile segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the platform, the global online gaming market is segmented into PC, console, mobile, and others. Among these, the mobile segment is anticipated to grow at the fastest CAGR growth through the forecast period. The rise of the mobile segment can be attributed to the increasing global usage of smartphones. There is an extensive range of games that appeal to various audiences and preferences, and mobile gaming apps are readily available through app stores. Games for mobile devices have become even more popular since they frequently include social networking aspects like leaderboards, multiplayer modes, and social media integration.

- The multiplayer segment accounted for the largest revenue share through the forecast period.

Based on the player count, the global online gaming market is segmented into single-player, multiplayer, MMO, and others. Among these, the multiplayer segment accounted for the largest revenue share through the forecast period. The multiplayer gaming genre, which includes games that allow for player interaction with two or more people, is growing due to the offers of a social gaming experience. The rising accessibility of online gaming platforms and the widespread adoption of high-speed internet have both helped to support this market. These kinds of games frequently have cooperative and competitive modes that improve player retention and engagement. The number of players actively participating in multiplayer games has been steadily rising, according to industry data, which highlights the segment's high level of appeal and long-term growth potential. This dominance is primarily due to the way that online gaming is developing, with a growing emphasis on community development and social engagement.

Regional Segment Analysis of the Global Online Gaming Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global online gaming market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global online gaming market over the forecast period. The large and quickly expanding user base in nations like China, Japan, South Korea, and India is the main factor driving this huge market share. These nations boost robust PC and mobile gaming infrastructures, which contribute to their strong gaming cultures. A major factor in the expansion of mobile gaming, which makes up an important portion of the online gaming business in Asia-Pacific, has been the spread of cost-effective smartphones and enhanced internet connectivity in the area. With its extensive player base and the presence of big gaming companies, China, the largest market in the region, makes a significant contribution to this domination. These companies serve both the domestic and international gaming markets, and their impact on the latter is only expanding. Notable contributors South Korea and Japan are also well-known for their advanced gaming technology and innovative graphics.

North America is expected to grow at the fastest CAGR growth of the global online gaming market during the forecast period. Factors include the existence of significant gaming companies, advanced internet infrastructure, and a robust online gaming culture. With a substantial amount of digital adoption and spending on gaming technology and content, the United States and Canada are major participants in the market. A thriving competitive gaming culture, including eSports, and high consumer spending on gaming essentially define the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global online gaming market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sony Group Corp.

- Alphabet Inc.

- Tencent Holdings Ltd.

- Sega Corp.

- PopReach Corp.

- Bandai Namco Holdings Inc.

- Nintendo Co. Ltd.

- Square Enix Holdings Co. Ltd.

- Ubisoft Entertainment

- GungHo Online Entertainment Inc.

- Electronic Arts Inc.

- Capcom Co. Ltd.

- Zeptolab Ltd

- Microsoft Corp.

- NEXON Co Ltd.

- Apple Inc.

- Take Two Interactive Software Inc.

- GREE Inc.

- NetEase Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Sony Interactive Entertainment LLC ("SIE") signed an agreement to acquire Firewalk Studios. Together with other elite development teams like Haven Interactive Studios and Bungie, SIE is aiming to usher in a new era of live gaming services for PlayStation players with this deal.

- In March 2023, Microsoft Corp. and Boosteroid signed a 10-year agreement to bring Xbox PC games to Boosteroid's cloud gaming platform. With more than 4 million users globally, Boosteroid, a cloud gaming company, has grown to become the biggest independent provider of cloud gaming. Its software development team is based in Ukraine. Customers of Boosteroid will soon be able to watch Activision Blizzard PC games as well, due to Microsoft's acquisition of the gaming company.

- In February 2023, NCSOFT and Amazon Games announced a deal to release the highly anticipated massively multiplayer online role-playing game THRONE AND LIBERTY in Europe, North America, South America, and Japan.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global online gaming market based on the below-mentioned segments:

Global Online Gaming Market, By Type

- Action

- Adventure

- Arcade

- Sports

- Puzzle

- Others

Global Online Gaming Market, By Platform

- PC

- Console

- Mobile

- Others

Global Online Gaming Market, By Player Count

- Single-Player

- Multiplayer

- MMO

- Others

Global Online Gaming Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Sony Group Corp., Alphabet Inc., Tencent Holdings Ltd., Sega Corp., PopReach Corp., Bandai Namco Holdings Inc., Nintendo Co. Ltd., Square Enix Holdings Co. Ltd., Ubisoft Entertainment, GungHo Online Entertainment Inc., Electronic Arts Inc., Capcom Co. Ltd., Zeptolab Ltd, Microsoft Corp., NEXON Co Ltd., Apple Inc., Take Two Interactive Software Inc., GREE Inc., NetEase Inc., and Others.

-

2. What is the size of the Global Online Gaming Market?The Global Online Gaming Market Size is Expected to Grow from USD 87.22 Billion in 2023 to USD 229.85 Billion by 2033, at a CAGR of 10.17% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global online gaming market over the predicted timeframe.

Need help to buy this report?