Global Operational Technology OT Security Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions, and Services), By Deployment (Cloud, and On-premises), By Enterprise Size (SMEs, and Large Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Operational Technology OT Security Market Insights Forecasts to 2033

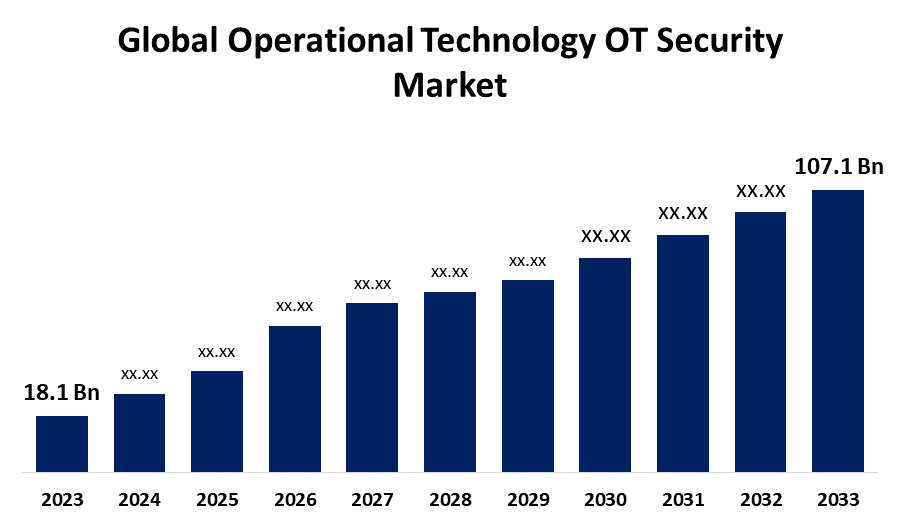

- The Global Operational Technology OT Security Market Size was Valued at USD 18.1 Billion in 2023

- The Market Size is Growing at a CAGR of 19.46% from 2023 to 2033

- The Worldwide Operational Technology OT Security Market Size is Expected to Reach USD 107.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Operational Technology OT Security Market Size is Anticipated to Exceed USD 107.1 Billion by 2033, Growing at a CAGR of 19.46% from 2023 to 2033.

Market Overview

Operational Technology (OT) security protects systems and devices designed to monitor and control industrial processes and physical operations. While traditional IT systems support data and communication, OT systems support machinery, equipment, and critical infrastructure, such as power plants, factories, transportation systems, and water treatment facilities. Such systems are usually equipped with sensors, controllers, and other connected devices necessary to achieve the goals of industrial processes efficiently. It means that the security of OTs deals with safeguarding these systems from cyberattacks, something which has lately become critical. Successful attacks on OT systems may cause physical damage, operational shutdowns, and even a threat to public safety. For instance, an intruder who has taken control of the power grid or manufacturing plant could have even wider impacts. Given that more industrial systems are getting connected to the internet through IIoT, OT is more likely to get an increased chance of cyberattacks. In this setting, OT security seeks to safeguard such critical systems by deploying firewalls, intrusion detection, regular monitoring, and even specialized security protocols. This ideally aims to ensure that important services work safely and dependably without causing costly and hazardous interruptions.

Report Coverage

This research report categorizes the market for the global operational technology OT security market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global operational technology OT security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global operational technology OT security market.

Global Operational Technology OT Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 18.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 19.46% |

| 2033 Value Projection: | USD 107.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Deployment, By Deployment, By Deployment, and By Region |

| Companies covered:: | Fortinet, Forcepoint, Cisco, Tenable, Forescout, Checkpoint, Broadcom, Trellix, Microsoft, OKTA, Palo Alto Networks, Qualys, Zscaler, BeyondTrust, CyberArk, and Other |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Cyber threats to operational technology systems are becoming more frequent and sophisticated.

Some of the major factors driving the global OT security market include the increasing frequency and sophistication of cyber threats against operational technology systems. The more interdependent organizations become in diverse ways through digital technologies, the higher the chances that critical infrastructures and industrial control systems face attacks from cyber-attacks. This, in turn, raises the demand for robust OT security solutions that protect against evolving threats and ensure operational continuity.

Restraining Factors

Insufficient number of skilled cybersecurity professionals

A major challenge in OT security is a shortage of skilled cybersecurity professionals with expertise in industrial control systems, which necessitates training and talent development to close the gap.

Market Segmentation

The global operational technology OT security market share is classified into component, deployment, and enterprise size.

- The solutions segment is expected to hold the largest share of the global operational technology OT security market during the forecast period.

Based on the component, the global operational technology OT security market is categorized into solutions and services. Among these, the solutions segment is expected to hold the largest share of the global operational technology OT security market during the forecast period.The high share can be attributed to the increasing preference of organizations for the deployment of OT security solutions with a view to protecting their critical infrastructure from cyberattacks. On the basis of solution type, the market is bifurcated into integrated platform and standalone. Integrated platform solutions can be defined as a suite of various OT security products and services that are integrated into working in unison to offer an integrated and common approach to fixing issues related to the security of OTs. Standalone solutions can be purchased and deployed separately, typically at a much lower cost, by organizations that require OT security products or services for their individual needs.

- The on-premises segment is expected to grow at the fastest CAGR during the forecast period.

Based on the deployment, the global operational technology OT security market is categorized into cloud, and on-premises. Among these, the on-premises segment is expected to grow at the fastest CAGR during the forecast period. The high share can be attributed to organizations prioritizing on-premises solutions in order to maintain complete control over their OT security systems. Concerns about security and privacy contribute to this preference, as on-premises solutions reduce the risks associated with cloud-based alternatives. The demand for optimal performance, as well as the continuous availability of OT security solutions, help to drive segment growth.

- The large enterprises segment is expected to grow at the fastest CAGR during the forecast period.

Based on the enterprise size, the global operational technology OT security market is categorized into SMEs and large enterprises. Among these, the large enterprises segment is expected to grow at the fastest CAGR during the forecast period. The high share can be attributed to the complexity and criticality of their operational technology (OT) landscapes, which are vulnerable to cyber-attacks. These companies have interconnected OT systems that allow attackers to move laterally within networks with ease. Also, their numerous remote access points create fertile ground for exploitation. The high value of proprietary data and intellectual property within these organizations fuels cyber attackers' motivation. Additionally, the consequences of a data breach for large businesses were more severe, including financial losses and operational disruptions. As a result, these businesses made significant investments in operational technology security to mitigate such risks.

Regional Segment Analysis of the Global Operational Technology OT Security Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global operational technology OT security market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global operational technology OT security market over the forecast period. Critical infrastructure, advanced industrial sectors, and an increasing demand due to a need for strong security are factors that have contributed to the growth in the North American region. Besides, strict regulatory frameworks of North America, such as those laid by NERC CIP standards, have necessitated comprehensive OT security protocols within the region. These regulations have played a critical role in raising awareness about the importance of operational technology security throughout North America.

Asia Pacific is expected to grow at the fastest CAGR growth of the global operational technology OT security market during the forecast period. Certain economies in this region, like China, India, and Indonesia, have been growing very fast and are also active in making investments in automation and digitization. Such a drive accelerates the use of OT solutions, which become vital for monitoring critical infrastructures like power plants, water treatment facilities, and transport systems. The demand for OT security goes hand in hand with the demand for OT solutions themselves. Also, increasing awareness regarding the threat of OT security is encouraging organizations across the Asia Pacific to make more investments and protect their critical infrastructure against all sorts of possible cyber-assaults.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global operational technology OT security market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fortinet

- Forcepoint

- Cisco

- Tenable

- Forescout

- Checkpoint

- Broadcom

- Trellix

- Microsoft

- OKTA

- Palo Alto Networks

- Qualys

- Zscaler

- BeyondTrust

- CyberArk

- Others

Key Market Developments

- In April 2024, AFWERX was awarded a Small Business Innovation Research, or SBIR, Phase II contract to deploy its operational technology (OT) and IoT security solutions. According to the company, Nozomi worked with the Air Force to develop tools for OT and IoT asset visibility, threat detection, and data analysis in order to reduce cyber risk and increase resiliency.

- In February 2023, Cisco introduced new cloud services within its IoT Operations Dashboard, with the goal of improving industrial asset visibility, enabling secure asset management from any location, and providing a seamless path to cloud automation for OT teams in the Industrial Internet of Things (IoT).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global operational technology OT security market based on the below-mentioned segments:

Global Operational Technology OT Security Market, By Component

- Solutions

- Services

Global Operational Technology OT Security Market, By Deployment

- Cloud

- On-premises

Global Operational Technology OT Security Market, By Enterprise Size

- SMEs

- Large Enterprises

Global Operational Technology OT Security Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global operational technology OT security market over the forecast period?The Global Operational Technology OT Security Market Size is Expected to Grow from USD 18.1 Billion in 2023 to USD 107.1 Billion by 2033, at a CAGR of 19.46% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global operational technology OT security market?North America is projected to hold the largest share of the global operational technology OT security market over the forecast period.

-

3. Who are the top key players in the operational technology OT security market?The top key players in the global operational technology OT security market are Fortinet, Forcepoint, Cisco, Tenable, Forescout, Checkpoint, Broadcom, Trellix, Microsoft, OKTA, Palo Alto Networks, Qualys, Zscaler, BeyondTrust, CyberArk, and Others.

Need help to buy this report?