Global Optical Sorter Market Size, Share, and COVID-19 Impact Analysis, By Type (Cameras, NIR, Lasers, Hyperspectral Cameras & Combined Sorters, Others) By Platform (Freefall, Belt, Lane, Hybrid) By Application (Recycling, Food, Mining) By End User (Food & Beverages, Waste Recycling, Pharmaceutical, Mining, Others) By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) Analysis and Forecast 2021 - 2030

Industry: Electronics, ICT & MediaGlobal Optical Sorter Market Insights Forecasts to 2030

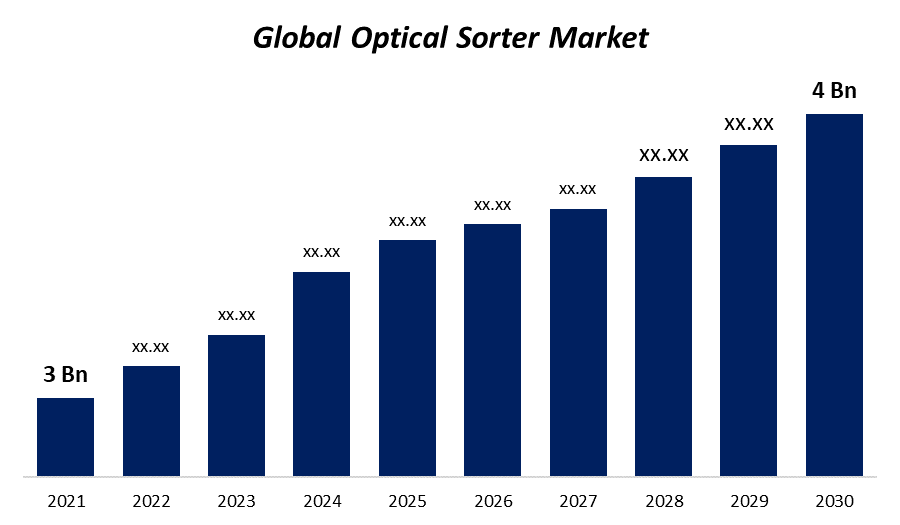

- The Optical Sorter Market size was valued at USD 3 billion in 2021.

- The market is growing at a CAGR of 8% from 2022 to 2030

- The Global Optical Sorter Market is expected to reach USD 8 billion by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Optical Sorter Market is expected to reach USD 4 billion by 2030, at a CAGR of 8% during the forecast period 2022 to 2030. The COVID-19 pandemic has been inapt and staggering with the optical sorter market facing rectritions of transportation of good and interruption in logistics management. Due to the long and continuous lockdown situation, working order of several end-user industries were suspended which resulted in a decline for the global optical sorter market. By effectively strategizing in accordance with the demands of the market, the optical sorter market is expected to recuperate after this global pandemic by the conclusion of the third quarter of the next year.

Market Overview

In an automated procedure called optical sorting, solid products are sorted via sensors and lasers. These optical sorters can distinguish an object's color, shape, size, morphology, and chemical properties using a variety of sensors and operating system intelligence. The sorters separate items of various grades or types of material or remove defective products and unwanted material from the manufacturing line. The feed system, optical system, image processing unit, and separation system unit are some of the parts that make up an optical sorter. Numerous sectors employ this technology widely owing to its many benefits, notably the manufacturing of high-quality goods, a rise in efficiency, and a decline in labour costs. Agricultural seedlings, coffee, fruit, nuts, cereals, sweets, livestock, and aquaculture are just a few of the culinary products that can be sorted with an optical sorter. In addition to mining materials like industrial minerals and precious metals, optical sorters also find widespread use in recycling materials like biological waste, plastic, metal, and paper.

Report Coverage

This research report categorizes the market for optical sorter market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the optical sorter market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the optical sorter market.

Driving Factors

Automation employs the production industry to enhance its performance by limiting errors and productivity in order to escalate measures and maintain the high calibre of the finished product. This, results in allowing these industries to reduce manual work, speed-up processes, and improve hygiene. Automated sorting is becoming the key unit of many industries' processing operations and the rising demand for this technology is consistent with its quality product and detectable adulteration. Henceforward, the market for optical sorters is exploding in numerous industries for its productivity and cost-reduction. In addition, increasing labour-cost in several nations and high-quality commodities are expected to drive the market growth of the optical sorting market.

Global Optical Sorter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 3 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 8% |

| 2030 Value Projection: | USD 4 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By End User, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Allgaier Werke, CP Manufacturing, Cimbria, Key Technology, Tomra, Greefa, Binder, Satake, Buhler, NEWTEC A/S, National Recovery Technologies, STEINERT, CP Global, Elica ASM, Raytec Vision, REDWAVE, Machinex, Sesotec, Pellenc ST |

| Pitfalls & Challenges: | Due to the increasing number of COVID-19 cases |

Get more details on this report -

Restraining Factors

The high capital investment in advanced technologies in optical sorting is expected to restrain the growth of the market. Since the capital investment for deployment of an optical sorter consists of not only the cost of the optical sorting unit but also peripheral units such as air compressor, debris removal, automatic washer, crushing and sizing equipment, conveyors feeders, sorting crates, containers, and systems overall installation cost. In addition, difficulties in sorting plastic waste, and high operating and maintenance costs are likely hindering the overall growth of the global optical sorter market.

Market Segmentation

- In 2021, the camera-type segment dominated the market with the largest share.

On the basis of type, the global optical sorter market is segmented into cameras, NIR, lasers, hyperspectral cameras & combined sorters, and others. Among these, cameras are supposed to have the largest share due to increasing demands for these sorters across various industries, especially in food processing industries all over the world. As such, a camera-based optical sensor enables the highest accuracy for sorting food grains, corn, peanuts, coffee, fruit, nuts, cereals, sweets, livestock, and aquaculture, it detects foreign substances with high-resolution cameras to ease the process without wastage.

- In 2021, the belt platform segment is witnessing significant CAGR growth over the forecast period.

Based on the platform, the global optical sorter market is segmented into freefall, belt, lane, and hybrid. Among these, the belt platform segment is witnessing significant CAGR growth over the forecast period owing to its wide range of applications in the food, pharmaceutical, recycling, and mining industries. The demand for this market segment is being driven by the more efficient belt platform, which allows the sorter to better focus on objects to identify minor foreign materials and flaws and enhance the accuracy of the ejection system.

- In 2021, the food application segment to generate the highest revenue over the predicted timeframe.

On the basis of application, the global optical sorter market is segmented into recycling, food, and mining. Among these, the food segment is expected to generate the highest revenue over the predicted timeframe owing to rising consumer demand for packaged food goods, the food sector is expanding quickly. According to estimates, the rise of the packaged food business would be fueled by rising labour wages across the globe and rigorous rules and regulations. To prevent food wastage, a number of food processing industries have adopted cutting-edge technology.

- In 2021, the food & beverages end-user segment is anticipated to generate the highest revenue over the forecast period.

Based on end users, the global optical sorter market is segmented into food & beverages, waste recycling, pharmaceutical, and mining, and others. In end-user, the food & beverages segment is expected to generate the highest revenue over the forecasted period owing to key manufacturers' increasing advancement and development of food grain sorters as the optical sorters are used to remove unrequired contaminations and cereal grains. Such an increase in cereals and food grains production is expected to create an immense market for optical sorters over the predicted time frame.

Regional Segment Analysis of the Optical Sorter Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

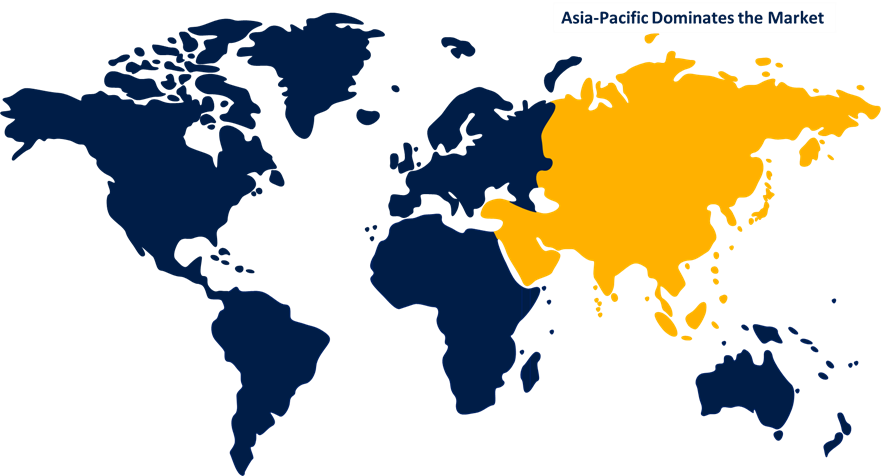

Asia Pacific region is anticipated to dominate with the largest market share by 2030

Asia Pacific is anticipated to hold the largest share of the global optical sorter market owing to the presence of key manufacturers such as Anhui Zhongke Optic, Satake, Angelon, and Inaba Peanuts Co., Ltd. A rise in food processing manufacturers as a result of population growth is anticipated to fuel market expansion. It is projected that the region's development of cutting-edge sorters for food and recycling industries will fuel market expansion.

North America is anticipated to experience the fastest increase during the timeframe. The introduction of automated technology into the food industry along with the existence of strict laws for food safety in North American nations will expand the market in this area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global optical sorter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players

- Allgaier Werke

- CP Manufacturing

- Cimbria

- Key Technology

- Tomra

- Greefa

- Binder

- Satake

- Buhler

- NEWTEC A/S

- National Recovery Technologies

- STEINERT

- CP Global

- Elica ASM

- Raytec Vision

- REDWAVE

- Machinex

- Sesotec

- Pellenc ST

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2022, TOMRA Launched a Premium sorting machine with BSI Technologies, for better and quality sorting of fruits, vegetables, cereals, and food & beverages packaging.

- In June 2020, Key Technology launched VERYX BioPrint digital sorter. The sorter can combine near-infrared hyperspectral detection with color cameras it analyzes a richer set of data about the materials it is sorting to improve detection performance and maximize process yield.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global optical sorter market based on the below-mentioned segments:

Optical Sorter Market, By Type

- Cameras

- NIR

- Lasers

- Hyperspectral Cameras & Combined Sorters

- Others

Optical Sorter Market, By Platform

- Freefall

- Belt

- Lane

- Hybrid

Optical Sorter Market, By Application

- Recycling

- Food

- Mining

Optical Sorter Market, By End User

- Food & Beverages

- Waste Recycling

- Pharmaceutical

- Mining

- Others

Optical Sorter Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?