Global Optical Transceiver Market Size, Share, and COVID-19 Impact Analysis, By Protocol (Ethernet, Fiber Channel, CWDM/DWDM, FTTx), By Form Factor (SFF, QSFP, CFP, XFP, CFP), By Data Rate (less Than 10 Gbps, 10 Gbps To 40 Gbps, 100 Gbps, Greater Than 100 Gbps), By Distance (Less than 1 km, 1-10 km, 11-100 km, More than 100 km), By Application (Data Center, Telecommunication, Enterprise), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Semiconductors & ElectronicsGlobal Optical Transceiver Market Insights Forecasts to 2033

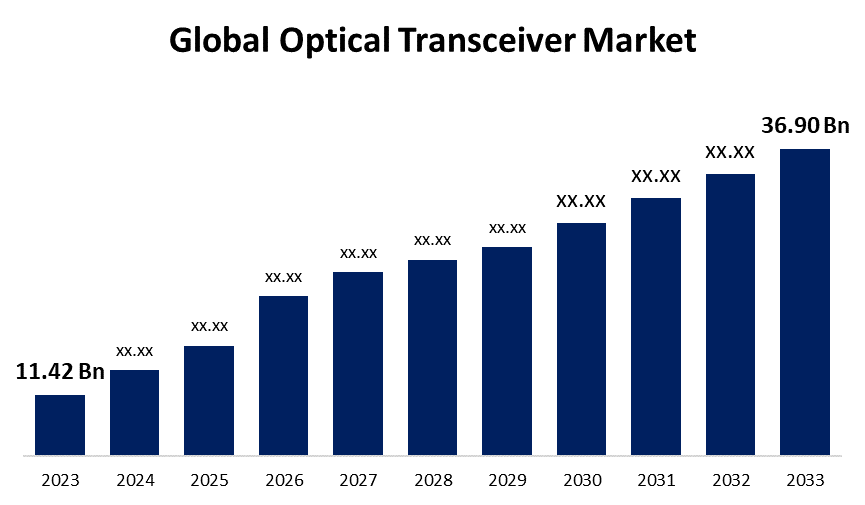

- The Global Optical Transceiver Market Size was Valued at USD 11.42 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.4% from 2023 to 2033

- The Worldwide Optical Transceiver Market Size is Expected to Reach USD 36.90 Billion by 2033

- Asia-Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Optical Transceiver Market Size is Anticipated to Exceed USD 36.90 Billion by 2033, Growing at a CAGR of 12.4% from 2023 to 2033.

Market Overview

The optical transceiver is a compact and powerful interconnect device that can transmit and receive data in the form of light pulses via an optical fiber at extremely high rates and over long distances in optical networking and communication. It converts electrical impulses into optical (light) signals, as well as optical signals back into electrical signals. Furthermore, the need for faster ethernet speeds, combined with the accessibility of cloud computing, the Internet of Things, and virtual data centers, has driven the global optical transceiver industry to expand rapidly to meet leading-edge broadband network capacity. In the forecast period, 1G, 10/25G, and 40/100G optical transceivers have been widely adopted, with higher-speed 200G and 400G transceivers on the horizon. Sales of high-speed optical components are gradually increasing and are projected to continue in the years ahead. Optical transceivers have many different types of sizes, forms, and form factors. The expected distance, pace, and type of data define the form factor. Moreover, the purpose of the optical transceiver is to address fiber exhaust and streamline wavelength management. It acts as an interface between the interconnecting cables of networking equipment, such as switches, repeaters, routers, and multiplexers.

Report Coverage

This research report categorizes the market for the global optical transceiver market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global optical transceiver market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global optical transceiver market.

Global Optical Transceiver Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.42 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 12.4% |

| 2033 Value Projection: | USD 36.90 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Protocol, By Form Factor, By Data Rate, By Distance, By Application, By Region. |

| Companies covered:: | Renoise, Audiotool FL Studio, Harrison Consoles, Apple Inc., Bitwig, Reaper, BandLab Technologies, Adobe, Acoustica, Magix, Cakewalk, Mark of the Unicorn, MuLab, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Global data traffic continues to rise due to the increasing number of digital devices, cloud computing, and IoT (Internet of Things) applications such as machine learning (ML), artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) and Ethernet turning to 400GE/800GE era. Because optical transceivers are important for high-speed, long-distance data transmission, their demand is rising in tandem with rising data consumption. As 5G technology is still going on, more bandwidth will be required to enable 5G's lower latency and faster data transfer rates. To address these needs, optical transceivers are in high demand due to their effective handling of huge amounts of data. Data center networks are rapidly adopting fiber optic technology. A fiber-based network for data centers is created by combining multiple fiber optic devices. Optical transceivers are a critical component of these high-capacity networks.

Restraining Factors

Some data centers still use copper-based network devices that cannot support fiber-optic connections. This is leading to an increase in network complexity, which is expected to limit the growth of the global optical transceivers market during the forecast period. Installing and integrating optical transceivers requires specialized techniques, which can add to the deployment time and costs, especially for companies with no prior experience in optical networking technologies.

Market Segmentation

The global optical transceiver market share is classified into protocol, form factor, data rate, distance, and application.

- The FTTx (fiber to the x) segment is expected to hold the largest share of the global optical transceiver market during the forecast period.

Based on protocol, the global optical transceiver market is categorized into ethernet, Fiber Channel, CWDM/DWDM, and FTTx. Among these, the FTTx segment is expected to hold the largest share of the global optical transceiver market during the forecast period. FTTx technology plays an important role in modern telecommunications infrastructure, offering high-speed broadband connectivity to residential, commercial, and industrial users. As the demand for faster internet speeds and greater bandwidth capacity continues to surge, particularly in densely populated urban areas, FTTx deployments become increasingly prevalent. Moreover, FTTx solutions facilitate the delivery of various services such as internet access, IPTV, VoIP, and video-on-demand, catering to diverse consumer demands and preferences.

- The data rate 100 Gbps segment is expected to hold the largest share of the global optical transceiver market during the forecast period.

Based on the data rate, the global optical transceiver market is categorized into less Than 10 Gbps, 10 Gbps To 40 Gbps, 100 Gbps, and greater than 100 Gbps. Among these, the data rate 100 Gbps segment is expected to hold the largest share of the global optical transceiver market during the forecast period. Data rate network speeds of 100 Gbps are increasingly popular because they offer high-frequency trading, minimal latency, high-definition video streaming, virtual reality, big data analytics, and rapid speeds to both data centers and users. Moreover, the frequent adoption of higher-speed interfaces in data center interconnects, telecommunications networks, and enterprise environments contributes to the driving of the 100 Gbps data rate segment.

- The QSFP segment is expected to hold the largest share of the global optical transceiver market during the forecast period.

Based on the form factor, the global optical transceiver market is categorized into SFF, QSFP, CFP, XFP, and SFP. Among these, the QSFP segment is expected to hold the largest share of the global optical transceiver market during the forecast period. Quad Small Form-factor Pluggable (QSFP) holds the largest share primarily due to its versatility, high data transmission capabilities, and widespread adoption in data center and networking environments. The QSFP form factor enables the transmission of high-speed data over short and long distances, making it suitable for various applications ranging from interconnectivity within data centers to long-haul telecommunications networks. Additionally, QSFP transceivers support a wide range of protocols and interfaces, including Ethernet, InfiniBand, and Fibre Channel, allowing for seamless integration into diverse networking environments.

- The data center segment is expected to hold the largest share of the global optical transceiver market during the forecast period.

Based on the application, the global optical transceiver market is categorized into data center, telecommunication, and enterprise. Among these, the data center segment is expected to hold the largest share of the global optical transceiver market during the forecast period. Data centers are driving market expansion as more businesses move their data and applications to the cloud. Businesses are implementing optical modules to handle the increased data traffic due to cloud applications. Optical modules are becoming important in data centers because they connect servers, storage, and networking devices. They provide a high-speed, low-latency, and low-power alternative to traditional copper-based networks, allowing data centers to handle the increasing volume of data traffic caused by data-intensive applications. These characteristics are pushing data centers to use optical modules, which is driving this market's growth.

Regional Segment Analysis of the Global Optical Transceiver Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

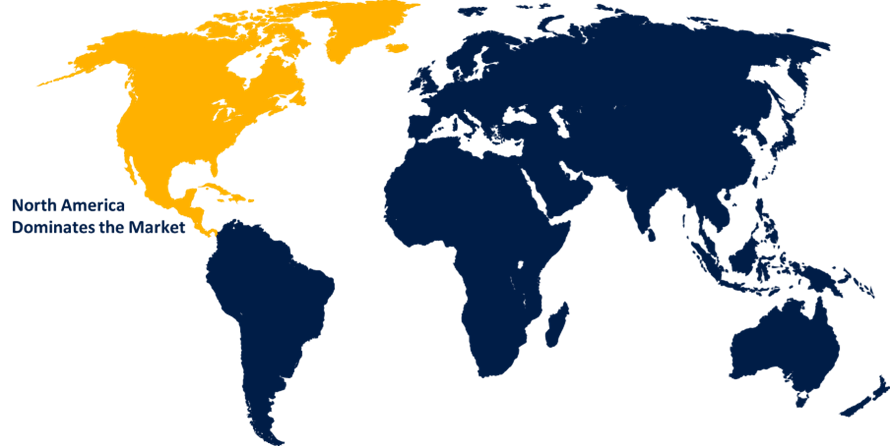

North America is anticipated to hold the largest share of the global optical transceiver market over the predicted time frame.

Get more details on this report -

North America is projected to hold the largest share of the global optical transceiver market over the forecast period. The United States has seen a high rate of internet adoption along with the adoption of advanced technologies like 5G, IOT, and AI (artificial intelligence), which has increased the demand for high data transmission rates and driven market growth. Growing data traffic has increased the need for building more data centers to serve consumers and businesses. The creation of massive, hyper-scale cloud-based data centers is facilitated by the use of cloud computing and applications. The US, UK, and China versions of Google, Microsoft, and Amazon are some of the major data center companies that have made significant contributions to the growth of the optical transceiver market in North America.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This growth is driven by several factors, including rapid industrialization, urbanization, and infrastructure development in countries like China, India, Japan, and South Korea. Moreover, increasing investments in telecommunications, data centers, and high-speed broadband networks contribute to the rising demand for optical transceivers in the region. Additionally, the expansion of 5G networks, deployment of fiber-to-the-home (FTTH) infrastructure, and growing adoption of cloud computing services further boost the demand for optical transceivers in the Asia-Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global optical transceiver along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Renoise

- Audiotool FL Studio

- Harrison Consoles

- Apple Inc.

- Bitwig

- Reaper

- BandLab Technologies

- Adobe

- Acoustica

- Magix

- Cakewalk

- Mark of the Unicorn

- MuLab

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Global Optical Transceiver Market based on the below-mentioned segments:

Recent development

- In March 2022, Fujitsu Optical Components Ltd. announced the development of the CFP2-DCO unity transceiver for 400Gbps DWDM open systems in March 2022, and sales began to increase in the second half of 2021.

- In November 2021, Lumentum Operations LLC purchased NeoPhotonics, an established developer and manufacturer of optoelectronic and laser technologies, in November 2021 for US$ 16.00 per share in cash, for a total equity value of about US$ 918 million.

Global Optical Transceiver Market, By Protocol

- Ethernet

- Fiber Channel

- CWDM/DWDM

- FTTx

Global Optical Transceiver Market, By Form Factor

- SFF

- QSFP

- CFP

- XFP

- CFP

Global Optical Transceiver Market, By Data Rate

- less Than 10 Gbps

- 10 Gbps To 40 Gbps

- 100 Gbps

- Greater Than 100 Gbps

Global Optical Transceiver Market, By Distance

- Less than 1 km

- 1-10 km

- 11-100 km

- More than 100 km

Global Optical Transceiver Market, By Application

- Data Center

- Telecommunication

- enterprise

Global Optical Transceiver Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global optical transceiver market over the forecast period?The global optical transceiver market is projected to expand at a CAGR of 12.4% during the forecast period.

-

2. What is the projected market size & growth rate of the global optical transceiver market?The global optical transceiver market was valued at USD 11.42 Billion in 2023 and is projected to reach USD 36.90 Billion by 2033, growing at a CAGR of 12.4% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global optical transceiver market?The North America region is expected to hold the highest share of the global optical transceiver market.

Need help to buy this report?