Global Organic Bread Flour Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Whole Wheat Organic Bread Flour, All-Purpose Organic Bread Flour, Specialty Organic Bread Flour, Ancient Grain Organic Bread Flour), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Direct-to-Consumer), By End User (Home Baking, Small Bakeries, Cafes and Restaurants), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Organic Bread Flour Market Insights Forecasts to 2033

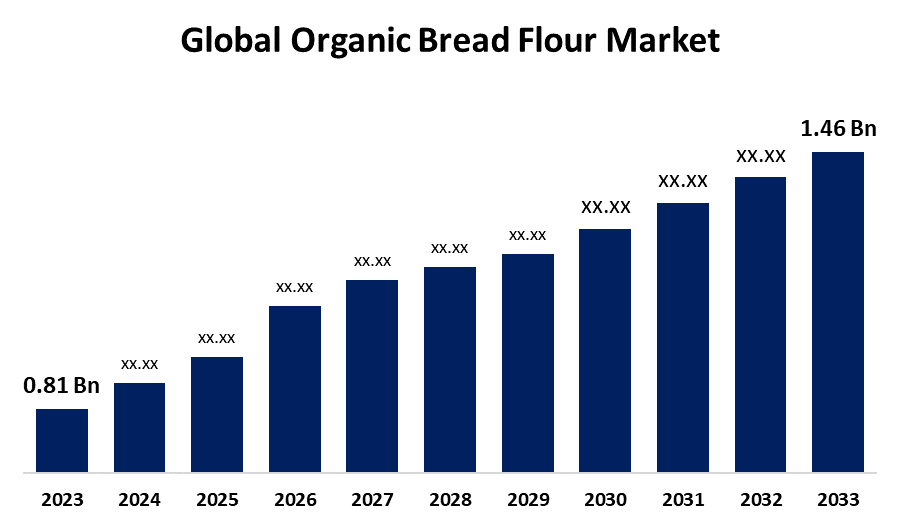

- The Global Organic Bread Flour Market Size was estimated at USD 0.81 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 6.07% from 2023 to 2033

- The Worldwide Organic Bread Flour Market Size is Expected to Reach USD 1.46 Billion By 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Organic Bread Flour Market Size was worth around USD 0.81 Billion in 2023 and is predicted to Grow to around USD 1.46 Billion By 2033 with a compound annual Growth rate (CAGR) of 6.07% between 2023 and 2033. The global organic bread flour market is driven by health-conscious consumers, rising demand for clean-label products, the growing popularity of home baking, the growing popularity of home baking, and preference for artisanal and specialty bread.

Market Overview

The organic bread flour market is described as the segment of the market that involves the manufacturing, distribution, and sale of organic flour exclusively for bread and other baked foods. Organic bread flour is produced using wheat or other grains that are cultivated without synthetic pesticides, herbicides, or GMOs and meet organic farming practices, usually certified by reputable organizations such as the USDA organic label or similar certifications in other regions. Owing to growing health concerns among consumers and a surge in the demand for food crops produced organically, the demand for organic bread flour is evolving. Moreover, the sector is being supported by the rise in the use of organic products. Organic wheat is rich in fiber, minerals, proteins, antioxidants, and other nutrients. The increasing popularity of specialty and artisanal bread products, which frequently incorporate organic ingredients, has driven demand for organic bread flour. Consumers are willing to pay a premium for high-quality, organic ingredients in their baked products. While gluten-free flour is a primary concern for some consumers, others are looking for organic alternatives for wheat bread. Organic flours from alternative grains, such as spelt or rye, are also becoming increasingly popular, further stimulating the market.

Report Coverage

This research report categorizes the organic bread flour market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the organic bread flour market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the organic bread flour market.

Global Organic Bread Flour Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.81 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.07% |

| 2033 Value Projection: | USD 1.46 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type, By Distribution Channel, By End User, By Region |

| Companies covered:: | King Arthur Baking Company, Bob’s Red Mill Natural Foods, Arrowhead Mills (The Hain Celestial Group), Great River Organic Milling, Hodgson Mill, Giusto’s Vita-Grain, To Your Health Sprouted Flour Co., Heartland Mill, Inc., Sunrise Flour Mill, Organic Valley (CROPP Cooperative), Ardent Mills, Central Milling Company, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing knowledge of the health advantages of organic food, organic products are increasingly being selected by consumers, including organic bread flour driving its demand. Organic bread flour is perceived as a healthier choice since it is not treated with synthetic pesticides, herbicides, and GMOs, making it more appealing to consumers who are health-conscious. The expanding trend towards specialty and artisanal bread, which frequently highlights the use of organic, high-quality ingredients, is driving organic bread flour demand.

Restraining Factors

Organic bread flour tends to cost more than traditional flour because the organic farming process is more expensive, including the cost of certification, lower yields per crop, and the lack of synthetic pesticides and fertilizers. This price difference may discourage some consumers, particularly in price-conscious markets, further restricting the demand for organic bread flour.

Market Segmentation

The organic bread flour market share is classified into product type, distribution channel, and end user.

- The wheat organic bread flour segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the organic bread flour market is divided into whole wheat organic bread flour, all-purpose organic bread flour, specialty organic bread flour, and ancient grain organic bread flour. Among these, the organic bread flour segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to wheat flour being considered healthier than flours that have been refined as it contains higher levels of fiber, vitamins, and minerals. With more customers opting for healthier alternatives, organic whole wheat bread flour is among the most demanded products.

- The supermarket/hypermarket segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the distribution channel, the organic bread flour market is divided into supermarkets/hypermarkets, specialty stores, online retail, and direct-to-consumer. Among these, the supermarket/hypermarket segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven due to supermarkets and hypermarkets are the most frequently visited retail outlets, providing a variety of organic products, such as organic bread flour. They offer convenient access for a wide consumer base, making it easy for consumers to access organic products.

- The home baking segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the organic bread flour market is divided into home baking, small bakeries, cafes, and restaurants. Among these, the home baking segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to home bakers' tendency to use organic ingredients so that their homemade bread is prepared from healthier, more natural ingredients. Organic bread flour is regarded as a healthier choice because it does not contain pesticides, GMOs, and other chemicals used in traditional farming.

Regional Segment Analysis of the Organic Bread Flour Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the organic bread flour market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the organic bread flour market over the predicted timeframe. North American consumers are very concerned with healthy and sustainable consumption, which stimulates demand for organic food products, such as organic bread flour. The U.S. and Canada have robust organic certification schemes and government incentives favoring organic farming, which helps to boost the supply of organic flour.

Asia Pacific is expected to grow at a rapid CAGR in the organic bread flour market during the forecast period. As consumers in Asia become more health-aware, demand for natural and organic food products, including organic flour, is on the increase. A developing middle class in Asia-Pacific nations is moving towards healthier food habits, causing higher demand for organic products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the organic bread flour market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- King Arthur Baking Company

- Bob's Red Mill Natural Foods

- Arrowhead Mills (The Hain Celestial Group)

- Great River Organic Milling

- Hodgson Mill

- Giusto's Vita-Grain

- To Your Health Sprouted Flour Co.

- Heartland Mill, Inc.

- Sunrise Flour Mill

- Organic Valley (CROPP Cooperative)

- Ardent Mills

- Central Milling Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Nature's Path, North America's premium organic breakfast and snack food company, launched in the U.S. retail market its Organic Flour line, aligning with the company's commitment to increasing access to organic food by entering the baking category for the first time. Capitalizing on the firm's tradition of providing high-quality, nutrient-dense products, Nature's Path Organic Flour facilitates customers' ability to upgrade their baking experience with organic, non-GMO ingredients without compromising the health of people and the planet not flavor.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the organic bread flour market based on the below-mentioned segments:

Global Organic Bread Flour Market, By Product Type

- Whole Wheat Organic Bread Flour

- All-Purpose Organic Bread Flour

- Specialty Organic Bread Flour

- Ancient Grain Organic Bread Flour

Global Organic Bread Flour Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Direct-to-Consumer

Global Organic Bread Flour Market, By End User

- Home Baking

- Small Bakeries

- Cafes and Restaurants

Global Organic Bread Flour Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the organic bread flour market over the forecast period?The global organic bread flour market is projected to expand at a CAGR of 6.07% during the forecast period.

-

2. What is the market size of the organic bread flour market?The global organic bread flour market size is expected to grow from USD 0.81 Billion in 2023 to USD 1.46 Billion by 2033, at a CAGR of 6.07 % during the forecast period 2023-2033.

-

3. Which region holds the largest share of the organic bread flour market?North America is anticipated to hold the largest share of the organic bread flour market over the predicted timeframe.

Need help to buy this report?