Global Orthodontic Supplies Market Size, Share, and COVID-19 Impact Analysis, By Product (Fixed Braces, Removable Braces, Orthodontic Adhesives, and Others), By Patient (Children & Teenagers and Adult), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: HealthcareGlobal Orthodontic Supplies Market Size Insights Forecasts to 2032

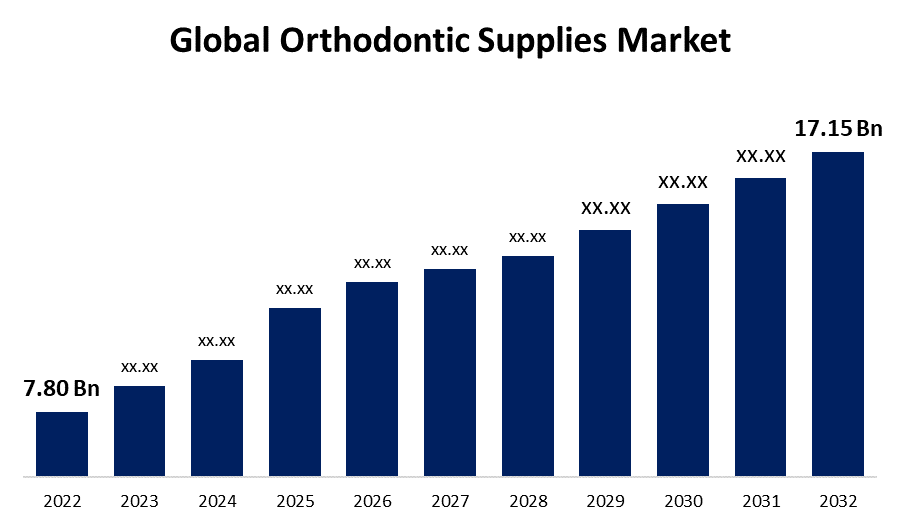

- The Global Orthodontic Supplies Market Size was valued at USD 7.80 Billion in 2022.

- The Market is Growing at a CAGR of 8.2% from 2022 to 2032

- The Worldwide Orthodontic Supplies Market Size is expected to reach USD 17.15 Billion by 2032

- Asia-Pacific is expected to grow significant during the forecast period.

Get more details on this report -

The Global Orthodontic Supplies Market Size is expected to reach USD 17.15 Billion by 2032, at a CAGR of 8.2% during the forecast period 2022 to 2032.

Market Overview

Orthodontic supplies are essential tools used by orthodontists and dental professionals to diagnose, prevent, and correct dental irregularities and malocclusions. These supplies encompass a wide range of products designed to facilitate orthodontic treatments, such as braces, aligners, wires, and elastics, among others. Brackets, commonly made of metal or ceramic, are bonded to teeth to hold the archwires that apply controlled pressure, guiding teeth into proper alignment over time. Orthodontic elastics and rubber bands aid in adjusting jaw position and bite alignment. In recent years, advancements in technology have introduced clear aligners, providing patients with a more discreet orthodontic option. The continuous development and availability of orthodontic supplies contribute to more efficient and effective orthodontic care, ultimately improving patients' oral health and aesthetics.

Report Coverage

This research report categorizes the market for global orthodontic supplies market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global orthodontic supplies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the global orthodontic supplies market.

Global Orthodontic Supplies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.80 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.2% |

| 2032 Value Projection: | USD 17.15 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Patient, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | TP Orthodontics, Align Technology, Inc., 3m Company, American Orthodontics Inc., Ormco (Danaher Corporation), Aster Orthodontics, Inc., DB Orthodontics Ltd., Dentaurum, Dental Morelli, Dentsply Sirona, Inc., Great Lakes Orthodontics Inc., G&H Orthodontics Inc., Orthodontic Supply & Equipment Company, Rocky Mountain Orthodontics, Oswell Dental, Straumann (ClearCorrect), Ultradent Products Inc. and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The orthodontic supplies market is driven by several key factors that collectively influence its growth and demand, such as the increasing prevalence of dental malocclusions and orthodontic issues worldwide is a significant driver, leading to a higher demand for orthodontic treatments and supplies. Additionally, rising awareness among individuals about the importance of oral health and aesthetics has prompted a growing number of people seeking orthodontic procedures, further fueling the market growth. Technological advancements, such as digital orthodontics and 3D printing, have revolutionized the manufacturing process and improved treatment outcomes, attracting both patients and practitioners. Moreover, favorable reimbursement policies and insurance coverage for orthodontic procedures in some regions play a role in driving the market. Overall, the growing disposable income in emerging economies has made orthodontic treatments more affordable and accessible to a broader population, contributing to market expansion. Together, these drivers are propelling the orthodontic supplies market forward and are likely to continue shaping its trajectory in the foreseeable future.

Restraining Factors

The orthodontic supplies market also faces several restraints that can impact its growth and expansion, such as the high cost associated with orthodontic treatments and supplies can act as a significant restraint, limiting access to care for some individuals. Additionally, the lengthy treatment duration required for orthodontic procedures may deter some patients from seeking treatment. Limited reimbursement coverage and insurance options in certain regions can also impede market growth. Moreover, the shortage of skilled orthodontists and dental professionals in some areas can pose challenges in delivering orthodontic services. Overall, the ongoing impact of economic fluctuations and uncertainties may influence consumer spending behavior, affecting the demand for orthodontic supplies.

Market Segmentation

- In 2022, the removable braces segment accounted for around 58.5% market share

On the basis of the product, the global orthodontic supplies market is segmented into fixed braces, removable braces, orthodontic adhesives, and others. The removable braces segment dominates the orthodontic supplies market for several compelling reasons. Removable braces, also known as clear aligners, have gained immense popularity among patients and orthodontists alike, driving their widespread adoption and market dominance. One key factor contributing to their dominance is the aesthetic appeal they offer. Clear aligners are transparent and virtually invisible, making them an attractive choice for patients who seek a more discreet orthodontic solution compared to traditional braces, which are more noticeable. This aesthetic advantage has led to increased acceptance and demand for removable braces, particularly among adults and image-conscious individuals. Moreover, removable braces provide enhanced comfort and convenience. Unlike fixed braces, clear aligners can be easily removed for eating, brushing, and flossing, allowing for better oral hygiene maintenance and reduced discomfort during meals. This feature has been a significant selling point for patients, making removable braces an attractive option for those seeking orthodontic treatment without lifestyle disruptions. Additionally, advancements in technology and the growing expertise of orthodontic professionals have led to the development of sophisticated software and manufacturing processes for clear aligners. This has resulted in highly precise, personalized aligners that offer efficient and effective teeth movement, leading to better treatment outcomes. Furthermore, the increasing availability of affordable clear aligner treatment options has broadened their accessibility to a wider patient base, further fueling their dominance in the market. As a result, many orthodontic practices and companies have shifted their focus to providing clear aligner treatments, reinforcing the segment's prominence.

In conclusion, the removable braces segment, represented mainly by clear aligners, dominates the Orthodontic Supplies Market due to their aesthetic appeal, comfort, convenience, technological advancements, and affordability. With a rising number of patients preferring this innovative orthodontic solution, the dominance of removable braces is expected to continue growing in the foreseeable future

- In 2022, the adult segment dominated with more than 62.7% market share

Based on the patient, the global orthodontic supplies market is segmented into children & teenagers and adults. The adult segment dominates the orthodontic supplies market for various compelling reasons, signifying a significant shift in the orthodontic landscape. In recent years, there has been a notable increase in the number of adults seeking orthodontic treatments, which has fueled the growth of this segment. The changing societal attitudes and cultural shifts have led to a greater emphasis on personal appearance and self-confidence among adults. As a result, many adults are opting for orthodontic treatments to improve their smiles and enhance their overall facial aesthetics, contributing to the surge in demand for orthodontic supplies within this demographic. The advancements in orthodontic technology have played a crucial role in attracting adult patients. The availability of discreet treatment options, such as clear aligners and lingual braces, has resonated well with adults who may be more conscious about the visibility of traditional braces during professional and social interactions. Furthermore, the increasing awareness of the importance of oral health throughout life has encouraged adults to seek orthodontic care to correct misalignments and bite issues, which can lead to better oral hygiene and overall health. Additionally, the growing acceptance of orthodontic treatments as a viable option for adults by dental professionals and orthodontists has encouraged more adults to consider and pursue such treatments. Moreover, factors like rising disposable incomes and better access to orthodontic services have made treatments more affordable and accessible to the adult population, further contributing to the dominance of this segment in the market. Overall, the adult segment's dominance in the orthodontic supplies market can be attributed to changing societal perceptions, technological advancements, increased awareness of oral health, and improved affordability and accessibility of orthodontic treatments, all of which have collectively encouraged more adults to seek orthodontic care to achieve their desired smile and dental aesthetics.

Regional Segment Analysis of the Orthodontic Supplies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

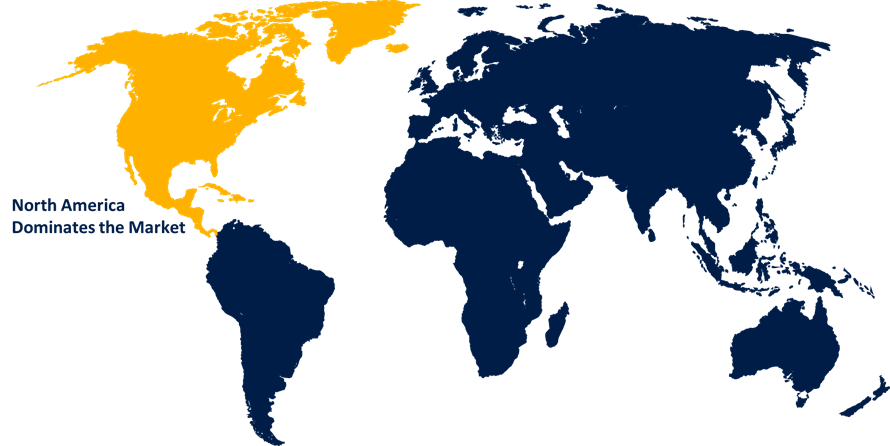

North America dominated the market with more than 37.4% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the dominant player in the orthodontic supplies market, holding the largest market share for several reasons, such as the region boasting a well-established and advanced healthcare infrastructure, making orthodontic treatments widely accessible to the population. The high prevalence of dental irregularities and the growing awareness of aesthetic dental procedures have driven the demand for orthodontic supplies in this region. Furthermore, North America has witnessed significant investments in research and development, leading to the introduction of innovative orthodontic products and technologies. The presence of key market players and manufacturers in the region has also contributed to its leadership position. Additionally, favorable reimbursement policies, increasing disposable income, and a strong focus on oral health maintenance have further bolstered the demand for orthodontic supplies, solidifying North America's prominent market share in the industry.

Recent Developments

- In May 2022, Ormco Corporation introduced the Ultima Hook, which was designed exclusively for the Ultima wire. It is created and manufactured to be used in combination with orthodontic equipment to address malocclusions while also delivering performance and efficiency.

- In April 2022, Aeon Dental introduced a redesigned Aeon Aligner ecosystem of solutions and support services. With this new introduction, Aeon Aligner will be able to offer its clients more initiatives in order to provide cutting-edge, patient- and doctor-centric solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global orthodontic supplies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- TP Orthodontics

- Align Technology, Inc.

- 3m Company

- American Orthodontics Inc.

- Ormco (Danaher Corporation)

- Aster Orthodontics, Inc.

- DB Orthodontics Ltd.

- Dentaurum

- Dental Morelli

- Dentsply Sirona, Inc.

- Great Lakes Orthodontics Inc.

- G&H Orthodontics Inc.

- Orthodontic Supply & Equipment Company

- Rocky Mountain Orthodontics

- Oswell Dental

- Straumann (ClearCorrect)

- Ultradent Products Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global orthodontic supplies market based on the below-mentioned segments:

Orthodontic Supplies Market, By Product

- Fixed Braces

- Removable Braces

- Orthodontic Adhesives

- Others

Orthodontic Supplies Market, By Patient

- Children & Teenagers

- Adult

Orthodontic Supplies Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?