Global Orthopedic Biomaterials Market Size, Share, and COVID-19 Impact Analysis, By Material (Metal, Polymers, Ceramics & Bioactive Glass Biomaterials), By Application (Orthobiologics, Orthopedic Implants), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Orthopedic Biomaterials Market Insights Forecasts to 2033

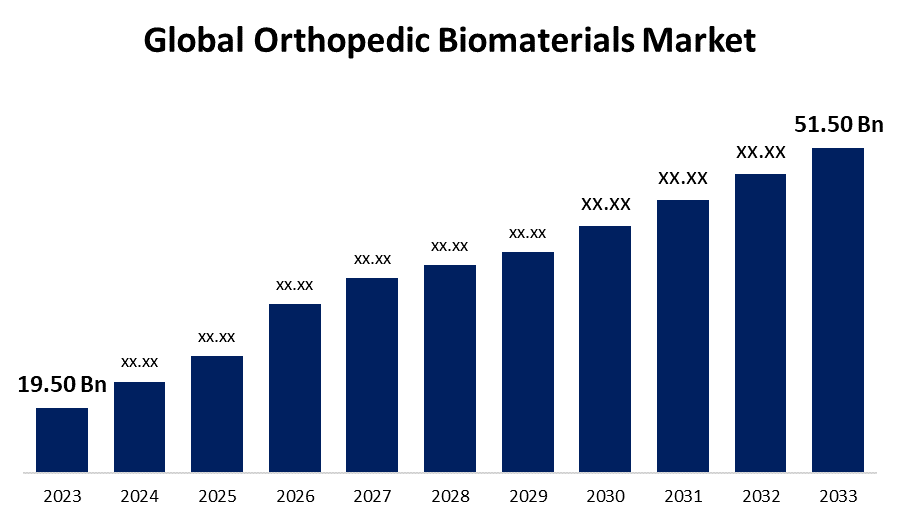

- The Global Orthopedic Biomaterials Market Size was Valued at USD 19.50 Billion in 2023

- The Market Size is Growing at a CAGR of 10.20% from 2023 to 2033

- The Worldwide Orthopedic Biomaterials Market Size is Expected to Reach USD 51.50 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Orthopedic Biomaterials Market Size is Anticipated to Exceed USD 51.50 Billion by 2033, Growing at a CAGR of 10.20% from 2023 to 2033.

Market Overview

Orthopedic biomaterials are materials specifically designed and used in orthopedic applications to repair, replace, or support damaged or diseased bone and joint tissues. Orthopedic biomaterials materials must possess properties that make them compatible with the human body and suitable for withstanding mechanical stresses. Orthopedic biomaterials play a crucial role in supporting and replacing damaged bone and joint tissues across various medical applications. Orthopedic biomaterials, including metals like titanium and stainless steel, polymers such as polymethylmethacrylate, and ceramics, are used in bone implants, joint replacements, and spinal fusion surgeries to provide strength, stability, and durability. They are also integral in bone grafting, cartilage repair, and ligament reconstruction, utilizing both synthetic and biologically derived substances.

For Instance, In January 2023, Alpha Healthcare Acquisition Corp. III announced a merger with Carmell Therapeutics, a Phase 2 stage biotechnology platform company developing allogeneic plasma-based biomaterials for bone and soft tissue healing indications.

Report Coverage

This research report categorizes the market for orthopedic biomaterials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the orthopedic biomaterials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the orthopedic biomaterials market.

Global Orthopedic Biomaterials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.50 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.20% |

| 2033 Value Projection: | USD 51.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material, By Application, By Region |

| Companies covered:: | Evonik Industries AG, Stryker Corp., DSM Biomedical, Depuy Synthes Inc., Zimmer Biomet, Invibo Ltd., Globus Medical, Exactech, Inc., AdvanSource, Matexcel, Biomaterials Corp., CAM Bioceramics B.V., Heraeus Holding, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The orthopedic biomaterials market is significantly influenced by an aging population and the rising incidence of orthopedic disorders, which drive demand for implants and devices. Technological advancements, such as 3D printing and innovations in biomaterial development, are enhancing treatment options and expanding market opportunities. Improved surgical techniques and the increasing frequency of joint replacement surgeries also contribute to market growth. Additionally, the surge in sports and physical activities, coupled with advancements in healthcare infrastructure and economic factors, further propel the demand for orthopedic biomaterials.

Restraining Factors

The orthopedic biomaterials market faces several restraining factors, including the high costs associated with advanced materials and stringent regulatory challenges that can delay product approval and increase expenses. Limited biocompatibility and potential for complications, such as infections or implant failures, also pose significant risks. Additionally, economic uncertainty, resistance from patients or healthcare providers technological complexities in developing effective biomaterials, and market saturation in some regions can hinder growth.

Market Segmentation

The orthopedic biomaterials market share is classified into material and application.

- The ceramics & bioactive glass biomaterials segment is estimated to hold the highest market revenue share through the projected period.

Based on the material, the orthopedic biomaterials market is classified into metal, polymers, ceramics & bioactive glass biomaterials. Among these, the ceramics & bioactive glass biomaterials segment is estimated to hold the highest market revenue share through the projected period. This segment’s dominance is due to the unique properties of ceramics and bioactive glasses, such as excellent biocompatibility, high strength, and the ability to promote bone growth and integration. Ceramics & bioactive glass biomaterials are particularly valued for their performance in load-bearing applications and their effectiveness in enhancing the success of orthopedic implants and prosthetics. The continued advancements in ceramic and bioactive glass technologies are expected to drive their increased adoption and market leadership.

- The orthopedic implants segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the orthopedic biomaterials market is divided into orthobiologics and orthopedic implants. Among these, the orthopedic implants segment is anticipated to hold the largest market share through the forecast period. This dominance is driven by the high demand for various types of implants used in surgeries to repair or replace damaged bones and joints. Orthopedic implants, including those made from metals, ceramics, and polymers, are essential in treating conditions such as fractures, joint degeneration, and deformities. Orthopedic implant has a crucial role in surgical interventions and the ongoing advancements in implant technology contribute to their leading position in the market.

Regional Segment Analysis of the Orthopedic Biomaterials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the orthopedic biomaterials market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the orthopedic biomaterials market over the predicted timeframe. North America is poised to dominate the orthopedic biomaterials market due to its advanced healthcare infrastructure, high prevalence of orthopedic conditions, and strong research and development activities. The region benefits from a significant number of leading companies in the sector, extensive funding from both government and private sources, and a high rate of innovation driving the North American region's growth.

Bottom of Form

Asia Pacific is expected to grow at the fastest CAGR growth in the orthopedic biomaterials market during the forecast period. This rapid growth can be attributed to several factors including the rising population with increasing orthopedic conditions, expanding healthcare infrastructure, and growing awareness of advanced treatment options. Additionally, economic development in countries like China and India is leading to greater investment in healthcare and medical technologies. The region's growing demand for innovative and cost-effective orthopedic solutions, combined with improving regulatory frameworks and increasing medical research, contributes to its robust growth of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the orthopedic biomaterials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Evonik Industries AG

- Stryker Corp.

- DSM Biomedical

- Depuy Synthes Inc.

- Zimmer Biomet

- Invibo Ltd.

- Globus Medical

- Exactech, Inc.

- AdvanSource

- Matexcel

- Biomaterials Corp.

- CAM Bioceramics B.V.

- Heraeus Holding

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Himed, a major maker of bioceramic materials, and Lithoz, a pioneer in ceramic 3D printing equipment, announced the creation of a new Bioceramics Center of Excellence at Himed's New York headquarters.

- In March 2023, Invibio Biomaterial Solutions launched the Peek-Optima Am filament, an implantable polyetheretherketone polymer for the production of 3D-printed medical devices.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the orthopedic biomaterials market based on the below-mentioned segments:

Global Orthopedic Biomaterials Market, By Material

- Metal

- Polymers

- Ceramics & Bioactive Glass Biomaterials

Global Orthopedic Biomaterials Market, By Application

- Orthobiologics

- Orthopedic Implants

Global Orthopedic Biomaterials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the orthopedic biomaterials market over the forecast period?The orthopedic biomaterials market is projected to expand at a CAGR of 10.20% during the forecast period.

-

2. What is the market size of the orthopedic biomaterials market?The Global Orthopedic Biomaterials Market Size is Expected to Grow from USD 19.50 Billion in 2023 to USD 51.50 Billion by 2033, at a CAGR of 10.20% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the orthopedic biomaterials market?North America is anticipated to hold the largest share of the orthopedic biomaterials market over the predicted timeframe.

Need help to buy this report?