Global Orthopedic Insole Manufacturing Thermosealer Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Manual Thermosealers, Semi-Automatic Thermosealers, Automatic Thermosealers), By Application (Orthopedics, Podiatry), By End-User (Hospitals, Clinics, Orthopedic Laboratories, Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Orthopedic Insole Manufacturing Thermosealer Market Insights Forecasts to 2033

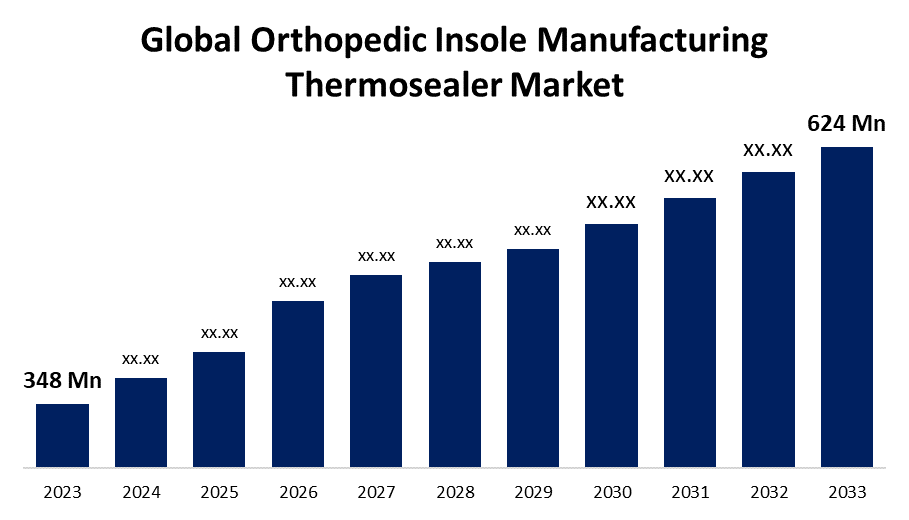

• The Global Orthopedic Insole Manufacturing Thermosealer Market Size was Valued at USD 348 Million in 2023

• The Market Size is Growing at a CAGR of 6.01% from 2023 to 2033

• The Worldwide Orthopedic Insole Manufacturing Thermosealer Market Size is Expected to Reach USD 624 Million by 2033

• Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Orthopedic Insole Manufacturing Thermosealer Market Size is expected to grow from 348 million in 2023 to USD 624 million by 2033, at a CAGR of 6.01% during the forecast period 2023-2033. The advanced technologies, rising awareness about foot health, and increasing demand for customization guide the demand in the orthopedic insole manufacturing thermosealer market. Innovations, efforts toward sustainability, and regional developments have poised the market for healthy growth, especially in North America and Europe.

Market Overview

The orthopedic insole manufacturing thermosealer market involves specialty equipment in medical products for preparing customized orthopedic insoles. Thermosealers are devices that apply both heat and pressure to shape and seal materials such as EVA (ethylene-vinyl acetate), polyurethane, or other supportive components to ensure proper moulding against one's foot anatomy. Such technology offers support towards helping podiatrists, orthopedic specialists, as well as manufacturers of insoles to make customized products with accurate specifications for plantar fasciitis, flat feet, or diabetic foot ulcers. Furthermore, rising demand for custom insoles due to aged populations, increasing foot disorder prevalence, and sports injuries will drive the growth of the market for orthopedic insole manufacturing thermosealer. Healthcare trends favouring preventive health care along with enlarging markets in developing regions further support the acceptance of advanced thermosealing technologies.

Recent innovations in the orthopedic insole manufacturing thermosealer market include advanced thermosealers with improved precision and eco-friendly designs. The leading players such as NAMROL and Podiatech enter into emerging markets by providing cost-effective solutions. Collaborative efforts with clinics and focusing on sustainable and energy-efficient technologies have captured growth and adoption in the market. Further, in October 2021, an Australia-based researchers' team at the University of Queensland successfully designed a novel insole technology. The product works through an application installed in a mobile device, intended to enable people who suffer nerve damage to keep their balance. Researches like such is likely to further boost the sales for products during the forecast period.

Opportunities and Trends in the Global Orthopedic Insole Manufacturing Thermosealer Market:

Rising demand for customized, high-quality orthopedic insoles is driving the global orthopedic insole manufacturing thermosealer market. Opportunities include advancements in thermosealing technology for precision and efficiency, growing awareness of foot health, and expanding healthcare infrastructure. Key trends will include eco-friendly materials, digitalization in manufacturing, and increased adoption in emerging markets due to affordability and accessibility improvements.

Report Coverage

This research report categorizes the global orthopedic insole manufacturing thermosealer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global orthopedic insole manufacturing thermosealer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global orthopedic insole manufacturing thermosealer market.

Global Orthopedic Insole Manufacturing Thermosealer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 348 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.01% |

| 2033 Value Projection: | USD 624 Million |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 162 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | Bauerfeind AG, Aetrex Worldwide, Inc., Hanger Clinic, ComfortFit Orthotic Labs, Inc., Powerstep, Spenco Medical Corporation, Footbalance System Ltd., Orthofeet Inc., Tynor Orthotics Pvt. Ltd., Dr. Scholl’s, Vionic Group LLC, Birkenstock Digital GmbH, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main drivers for orthopedic insole manufacturing thermosealer market growth are the increased prevalence of foot-related issues, ageing populations, and the growing demand for individualized medical solutions. Increasing attention to preventative healthcare and improvements in thermosealing technology allowing for faster and more precise production support growth in demand. Growth is further supported by demands in the sports and occupational sectors for durable, high-performance insoles.

Innovations in orthopedic insole thermosealers in the field include energy-efficient designs, AI-driven precision, and integration with 3D printing. Developments focus on environmental technologies, compact models for small-scale producers, and quicker sealing times, thus enhancing sustainability and efficiency. For instance, in March 2023, Swiss scientists have designed an insole manufactured using 3D printing technology integrated with sensors. These sensors provide the exact measurement of pressure as presented by the foot on the sole. Thus, industry growth would be spurred by the integration of this advanced technology.

Restraints & Challenges

Challenges facing the orthopedic insole thermosealer market include high initial investment costs, low adoption in low-income regions, and the requirement for competent operators. Restraints include competition from other methods of manufacturing insoles, environmental concerns relating to the non-recyclable use of materials, and slower growth in the regions, where awareness about the advanced solutions for foot care is relatively low.

Market Segmentation

The global orthopedic insole manufacturing thermosealer market share is classified into product type, application, and end-user.

• The automatic thermosealers segment is expected to hold the largest share of the global orthopedic insole manufacturing thermosealer market during the forecast period.

Based on product type, the global orthopedic insole manufacturing thermosealer market is categorized as manual thermosealers, semi-automatic thermosealers, and automatic thermosealers. Among these, the automatic thermosealers segment is expected to hold the largest share of the global orthopedic insole manufacturing thermosealer market during the forecast period. This is due to their ability to streamline the production process with minimal manual interference, with guaranteed consistency and precision in the produced orthopedic insoles. They are suitable for large-scale manufacturing, satisfying the increasing need for customized orthopedic insoles. Finally, the gaining momentum of automation reduces operational costs, efficiency improved, thus embraced.

• The podiatry segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global orthopedic insole manufacturing thermosealer market is categorized as orthopedics, and podiatry. Among these, the podiatry segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to heightened awareness regarding health, growing incidence of disorders like plantar fasciitis and flat feet, and increase in customized insoles adoption for preventive care. Advances in podiatric diagnostics and treatment and greater access to specialty foot care drive the fast growth of this segment.

• The orthopedic laboratories segment is expected to hold the largest share of the global orthopedic insole manufacturing thermosealer market during the forecast period.

Based on end-user, the global orthopedic insole manufacturing thermosealer market is categorized as hospitals, clinics, orthopedic laboratories, and others. Among these, the orthopedic laboratories segment is expected to hold the largest share of the global orthopedic insole manufacturing thermosealer market during the forecast period. This is because it specializes in manufacturing customized insoles on an industrial scale. It utilizes advanced thermosealing technologies, guaranteeing precision and efficiency in its pursuit of meeting the demand for high-quality orthopedic solutions. The capability to satisfy both the medical and commercial applications enhances their dominant position in the market.

Regional Segment Analysis of the Global Orthopedic Insole Manufacturing Thermosealer Market

• North America (U.S., Canada, Mexico)

• Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

• Asia Pacific (China, Japan, India, Rest of APAC)

• South America (Brazil and the Rest of South America)

• The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global orthopedic insole manufacturing thermosealer market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global orthopedic insole manufacturing thermosealer market over the forecast period. This supremacy is due to improved healthcare infrastructure, a high prevalence of orthopedic and foot-related disorders, a strong demand for customized insoles, and major investments in technological developments in manufacturing processes. Furthermore, In North America, some of the leading companies include Apex Foot Health Industries and Superfeet, which have developed new technology in AI-driven thermosealers and produced 3D printing for personalized custom orthopedic insoles. Such innovations help increase efficiency, precision, and volume of production. These advanced thermosealing machines equipped with digital scanning tools are improving customization for insoles, thus fueling market growth due to increasing demand for customized foot care solutions.

Europe is expected to grow at the fastest CAGR growth of the global orthopedic insole manufacturing thermosealer market during the forecast period. The growth is also spurred by increased foot health awareness, the ageing population, and the developing healthcare infrastructure. Besides, the demand for customized insoles in orthopedic treatments remains on the rise, hence contributing to the widespread adoption of advanced thermosealing technologies. Furthermore, advanced thermosealers, which offer faster high-precision sealing in Europe, are made available by key players like Sole Technology. Manufacturers remain concerned with sustainability, developing biodegradable thermosealers and the materials used to create them. In addition, companies incorporate thermosealing technology into digital scanning and 3D modelling for customized insoles. Strategic partnerships with medical institutions expedite growth. These drivers of personalized foot care solutions spread throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global orthopedic insole manufacturing thermosealer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bauerfeind AG

- Aetrex Worldwide, Inc.

- Hanger Clinic

- ComfortFit Orthotic Labs, Inc.

- Powerstep

- Spenco Medical Corporation

- Footbalance System Ltd.

- Orthofeet Inc.

- Tynor Orthotics Pvt. Ltd.

- Dr. Scholl's

- Vionic Group LLC

- Birkenstock Digital GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In February 2022, Foot Solutions, Inc. announced the acquisition of Florida-based retailer Happy Feet Plus, Inc. The transaction combines two key retail powers in speciality footwear.

- In February 2022, Digital Orthotics Laboratories Australia Pty Ltd announced the release of the DOLA app, which includes an iPhone scanning feature that allows customers to scan, consult, and order orthotics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global orthopedic insole manufacturing thermosealer market based on the below-mentioned segments:

Global Orthopedic Insole Manufacturing Thermosealer Market, By Product Type

- Manual Thermosealers

- Semi-Automatic Thermosealers

- Automatic Thermosealers

Global Orthopedic Insole Manufacturing Thermosealer Market, By Application

- Orthopedics

- Podiatry

Global Orthopedic Insole Manufacturing Thermosealer Market, By End-User

- Hospitals

- Clinics

- Orthopedic Laboratories

- Others

Global Orthopedic Insole Manufacturing Thermosealer Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global orthopedic insole manufacturing thermosealer market over the forecast period?The global orthopedic insole manufacturing thermosealer market size is expected to grow from USD 348 Million in 2023 to USD 624 Million by 2033, at a CAGR of 6.01% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global orthopedic insole manufacturing thermosealer market?North America is projected to hold the largest share of the global orthopedic insole manufacturing thermosealer market over the forecast period.

-

3. Who are the top key players in the global orthopedic insole manufacturing thermosealer market?Bauerfeind AG, Aetrex Worldwide, Inc., Hanger Clinic, ComfortFit Orthotic Labs, Inc., Powerstep, Spenco Medical Corporation, Footbalance System Ltd., Orthofeet Inc., Tynor Orthotics Pvt. Ltd., Dr. Scholl's, Vionic Group LLC, Birkenstock Digital GmbH, and Others.

Need help to buy this report?