Global Orthopedic Splints Market Size, Share, and COVID-19 Impact Analysis, By Product (Plastic Splints, Tools and Accessories, Fiberglass Splints, and Others), By Application (Upper Extremity and Lower Extremity), By End-User (Hospitals, Specialty Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Orthopedic Splints Market Insights Forecasts to 2033

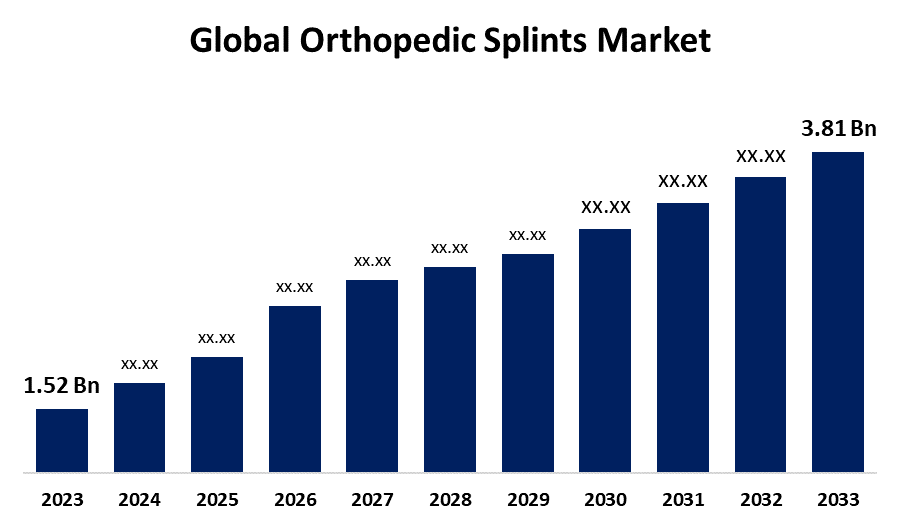

- The Global Orthopedic Splints Market Size was Estimated at USD 1.52 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 9.62% from 2023 to 2033

- The Worldwide Orthopedic Splints Market Size is Expected to reach USD 3.81 Billion by 2033

- Asia Pacific is predicted to Grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global Orthopedic Splints Market Size is predicted to Exceed USD 3.81 Billion by 2033, Growing at a CAGR of 9.62% from 2023 to 2033. The orthopedic splints market growth is accelerated by the increasing prevalence of musculoskeletal diseases, rising cases of orthopedic fractures, innovations in the materials used in orthopedic splints, a growing proportion of the geriatric population, and the increasing occurrence of road traffic collisions.

Market Overview

The orthopedic splint market encompasses the manufacturing and commercialization of orthopedic splints that are utilized to immobilize and support broken bones, sprains, and other musculoskeletal injuries. The orthopedic splint is a rigid support made up of several materials including metal, plastic, or plaster. Orthopedic splints have a wide variety of applications such as immobilization of suspected occult fractures, promoting healing, pain relief, preventing contracture and deformity, controlling inflammation, etc. The marketed products of orthopedic splints are the Thomas splint, Orthopedic Roll Splint, Artificial Orthopaedic Implants Dennis Browne Splint, HDPE Air Splint for legs and hands, etc. Orthopedic Splints are used to prevent deformity by replacing weak or absent muscle strength in cases of peripheral nerve injuries, spinal cord lesions, and neuromuscular diseases. They support, protect, or immobilize joints, allowing healing after injury or inflammation. Splints are used to correct existing deformities, achieve full active joint motion potential, and provide directional control for coordination problems. They serve as a base for the attachment of specialized devices that may enhance hand function.

The rising prevalence of musculoskeletal disease conditions escalates the demand for orthopedic splints resulting in the orthopedic splints market growth. For instance, the data provided by the World Health Organization (WHO) revealed that globally, musculoskeletal disorders are the leading cause of disability. In 2019, 1.71 billion people were estimated to have musculoskeletal conditions including low back pain, neck pain, rheumatoid arthritis, injuries, fractures, and osteoarthritis. There are 441 million afflicted in high-income nations, followed by those in the WHO Western Pacific and South-East Asia regions. Worldwide, musculoskeletal disorders account for about 149 million years lived with disability (YLDs), approximately 17% of the total YLDs.

Globally, degenerative joint diseases such as osteoarthritis cases are rising which accelerates the demand for orthopedic splints to stabilize the affected joints, reduce the pain, and minimize the stress on injured joints resulting in the expansion of the orthopedic splints market. For example, Global Burden of Disease (GBD) an epidemiological study, evaluated that in 2020, 7.6% of the global population was affected by osteoarthritis. The prevalence of osteoarthritis was higher in women than men. It is projected to rise by 60 to 100% by 2050. The growing proportion of the aged population worldwide increases the occurrence of joint-related diseases driving the demand for orthopedic splints resulting in the expansion of the market.

Report Coverage

This research report categorizes the global orthopedic splints market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global orthopedic splints market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global orthopedic splints market.

Global Orthopedic Splints Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.52 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.62% |

| 2033 Value Projection: | USD 3.81 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By End-User |

| Companies covered:: | 3M, United Medicare Breg, Inc., Orthosys, Stryker Corporation, Essity, Ossur, Zimmer Biomet, DeRoyal Industries Inc., Sam Medical, Otto Bock Healthcare, Medi GmbH and Co. KG, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors:

Increasing prevalence of orthopedic injuries and disorders:

The market for orthopedic splints is expanding owing to the increasing occurrence of orthopedic injuries, including sports-related injuries, accidents, and age-related musculoskeletal conditions. These splints provide stability, restrict movement, and protect the affected area during recovery, aiding in the healing process and preventing further damage. The rising incidence of orthopedic injuries drives the demand for these splints as a primary treatment modality, driving the market's growth.

Innovations in the materials and designs utilized in the orthopedic splints:

Improvements in orthopedic splint technology have increased patient efficacy and comfort. In an attempt to improve immobilization, ventilation, and moisture control, manufacturers employ materials that are lightweight, breathable, and adaptable. These innovations enhance anatomical fit, heal quicker, and lessen discomfort. The market is expanding and product demand is driven by a need for improved materials, which improve overall results, speed up healing, and lower complications. The demand for products is driven by the ongoing search for novel substances and design characteristics.

Prominence of the non-invasive treatment:

Orthopedic splints are one of the most important non-surgical treatment options for orthopedic disorders. In wounded body parts, they enable support, immobilization, and stabilization, which reduces pain, stops additional damage, and promotes the body's natural healing processes. The use of orthopedic splints in non-surgical treatment approaches is being fueled by the growing need for non-invasive alternatives as well as their efficacy. As more healthcare professionals recognize the advantages of conservative management led to rising demand for orthopedic splints resulting in market growth.

Restraining Factors

The market growth is constrained by several factors including high manufacturing costs, stringent regulatory guidelines, limited access and availability in low-income regions, stringent regulatory guidelines, the presence of alternative treatment options for the management of musculoskeletal abnormal conditions, and the high cost of orthopedic splints.

Market Segmentation

The global orthopedic splints market share is classified into product, application, and end-user.

- The fiberglass splints segment dominated the market with 28.81% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period.

Based on the product, the global orthopedic splints market is categorized into plastic splints, tools and accessories, fiberglass splints, and others. Among these, the fiberglass splints segment dominated the market with 28.81% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period. This segment growth is facilitated by durability, lighter weight, fostered with reliable mold, porous structure, ease of application, reduced risk of itchy skin, greater stabilization, relief of pain effectively, improved patient compliance, idealistic strength, characteristic rigidity, and better air circulation.

- The lower extremity segment accounted for the largest market share of 53.15% in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the application, the global orthopedic splints market is categorized into upper extremity and lower extremity. Among these, the lower extremity segment accounted for the largest market share of 53.15% in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. This segment growth is ascribed to the availability of a wide variety of applications of orthopedic splints in the abnormalities of the lower extremities such as hips, thighs, knees, ankles, and feet, rising cases of sports injuries and accidents, increasing prevalence of the fractures of the foot bone.

- The hospitals segment accounted for the largest market share of 42.38% in 2023 and is anticipated to grow at a CAGR of 8.12% throughout the projected timeframe.

Based on the end-user, the global orthopedic splints market is categorized into hospitals, specialty centers, and others. Among these, the hospitals segment accounted for the largest market share of 42.38% in 2023 and is anticipated to grow at a CAGR of 8.12% throughout the projected timeframe. The segmental expansion is attributed to the availability of skilled doctors and orthopedic surgeons, the increasing proportion of admission in hospitals due to rising cases of accidents and injuries, the availability of tools and devices required for the management of orthopedic ailments, and the extensive usage of orthopedic splints.

Regional Segment Analysis of the Global Orthopedic Splints Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global orthopedic splints market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global orthopedic splints market over the predicted timeframe. A growing number of patients with orthopedic difficulties, an increasing elderly population, and major industry players are all contributing factors to the huge demand for orthopedic splints in North America. The demand for the product is anticipated to rise as osteoarthritis becomes more common in adults. Advanced orthopedic care and a robust healthcare system in North America will propel market growth. The use and demand for orthopedic splints have grown as a result of technological developments, including novel materials and designs. Patients can now readily and affordably obtain orthopedic splints considering to the established healthcare systems and advantageous reimbursement regulations. It is anticipated that the aging population, growing awareness of preventative healthcare, and developments in splint technology will propel market expansion.

Asia Pacific is anticipated to grow at the fastest CAGR throughout the projected timeframe. This is attributed to the technological advancements in the healthcare infrastructure, increasing awareness of joint-related diseases, rising non-surgical treatment for musculoskeletal diseases, increasing number of geriatric populations, rising focus and interest of researchers in research and development and clinical research on the orthopedic devices and tools for the effective management of the orthopedic disease, and increasing expenditure in the healthcare sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global orthopedic splints market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- United Medicare Breg, Inc.

- Orthosys

- Stryker Corporation

- Essity

- Ossur

- Zimmer Biomet

- DeRoyal Industries Inc.

- Sam Medical

- Otto Bock Healthcare

- Medi GmbH and Co. KG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, Dassiet introduced UCAST, a new product line for hospitals and health centers, aimed at expediting and enhancing fracture treatment. Thermoplastic UCAST casts, made of non-allergenic and non-toxic materials, take only five minutes to apply, making them quick and easy for patients and nursing staff. The lightweight, breathable splints are unobtrusive to the patient.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global orthopedic splints market based on the below-mentioned segments:

Global Orthopedic Splints Market, By Product

- Plastic Splints

- Tools and Accessories

- Fiberglass Splints

- Others

Global Orthopedic Splints Market, By Application

- Upper extremity

- Lower Extremity

Global Orthopedic Splints Market, By End-User

- Hospitals

- Specialty Centers

- Others

Global Orthopedic Splints Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global orthopedic splints market?The global orthopedic splints market is projected to expand at a CAGR of 9.62% during the forecast period.

-

2. Who are the top key players in the global orthopedic splints market?The key players in the global orthopedic splints market are 3M, United Medicare Breg, Inc., Orthosys, Stryker Corporation, Essity, Ossur, Zimmer Biomet, DeRoyal Industries Inc., Sam Medical, Otto Bock Healthcare, Medi GmbH and Co. KG, and others.

-

3. Which region holds the largest share of the market?North America is anticipated to hold the largest share of the global orthopedic splints market over the predicted timeframe.

Need help to buy this report?