Global Osteoporosis Drugs Market Size, Share, and COVID-19 Impact Analysis, By Type (Bisphosphonates, Parathyroid Hormone Therapy, Calcitonin, Selective Estrogen Inhibitors Modulator (SERM), Rank Ligand Inhibitors, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Osteoporosis Drugs Market Insights Forecasts to 2033

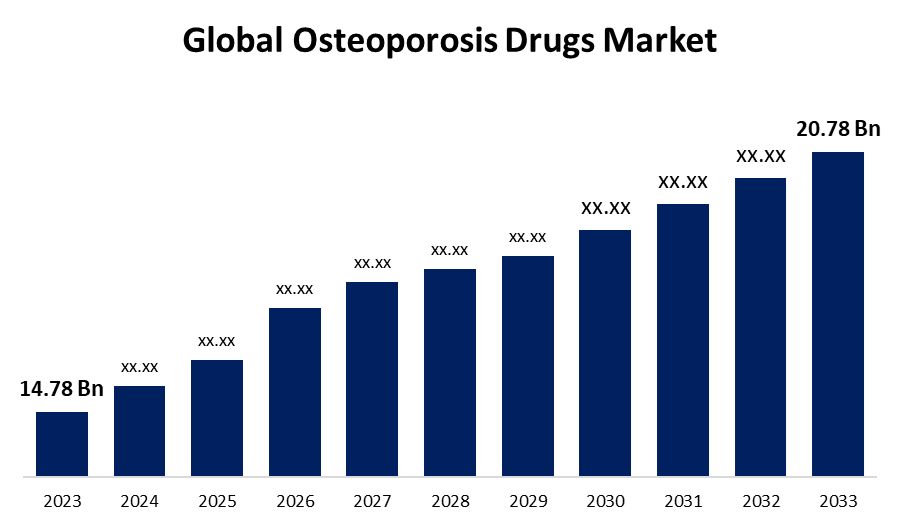

- The Global Osteoporosis Drugs Market Size was Estimated at USD 14.78 Billion in 2023

- The Global Osteoporosis Drugs Market Size is Expected to Grow at a CAGR of around 3.47% from 2023 to 2033

- The Worldwide Osteoporosis Drugs Market Size is Expected to Reach USD 20.78 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Osteoporosis Drugs Market Size is expected to cross USD 20.78 Billion by 2033, growing at a CAGR of 3.47% from 2023 to 2033. A number of factors, including the ongoing advancements in drug discovery, the increasing need for integrated digital health solutions, the expanding focus on fracture prevention, and the growing need for biologic medicines, are driving the growth of the osteoporosis drugs market.

Market Overview

The global sector devoted to the creation, manufacturing, and distribution of drugs intended to treat and prevent osteoporosis, a disorder marked by weakening bones and an elevated risk of fractures is known as the osteoporosis drugs market. Increased bone density, decreased fracture risk, and slowed bone loss are the goals of these medications. Glucocorticoid-induced osteoporosis, postmenopausal osteoporosis, and age-related bone loss are the main conditions for which they are prescribed. The osteoporosis drugs market aims to improve the quality of life for those affected by osteoporosis by offering medications that assist in controlling and preventing the condition. The market is being driven by the rising incidence of osteoporosis, especially among postmenopausal women and the elderly population. Pharmaceutical research advancements, such as novel medication formulations and accurate delivery systems, are driving the osteoporosis drugs market. Growing knowledge of available therapies and increased healthcare spending on medication development and discovery further support osteoporosis drugs market growth. The market is anticipated to rise steadily due to the aging population and ongoing advancements in treatment alternatives.

Report Coverage

This research report categorizes the osteoporosis drugs market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the osteoporosis drugs market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the osteoporosis drugs market.

Global Osteoporosis Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.78 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.47% |

| 2033 Value Projection: | USD 20.78 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 280 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Distribution Channel and By Region |

| Companies covered:: | Merck & Co., Inc., Radius Health, Inc., Pfizer Inc., UCB S.A., Novartis AG, GSK plc, Amgen Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Teva Pharmaceutical Industries Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Continued improvements in medical technology, increased osteoporosis prevalence, an aging population, an increase in fractures, and a greater focus on preventive healthcare are some of the factors driving the osteoporosis drugs market's rapid expansion. The developments improve patient outcomes, increase treatment options, and increase the efficacy of osteoporosis medications, all of which support osteoporosis drugs market expansion. The market is anticipated to be driven by the aforementioned aspects, and bone-forming treatments promote the creation of new bone and can be particularly useful for those with severe osteoporosis or those who are at high risk of fractures.

Restraining Factors

The market for osteoporosis drugs is restricted by several problems, including high treatment costs, poor patient adherence, unfavourable side effects, severe regulations, and patent expirations. These constraints are combined to prevent the market from expanding and to prevent the broad use of medicines.

Market Segmentation

The osteoporosis drugs market share is classified into type and distribution channel.

- The bisphosphonates segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the osteoporosis drugs market is divided into bisphosphonates, parathyroid hormone therapy, calcitonin, selective estrogen inhibitors modulators (SERM), rank ligand inhibitors, and others. Among these, the bisphosphonates segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Drugs called bisphosphonates are frequently used to treat osteoporosis because they effectively lower the risk of fracture and bone loss. Healthcare professionals favour them due to their capacity to prevent bone resorption and increase bone density.

- The retail pharmacies segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the osteoporosis drugs market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the retail pharmacies segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Retail pharmacies are essential for making drugs easily accessible, especially for elderly people with long-term medical issues. Their extensive reach and individualised prescription management and patient care services help them maintain their market leadership.

Regional Segment Analysis of the Osteoporosis Drugs Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA

North America is anticipated to hold the largest share of the osteoporosis drugs market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the osteoporosis drugs market over the predicted timeframe. The growing senior population, advantageous reimbursement rules, and a well-established healthcare infrastructure all contributed to the regional market's expansion. The North American osteoporosis medication market is driven by a number of important pharmaceutical firms, considerable research programs, and a high level of awareness regarding osteoporosis therapy. The National Bone Health Campaign, which was started in 1999, also aims to prevent osteoporosis by instructing students on methods to improve bone health via healthy eating and exercise.

Asia Pacific is expected to grow at the fastest CAGR growth of the osteoporosis drugs market during the forecast period. Growing awareness of osteoporosis and better access to healthcare in developing nations are driving the market expansion for osteoporosis medications in the Asia Pacific region. Additionally, there is a greater need for efficient osteoporosis care strategies due to the region's aging population. Higher diagnosis rates and treatment uptake are the results of investments made in healthcare infrastructure and the expansion of osteoporosis screening programs in nations like China, India, and Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the osteoporosis drugs market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck & Co., Inc.

- Radius Health, Inc.

- Pfizer Inc.

- UCB S.A.

- Novartis AG

- GSK plc

- Amgen Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Teva Pharmaceutical Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, the FDA approved Teva Pharmaceuticals' generic version of Forteo (teriparatide injectable) for use in the United States. Teva's market share in osteoporosis medications increased with its approval, which gave postmenopausal women and men with primary or hypogonadal osteoporosis as well as those with glucocorticoid-induced osteoporosis and are at high risk of fractures, a therapeutic alternative.

- In June 2023, Pfizer announced that DUAVEE (conjugated estrogens/bazedoxifene) would be relaunched in the U.S. market after a voluntary recall in May 2020 due to packaging concerns. There were no safety or effectiveness issues with the product; the recall was only brought on by packaging issues. To guarantee product stability over the course of its shelf life, the firm updated its packaging.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the osteoporosis drugs market based on the below-mentioned segments:

Global Osteoporosis Drugs Market, By Type

- Bisphosphonates

- Parathyroid Hormone Therapy

- Calcitonin

- Selective Estrogen Inhibitors Modulator (SERM)

- Rank Ligand Inhibitors

- Others

Global Osteoporosis Drugs Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Global Osteoporosis Drugs Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the osteoporosis drugs market over the forecast period?The osteoporosis drugs market is projected to expand at a CAGR of 3.47% during the forecast period.

-

2. What is the market size of the osteoporosis drugs market?The Global Osteoporosis Drugs Market Size is Expected to Grow from USD 14.78 billion in 2023 to USD 20.78 Billion by 2033, at a CAGR of 3.47% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the osteoporosis drugs market?North America is anticipated to hold the largest share of the osteoporosis drugs market over the predicted timeframe.

Need help to buy this report?