Global OTC Hearing Aids Market Size, Share, and COVID-19 Impact Analysis, By Product Type (In-the-Ear Hearing Aids, Receiver-in-the-Ear Hearing Aids, Behind-the-Ear Hearing Aids, and Canal Hearing Aids), By Technology (Digital Hearing Aids and Analog Hearing Aids), By Distribution Channel (Retail Stores, Online, and Audiology Offices), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032

Industry: HealthcareGlobal OTC Hearing Aids Market Insights Forecasts to 2032

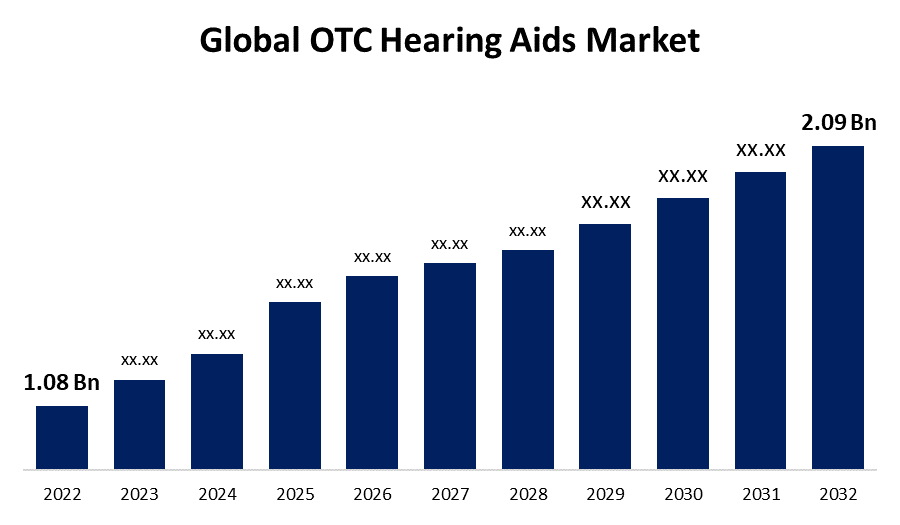

- The Global OTC Hearing Aids Market Size valued at USD 1.08 Billion in 2022.

- The Market is growing at a CAGR of 6.8% from 2023 to 2032

- The Worldwide OTC Hearing Aids Market Size is expected to reach USD 2.09 Billion by 2032

- Asia-Pacific is expected to grow higher during the forecast period

Get more details on this report -

The Global OTC Hearing Aids Market Size is expected to reach USD 2.09 billion by 2032, at a CAGR of 6.8% during the forecast period 2023 to 2032.

Market Overview

Over-The-Counter (OTC) hearing aids are a type of hearing device that can be purchased directly by consumers without a prescription or professional fitting. These devices are designed to help individuals with mild to moderate hearing loss improve their auditory abilities and enhance their quality of life. OTC hearing aids are typically more affordable and accessible compared to traditional hearing aids, as they can be obtained from various retail channels, including pharmacies, online stores, and hearing aid specialty shops. While OTC hearing aids offer convenience and cost savings, it's important to note that they may not be suitable for all individuals with hearing loss. Professional evaluation and fitting by a hearing healthcare professional are essential to ensure optimal performance and proper customization of the device to the individual's specific needs. It is recommended that individuals consult with a licensed audiologist or hearing specialist before purchasing an OTC hearing aid to determine the most appropriate solution for their hearing needs.

Report Coverage

This research report categorizes the market for OTC hearing aids market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the OTC hearing aids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the OTC hearing aids market.

OTC Hearing Aids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.08 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.8% |

| 2032 Value Projection: | USD 2.09 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Technology, By Distribution Channel, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Audien Hearing, Eargo Inc., Innerscope Hearing Technologies Inc., GN Hearing A/S, Lexie Hearing, MD Hearing, Audicus, Sony Corporation, Hangzhou AcoSound Technology Co., Ltd., WS Audiology, NUVOMED, Inc., Nuheara Limited, Etymotic Research, Inc., Xiamen Melosound Technology Co. Ltd., Soundwave Hearing, LLC, Austar Hearing Science & Technology (Xiamen) Co., and Ltd. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The over-the-counter (OTC) hearing aids market is driven by several factors, there is a growing demand for accessible and affordable hearing solutions, as hearing loss is a prevalent condition worldwide. OTC hearing aids cater to individuals with mild to moderate hearing loss who may not require extensive professional intervention. Additionally, advancements in technology have led to the development of high-quality OTC devices that offer improved sound amplification and customization options. The aging population, coupled with increased awareness and acceptance of hearing loss, is also contributing to market growth. Moreover, regulatory changes in some countries, such as the over-the-counter hearing aid act in the United States, have facilitated the availability and sale of OTC hearing aids, further fueling market expansion. Overall, the combination of affordability, convenience, technological advancements, and changing regulations is driving the growth of the OTC hearing aids market.

Restraining Factors

The over-the-counter (OTC) hearing aids market faces certain restraints that impact its growth. One key restraint is the limitation in addressing severe or profound hearing loss, as OTC devices are primarily designed for individuals with mild to moderate hearing loss. This restricts their potential customer base. Additionally, the lack of professional evaluation and fitting can lead to improper usage and suboptimal outcomes. Some individuals may require more personalized solutions or additional features that OTC devices may not offer. Moreover, concerns about the quality and effectiveness of OTC hearing aids compared to professionally fitted devices may deter some consumers from opting for OTC solutions. These restraints highlight the importance of considering individual hearing needs and seeking professional guidance when selecting a hearing aid.

Market Segmentation

- In 2022, the canal hearing aids segment accounted for around 30.7% market share

On the basis of the product type, the global OTC hearing aids market is segmented into in-the-ear hearing aids, receiver-in-the-ear hearing aids, behind-the-ear hearing aids, and canal hearing aids. The canal hearing aids segment has emerged as the dominant player, holding the largest market share in the hearing aids industry. This can be attributed to canal hearing aids offer a discreet and cosmetically appealing solution for individuals with hearing loss. With their compact design, these devices fit comfortably inside the ear canal, making them less noticeable to others. This aesthetic advantage has contributed to their popularity among users who prioritize a subtle hearing aid appearance. Additionally, canal hearing aids offer improved sound quality and reduced feedback compared to other types of hearing aids. Their proximity to the eardrum allows for more natural sound transmission and better amplification, enhancing the overall listening experience. Moreover, advancements in technology have enabled the miniaturization of components, making canal hearing aids more powerful and versatile. They can now be customized to fit various degrees of hearing loss, from mild to severe. As a result, the canal hearing aids segment has witnessed widespread acceptance and demand, driving its market dominance and larger market share.

- In 2022, the digital hearing aids segment dominated with more than 83.2% market share

Based on the technology, the global OTC hearing aids market is segmented into digital hearing aids and analog hearing aids. The digital segment has emerged as the frontrunner, accounting for the largest revenue share in the hearing aids market. This dominance can be attributed to the digital hearing aids offer superior sound quality and advanced signal processing capabilities compared to their analog counterparts. They use digital technology to convert sound into digital signals, allowing for precise customization and adjustment of amplification settings to meet the unique hearing needs of individuals. This advanced signal processing helps in improving speech clarity, reducing background noise, and enhancing overall listening experiences. Additionally, digital hearing aids often come with features like directional microphones, feedback cancellation, and connectivity options, offering users a wide range of functionalities. Furthermore, advancements in digital technology have led to the development of smaller, more discreet hearing aids, increasing their appeal to users who prioritize aesthetics. Moreover, digital hearing aids can be programmed and adjusted by hearing healthcare professionals to provide personalized and fine-tuned solutions. These factors, combined with increasing awareness about the benefits of digital hearing aids, have propelled the digital segment to capture the largest revenue share in the market.

Regional Segment Analysis of the OTC Hearing Aids Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 34.6% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the dominant market for Over-The-Counter (OTC) hearing aids. North America has a large aging population, and age-related hearing loss is prevalent, creating a substantial customer base for hearing aids. Moreover, the region has a well-developed healthcare infrastructure and a high level of awareness about hearing health, which drives the demand for hearing aids. Additionally, favorable government regulations, such as the over-the-counter hearing aid act in the United States, have facilitated the availability and sale of OTC hearing aids, boosting market growth. Furthermore, North America is home to several major players in the hearing aid industry, which enhances the accessibility and diversity of OTC hearing aid options for consumers. These factors combined have positioned North America as the leading market for OTC hearing aids.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global OTC hearing aids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Audien Hearing

- Eargo Inc.

- Innerscope Hearing Technologies Inc.

- GN Hearing A/S

- Lexie Hearing

- MD Hearing

- Audicus

- Sony Corporation

- Hangzhou AcoSound Technology Co., Ltd.

- WS Audiology

- NUVOMED, Inc.

- Nuheara Limited

- Etymotic Research, Inc.

- Xiamen Melosound Technology Co. Ltd.

- Soundwave Hearing, LLC

- Austar Hearing Science & Technology (Xiamen) Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Jabra has introduced the Jabra Enhance Plus, a versatile in-ear device that enhances hearing and enables users to conveniently handle calls and enjoy music. The product will be accessible both online and through physical retail locations, ensuring wide availability for consumers. With its combination of improved hearing capabilities and multifunctionality, Jabra Enhance Plus aims to provide users with an enhanced auditory experience in various everyday scenarios.

- In October 2022, Lexie (hearX IP (Pty) Ltd.) has launched the Lexie B2, an over-the-counter (OTC) hearing aid, in the United States. The Lexie B2 is a receiver-in-canal (RIC) device developed to help those with mild to moderate hearing loss with accessible and inexpensive hearing solutions. This release broadens the number of OTC alternatives accessible to customers in the United States looking for self-fitting hearing aids.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global OTC hearing aids market based on the below-mentioned segments:

OTC Hearing Aids Market, By Product Type

- In-the-Ear Hearing Aids

- Receiver-in-the-Ear Hearing Aids

- Behind-the-Ear Hearing Aids

- Canal Hearing Aids

OTC Hearing Aids Market, By Technology

- Digital Hearing Aids

- Analog Hearing Aids

OTC Hearing Aids Market, By Distribution Channel

- Retail Stores

- Online

- Audiology Offices

OTC Hearing Aids Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?