Global Over The Counter (OTC) Drug Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Analgesics, Cold & Cough Remedies, Digestives & Intestinal Remedies, Skin Treatment, Vitamins & Minerals, Others), By Distribution Channel (Drug Stores & Retail Pharmacies, Hospital Pharmacies, Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Over The Counter (OTC) Drug Market Insights Forecasts to 2033

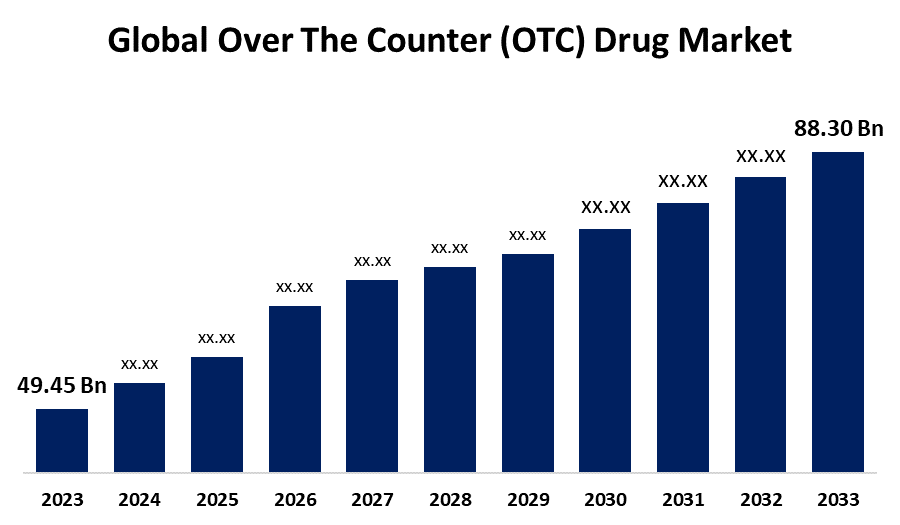

- The Global Over The Counter (OTC) Drug Market Size was Estimated at USD 49.45 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.97% from 2023 to 2033

- The Worldwide Over The Counter (OTC) Drug Market Size is Expected to Reach USD 88.30 Billion by 2033

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Over the counter (OTC) drug market size was worth around USD 49.45 Billion in 2023 and is predicted to grow to around USD 88.30 Billion by 2033 with a compound annual growth rate (CAGR) of 5.97% between 2023 and 2033. The Over-the-counter (OTC) medicines market is being fueled by escalating self-medication habits, growing healthcare awareness, aging populations, and increased availability through retail and internet channels. Government support for switching prescription drugs to OTC and expanding demand for cost-effective, convenient healthcare options further spur market growth.

Market Overview

The over-the-counter (OTC) drug market is the part of the pharmaceutical market that comprises drugs available for sale without a prescription. They are accessible in hospital pharmacies, medical shops, and even grocery stores, and are sold legally without any prescription. OTC drugs are employed to cure some of the common symptoms, which are the common cold, body pain, allergies and flu, heartburn, acne, and other basic ailments. Additionally, the increasing incidence of respiratory illnesses like cold, flu, and cough, most likely during seasonal changes necessitates the demand for immediate treatment for early symptom relief. This drives the consumer's demand for OTC medications like decongestants, cough syrups, and analgesics. Advances like fast-dissolving dosage forms and synergistic combination therapies address consumer demands for convenience and improved therapeutic outcomes. Additionally, growth in digital pharmacies and online retailing has significantly enhanced access to OTC products. The web-based platforms provide competitive prices, doorstep delivery, and a general boost in customer convenience, fueling further market growth.

Report Coverage

This research report categorizes the over the counter (OTC) drug market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the over the counter (OTC) drug market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the over the counter (OTC) drug market.

Global Over The Counter (OTC) Drug Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 49.45 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.97% |

| 2033 Value Projection: | USD 88.30 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Distribution Channel, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Abbott, Alkem Laboratories, Aytu Biopharma (Aytu Consumer Health), Bayer AG, Cipla, Dr. Reddy’s Laboratories, GlaxoSmithKline, Glenmark Pharmaceuticals, Haleon, Johnson & Johnson Services, Perrigo Company, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Over-the-counter medicines give consumers the ability to deal with minor medical conditions such as pain, colds, and allergies without going to a physician. The overall trend towards self-care and time-efficient solutions is driving OTC drug consumption globally, particularly for rapid relief and affordable treatment, making self-medication a leading market growth factor. Additionally, growing public knowledge of health, wellness, and early symptom care prompts individuals to take OTC medications. As patients become better educated on controlling non-serious diseases, they increasingly turn to OTC products for preventive management and symptom relief, boosting the demand for affordable, available drug solutions.

Restraining Factors

OTC medications are convenient to access, which exposes people to the risk of self-medication mistakes, overdosing, or abuse. People can abuse painkillers, cold treatments, or sleeping aids without knowing the appropriate doses, causing medical issues and boosting regulatory scrutiny that may restrict market freedom.

Market Segmentation

The over the counter (OTC) drug market share is classified into product type and distribution channel.

- The analgesics segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the over the counter (OTC) drug market is divided into analgesics, cold & cough remedies, digestives & intestinal remedies, skin treatment, vitamins & minerals, and others. Among these, the analgesics segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to analgesics commonly used to relieve common, recurring ailments such as headaches, muscle pains, joint pains, toothaches, menstrual pains, and minor trauma. These day-to-day aches afflict a wide population base, leading to frequent and sustained demand for pain relief products.

- The drug stores & retail pharmacies segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the distribution channel, the over the counter (OTC) drug market is divided into drug stores & retail pharmacies, hospital pharmacies, and online pharmacies. Among these, the drug stores & retail pharmacies segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is attributed to drug stores and retail pharmacies are prevalent in urban as well as rural centers, providing customers with an easy and quick way to buy OTC drugs without a prescription or waiting in line for extended periods. In-store pharmacists are often used by consumers for instant health counsel or product advice for common complaints. The familiar interaction encourages consumer confidence and increases in-store OTC drug sales.

Regional Segment Analysis of the Over The Counter (OTC) Drug Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the over the counter (OTC) drug market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the over the counter (OTC) drug market over the predicted timeframe. North America, especially the United States, is the greatest market for OTC drugs because of increased healthcare consciousness, a substantial elderly population, and the inclination toward self-medication. The demand is fueled by the presence of a vast number of OTC products, such as painkillers, cold remedies, and food supplements. The FDA (Food and Drug Administration) has a significant role in maintaining the safety and efficiency of OTC drugs, thus enhancing consumer confidence and fueling market growth.

Asia Pacific is expected to grow at a rapid CAGR in the over the counter (OTC) drug market during the forecast period. Asia Pacific is experiencing a rise in healthcare consciousness, particularly in emerging markets such as China, India, and Southeast Asia. The increasing tendency of self-medication is driving the demand for OTC medicines. Governments across the region are encouraging the use of OTC drugs to ease healthcare systems' workloads, which increases the availability and acceptability of OTC drugs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the over the counter (OTC) drug market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- Alkem Laboratories

- Aytu Biopharma (Aytu Consumer Health)

- Bayer AG

- Cipla

- Dr. Reddy's Laboratories

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Haleon

- Johnson & Johnson Services

- Perrigo Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Walgreens brought the market its own naloxone nasal spray brand, an opioid overdose-reversal medication, without a prescription. Sold at $34.99, it is meant to expand access to life-saving medication during the opioid epidemic.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the over the counter (OTC) drug market based on the below-mentioned segments:

Global Over The Counter (OTC) Drug Market, By Product Type

- Analgesics

- Cold & Cough Remedies

- Digestives & Intestinal Remedies

- Skin Treatment

- Vitamins & Minerals

- Others

Global Over The Counter (OTC) Drug Market, By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Global Over The Counter (OTC) Drug Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the over the counter (OTC) drug market over the forecast period?The global over the counter (OTC) drug market is projected to expand at a CAGR of 5.97% during the forecast period.

-

2. What is the market size of the over the counter (OTC) drug market?The global over the counter (OTC) drug market size is expected to grow from USD 49.45 Billion in 2023 to USD 88.30 Billion by 2033, at a CAGR of 5.97% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the over the counter (OTC) drug market?North America is anticipated to hold the largest share of the over the counter (OTC) drug market over the predicted timeframe.

Need help to buy this report?