Global Ovulation Inducing Drug Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Clomiphene and Gonadotropins), By Route of Administration (Oral, Injectable, and Subcutaneous Methods), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Ovulation Inducing Drug Market Insights Forecasts to 2033

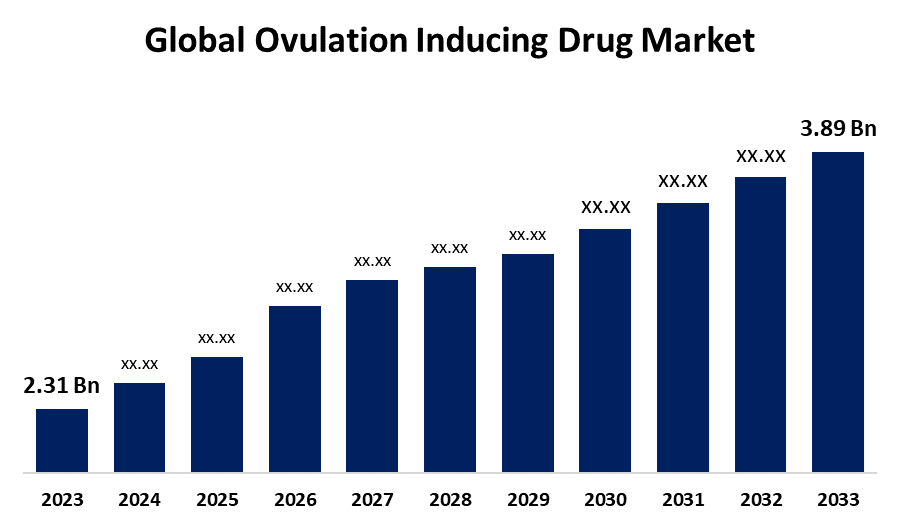

- The Global Ovulation Inducing Drug Market Size was Valued at USD 2.31 Billion in 2023

- The Market Size is Growing at a CAGR of 5.35% from 2023 to 2033

- The Worldwide Ovulation Inducing Drug Market Size is Expected to Reach USD 3.89 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Ovulation Inducing Drug Market Size is anticipated to exceed USD 3.89 Billion by 2033, growing at a CAGR of 5.35% from 2023 to 2033.

Market Overview

The method known as "ovulation induction" makes use of drugs to promote the ovary's release of an egg. Women with irregular or nonexistent ovulation (such as those with polycystic ovarian syndrome (PCOS), functional hypothalamic amenorrhea (FHA), or other reasons) are the target audience for this therapy option. Ovulation induction is the process of stimulating a woman's egg production and release in order to conceive by using hormonal drugs like Clomid and Femara. Ovulation medications are now a standard component of reproductive therapies. Medication can be used alone or in conjunction with other assisted reproductive technologies like intrauterine insemination (IUI) and in vitro fertilization (IVF). Additionally, the market for ovulation-inducing medications is anticipated to increase significantly over the course of the forecast period. Around the world, in vitro fertilization (IVF) or assisted reproductive therapies have become more popular due to comorbidities, delayed pregnancy, negative medication side effects, and changing lifestyles. Because fertilization and other IVF treatments have low unpredictability and high failure rates, doctors insist on harvesting a maximum number of eggs.

Report Coverage

This research report categorizes the global ovulation inducing drug market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global ovulation inducing drug market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global ovulation inducing drug market.

Global Ovulation Inducing Drug Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | 2.31 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | CAGR of 5.35% |

| 2033 Value Projection: | 3.89 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Drug Class, By Route of Administration, and By Region |

| Companies covered:: | Merck and Co, Mylan, Bristol-Myers Squibb, Amgen, Eli Lilly, Hikma Pharmaceuticals, Teva Pharmaceutical Industrie, AbbVie, Watson Pharmaceuticals, Cardinal Health, Aurobindo Pharma, Others, |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for ovulation-inducing drugs is anticipated to expand as a result of the rising incidence of infertility in women. The biological condition known as women's infertility occurs when a woman cannot conceive or bring a pregnancy to term even after having frequent, unprotected sex for a long time, usually a year or longer. According to World Health Organization (WHO) figures, PCOS affects about 116 million women worldwide (3.4%). Due to the growing need for treatments to address infertility and other associated health conditions, the market for ovulation-inducing drugs is significantly influenced by the rising prevalence of PCOS. Additionally, IVF is now one of the most used assisted reproductive technologies in the world. IVF and other assisted reproductive methods are thought to have produced approximately 12 million kids globally as of 2023. As more people look for these medications to improve their fertility and chances of conception, the market for ovulation-inducing pharmaceuticals is significantly influenced by the growing accessibility and success of IVF treatments.

Restraints & Challenges

The main reasons holding back the worldwide ovulation-inducing medication market are the high expense of the IVF treatment and the low success rates.

Market Segmentation

The global ovulation inducing drug market share is classified into drug class and route of administration.

- The clomiphene segment is expected to hold the largest share of the global ovulation inducing drug market during the forecast period.

Based on the drug class, the global ovulation inducing drug market is categorized as clomiphene and gonadotropins. Among these, the clomiphene segment is expected to hold the largest share of the global ovulation inducing drug market during the forecast period. A common drug that is affordable, effective when taken orally, has fewer side effects, and is generally safe for the fetus is clomiphene citrate. Ovulatory infertility caused by PCOS may be treated with it.

- The injectable segment is expected to grow at the fastest CAGR during the forecast period.

Based on the route of administration, the global ovulation inducing drug market is categorized as oral, injectable, and subcutaneous methods. Among these, the injectable segment is expected to grow at the fastest CAGR during the forecast period. Injectable administration is frequently chosen due to its quick beginning of action and efficacy in particular therapeutic areas.

Regional Segment Analysis of the Global Ovulation inducing drug Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

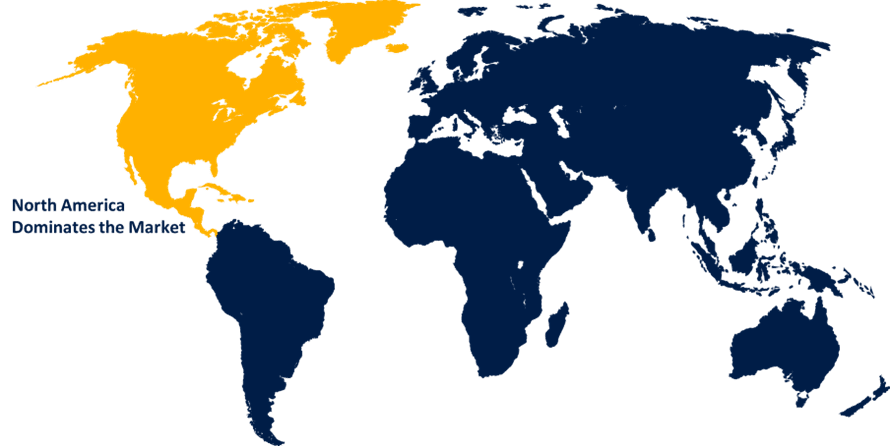

North America is projected to hold the largest share of the global ovulation inducing drug market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global ovulation inducing drug market over the forecast period. The main cause of this domination is the rising prevalence of endometriosis, thyroid issues, urinary tract infections, menopausal disorders, and other illnesses among women as a result of hectic lives and elevated stress levels. Additionally, during the course of the projection period, the market is anticipated to rise due to an increasing number of new FDA medicinal approvals. Due to the rise in infertility cases, increased awareness of ovulation-inducing medications, and improved healthcare facilities, North America has been experiencing good growth for the global market for ovulation-inducing pharmaceuticals over the projection period.

Europe is expected to grow at the fastest CAGR growth of the global ovulation inducing drug market during the forecast period. The growing incidence of infertility among women of childbearing age, comprehensive healthcare systems, and reproductive health regulations. Public health initiatives, fertility clinics, and assisted reproductive technology facilities that provide ovulation induction cycles and ART operations are examples of countries that prioritize fertility treatments, including Germany, the United Kingdom, and France. Harmonization of regulations, reimbursement schemes for fertility drugs, and patient access programs that enable fair access to reproductive health services and fertility care among member states all help to support the growth of the European market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ovulation inducing drug market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck and Co

- Mylan

- Bristol-Myers Squibb

- Amgen

- Eli Lilly

- Hikma Pharmaceuticals

- Teva Pharmaceutical Industrie

- AbbVie

- Watson Pharmaceuticals

- Cardinal Health

- Aurobindo Pharma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In January 2021, Merck & Co. Inc. and Koninklijke Philips N.V., a health technology firm located in the Netherlands, joined forces. The collaboration between Merck and Philips represents a major advancement in reproductive treatment. For couples with infertility, it can increase their chances of success and facilitate the realization of their goal of becoming parents.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global ovulation inducing drug market based on the below-mentioned segments:

Global Ovulation Inducing Drug Market, By Drug Class

- Clomiphene

- Gonadotropins

Global Ovulation Inducing Drug Market, By Route of Administration

- Oral

- Injectable

- Subcutaneous Methods

Global Ovulation Inducing Drug Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?