Global Oxygen-Free Copper Market Size, Share, and COVID-19 Impact Analysis, By Grade (Cu-OF and Cu-OFE), By Product (Wires, Strips, Busbars & Rods, and Others), By Application (Electrical & Electronics, Automotive, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Oxygen-Free Copper Market Insights Forecasts to 2033

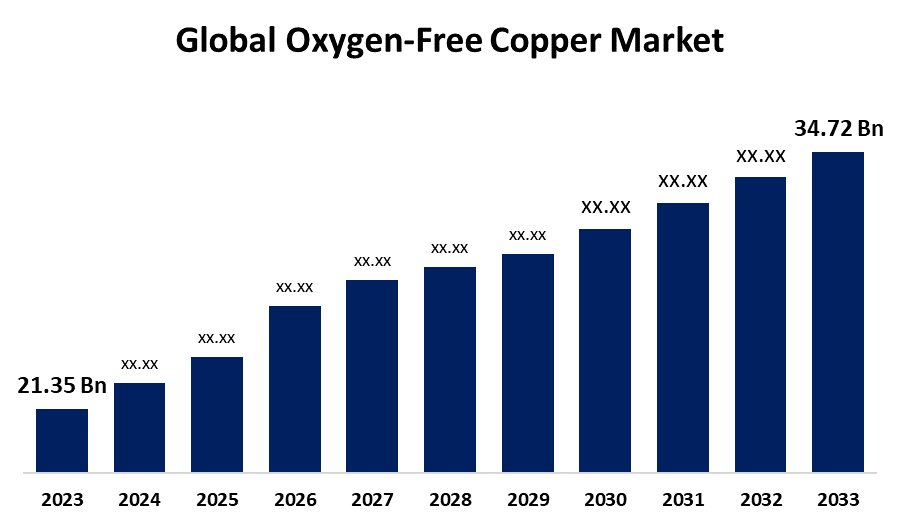

- The Global Oxygen-Free Copper Market Size was Estimated at USD 21.35 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.98% from 2023 to 2033

- The Worldwide Oxygen-Free Copper Market Size is Expected to Reach USD 34.72 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Oxygen-Free Copper Market Size is projected to reach USD 34.72 Billion by 2033, growing at a CAGR of 4.98% from 2023 to 2033. The growth of automotive industry, demand for consumer electronics, and technological progressions are the factors driving the market growth for oxygen-free copper.

Market Overview

The oxygen-free copper market is the industry involving the type of copper with very low oxygen content used in industries such as electronics, automotive, and renewable energy. Oxygen-free copper is a premium grade of copper that has a high level of conductivity and is virtually free from oxygen content. It is a group of wrought high-conductivity copper alloys that have been electrolytically refined to reduce the level of oxygen to 0.001% or below. It is highly recommended for applications requiring higher conductivity and congruences, such as superconducting wires, PCBs, x-ray tubes, vacuum interpreters, rotor bars, and motor coils. The increasing global proliferation of electronic devices like smartphones, tablets, TV sets, and smart devices is predicted to raise demand for oxygen-free copper in the upcoming years. The use of oxygen-free copper has expanded in several applications as a result of the rising demand for renewable energy. The extensive application of oxygen free copper in various sectors such as defense, aerospace, and medical sectors along with the upsurging R&D efforts, modernization, and technical development in manufacturing processes is offering lucrative market growth opportunity.

Report Coverage

This research report categorizes the oxygen-free copper market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oxygen-free copper market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oxygen-free copper market.

Global Oxygen-Free Copper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 21.35 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.98% |

| 023 – 2033 Value Projection: | USD 34.72 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Grades, By Product, By Application, By Regional |

| Companies covered:: | Hitachi Metals Neomaterial, Ltd., Mitsubishi Materials Corporation, Sam Dong, Copper Braid Products, Hussey Copper Ltd., Aviva Metals, Farmer’s Copper Ltd., Heyco Metals Inc., Cupori, Haviland Enterprises Inc., Metrod Holdings Berhad, Southwire Company, LLC, Wieland, Zheijang Libo Holding Group Co., Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The increasing focus on the use of high-quality materials for defense, aerospace, transportation, and electronics industries is propelling the oxygen-free copper market. Because of its many uses, such as printed circuit boards, microwaves, vacuum seals, vacuum interrupters, vacuum tubes, vacuum capacitors, and waveguides for TV transmitters, radios, and magnetrons, oxygen-free copper is becoming more and more popular, thereby propelling the market expansion.

Restraining Factors

The specialized refining processes required for the production of oxygen free copper lead to its increased cost, thereby challenging the oxygen-free copper market.

Market Segmentation

The global oxygen-free copper market share is classified into grade, product, and application.

- The Cu-OFE segment dominated the market with the largest revenue share of about 57.0% in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the oxygen-free copper market is classified into Cu-OF and Cu-OFE. Among these, the Cu-OFE segment dominated the market with the largest revenue share of about 57.0% in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Cu-OFE grade of oxygen-free copper contains 99.99% of copper and 0.0005% of oxygen content. The Cu-OFE’s excellent formability and its capability to be welded and brazed are responsible for driving the market in the Cu-OFE segment.

- The wires segment accounted for the largest revenue share of over 30.0% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the oxygen-free copper market is classified into wires, strips, busbars & rods, and others. Among these, the wires segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing need for oxygen free copper cables in a number of end-use industries such as electrical and electronics engineering and the automobile industry, because of their potent conductive properties.

- The electrical & electronics segment held the largest revenue share of over 34.70% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the oxygen-free copper market is classified into electrical & electronics, automotive, and others. Among these, the electrical & electronics segment held the largest revenue share of over 34.70% in 2023 and is expected to grow at a significant CAGR during the forecast period. The increased electrical conductivity and low impurity levels of oxygen free copper are driving the market demand in the electrical and electronics sector.

Regional Segment Analysis of the Oxygen-Free Copper Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the oxygen-free copper market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the oxygen-free copper market over the predicted timeframe. The region’s growing consumption of electronic products and electric vehicles along with the industrialization and rising e-commerce sector is driving the market. The existing automotive sector, increasing production of electric vehicles, technological competence, and well-established corporations are the factors responsible for driving the market growth.

North America is expected to grow at the fastest CAGR growth of the oxygen-free copper market during the forecast period. Since oxygen free copper is heavily utilized in electric vehicles, the region’s growing demand for these vehicles is anticipated to escalate the market expansion. The increase in automotive industries as well as its consumption in manufacturing of superconductors, semiconductors, and high-vacuum systems is propelling the oxygen-free copper market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the oxygen-free copper market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi Metals Neomaterial, Ltd.

- Mitsubishi Materials Corporation

- Sam Dong

- Copper Braid Products

- Hussey Copper Ltd.

- Aviva Metals

- Farmer’s Copper Ltd.

- Heyco Metals Inc.

- Cupori

- Haviland Enterprises Inc.

- Metrod Holdings Berhad

- Southwire Company, LLC

- Wieland

- Zheijang Libo Holding Group Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, C4V, a Li-Ion battery technology company based in the U.S.A., entered into a Memorandum of Understanding (MOU) with Hindalco Industries for the collaboration in the development and supply of Battery Grade Aluminium foil, Coated Foils, and structural components for Li-ion cells, catering to the growing market for electric vehicle (EV) battery materials.

- In November 2023, Toyota and Redwood Materials expanded a previous agreement for the automaker to source recycled materials for its battery supply chain. Under the expanded partnership, Toyota plans to procure recycled cathode active material (CAM) and anode copper foil from Redwood, according to a Nov. 16 press release.

- In October 2023, South Korea’s SK Nexilis Co., the world’s largest copper foil maker, started commercial production at its first overseas factory in Kota Kinabalu, Malaysia. The new facility boasts the world's largest production lines of copper foil, a core material of rechargeable batteries, with the most diversified types of products.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the oxygen-free copper market based on the below-mentioned segments:

Global Oxygen-Free Copper Market, By Grade

- Cu-OF

- Cu-OFE

Global Oxygen-Free Copper Market, By Product

- Wires

- Strips

- Busbars & Rods

- Others

Global Oxygen-Free Copper Market, By Application

- Electrical & Electronics

- Automotive

- Others

Global Oxygen-Free Copper Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the oxygen-free copper market over the forecast period?The oxygen-free copper market is projected to expand at a CAGR of 4.98% during the forecast period.

-

2. What is the market size of the oxygen-free copper market?The oxygen-free copper Market Size is Expected to Grow from USD 21.35 Billion in 2023 to USD 34.72 Billion by 2033, at a CAGR of 4.98% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the oxygen-free copper market?Asia Pacific is anticipated to hold the largest share of the oxygen-free copper market over the predicted timeframe.

Need help to buy this report?