Global Packaging Adhesives Market Size, Share, and COVID-19 Impact Analysis, By Technology (Water-Based, Solvent-Based, Hot Melt, and Others), By Resins (PVA, Acrylics, Polyurethane, and Others), By Application (Case & Carton, Corrugated Packaging, Labeling, Flexible Packaging, Folding Cartons, Specialty Packaging, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Packaging Adhesives Market Insights Forecasts to 2033

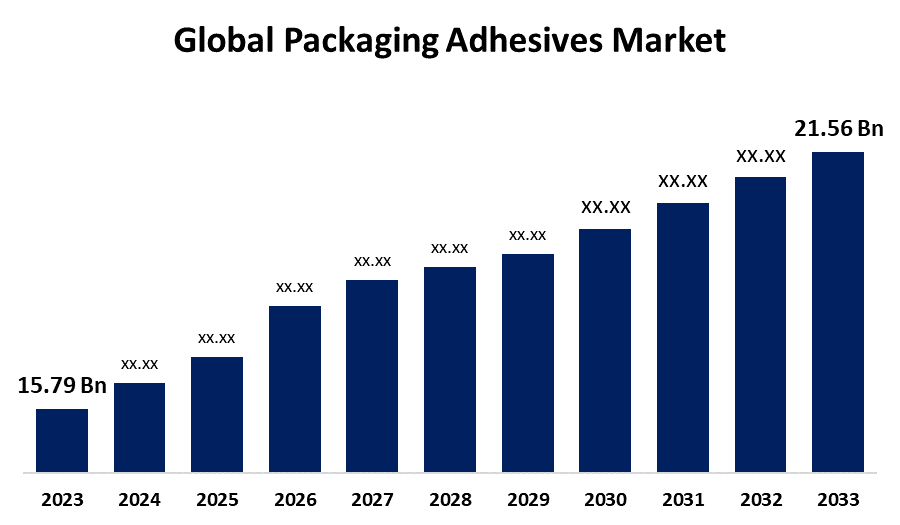

- The Global Packaging Adhesives Market Size was Valued at USD 15.79 Billion in 2023

- The Market Size is Growing at a CAGR of 3.16% from 2023 to 2033

- The Worldwide Packaging Adhesives Market Size is Expected to Reach USD 21.56 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Packaging Adhesives Market Size is Anticipated to Exceed USD 21.56 Billion by 2033, Growing at a CAGR of 3.16% from 2023 to 2033.

Market Overview

Adhesives used to adhere two or more pieces of packing material together are referred to as packaging adhesives. Generally, polymeric compounds which are obtained both naturally and artificially are used in their production. They are usually classified based on their adhesion mechanism, which is further divided into reactive and non-reactive categories based on whether or not a chemical reaction allows them to expand. On the other hand, the third type of packing adhesives requires melting before use. They are known as hot melt adhesives and are often based on thermoplastic. Because of the vital function adhesives play in the packaging sector, about 70% of all adhesives manufactured worldwide are consumed by this industry. In the paper and packaging industries, adhesives are crucial parts of rigid and flexible packaging. The packaging sector is expanding due to the growing need for appealing design, consumer preference for cutting-edge print and packaging, and sustainability. As a result, companies that produce packaging adhesive are more focused on creating a long-lasting, sustainable product. Furthermore, a variety of product shapes and sizes can be accommodated by flexible packaging structures made with modern adhesive technologies, such as pouches, sachets, and wraps. Due to a constant shift in consumer preferences toward simplicity and comfort of use, which is fueling market expansion, these flexible packaging decisions are in high demand.

Report Coverage

This research report categorizes the market for the packaging adhesives market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the packaging adhesives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the packaging adhesives market.

Global Packaging Adhesives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.79 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.16% |

| 2033 Value Projection: | USD 21.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 204 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Resins, By Application, By Region |

| Companies covered:: | Henkel AG & Company, 3M, Ashland Global Holdings Inc., Avery Dennison Corporation, Dymax Corporation, Sika AG, Wacker Chemie AG, Jowat SE, The Dow Chemical Company, HB Fuller, Bostik SA, DowDuPont Inc., Huntsman Corporation., Paramelt B.V., Hitachi Chemical Company Ltd., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The packaged food and beverage products mostly consist of cake mixes, frozen dinners, snacks, and easy ready to eat food products. It is anticipated that the manufacturers will raise their production capacity in response to the increased demand for these objects. The packaging sector is expanding significantly as an outcome of urbanization, population increase, and shifting consumer preferences. Packaging adhesives are needed to assemble and seal the packaging materials, and their demand grows as more products are packaged.

Restraining Factors

The government's regulations frequently establish restrictions on the use of particular chemicals in packaging adhesives, particularly those that are considered hazardous or involve potential risks to human health or the environment.

Market Segmentation

The packaging adhesives market share is classified intotechnology, resins, and application.

- The water-based segment dominates the market with the highest market share through the forecast period.

Based on the technology, the packaging adhesives market is categorized into water-based, solvent-based, hot melt, and others. Among these, the water-based segment dominates the market with the highest market share through the forecast period. Packaging adhesives that use water as a solvent or carrier to distribute adhesive ingredients are known as water-based adhesives. Due to their benefits for sustainability, water-based adhesives are becoming increasingly common in the packaging industry.

- The acrylics segment predicted to account the largest revenue share through the forecast period.

Based on the resins, the packaging adhesives market is categorized into PVA, acrylics, polyurethane, and others. Among these, the acrylics segment predicted to account the largest revenue share through the forecast period. High shock and impact resistance, superior shear and peel strength, and high tensile strength are characteristics of acrylic adhesives. Because these adhesives cure at room temperature, they use a lesser amount of heat, UV, or electrical energy during production, increasing production efficiency.

- The flexible packaging segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the packaging adhesives market is categorized into case & carton, corrugated packaging, labeling, flexible packaging, folding cartons, specialty packaging, and others. Among these, the flexible packaging segment is anticipated to grow at the fastest CAGR during the forecast period. Flexible packaging adhesives work effectively in a variety of applications, such as fill, blister, lamination, heat and cold seal, lidding, and horizontal flow packing. The growing need for adhesives ensuring reliable and secure bonding on a range of flexible substrates is an increasing trend in the packaging adhesives market for flexible packaging.

Regional Segment Analysis of the Packaging Adhesives Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the packaging adhesives market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the packaging adhesives market over the forecast period. The demand for water-based adhesives is prominent in the region, owing to increasing technological developments, the use of bio-based raw materials, and the introduction of innovative techniques. In addition, factors like low cost and easy application of water-based adhesives in various ways such as roller-coating, screen-printing, and spraying are anticipated to further increase product usage in coming years. Sustainable adhesives are becoming increasingly important as environmental concerns develop and manufacturers seek environmentally friendly solutions. The rise in online purchasing has also led to an explosion in demand for adhesives that are suitable for e-commerce.

Asia Pacific is expected to grow at the fastest CAGR growth in the packaging adhesives market during the forecast period. The demand for effective packaging solutions has been driven by rising industrialization and urbanization. The growth of e-commerce and changing consumer preferences are contributing to developments in the packaging adhesives industry in the Asia-Pacific region. The growth of e-commerce has increased demand for adhesives that are both secure and flexible, as packaging is required to be able to withstand handling and shipping challenges. Furthermore, sustainability is a major priority, and demand for environmentally friendly and green adhesives is rising.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the packaging adhesives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Henkel AG & Company

- 3M

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- Dymax Corporation

- Sika AG

- Wacker Chemie AG

- Jowat SE

- The Dow Chemical Company

- HB Fuller

- Bostik SA

- DowDuPont Inc.

- Huntsman Corporation.

- Paramelt B.V.

- Hitachi Chemical Company Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Arkema’s acquisition of Dow’s flexible packaging laminating adhesives business is a calculated step taken by Arkema to extend its scope of operations and seize its place in the flexible packaging industry1. At USD 250 million in annual sales, the acquired company is among the leading manufacturers of adhesives for flexible packaging.

- In Jun 2023, Henkel improved its technological portfolio and strengthened its Sonderhoff Group and the international Darex Packaging Technologies Company to expand its Adhesive Technologies branch.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the packaging adhesives market based on the below-mentioned segments:

Global Packaging Adhesives Market, By Technology

- Water-Based

- Solvent-Based

- Hot Melt

- Others

Global Packaging Adhesives Market, By Resins

- PVA

- Acrylics

- Polyurethane

- Others

Global Packaging Adhesives Market, By Application

- Case & Carton

- Corrugated Packaging

- Labeling

- Flexible Packaging

- Folding Cartons

- Specialty Packaging

- Others

Global Packaging Adhesives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global packaging adhesives market over the forecast period?The global packaging adhesives market is to expand at 3.16% during the forecast period.

-

2. Which region is Expected to hold the highest share in the global packaging adhesives market?The North America region is expected to hold the largest share of the global packaging adhesives market.

-

3. Who are the top key players in the packaging adhesives market?The key players in the global packaging adhesives market are Henkel AG & Company, 3M, Ashland Global Holdings Inc., Avery Dennison Corporation, Dymax Corporation, Sika AG, Wacker Chemie AG, Jowat SE, The Dow Chemical Company, HB Fuller, Bostik SA, DowDuPont Inc., Huntsman Corporation., Paramelt B.V., Hitachi Chemical Company Ltd.

Need help to buy this report?