Global Packaging Materials Market Size, Share, and COVID-19 Impact Analysis, By Material (Paper, Cardboard, Rigid Plastic, Flexible Plastic, Wood, Textile, Glass, and Metal), By Product (Bag, Pouch, Box, Bottles, Cans & Jars, Containers, Wraps, Drums, and IBCs), By End-User (Food & Beverage, Healthcare, Household Products, Chemicals, and Cosmetics), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032).

Industry: Chemicals & MaterialsGlobal Packaging Materials Market Insights Forecasts to 2032

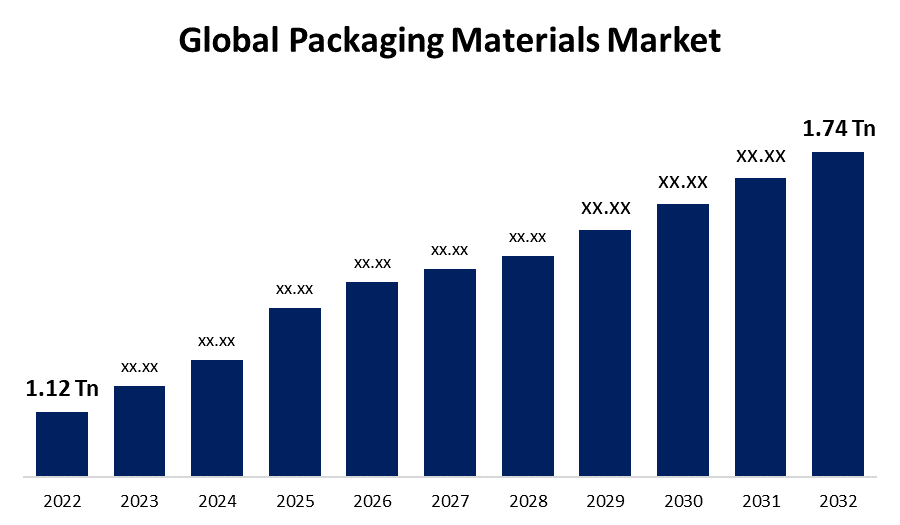

- The Packaging materials market was valued at USD 1.12 Trillion in 2022.

- The Market is growing at a CAGR of 4.5% from 2022 to 2032.

- The Global packaging materials market is expected to reach USD 1.74 Trillion by 2032.

- Europe is expected to grow significant during the forecast period.

Get more details on this report -

The Global packaging materials market is expected to reach USD 1.74 Trillion by 2032, at a CAGR of 4.5% during the forecast period 2022 to 2032.

Market Overview

Packaging materials play a crucial role in protecting and preserving products throughout the supply chain, as well as enhancing their presentation and marketability. A diverse range of packaging materials are available, each offering unique characteristics and advantages. Traditional materials such as cardboard, paper, and glass remain widely used due to their versatility, recyclability, and consumer familiarity. Additionally, plastics continue to be a popular choice for packaging, offering durability, flexibility, and barrier properties. However, with growing concerns about environmental sustainability, there has been a significant shift towards eco-friendly alternatives. Biodegradable and compostable materials, such as bio-based plastics and plant-based fibers, have gained traction due to their reduced environmental impact. Furthermore, innovative materials like edible packaging and mushroom-based materials are emerging as promising solutions for reducing waste and promoting a circular economy. The packaging industry is continually evolving to meet changing consumer demands and environmental considerations, striving to strike a balance between functionality, aesthetics, and sustainability.

Report Coverage

This research report categorizes the market for packaging materials market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the packaging materials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the packaging materials market.

Global Packaging Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.12 Trillion |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 4.5% |

| 022 – 2032 Value Projection: | USD 1.74 Trillion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Material, By Product, By End-User, By Region. |

| Companies covered:: | Amcor, Ball Corporation, Crown Holdings, International Paper, Reynolds Group, Mondi, Owens-Illinois, Stora Enso, Sealed Air, WestRock, Bemis, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The packaging materials market is driven by several key factors because of the rising global population and increasing consumer spending power have led to a surge in demand for packaged goods across various industries, including food and beverages, pharmaceuticals, and consumer goods. This drives the need for packaging materials to ensure product safety and integrity. The changing consumer preferences and lifestyles, such as the demand for convenience, portability, and sustainable packaging, are influencing the market. As environmental concerns grow, there is a shift towards eco-friendly materials, driving the adoption of biodegradable and compostable packaging solutions. Additionally, stringent regulations and standards imposed by governments and industry bodies regarding product safety, labeling, and recycling further impact the packaging materials market. Moreover, advancements in technology and materials, such as smart packaging and flexible packaging solutions, are driving innovation and market growth. Overall, increasing e-commerce activities and the need for secure and efficient packaging for online deliveries contribute to the market's expansion.

Restraining Factors

The packaging materials market faces certain restraints that impact its growth. One significant restraint is the increasing concerns regarding the environmental impact of packaging waste. This has led to stricter regulations on single-use plastics and a push for sustainable packaging alternatives. Additionally, fluctuations in raw material prices, such as fluctuations in oil prices affecting plastic packaging, can pose challenges to the market. Moreover, the high cost of implementing innovative packaging materials and technologies, along with the need for specialized equipment and machinery, can be a barrier for some companies. Lastly, the complexity of global supply chains and logistics can present challenges in terms of transportation, storage, and handling of different packaging materials.

Market Segmentation

- In 2022, the rigid plastic segment accounted for around 34.2% market share

On the basis of the material, the global packaging materials market is segmented into paper, cardboard, rigid plastic, flexible plastic, wood, textile, glass, and metal. The rigid plastic segment has made a significant impact on the packaging materials market, generating a remarkable market share. The rigid plastic offers a range of advantages that make it a preferred choice for packaging. Its durability and strength ensure the protection of products during transportation and handling. Rigid plastic also provides excellent barrier properties, protecting against moisture, light, and other external factors that could affect the product's quality and shelf life. Additionally, it offers versatility in terms of shape and design, allowing for unique and appealing packaging solutions. Rigid plastic packaging aligns with the growing demand for sustainable packaging materials. Many rigid plastic options are recyclable, and the industry has witnessed advancements in recycling technologies, enabling better circularity. This addresses concerns related to plastic waste and environmental impact, driving the adoption of rigid plastic in the market. Moreover, the versatility of rigid plastic makes it suitable for a wide range of industries. It is extensively used in sectors such as food and beverages, personal care, healthcare, and household products. The versatility allows for packaging solutions that meet specific requirements, including product protection, convenience, and branding. Furthermore, rigid plastic packaging offers cost-effective solutions for manufacturers and retailers. Its lightweight nature reduces transportation costs and facilitates easier handling. The stackability and efficient use of shelf space also contribute to operational efficiency. Overall, the remarkable market share generated by the rigid plastic segment can be attributed to its numerous advantages, including durability, barrier properties, sustainability, versatility, and cost-effectiveness.

- In 2022, the bottles segment dominated with more than 55.4% market share

Based on the product, the global packaging materials market is segmented into bag, pouch, box, bottles, cans & jars, containers, wraps, drums, and IBCs. The bottles segment has emerged as a leader in the packaging materials market, capturing a significant market share. The bottles are widely used across various sectors, including food and beverages, pharmaceuticals, personal care, and household products. The demand for bottles in these industries is driven by factors such as consumer convenience, product safety, and brand differentiation. Bottles provide a secure and convenient packaging solution for liquids, powders, and solid products, making them a preferred choice for manufacturers. The bottles offer excellent functionality and versatility. They come in a wide range of shapes, sizes, and materials, catering to diverse packaging needs. For example, plastic bottles are lightweight, shatter-resistant, and can be molded into various designs, while glass bottles convey a premium image and provide better product visibility. This versatility allows manufacturers to choose the most suitable bottle type for their specific product requirements. Additionally, the growing emphasis on sustainability has influenced the bottles segment. Manufacturers are increasingly adopting eco-friendly materials, such as recycled plastics or bio-based plastics, to reduce environmental impact. Furthermore, the recycling infrastructure for bottles has improved, promoting the circular economy and reducing waste. Moreover, bottles are a preferred packaging option for e-commerce due to their durability and ability to withstand transportation challenges. The e-commerce sector's rapid growth has contributed to the increased demand for bottles as they ensure product integrity and minimize the risk of leakage or damage during transit. Lastly, bottles play a crucial role in branding and marketing strategies. Customized bottle designs, labeling, and branding help differentiate products on the store shelves and enhance consumer perception. Bottles with unique shapes and eye-catching designs can attract consumer attention and create a lasting impression. Overall, the bottles segment's leading market share can be attributed to its widespread use across industries, functionality, versatility, sustainability efforts, suitability for e-commerce, and branding opportunities.

Regional Segment Analysis of the Packaging Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 45.2% revenue share in 2022.

Get more details on this report -

Based on region, the Asia-Pacific region has emerged as the dominant force in the packaging materials market. This can be attributed to the booming population and rapid urbanization has led to increased consumption and demand for packaged goods across various industries. The rising middle class with higher disposable incomes has fueled the growth of e-commerce, further driving the need for efficient and protective packaging materials. Additionally, the presence of major manufacturing hubs in countries like China, India, and Japan has facilitated the production and supply of packaging materials. Moreover, governments in the region have implemented initiatives and regulations promoting sustainable packaging practices, leading to the adoption of eco-friendly materials. Overall, the Asia-Pacific region's economic growth, changing consumer behavior, and supportive regulatory environment have contributed to its dominance in the packaging materials market.

Recent Developments

- In February 2023, Cruz Foam announced the introduction of a new sustainable packaging material in the shape of foam packaging. The novel packing method is intended for the shipment of delicate and temperature sensitive commodities. Cruz Foam intends to replace bubble wrap, bubble mailers, and other types of plastic packaging.

- In April 2022, Zomato, India's largest food delivery partner, has announced its commitment to using 100% plastic-neutral packaging going forward. The company has set a target to deliver over ten crore orders using sustainable packaging materials. This initiative reflects Zomato's dedication to reducing plastic waste and promoting environmental sustainability in the food delivery industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global packaging materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Amcor

- Ball Corporation

- Crown Holdings

- International Paper

- Reynolds Group

- Mondi

- Owens-Illinois

- Stora Enso

- Sealed Air

- WestRock

- Bemis

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global packaging materials market based on the below-mentioned segments:

Packaging Materials Market, By Material

- Paper

- Cardboard

- Rigid Plastic

- Flexible Plastic

- Wood

- Textile

- Glass

- Metal

Packaging Materials Market, By Product

- Bag

- Pouch

- Box

- Bottles

- Cans & Jars

- Containers

- Wraps

- Drums

- IBCs

Packaging Materials Market, By End-User

- Food & Beverage

- Healthcare

- Household Products

- Chemicals

- Cosmetics

Packaging Materials Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?