Global Passenger to Freighter Market Size By Build Type (New Build and Refurbished), By Aircraft Model (Narrow Body, Wide Body, and Regional Jets), By Fitment (Slot/Retro Fitment and Line Fitment), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Passenger to Freighter Market Insights Forecasts to 2033

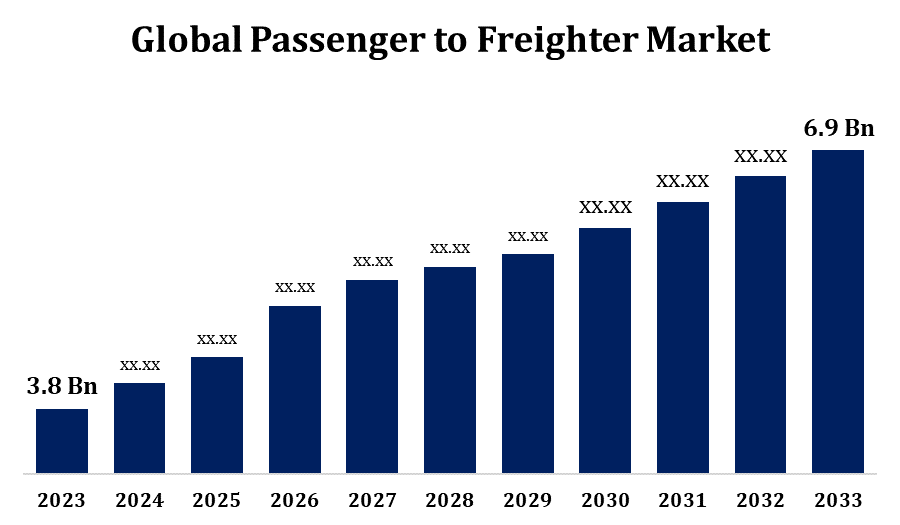

- The Global Passenger to Freighter Market Size was valued at USD 3.8 Billion in 2023.

- The Market Size is growing at a CAGR of 6.15% from 2023 to 2033

- The Worldwide Passenger to Freighter Market Size is expected to reach USD 6.9 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Passenger to Freighter Market Size is expected to reach USD 6.9 Billion by 2033, at a CAGR of 6.15% during the forecast period 2023 to 2033.

The need for air freight services is rising as global trade and e-commerce both continue to develop. Especially during the busiest shipping seasons, converting from passenger to freighter is a cost-effective solution to meet this demand. Purchasing new freighter aircraft is frequently more expensive than converting current passenger aircraft into freighters. It makes advantage of the current infrastructure and enables airlines and freight companies to prolong the life of their aircraft. Fuel prices, economic development, trade policy, and other air cargo market dynamics all have an impact on the demand for freighter aircraft and, by extension, the Passenger to Freighter conversion market.

Passenger to Freighter Market Value Chain Analysis

Market trends, the need for air cargo services, and the viability of Passenger to Freighter conversions are all examined by market research companies and consultants. Airlines and cargo operators analyse the advantages of turning passenger aircraft to freighters as well as their fleet requirements. The conversion procedure is designed by engineering companies that specialise in aircraft modifications, taking into account elements like structural integrity, cargo capacity, and regulatory compliance. The physical conversion of passenger aircraft to freighters is done by conversion centres or maintenance, repair, and overhaul (MRO) facilities. Manufacturers create the specialised systems and parts—like cargo doors, floor reinforcements, and cargo handling equipment—that are needed for Passenger to Freighter conversions. Airlines, cargo operators, lessors, and leasing firms are the target market for Passenger to Freighter conversion services offered by conversion providers and MRO facilities.

Passenger to Freighter Market Opportunity Analysis

Evaluating the global demand for air cargo services, taking into account the demand for air freight driven by e-commerce, pharmaceuticals, perishables, and other industries. locating freight capacity-hungry routes and areas where Passenger to Freighter conversions can alleviate capacity issues or inefficiencies. examining the age and make-up of the current fleets of freighters and passengers to find areas where they might be updated and renewed. identifying airlines that might find that Passenger to Freighter conversions are a more affordable option than buying new freighters for their fleets of ageing passenger aircraft. determining whether any passenger aircraft would be a good fit for conversion while taking the type, age, condition, and market availability into account. Comparing the price of Passenger to Freighter conversions to the price of purchasing new freighter aircraft in a cost-benefit analysis.

Global Passenger to Freighter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.15% |

| 2033 Value Projection: | USD 6.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Build Type, By Fitment, By Region, By Geographic Scope |

| Companies covered:: | Commercial Aircraft Corporation of China, Ltd, Airbus Group, General Electric, The Boeing Company, Lockheed Martin Corporation, General Dynamics Corporation, Embraer S.A., Raytheon Technologies Corporation,, Textron Inc., Dassault Aviation, and Other Key Vendors. |

| Growth Drivers: | Rise in Aircraft Conversion Facilities Infrastructure by Key Players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Passenger to Freighter Market Dynamics

Rise in Aircraft Conversion Facilities Infrastructure by Key Players

The increased demand for freighter aircraft is being met by the growth of conversion facilities, which enables more aircraft to undergo Passenger to Freighter conversions concurrently. The growing requirement for effective air cargo transportation resulting from the expansion of global trade and e-commerce is driving up demand for freighter aircraft. Lead times for Passenger to Freighter conversions might be shortened with more conversion slots available. Faster turnaround times are advantageous for airlines and cargo operators looking to convert existing passenger aircraft into freighters since it enables them to put converted freighters into service sooner and take advantage of market possibilities. Conversion providers can handle a higher volume of aircraft conversions thanks to expanded conversion facilities, which boost the overall capacity for Passenger to Freighter conversions.

Restraints & Challenges

To maintain airworthiness and cargo compatibility, major engineering and structural modifications are required when converting passenger aircraft into freighters. Specialised knowledge and resources are needed to handle technical issues including weight distribution, structural strengthening, and freight handling systems integration. The demand for air cargo, the state of the economy, fuel prices, and geopolitical issues can all affect the Passenger to Freighter market. Market uncertainties can cause problems for conversion suppliers and operators by influencing fleet planning, investment decisions, and conversion project schedules. The Passenger to Freighter conversion process depends on a convoluted supply chain that sources parts, supplies, and specialised machinery from numerous vendors. Supply chain disruptions brought on by things like factory hold-ups, traffic jams, or geopolitical unrest can affect the budget and schedule of conversion projects.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Passenger to Freighter Market from 2023 to 2033. There is a substantial Passenger to Freighter market in North America, where there are many passenger planes that might be converted into freighters. The industry is still expanding as a result of factors such changing supply chain dynamics, the rise in e-commerce, and the growing demand for air cargo services. The retail, automotive, pharmaceutical, and perishable industries are among the industries driving the demand for freighter aircraft in North America. Efficient air freight transportation is in high demand due to the region's dynamic economy, broad trade networks, and reliance on just-in-time inventory management. For the Passenger to Freighter market, North America has an extensive infrastructure of conversion facilities, maintenance, repair, and overhaul (MRO) centres, and support services.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Due to the region's enormous supply chains and commercial networks, the Asia-Pacific area is a major hub for air cargo operations, with a notable need for freighter aircraft. Asia-Pacific's Passenger to Freighter market is expanding rapidly, driven by increased consumer demand, urbanisation, and economic growth. The Asia-Pacific region's need for freighter aircraft is fueled by a number of industries, including consumer products, electronics, manufacturing, and automotive. The growing e-commerce industry in the region is creating a large need for Passenger to Freighter conversions and air cargo services, especially in nations like China and India. The Asia-Pacific area supports the Passenger to Freighter sector with a strong infrastructure of shipping hubs, MRO centres, and conversion facilities.

Segmentation Analysis

Insights by Build Type

The refurbished segment accounted for the largest market share over the forecast period 2023 to 2033. It may be less expensive to refurbish old freighter aircraft rather than buy new ones. By utilising current assets, it enables operators to increase return on investment and prolong the service life of their aircraft. An easily accessible pool of assets for refurbishing is made possible by the availability of retired or used passenger and freighter aircraft. Refurbishment is a desirable alternative for operators wishing to replace ageing aircraft or grow their fleet because these aircraft may be purchased for comparatively less money than new aircraft. Factors including the rise in e-commerce, the development of air cargo networks, and the growing need for expedited and time-sensitive cargo transportation services are driving the market demand for reconditioned freighter aircraft. Refurbished freighters provide an affordable way to satisfy these changing market needs.

Insights by Aircraft Model

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. The need for air cargo delivery has surged due to the growth of e-commerce, especially for smaller, expedited goods. Narrow-body freighter aircraft are perfect for meeting the needs of e-commerce logistics networks since they are well-suited for serving short- and regional-haul routes. Narrow-body freighters provide last-mile connection in the air cargo supply chain by providing the flexibility to reach smaller airports and isolated areas. By reaching locations that larger freighter aircraft might not be able to reach, this capacity improves network coverage and service dependability. The demand for narrow-body freighters has been fueled by the expansion of niche markets and the necessity for specialised cargo transportation. Operators that serve niche markets or certain sectors frequently need smaller, more manoeuvrable aircraft to effectively meet their particular needs.

Insights by Fitment

The slot/ retro segment accounted for the largest market share over the forecast period 2023 to 2033. An affordable substitute for buying new freighter aircraft is to convert ageing passenger aircraft into freighters. It enables operators to optimise return on investment and prolong the useful life of current assets. In order to facilitate the growth of air cargo networks, there is an increasing need for freighter aircraft, especially in areas where e-commerce is expanding quickly and trade volumes are rising. For operators looking to increase their cargo capacity in order to satisfy this demand, retrofit conversions provide a prompt answer. Through retrofit conversions, operators can bring their fleets up to date by adding newer features and technology to older aircraft. The performance and economy of modified freighters can be increased by installing more fuel-efficient engines, cutting-edge avionics systems, and enhanced cargo handling capabilities.

Recent Market Developments

- In February 2022, the company ST Engineering declared that it has reached a deal with Vaayu Group (Vaayu) to lease up to five Airbus A320 P2F aircraft. Astral Aviation, a Nairobi, Kenya-based all-cargo airline with one of the fastest rates of growth in the world, will sublease the first two of the five A320P2F aircraft from Vaayu to serve as the launch operator.

Competitive Landscape

Major players in the market

- Commercial Aircraft Corporation of China, Ltd

- Airbus Group

- General Electric

- The Boeing Company

- Lockheed Martin Corporation

- General Dynamics Corporation

- Embraer S.A.

- Raytheon Technologies Corporation,

- Textron Inc.

- Dassault Aviation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Passenger to Freighter Market, Build Type Analysis

- New Build

- Refurbished

Passenger to Freighter Market, Aircraft Model Analysis

- Narrow Body

- Wide Body

- Regional Jets

Passenger to Freighter Market, Fitment Analysis

- Slot/Retro Fitment

- Line Fitment

Passenger to Freighter Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Passenger to Freighter Market?The global Passenger to Freighter Market is expected to grow from USD 3.8 billion in 2023 to USD 6.9 billion by 2033, at a CAGR of 6.15% during the forecast period 2023-2033.

-

2. Who are the key market players of the Passenger to Freighter Market?Some of the key market players of the market are Commercial Aircraft Corporation of China, Ltd, Airbus Group, General Electric, The Boeing Company, Lockheed Martin Corporation, General Dynamics Corporation, Embraer S.A., Raytheon Technologies Corporation, Textron Inc., Dassault Aviation.

-

3. Which segment holds the largest market share?The slot/ retro fitment segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Passenger to Freighter Market?North America is dominating the Passenger to Freighter Market with the highest market share.

Need help to buy this report?