Global Passive and Interconnecting Electronic Components Market Size, Share, and COVID-19 Impact Analysis, By Component (Passive and Interconnecting), By Application (Consumer Electronics and IT & Telecommunication), Analysis and Forecast 2023 - 2033.

Industry: Semiconductors & ElectronicsGlobal Passive and Interconnecting Electronic Components Market Insights Forecasts to 2033

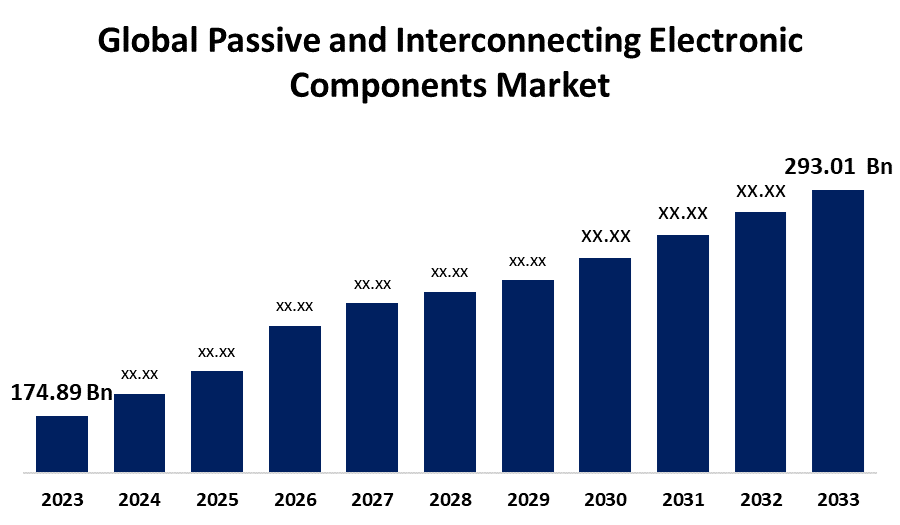

- The Global Passive and Interconnecting Electronic Components Market Size was estimated at USD 174.89 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.3% from 2023 to 2033

- The Worldwide Passive and Interconnecting Electronic Components Market Size is Expected to Reach USD 293.01 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The global passive and interconnecting electronic components market size was worth around USD 174.89 billion in 2023 and is predicted to grow to around USD 293.01 billion by 2033 with a compound annual growth rate (CAGR) of approximately 5.3% between 2023 and 2033. The significantly growing adoption of smartphones and laptops in developing countries such as India and China is estimated to drive global passive and interconnecting electronic components market growth over the forecast period.

Market Overview

The market for passive and interconnecting electronic components includes a broad range of electronics that are considered crucial in the function of electronic equipment but do not have a necessity for some form of power supply source. The global market for passive and interconnecting electronic components has seen significant growth due to the increasing demand for electronic devices across various industries, including consumer electronics, automotive, telecommunications, and industrial automation. Passive components like resistors, capacitors, inductors, and transformers, along with interconnecting components such as connectors, cables, and PCBs, form the backbone of modern electronic systems. The surge in technologies like 5G, IoT, and electric vehicles (EVs) has further accelerated market growth, as these innovations rely heavily on robust and reliable electronic components. Additionally, the trend toward miniaturization, higher efficiency, and integration in devices has spurred the development of advanced passive components with enhanced performance. The shift toward renewable energy solutions also demands specialized components, like capacitors in solar power systems.

Report Coverage

This research report categorizes the passive and interconnecting electronic components market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the passive and interconnecting electronic components market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the passive and interconnecting electronic components market.

Global Passive and Interconnecting Electronic Components Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | 174.89 billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.3% |

| 023 – 2033 Value Projection: | USD 293.01 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component , By Application ( |

| Companies covered:: | Videojet Technologies Inc., Pannier Corporation, Canon Inc., HP Development Company, L.P., Konica Minolta, Inc., KEYENCE CORPORATION, Mimaki, Xerox Corporation, Seiko Epson Corporation, Brother Industries, Ltd., InkJet, Inc., CONTROL PRINT LTD., |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid change in the industrial sector is due to the growing adoption of Internet of Things (IoT) devices. Industrial IoT devices improve the productivity and efficiency of operations in the manufacturing facility through the simplification of processes and reduction of system downtime. Moreover, the fourth industrial revolution, or Industry 4.0, has led many manufacturing facilities to install connected devices that help monitor the processes remotely for better workflow management.

Restraining Factors

One of the primary challenges is the volatility in raw material prices, especially for components like capacitors, resistors, and inductors, which are dependent on materials such as metals and rare-earth elements.

Market Segmentation

The passive and interconnecting electronic components market share is classified into component and application.

- The interconnecting segment accounted for the largest share in 2023 and is projected to grow at a significant CAGR during the forecast period.

Based on the component, the passive and interconnecting electronic components market is divided into passive and interconnecting. Among these, the interconnecting segment accounted for the largest share in 2023 and is projected to grow at a significant CAGR during the forecast period. The growth of this segment can be attributed to the need for a reliable and secure method of connecting different electronic components in an electronic circuit. Connectors allow manufacturers to assemble, repair, or upgrade different components within an electronic system easily.

- The consumer electronics segment accounted for a highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the passive and interconnecting electronic components market is divided into consumer electronics and IT & telecommunication. Among these, the consumer electronics segment accounted for a highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growing demand for consumer electronics devices, including smartphones and home appliances, contributes to the increased growth in the segment. Passive as well as interconnecting electronic components would continue to gain increased demand with growing smartphone adoptions.

Regional Segment Analysis of the Passive and Interconnecting Electronic Components Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

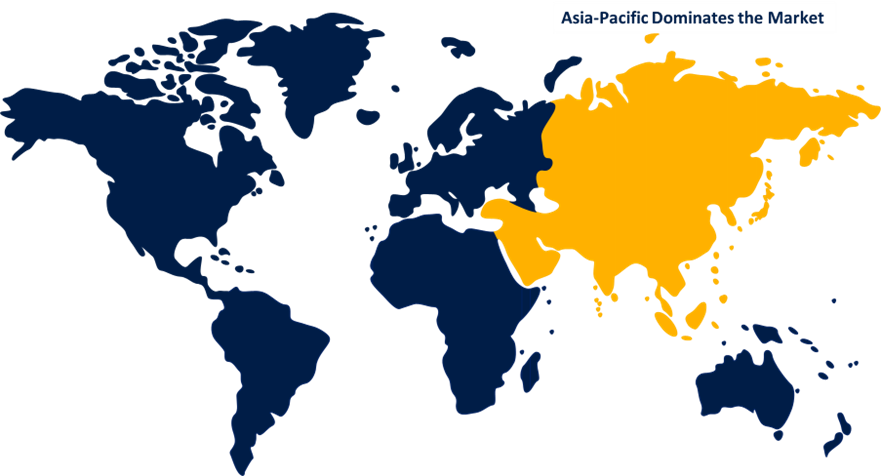

Asia Pacific is anticipated to hold the largest share of the passive and interconnecting electronic components market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the passive and interconnecting electronic components market over the predicted timeframe. Regional growth is fueled by growing populations, rising disposable income, and increasing urbanization. The region contributes to a considerable share of global demand for smartphones, tablets, laptops, televisions, and other electronic gadgets, which necessitate a vast array of passive and interconnecting electronic components. With the increasing complexity and innovation in consumer electronics, the components required, such as resistors, capacitors, connectors, and PCBs are also expected to increase.

North America is expected to grow at a fastest CAGR in the passive and interconnecting electronic components market during the forecast period. The regional growth is due to increased expansion in telecommunication networks, 5G deployment, and the IoT ecosystem, which requires the components for transmission, network connectivity, and a good wireless communication infrastructure. Additionally, the U.S. aerospace and defense industry is a major consumer of passive and interconnecting electronic components for avionics, navigation systems, radar systems, communications systems, missile guidance systems, and a host of other military applications. Future military modernization programs, space exploration missions, and commercial aerospace projects will also require a high-performance electronic component demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the passive and interconnecting electronic components market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Videojet Technologies Inc.

- Pannier Corporation

- Canon Inc.

- HP Development Company, L.P.

- Konica Minolta, Inc.

- KEYENCE CORPORATION

- Mimaki

- Xerox Corporation

- Seiko Epson Corporation

- Brother Industries, Ltd.

- InkJet, Inc.

- CONTROL PRINT LTD.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, Samtec unveiled the extension of its Edge Rate connectors with the introduction of the ERM6 & ERF6 Series. These connectors boast a denser mated set, narrower width, and a low-profile height of 5 mm, catering to industries like embedded vision, industrial, instrumentation, and robotics with support for 56 Gbps PAM4 high-speed applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the passive and interconnecting electronic components market based on the below-mentioned segments:

Global Passive and Interconnecting Electronic Components Market, By Component

- Passive

- Interconnecting

Global Passive and Interconnecting Electronic Components Market, By Application

- Consumer Electronics

- IT & Telecommunication

Global Passive and Interconnecting Electronic Components Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?