Global Patient-matched Implants Market Size, Share, and COVID-19 Impact Analysis, By Product (Cranial Implants, Orthopedic Implants, Dental Implants, and Others), By Material (Metals, Polymers, Ceramics, and Composite Materials), By End-use (Hospitals, Speciality Clinics, and Ambulatory Surgical Centers), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Patient-matched Implants Market Insights Forecasts to 2033

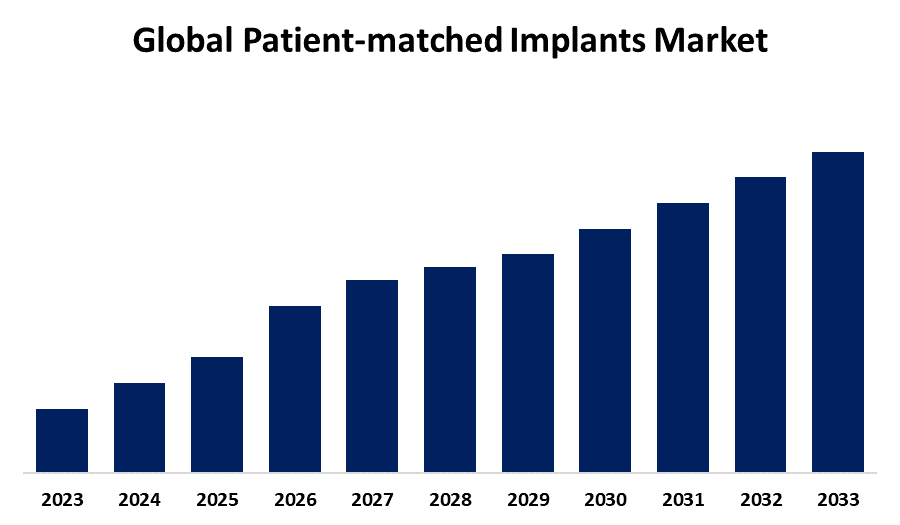

- The Market Size is Growing at a CAGR of 6.84% from 2023 to 2033

- The Worldwide Patient-matched Implants Size is Expected to Hold a Significant Share by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Patient-matched Implants Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 6.84% from 2023 to 2033. The patient-matched implants market is growing very rapidly with the advancement of 3D printing and imaging for personalized solutions. High demand in orthopedics and dental sectors and regulatory support and improved biocompatible materials boost expansion in the market, especially in North America and Europe.

Market Overview

Patient-matched implants are customized medical devices that fit each patient's anatomy. Therefore, they are very useful in surgical treatments where it may not be possible to have an off-the-shelf implant that gives an optimal fit or function. Advanced imaging techniques, such as CT scans or MRIs, capture detailed images of the affected area in 3D. This creates an accurate digital model of a patient's anatomy based on imaging data, allowing for the design of highly tailored implants that match the specific patient's anatomy. The so-designed implants are made out of materials like titanium, ceramic, or biocompatible polymers and then surgically implanted, providing an exact fit and improved function. This may thus lead to better surgical results, patient satisfaction, and quality of life through better matching with individual needs for a more tailored solution that closely aligns with a person's needs.

Market demand is expected to grow fast and primarily due to improvements in medical imaging technology, 3D modeling, and manufacturing, allowing such products to fit the individual anatomy of patients well. The market is also likely to benefit from the growing demand for customized health care, including complex orthopaedic, cranial, and dental procedures. In addition, higher awareness of better patient outcomes, shorter recovery periods, and better functionality of the implants is motivating more healthcare providers and patients to embrace these customized solutions, hence providing a robust growth trend in the forecast period.

Opportunities and Trends in the Patient-matched Implants Market:

Trends influencing the patient-matched implants market include developments in 3D printing, demand for customized production, and digital modelling for a precise fit based on an individual's anatomy that helps to contribute to improved patient satisfaction and recovery results. Growth in the market results from the progress of ever-changing materials joined with additive technology that becomes available and affordable for healthcare facilities as on-site, patient-specific production regulatory frameworks become clearer. This customization approach finds an opportunity in the orthopaedic sector, too, where incremental improvements in routine surgeries can greatly benefit both the hospital and the patient.

Challenges in the Market for the Patient-matched Implants Market:

Higher production costs and poor reimbursement rates through insurance also affect the ability to access these patient-matched implants. The regulatory complexity involving personalized devices hinders manufacturers as well, while health providers require special training for such high-tech, patient-specific approaches.

Report Coverage

This research report categorizes the global patient-matched implants market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global patient-matched implants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global patient-matched implants market.

Global Patient-matched Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.84% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Material, By End-use, By Region |

| Companies covered:: | Johnson & Johnson Services, Inc.,, 3D Systems, Inc., restor3d, Materialise, SMITH & NEPHEW PLC, Conformis, Zimmer Biomet, Onkos, Materialise, Stryker, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Risen demand for individualized care solutions in association with the improvement in 3D printing and imaging technologies will enhance precise, patient-matched implants. Backing innovation in medical technology by governments and growth in healthcare expenditure in developed countries boost growth for the market. Also, increasing acknowledgement from regulatory bodies of patient-matched implant capabilities are leading to clinical adoption and product innovation.

CurvaFix, Inc. developed the 7.5mm CurvaFix IM Implant in 2023, specifically for the small-boned patient population. This innovative device has been designed to minimize surgery time while still offering excellent, stable fixation; these design considerations are intended to make it more anatomically applicable for better results in the patient's care.

Restraining Factors

The high up-front investment involved in manufacturing with high technology equipment discourages smaller companies from entering the market. Inconsistent regulatory frameworks across regions create uncertainty in manufacturers' minds, thereby hindering the introduction of newer products.

Market Segmentation

The global patient-matched implants market share is classified into product, material, and end-use.

- The orthopaedic implants segment is expected to hold the largest share of the global patient-matched implants market during the forecast period.

Based on product, the global patient-matched implants market is categorized as cranial implants, orthopaedic implants, dental implants, and others. Among these, the orthopaedic implants segment is expected to hold the largest share of the global patient-matched implants market during the forecast period. This segment is growing because of the increasing incidence of orthopaedic conditions and increased demand for more customized procedures that improve surgical results. The advancement of 3D printing technology helps create custom orthopaedic implants that will facilitate better fitting with a patient's anatomy and will ensure shorter recovery times. Increasing age demographics are also projected to add a considerable market expansion due to older patients who typically require orthopaedic intervention.

- The polymers segment is expected to grow at the fastest CAGR during the forecast period.

Based on the material, the global patient-matched implants market is categorized as metals, polymers, ceramics, and composite materials. Among these, the polymers segment is expected to grow at the fastest CAGR during the forecast period. These advancements are backed by new trends in implantation, using more biocompatible materials that become increasingly light and flexible for the purpose of modification according to individual patient needs and to achieve better flexibility, high strength, and bioactive capabilities that enhance their versatility in orthopaedic and dental applications.

- The hospitals segment is expected to hold the largest share of the global patient-matched implants market during the forecast period.

Based on end-use, the global patient-matched implants market is categorized as hospitals, speciality clinics, and ambulatory surgical centres. Among these, the hospitals segment is expected to hold the largest share of the global patient-matched implants market during the forecast period. Hospitals generally are the primary institutions for technical complex interventions, such as orthopaedic, neurosurgery, and maxillofacial surgeries- areas of high priority for patient-matched implants. High-end resources and in-house specialized equipment, like 3D printing technology, can support the production and application of customized implants. Furthermore, increased investments in healthcare infrastructure and the availability of experienced staff in hospitals help to maintain their market leadership in patient-matched implants.

Regional Segment Analysis of the Global Patient-matched Implants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global patient-matched implants market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global patient-matched implants market over the forecast period. Advanced health infrastructure, higher healthcare expenditure, and the presence of key market players are some of the factors which propel this market. The region also witnesses an increased ageing population and a high prevalence of orthopaedic and dental conditions, thus creating a need for personalized healthcare. More and more governmental programs and innovations are there to promote patient-matched implants. In this regard, for instance, the FDA has outlined streamlined pathways for approval for custom medical devices. With this, the application of these patient-specific implants is very easy to adopt, particularly in the new launches that emanate from such frameworks. The latest such product in this category from Johnson & Johnson's subsidiary, DePuy Synthes, recently launched the first 3D-printed implants that are specific to complex orthopaedic procedures and that address unique anatomical needs.

Europe is expected to grow at the fastest CAGR growth of the global patient-matched implants market during the forecast period. Government-backed healthcare innovations and favourable regulations. For instance, the Medical Device Regulation of the European Union is aimed at patient safety, which provides an avenue for innovation in the development of novel medical devices, such as patient-specific implants. Such a regulatory scenario fosters market growth with an approval and monitoring framework for custom devices. These changes can be observed in recent product launches in the region. For instance, Medacta Group, based in Switzerland, launched a new series of personalized shoulder and knee implants founded on advanced imaging and 3D-printing technologies which are designed to align directly with patient anatomy for more effective surgery. Companies, such as Zimmer Biomet, grow their patient-specific implant portfolios in Europe where demand for orthopaedic and dental applications tailored to individual needs is increasing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global patient-matched implants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson Services, Inc.,

- 3D Systems, Inc.

- restor3d

- Materialise

- SMITH & NEPHEW PLC

- Conformis

- Zimmer Biomet

- Onkos

- Materialise

- Stryker

- Others

Key Market Developments

- In September 2024, restor3d, a company that introduced the most recent medical implant device with 3D printing recently- Kinoss range articulating surface, comes forward stating this new line of vitamin E crosslinked polyethylene and 3D printed cobalt chrome implants marks the major leap in ankle replacement.

- In September 2024, Smith+Nephew, a medical technology company, recently announced that its Patient-matched TOTAL ANKLE guides have been launched and have so far armed surgeons with the equipment they need to rely on and definitely get the job done on their side when it comes to planning and delivering care for TAR. The single-use, all-in-one TOTAL ANKLE Patient-matched Guides were engineered with 3D Systems' VSP surgical planning workflows, and this device is meant to aid in providing accuracy to the planning and achieving an accurate fit through the use of adequate equipment and fluoroscopic alignment cues.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global patient-matched implants market based on the below-mentioned segments:

Global Patient-matched Implants Market, By Product

- Cranial Implants

- Orthopaedic Implants

- Dental Implants

- Others

Global Patient-matched Implants Market, By Material

- Metals

- Polymers

- Ceramics

- Composite Materials

Global Patient-matched Implants Market, End-use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

Global Patient-matched Implants Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global patient-matched implants market over the forecast period?The global patient-matched implants market is anticipated to hold a significant share by 2033, growing at a CAGR of 6.84% from 2023 to 2033.

-

2. Which region is expected to hold the highest share of the global patient-matched implants market?North America is projected to hold the largest share of the global patient-matched implants market over the forecast period.

-

3. Who are the top key players in the global patient-matched implants market?Johnson & Johnson Services, Inc., 3D Systems, Inc., restor3d, Materialise, SMITH & NEPHEW PLC, Conformis, Zimmer Biomet, Onkos, Materialise, Stryker, and Others.

Need help to buy this report?