Global Patient Monitoring Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Cardiac Monitoring Devices, Pulse Oximeter, Spirometer, Fetal Monitor, Temperature Monitor, Blood Pressure Monitors, ECG, ICP, Weight Monitoring), By End User (Hospitals & Clinics, Home Settings, Ambulatory Surgical Centers (ASCs)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Patient Monitoring Devices Market Insights Forecasts to 2033

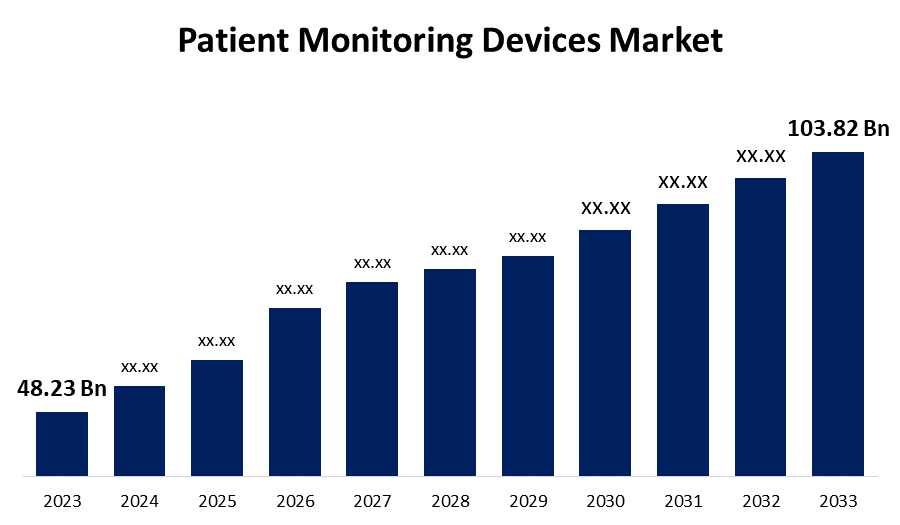

- The Global Patient Monitoring Devices Market Size was Valued at USD 48.23 Billion in 2023

- The Market Size is Growing at a CAGR of 7.97% from 2023 to 2033

- The Worldwide Patient Monitoring Devices Market Size is Expected to Reach USD 103.82 Billion by 2033

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Patient Monitoring Devices Market Size is Anticipated to Exceed USD 103.82 Billion by 2033, Growing at a CAGR of 7.97% from 2023 to 2033.

Market Overview

Patient monitoring devices are used to monitor a patient's functional signs and associated disorders. Temperature, blood pressure, oxygen permeation, level of consciousness, pain, pulse, respiratory rate, and urine output should all be monitored using such instruments. These devices accurately compile and display physiological data of patients suffering from various ailments such as cardiovascular disease and diabetes constantly, allowing clinicians to take immediate and precise treatment. In addition, this allows for the real-time generation of actionable insights, predictive risk classification, and the development of individualized treatment regimens to improve patient outcomes. Historically, assessing huge datasets from patient monitoring was a time-consuming task. AI systems can now examine this data in real-time, finding significant trends and potential concerns as they arise. Furthermore, as wireless technology advances, these devices can be utilized to remotely monitor patients' physical elements. Rising rates of protracted diseases due to the older population, lifestyle changes, and preference for remote monitoring equipment are expected to boost the market growth in the forecast period. Leveraging artificial intelligence (AI) allows for the evaluation of massive datasets generated by patient monitoring devices.

Report Coverage

This research report categorizes the market for the global patient monitoring devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global patient monitoring devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global patient monitoring devices market.

Global Patient Monitoring Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 48.23 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.97% |

| 2033 Value Projection: | USD 103.82 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End User, By Region |

| Companies covered:: | Medtronic Plc, Mindray Medical, Omron, 3M, Boston Scientific Corporation, Covidien,, Drägerwerk AG and Co. KGaA, GE Healthcare, Nihon Kohden Corporation, Biotricity Inc., Natus Medical Incorporated, DexCom, Inc., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The healthcare industry is seeing a dramatic change toward wireless monitoring devices within the larger patient monitoring market. Traditional patient monitoring approaches can limit patients' mobility and comfort by tying them to bedside devices. Wireless technologies overcome this issue by allowing for greater freedom of movement and promoting a more patient-centered approach to care delivery. Wireless monitoring allows for the continuous and real-time recording of vital signs, blood sugar levels, and other health indicators. This continuous data stream provides a more comprehensive view of a patient's health than traditional, intermittent measurements.

Restraining Factors

Patient monitoring systems, such as hemodynamic monitors or some wireless monitoring devices, can be costly to purchase and install, posing a financial challenge for hospitals and healthcare facilities, particularly smaller ones.

Market Segmentation

The global patient monitoring devices market share is classified into product and end user.

- The blood pressure monitors segment is expected to hold the largest share of the global patient monitoring devices market during the forecast period.

Based on the product, the global patient monitoring devices market is categorized into cardiac monitoring devices, pulse oximeter, spirometer, fetal monitors, temperature monitor, blood pressure monitors, ECGs, ICPs, and weight monitoring. Among these, the blood pressure monitors segment is expected to hold the largest share of the global patient monitoring devices market during the forecast period. Continuous glucose monitoring provides diabetics with simple access to their blood sugar levels throughout the day and night. Understanding the level of blood glucose and where it is headed might help patients make informed decisions about insulin management and dose.

- The hospitals & clinics segment is expected to grow at the fastest CAGR during the forecast period.

Based on the end user, the global patient monitoring devices market is categorized into hospitals & clinics, home settings, and ambulatory surgical centers (ASCs). Among these, the hospitals & clinics segment is expected to grow at the fastest CAGR during the forecast period. The rising number of blood glucose monitoring, pressure monitoring, and other devices being launched in hospitals & clinics is a major element driving revenue growth in this market. The increased prevalence of injuries and chronic diseases, as well as attractive reimbursement requirements, are likely to fuel revenue growth in this market. The ability to execute complex monitoring operations, as well as the availability of technologically advanced infrastructure and medical equipment, are projected to drive the segment's revenue growth.

Regional Segment Analysis of the Global Patient Monitoring Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

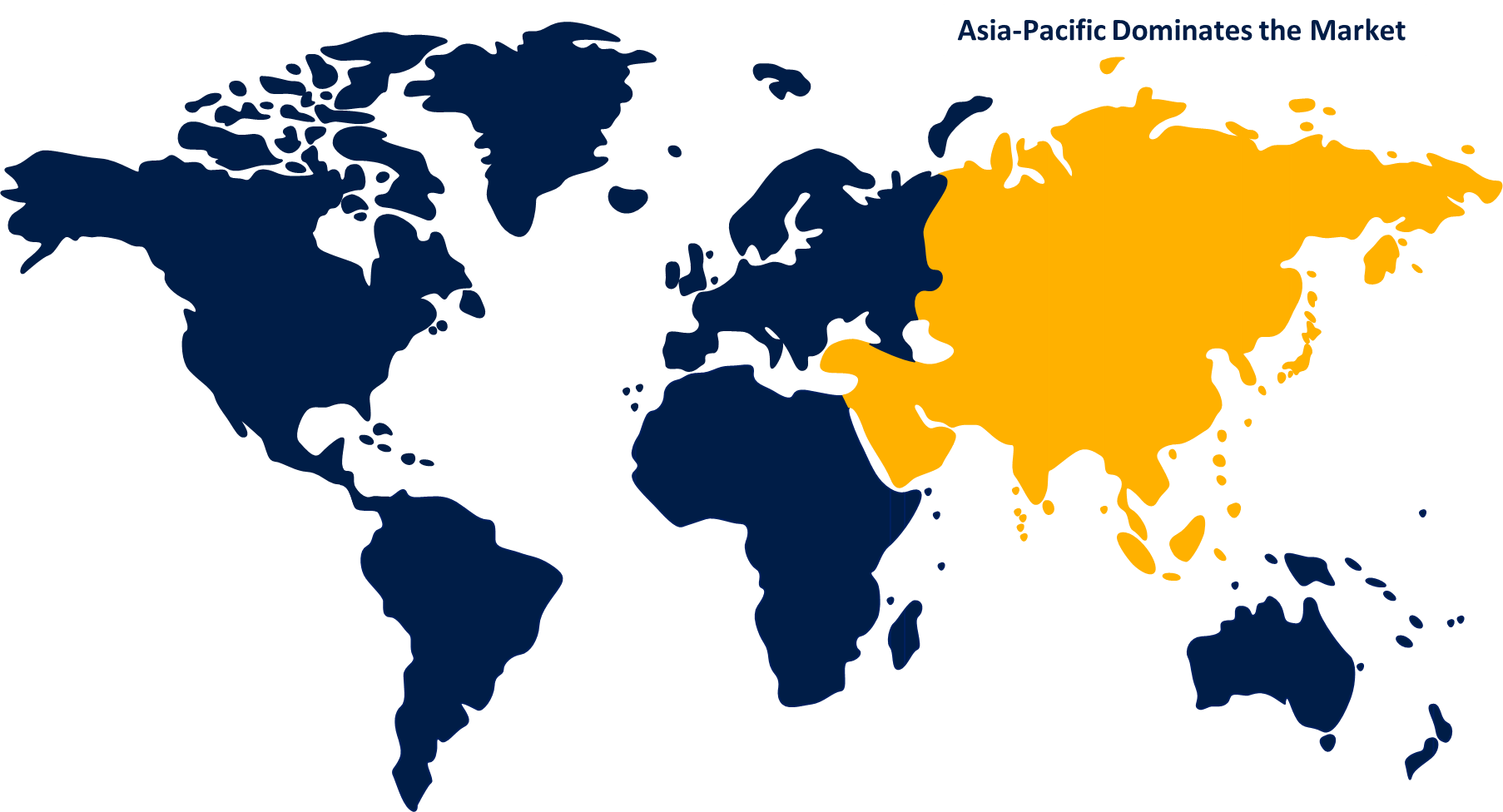

Asia Pacific is projected to hold the largest share of the global patient monitoring devices market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global patient monitoring devices market over the forecast period. This growth is mostly due to an ageing population. The increasing availability of advanced patient monitoring equipment, such as wearable devices, wireless monitors, and remote monitoring systems, is meeting the growing demand for these technologies in APAC countries. The APAC region is evolving as a medical tourism hotspot, drawing patients seeking high-quality healthcare treatments, such as advances in surgical procedures and the use of enhanced patient monitoring. Furthermore, the market in the Asia Pacific region is expected to rise significantly due to a mix of demographic, economic, and technical factors.

North America is expected to grow at the fastest CAGR growth of the global patient monitoring devices market during the forecast period. The region is expected to be a lucrative market for monitoring device manufacturers due to a rise in the prevalence of chronic diseases, increased consumption of unhealthy diets, massive healthcare expenditures, and favorable health insurance policies. In addition, the fast-growing startup environment in this region, driven by the influx of cash, is expected to drive additional research and development activities toward developing new healthcare technologies, which are likely to boost market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global patient monitoring devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic Plc

- Mindray Medical

- Omron

- 3M

- Boston Scientific Corporation

- Covidien,

- Drägerwerk AG and Co. KGaA

- GE Healthcare

- Nihon Kohden Corporation

- Biotricity Inc.

- Natus Medical Incorporated

- DexCom, Inc.

- Others

Key Market Developments

- In February 2023, 3M, a multinational company based in the United States, announced the enhancement of their medical adhesive that can attach to the skin and is intended for use with a wide range of health monitors, sensors, and long-term medical wearables. Prior to 2022, the average wear time for extended medical adhesives was up to 14 days. 3M is now doubling that standard to help deliver a more patient-centered type of care.

- In January 2023, Biobeat, a global manufacturer of wearable remote patient monitoring devices, announced that the U.S. Food and Drug Administration (FDA) has granted 510(k) clearance to monitor stroke volume and cardiac output, as well as cuffless blood pressure, blood oxygen saturation, pulse rate, respiratory rate, and body temperature.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global patient monitoring devices market based on the below-mentioned segments:

Global Patient Monitoring Devices Market, By Product

- Cardiac Monitoring Devices

- Pulse Oximeter

- Spirometer

- Fetal Monitor

- Temperature Monitor

- Blood Pressure Monitors

- ECG

- ICP

- Weight Monitoring

Global Patient Monitoring Devices Market, By End Users,

- Hospitals & Clinics

- Home Settings

- Ambulatory Surgical Centers (ASCs)

Global Patient Monitoring Devices Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the global patient monitoring devices market over the forecast period?The Global Patient Monitoring Devices Market Size is expected to Grow from USD 48.23 Billion in 2023 to USD 103.82 Billion by 2033, at a CAGR of 7.97% during the forecast period 2023-2033.

-

Which region is expected to hold the highest share in the global patient monitoring devices market?Asia Pacific is projected to hold the largest share of the global patient monitoring devices market over the forecast period.

-

Who are the top key players in the patient monitoring devices market?Medtronic Plc, Mindray Medical, Omron, 3M, Boston Scientific Corporation, Covidien, Drägerwerk AG and Co. KGaA, GE Healthcare, Nihon Kohden Corporation, Biotricity Inc., Natus Medical Incorporated, DexCom, Inc, and others.

Need help to buy this report?