Global Peaking Power Plant Market Size, Share, Growth, and Industry Analysis, By Type (Natural Gas, Hydropower, Diesel, and Others), By Application (Industrial, Commercial, Residential, and Utility), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) and Forecast to 2033

Industry: Energy & PowerGlobal Peaking Power Plant Market Peaking Power Plant Forecasts to 2033

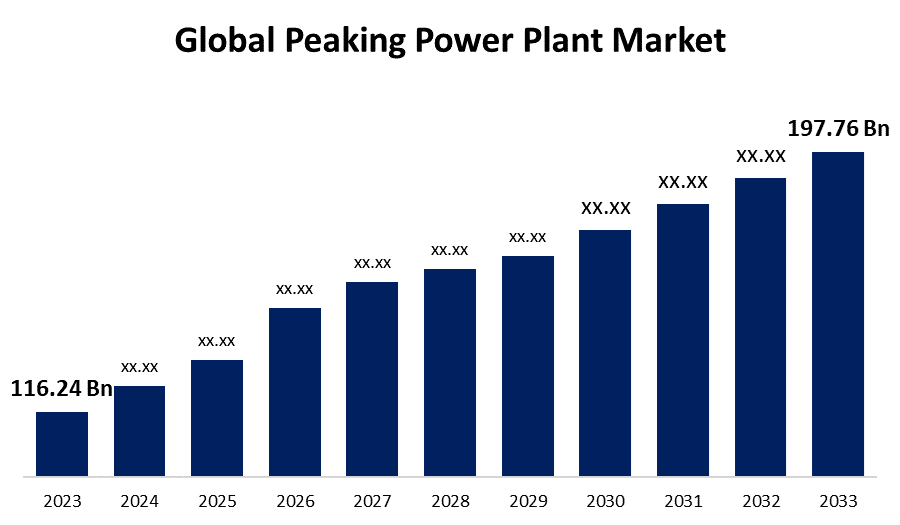

- The Global Peaking Power Plant Market Size was Valued at USD 116.24 Billion in 2023

- The Market Size is Growing at a CAGR of 5.46% from 2023 to 2033

- The Worldwide Peaking Power Plant Market Size is Expected to Reach USD 197.76 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Peaking Power Plant Market Size is Anticipated to Exceed USD 197.76 Billion by 2033, Growing at a CAGR of 5.46% from 2023 to 2033.

Peaking power plant markets are impacted by a number of variables, such as changing demand patterns, grid infrastructure development, and local energy policies.

PEAKING POWER PLANT MARKET REPORT OVERVIEW

Peaking power plants, often known as "peaker plants," are those that are called upon by grid operators when there is an especially high demand for electricity on the system. These plants are made to swiftly increase their output of electricity in response to unexpected spikes in demand, which usually occur during peak hours. Peaking power plants are essential to maintaining the stability and dependability of the grid because they supplement baseload and intermediate power generating sources, which deliver steady electricity over extended periods. Peak demand typically happens during the day when home requirements for heating and cooling are at their maximum. Peakers are used to augment other power plant types, like intermediate plants, which operate primarily during the day and less at night, and baseload plants, which operate continuously throughout the day and night.

Peaking power plants are essential for providing balancing when inclement weather hinders output, such as when the sun isn't shining or the wind isn't blowing. Peaking plants correct this imbalance, lessen the strain on the electrical grid, and provide power stability, which can help prevent blackouts and preserve the security of the supply of electricity. Reserve peak-lopping plants function in standby mode while not in use, unlike baseload power plants, and are triggered to run by the energy grid when there is a demand for electricity. Innovations in energy storage and the incorporation of renewable energy sources are causing a significant change in the peaking power plants industry. The requirement for grid stability and rising power demand are driving the use of fast-response peaking facilities. Furthermore, the environment is changing due to digitization and smart grid solutions, which allow for increased flexibility and efficiency in addressing peak power demands.

The anticipated peak electricity demand of 235 GW in May and 240 GW in June has been adequately addressed by the government's implementation of appropriate measures. According to the Ministry of Power, they have successfully fulfilled the 224 GW peak nighttime power demand in April 2024 through a variety of efforts.

Report Coverage

This research report categorizes the market for the global peaking power plant market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global peaking power plant market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global peaking power plant market.

Global Peaking Power Plant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 116.24 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.46% |

| 2033 Value Projection: | USD 197.76 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | TPSC (India) Pvt. Ltd., Voith, Andritz, ENGIE, ABB Ltd., Wartsila, General Electric, MAN Energy Solutions, Edina, Gama Investment A.S, Clarke Energy, WSP, APR Energy, ENGIE, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

DRIVING FACTORS:

The variations in the demand for electricity are driving market growth.

The amount of electricity used during the day varies greatly depending on a number of factors, including household activities, job schedules, and hours of waking. Peaking power plants are built to satisfy this daily demand at their highest points, guaranteeing a steady supply during what is known as peak hours—periods of heightened consumption. The demand for power is also affected by seasonal changes, which are impacted by various factors, including weather. Peaking power plants are essential in high-energy-demanding seasons like summer and winter when HVAC (heating, ventilation, and air conditioning) systems are in great demand.

Further, the Indian government chose to put gas-based power plants into operation in order to help satisfy the nation's high summertime electricity demand. Under Section 11 of the Electricity Act, 2003, the government has issued directives to all Gas-Based Generating Stations in order to ensure maximum power generation from these facilities. This section allows the relevant government to specify that, in exceptional circumstances, a generating company must operate and maintain any generating station in accordance with that government's directions.

RESTRAINING FACTORS

The change to greener energy sources limits the market expansion.

The conventional peaking power plants that rely on fossil fuels might be at a competitive disadvantage in areas where clean energy targets are highly valued. Cleaner alternatives to conventional peaking power plants may be preferred in the environment created by supportive policies, incentives, and laws supporting renewable energy projects. This may have an effect on the dynamics of the market and the appeal of investing in conventional peaking plants.

Market Segmentation

The peaking power plant market share is classified into type and application.

The market has been dominated by the natural gas segment due to its high effectiveness and low pollution.

Based on type, the peaking power plant market is classified into natural gas, hydropower, diesel, and others. There are many benefits to using natural gas as a dependable and adaptable energy source for peaking power plant operations. Natural gas power plants are primarily well-suited to fulfill the dynamic and variable demand during peak periods because of their ability to quickly ramp up and down their energy generation. Natural gas turbines' quick reaction times and adaptability enable effective resource management and energy grid management. From an environmental perspective, natural gas power plants are a good option because they have a lesser environmental impact and enhance air quality. Numerous places have substantial natural gas reserves, which guarantee a steady and dependable supply of fuel for the business that generates peak electricity.

The industrial segment is the most dominating throughout the forecast period.

Based on application, the peaking power plant market is classified into industrial, commercial, residential, and utility. Due to the rising deployment of peaking plants to supply the energy needs of industrial facilities, the industrial segment is the most dominant one in the market. In order to supply dependable power in a timely manner during times of high electricity demand, industrial peaking power plants are positioned strategically close to or inside industrial zones. When peaking plants are used to provide the power needs of commercial buildings, this is referred to as the commercial portion of the market. Owing to its installation in a variety of places, this segment leads the market in second place.

Regional Segment Analysis of the Global Peaking Power Plant Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific has the biggest share of the peaking power plant market throughout the forecast period.

Get more details on this report -

Due to rising industrial zone expenditures, rapid urbanization, increased technological research and development for peaking power plant plans, and increased power grid infrastructure, Asia-Pacific leads the world market for peaking power plants. India is the world's third-largest energy consumer. The Ministry of Power reports that consumption is expected to climb further. In June 2023, the nation's peak demand reached a new high of 223 gigawatts (GW), up 3.4% from the greatest level in 2022. Trade in energy goods and equipment between India and other countries increased to $18.5 billion in 2022 from $14 billion in 2021. The nation's expanding energy demand as well as their dedication to clean energy cooperation are the main drivers of the rise.

The North America is fastest growing region during the projected timeframe.

Natural gas abundance, efforts to integrate renewable energy, and the increased emphasis on grid dependability are some of the factors influencing the market in North America, which includes the United States and Canada. The policies and regulations pertaining to the environment also influence the energy landscape. Technology developments have also improved the efficiency and environmental friendliness of peaking plants. Government and private sector investments have been drawn to this, which has accelerated regional market expansion. The E&U industry in the United States depends on about 1,000 peaker plants, the most of which run on natural gas, to satisfy sporadic spikes in the demand for electricity. According to recent reports1, in order to meet demand requirements in states like California, Texas, and Arizona, the E&U sector in the United States may need to add 20 GW of peaking capacity to the grid in the next ten years, with 60 percent of that capacity needing to be added between 2023 and 2027.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global peaking power plant market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TPSC (India) Pvt. Ltd.

- Voith

- Andritz

- ENGIE

- ABB Ltd.

- Wartsila

- General Electric

- MAN Energy Solutions

- Edina

- Gama Investment A.S

- Clarke Energy

- WSP

- APR Energy

- ENGIE

- Others

Key Market Developments

- In November 2023, Together, GE Vernova and Duke Energy are constructing the first peaker plant in the country powered only by green hydrogen, a major step forward in the development of sustainable energy solutions.

- In April 2023, In Worcestershire, Centrica Business Solutions is constructing a 20 MW gas-fired peaking plant that is intended to be hydrogen-ready as part of an expansion of its energy portfolio.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global peaking power plant market based on the below-mentioned segments:

Global Peaking Power Plant Market, By Type

- Natural Gas

- Hydropower

- Diesel

- Others

Global Peaking power plant Market, By Application

- Industrial

- Commercial

- Residential

- Utility

Global Peaking power plant Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global peaking power plant market over the forecast period?The global peaking power plant market size is expected to grow from USD 116.24 Billion in 2023 to USD 197.76 Billion by 2033, at a CAGR of 5.46% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global peaking power plant market?Asia-Pacific is projected to hold the largest share of the global peaking power plant market over the forecast period.

-

3.Who are the top key players in the peaking power plant market?TPSC (India) Pvt. Ltd, Voith, Andritz, ENGIE, ABB Ltd, Wartsila, General Electric, MAN Energy Solutions Edina, Gama Investment A.S, Clarke Energy, WSP, APR Energy, ENGIE, and Others.

Need help to buy this report?