Global Pecan Nuts Market Size, Share, and COVID-19 Impact Analysis, By Product Form (Whole Pecans [In-shell and Shelled], Pecan Pieces and Halves, Pecan Meal/Flour, Pecan Oil, Pecan Butter, Flavored and Processed Pecans), By Application (Bakeries, Ice Cream Makers, Mixed Nuts Companies, Dairy & Desserts Makers, Confectionery Manufacturers, Retail, Others), By Distribution Channel (B2B and B2C [Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Others]), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Pecan Nuts Market Insights Forecasts to 2033

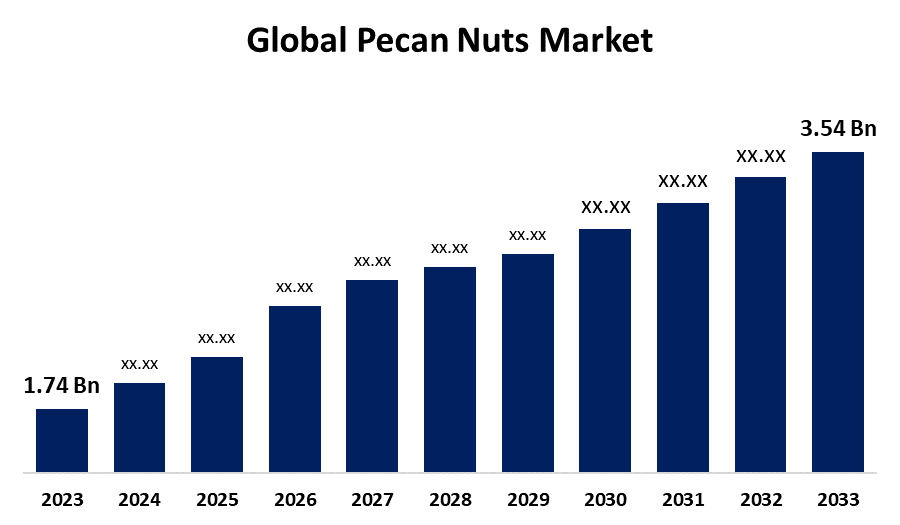

- The Global Pecan Nuts Market Size was estimated at USD 1.74 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 7.36% from 2023 to 2033

- The Worldwide Pecan Nuts Market Size is Expected to Reach USD 3.54 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Pecan Nuts Market Size was worth around USD 1.74 Billion in 2023 and is predicted to Grow to around USD 3.54 Billion by 2033 with a compound annual growth rate (CAGR) of 7.36% between 2023 and 2033. The pecan nuts market expansion is spurred by escalating consumer knowledge about the nut's nutritional value and its versatility across different food use cases. Indigenous to North America, pecans are becoming well-liked internationally as a fit healthy snack alternative and ingredient of many foodstuffs.

Market Overview

The pecan nuts market is described as the industry that engages in the production, processing, distribution, and retailing of pecan nuts. Pecan nuts are edible kernels extracted from the pecan tree (Carya illinoensis), which is chiefly cultivated in the southern part of the United States and some areas in Mexico. Pecan nuts contain high healthy fats, proteins, vitamins, and minerals, thus being a nice choice for health-oriented customers. The increasing demand for plant-based diets and natural, unprocessed foods further enhanced the demand for pecans. Additionally, the nut's distinct flavor has created greater use in a variety of products, including baked products and confectionery to cooked foods and plant milk alternatives. Moreover, the pecan industry has gained major technological enhancements in the cultivation, harvesting, and processing practices. These advancements have resulted in higher yields, improved quality nuts, and more efficient production. Additionally, the industry has been emphasizing sustainable agriculture and organic production to address the expanding consumer demand for environmentally friendly and chemical-free products.

Report Coverage

This research report categorizes the pecan nuts market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pecan nuts market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the pecan nuts market.

Global Pecan Nuts Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.74 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.36% |

| 2033 Value Projection: | USD 3.54 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Form, By Application, By Distribution Channel and By Region |

| Companies covered:: | Barry Callebaut, Suyog Food Products, Amercorp International, Carter Pecan (ARNCO Inc.), Ellis Bros. Pecans Inc., Global Commodities Exchange, Green Valley Pecan Company, Lamar Pecan Co., National Pecan Co., Nut Tree Pecan Co. (Cleaning Plant), Progressive Pecans Inc., Schermer Pecans Inc., South Georgia Pecan Company, and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Pecans contain a high content of healthy fats, protein, antioxidants, and fiber, and they are among the most sought-after nuts for health-conscious consumers. The heightened consciousness of the nutritional benefits of nuts, including the promotion of heart health, weight management, and overall nutrition, is also a factor in the rising demand for pecan nuts market. Additionally, the growing trend of vegetarian and plant-based diets and the shift toward natural, high-nutrient snacks increases the consumption of pecans as a healthy snack option fueling its demand.

Restraining Factor

The pecans nut market is competitive, with other common types such as almonds, cashews, and walnuts being readily available. These tend to be priced lower or have more stable supply chains, and they are used as substitutes for pecans, particularly in food production or snacking preventing pecans nuts market demand.

Market Segmentation

The pecan nuts market share is classified into product form, application, and distribution channel.

- The whole pecans segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product form, the pecan nuts market is divided into whole pecans, pecan pieces and halves, pecan meal/flour, pecan oil, pecan butter, and flavored and processed pecans. Among these, the whole pecans segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to whole pecans, shelled or in-shell, which are extremely in vogue for snacking and find widespread applications in baking and cooking. Pecans in-shell are preferred for their longer storage life, whereas shelled pecans are used for ease of use in recipes. They are preferred by those consumers who enjoy the freshness and versatility of whole nuts.

- The bakeries segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the pecan nuts market is divided into bakeries, ice cream makers, mixed nuts companies, dairy & desserts makers, confectionery manufacturers, retail, and others. Among these, the bakeries segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven by the pecan nuts are widely used in baked products as they are versatile and due to consumer preference for products based on pecans such as pies, cookies, and cakes. Increasing consumption of healthy, high-quality baked products containing nuts also drives this segment.

- The B2C segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the pecan nuts market is divided into B2B and B2C. Among these, The B2C segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to supermarkets and hypermarkets providing a high range of pecan products, ranging from raw nuts to flavored or processed variants, and engaging a wide population of consumers. Convenience, access, and range of products encourage high consumer purchases in these stores.

Regional Segment Analysis of the Pecan Nuts Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the pecan nuts market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the pecan nuts market over the predicted timeframe. The U.S. is the globe's number one producer of pecans, representing approximately 80% of global production. The Southwestern United States, Georgia, Texas, and New Mexico are dominant production areas. Pecans are widely used in American foods, especially in baking, and snacking, and even used in some savory dishes. The increasing trend towards healthy eating and the high use of pecans as a snack or ingredient for baked foods fuels aggressive demand.

Asia Pacific is expected to grow at a rapid CAGR in the pecan nuts market during the forecast period. In nations such as China and India, consumers are more and more embracing Western eating patterns, including eating more nuts and healthy snacks. Pecans are becoming more popular because of their nutritional value, with high amounts of healthy fats, antioxidants, and other compounds. The growth of e-commerce in the region is also making more access to imported items like pecans possible, accounting for the quick growth of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the pecan nuts market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barry Callebaut

- Suyog Food Products

- Amercorp International

- Carter Pecan (ARNCO Inc.)

- Ellis Bros. Pecans Inc.

- Global Commodities Exchange

- Green Valley Pecan Company

- Lamar Pecan Co.

- National Pecan Co.

- Nut Tree Pecan Co. (Cleaning Plant)

- Progressive Pecans Inc.

- Schermer Pecans Inc.

- South Georgia Pecan Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Kodiak, known for its high-protein, whole-grain breakfast products, and Zac Efron introduced a new Apple Brown Sugar Pecan Oatmeal, adding to the brand's breakfast line. The limited-edition, 100% whole-grain oatmeal will be available only at Walmart and will power consumers through a day of adventure.

- In January 2024, Pecana introduced Pecana PecanMilk this shelf-stable nut milk in Unsweetened and Vanilla varieties. Made with simple ingredients, a 32oz carton includes about 43 high-quality pecan halves, Himalayan Sea salt, and Tahitian vanilla extract. It is vegan, gluten-free, and Keto- and Paleo-friendly.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the pecan nuts market based on the below-mentioned segments:

Global Pecan Nuts Market, By Product Form

- Whole Pecans

- In-shell

- Shelled

- Pecan Pieces and Halves

- Pecan Meal/Flour

- Pecan Oil

- Pecan Butter

- Flavored and Processed Pecans

Global Pecan Nuts Market, By Application

- Bakeries

- Ice Cream Makers

- Mixed Nuts Companies

- Dairy & Desserts Makers

- Confectionery Manufacturers

- Retail

- Others

Global Pecan Nuts Market, By Distribution Channel

- B2B

- B2C

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Global Pecan Nuts Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the pecan nuts market over the forecast period?The global pecan nuts market is projected to expand at a CAGR of 7.36% during the forecast period.

-

2. What is the market size of the pecan nuts market?The global pecan nuts market size is expected to grow from USD 1.74 Billion in 2023 to USD 3.54 Billion by 2033, at a CAGR of 7.36% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the pecan nuts market?North America is anticipated to hold the largest share of the pecan nuts market over the predicted timeframe.

Need help to buy this report?