Global Pension Funds Market Size, Share, and COVID-19 Impact Analysis, By Type of Pension Plan (Defined Benefit, Defined Contribution, Reserved Fund, and Hybrid), By End-User (Government, Corporate, Individuals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Pension Funds Market Insights Forecasts to 2033

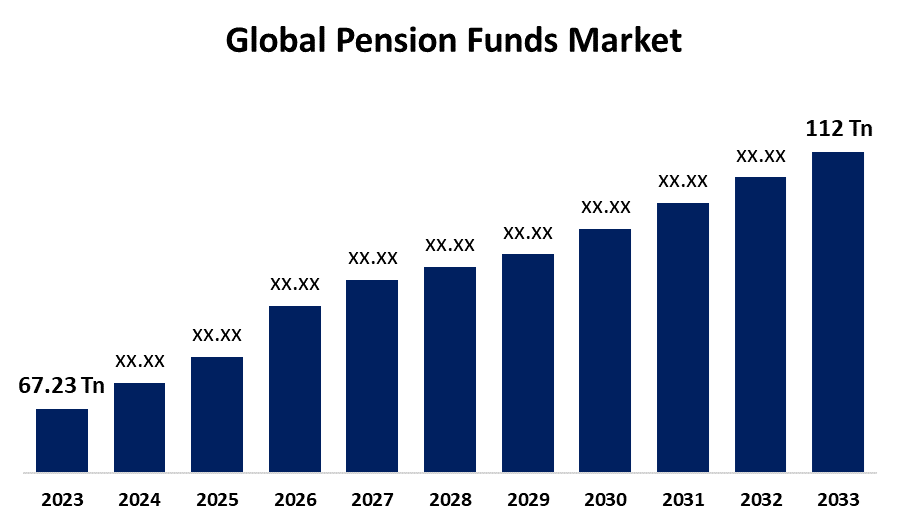

- The Global Pension Funds Market Size was Valued at USD 67.23 Trillion in 2023

- The Market Size is Growing at a CAGR of 5.24% from 2023 to 2033

- The Worldwide Pension Funds Market Size is Expected to Reach USD 112 Trillion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Pension Funds Market Size is Anticipated to Exceed USD 112 Trillion by 2033, Growing at a CAGR of 5.24% from 2023 to 2033.

Market Overview

Pension funds are defined as investment pools that collect, manage, and invest contributions for retirement benefits. They play a crucial role in ensuring long-term financial stability for millions of retirees around the world. The main goal of a pension fund is to ensure that there's enough money to cover employee pensions after they retire. Key benefits of pension funds include risk management through diversification, professional management, and regular income post-retirement.

There are two main types of pension plans: defined benefit and defined contribution. Defined-benefit plans guarantee retirees a specific monthly payment based on earnings and years of service, with the employer covering any shortfall. Defined-contribution plans involve employee contributions, possibly matched by the employer, with retirement benefits depending on investment performance and no further employer liability once the contribution is made. The 401(k) retirement plan is a popular example of a defined contribution plan. There are several opportunities in the pension funds market, especially in emerging economies, as they are witnessing rapid economic growth and urbanization.

Report Coverage

This research report categorizes the market for the global pension funds market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global pension funds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global pension funds market.

Global Pension Funds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 67.23 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.24% |

| 2033 Value Projection: | USD 112 Trillion |

| Historical Data for: | 2020-2022 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By End-User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Wells Fargo, Bank of America Corporation, JPMorgan Chase & Co., Deutsche Bank AG, BNP Paribas, UBS, State Street Corporation, BlackRock, The Vanguard Group, State Street Global, Fidelity Investments, BNY Mellon, Legal & General Investment, Wellington Management, and Other Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global pension funds market is fuelled by several factors. There is a rise in the aging population in many parts of the world. As the number of retirees increases, so does the demand for pension schemes that ensure financial security post-retirement. Furthermore, increasing awareness about the necessity of financial planning for the future has led to greater participation in pension schemes, with individuals seeking reliable and professional fund management.

Regulatory reforms across various countries are also playing a significant role. Governments are implementing policies to encourage savings and investment in pension funds, creating a more supportive environment for market expansion. Additionally, rapid economic growth, especially in emerging markets, is leading to higher disposable incomes, which in turn facilitates more pension contributions. The adoption of new technology, such as automation and artificial intelligence in fund management, is enhancing operational efficiency and customer service.

Restraining Factors

Some of the challenges anticipated to restrain the growth of the global pension funds market include market volatility, as fluctuations can adversely affect pension fund performance and investment returns. Prolonged low interest rates also pose challenges, as they limit the income-generating potential of pension fund investments. Additionally, the regulations in some regions is complex, making compliance burdensome and costly for pension funds. Demographic shifts, such as the increasing ratio of retirees to active contributors, can strain pension systems, leading to funding shortfalls. These factors necessitate strategic fund management, accurate predictions, and innovation to ensure sustainable growth in the pension funds market.

Market Segmentation

The global pension funds market share is classified into type of pension plan and end-user.

- The defined contribution plan segment is expected to hold the largest share of the global pension funds market during the forecast period.

Based on the type of pension plan, the global pension funds market is divided into defined benefit, defined contribution, reserved fund, and hybrid. Among these, the defined contribution plan segment is expected to hold the largest share of the global pension funds market during the forecast period. These plans are preferred as they offer flexibility and lower financial burden on employers, as contributions are defined but benefits are not guaranteed, shifting investment risk to the employees. The portability of these plans, allowing employees to transfer their accumulated funds when changing jobs, further enhances their appeal. Moreover, the increasing shift towards individual responsibility for retirement planning has boosted the adoption of defined contribution plans. Employers favor these plans as they provide predictable costs, while employees appreciate the control and potential for higher returns through personalized investment choices. These advantages solidify the position of defined contribution plans as the largest segment in the pension funds market.

- The government segment is expected to hold the largest share of the global pension funds market during the forecast period.

Based on end-users, the global pension funds market is divided into government, corporate, and individuals. Among these, the government segment is expected to hold the largest share of the global pension funds market during the forecast period. Government pension funds are typically extensive due to mandatory participation by public sector employees and the substantial number of beneficiaries they cover. These funds often provide defined benefit plans, which guarantee fixed retirement benefits, thereby ensuring financial security for government employees. The stability and reliability of government pensions, backed by public finances and long-term funding strategies, make them a cornerstone of the pension landscape. Additionally, governments globally prioritize social welfare, ensuring that these pension plans are well-funded and managed to meet the needs of retirees. This focus on financial security and broad coverage underpins the dominance of the government segment in the pension funds market.

Regional Segment Analysis of the Global Pension Funds Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global pension funds market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global pension funds market over the predicted timeframe. The presence of a mature and sophisticated financial infrastructure ensures efficient management and investment of pension funds. The regulatory environment in countries like the United States and Canada is robust, providing a strong framework for pension fund operations. Moreover, the high-income levels and savings among the working population contribute to substantial pension fund contributions. Additionally, North America has several corporate and public sector pension plans, with large-scale participation and large sums of assets under management. The aging population in this region drives the demand for well-structured pension schemes to ensure financial security in retirement. Technological advancements in fund management are also enhancing the efficiency and appeal of pension plans in the region.

Asia-Pacific is expected to grow at the fastest pace in the global pension funds market during the forecast period. This rapid growth is due to several factors, including robust economic development in countries such as China, India, Japan, and South Korea. Rising disposable incomes are enabling a higher collection of pension schemes. Furthermore, governments in the region are actively implementing policies to encourage retirement savings and improve the structure of pension systems. The growing awareness of financial planning for retirement, and a young and expanding workforce, further boosts market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global pension funds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wells Fargo

- Bank of America Corporation

- JPMorgan Chase & Co.

- Deutsche Bank AG

- BNP Paribas

- UBS

- State Street Corporation

- BlackRock

- The Vanguard Group

- State Street Global

- Fidelity Investments

- BNY Mellon

- Legal & General Investment

- Wellington Management

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Funds managed by Blackstone, along with the Canada Pension Plan Investment Board (“CPP Investments”), entered into a definitive agreement to acquire AirTrunk, the leading Asia Pacific data center platform, from Macquarie Asset Management and the Public Sector Pension Investment Board, for an implied enterprise value of over A$24 billion.

- In August 2024, the South Korean President pledged urgent reform of the national pension fund, one of the world's largest with $860 billion of assets, making it more equitable and ensuring income security for the aging population.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global pension funds market based on the below-mentioned segments:

Global Pension Funds Market, By Type of Pension Plan

- Defined Benefit

- Defined Contribution

- Reserved Fund

- Hybrid

Global Pension Funds Market, By End-User

- Government

- Corporate

- Individuals

Global Pension Funds Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Wells Fargo, Bank of America Corporation, JPMorgan Chase & Co., Deutsche Bank AG, BNP Paribas, UBS, State Street Corporation, BlackRock, The Vanguard Group, State Street Global, Fidelity Investments, BNY Mellon, Legal & General Investment, Wellington Management, and Others.

-

2. What is the size of the global pension funds market?The Global Pension Funds Market is expected to grow from USD 67.23 Trillion in 2023 to USD 112 Trillion by 2033, at a CAGR of 5.24% during the forecast period 2023-2033

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global pension funds market over the predicted timeframe.

Need help to buy this report?