Global Performance Bank Guarantee Market Size, Share, and COVID-19 Impact Analysis, By Type (Tender Guarantee, Financial Guarantee, Advance Payment Guarantee, Foreign Bank Guarantee, and Others), By Application (Small and Medium Enterprise, Large Enterprise, and Others), By Service Deployment (Online, and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Performance Bank Guarantee Market Insights Forecasts to 2033

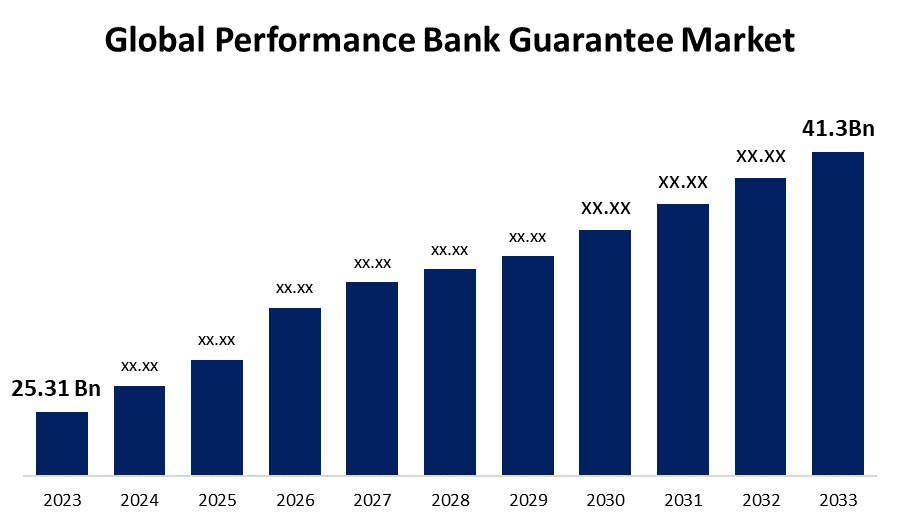

- The Global Performance Bank Guarantee Market Size was Valued at USD 25.31 Billion in 2023

- The Market Size is Growing at a CAGR of 5.02% from 2023 to 2033

- The Worldwide Performance Bank Guarantee Market Size is Expected to Reach USD 41.3 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Performance Bank Guarantee Market Size is Anticipated to Exceed USD 41.3 Billion by 2033, Growing at a CAGR of 5.02% from 2023 to 2033.

Market Overview

A performance bank guarantee (PBG) is a financial instrument provided by a bank on behalf of the contractor or supplier to assure the client or beneficiary, that the contractor will perform contractual responsibilities as specified in the contract.

If a contractor fails to fulfill these obligations, the client can claim compensation from the bank up to the amount specified in the guarantee. The performance bank guarantee offers several benefits like risk mitigation, enhancing trust and credibility, and acting as a financial barrier, ensuring only financially stable companies can engage in large projects. It is widely used in industries involving high-value contracts, such as construction and manufacturing projects, with market dynamics influenced by economic conditions, industry regulations, and the financial health of the contracting companies and banks.

The global performance bank guarantee is an essential part of the international finance sector. They are widely known for providing security to domestic and international business transactions, building trust, and facilitating smoother commercial operations. Developing countries are witnessing a rise in foreign direct investments, creating many opportunities for market growth. The market trends indicate rapid industrialization and infrastructural developments, leading to a rise in demand for PGBs.

Report Coverage

This research report categorizes the market for the global performance bank guarantee market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global performance bank guarantee market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global performance bank guarantee market.

Global Performance Bank Guarantee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.31 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.02% |

| 2033 Value Projection: | USD 41.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 289 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Service Deployment, By Region |

| Companies covered:: | Goldman Sachs, United Overseas Bank Limited, Macquarie Group Limited, Barclays, HDFC Bank Ltd, Citigroup, Federal Bank, Wells Fargo & Company, Standard Chartered, HSBC Group, JPMorgan Chase & Co, UBS Group AG, Deutsche Bank, Bank of America, DBS Bank, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The global performance bank guarantee market is driven by the increasing infrastructure development projects across the globe, as large-scale and long-term construction and manufacturing contracts require robust financial guarantees. The rise in international trade and globalization have increased the need for performance bank guarantees for risk mitigation of cross-border transactions.

Supportive government policies and regulations boosting investment and international trade are fueling market growth as businesses try to protect their time and financial investment and ensure compliance with obligations in contracts. The demand for performance bank guarantees is rising, driving the overall market growth and creating new opportunities for financial firms and PGB service providers.

Restraining Factors

Some challenges anticipated to restrain the global performance bank guarantee market include high fees and long processing time associated with obtaining performance guarantees. Furthermore, economic uncertainty and financial instability can reduce demand for guarantees as companies reduce their foreign investments and trades. The complex documentation and approval processes require lengthy correspondence, demotivating some businesses from using these financial instruments. Regulatory requirements remain a major barrier, adding layers of compliance and restraining market growth.

Market Segmentation

The global performance bank guarantee market share is classified into type, application, and service deployment.

- The tender guarantee segment is expected to hold the largest share of the global performance bank guarantee market during the forecast period.

Based on the type, the global performance bank guarantee market is divided into tender guarantee, financial guarantee, advance payment guarantee, foreign bank guarantee, and others. Among these, the tender guarantee segment is expected to hold the largest share of the global performance bank guarantee market during the forecast period. Tender guarantees are essential in public procurement and large-scale infrastructure projects where significant financial investments are at stake. Tender guarantees are also known as bid bonds. Contractors apply and participate in government and major corporate projects, assuring the bidder will execute the contract if awarded. It minimizes the financial risk of project owners, as only serious and financially capable bidders would participate in the bidding process. The rise of public sector projects and strict regulations for bidding processes also boost the demand for tender guarantees. Their ability to build trust and financial security in high-value transactions positions tender guarantees as the leading segment of the global performance bank guarantee market.

- The large enterprise segment is expected to hold the largest share of the global performance bank guarantee market during the forecast period.

Based on application, the global performance bank guarantee market is divided into small and medium enterprise, large enterprise, and others. Among these, the large enterprise segment is expected to hold the largest share of the global performance bank guarantee market during the forecast period. Large enterprises are involved in projects that require dependable financial assurances, making performance bank guarantees vital for their operations. These organizations engage in complex and high-value transactions, which necessitates the use of robust risk mitigation financial tools. Additionally, large enterprises generally have the strength to bear the costs and meet the strict regulations associated with obtaining performance guarantees. These financial instruments help them secure the supply chain, ensure compliance in international trade, and minimize risks involved in large-scale projects.

- The online segment is expected to grow at the fastest CAGR in the global performance bank guarantee market during the forecast period.

Based on service deployment, the global performance bank guarantee market is divided into online, and offline. Among these, the online is expected to grow at the fastest CAGR in the global performance bank guarantee market during the forecast period. There is a rapid shift towards online platforms due to the rapid digitization of financial services and the adoption of new technologies. Online deployment offers advantages like better accessibility, low processing time, and more transparency, which appeal to businesses and financial institutions. The convenience of digital platforms enables companies to manage guarantees remotely, reducing administrative burdens and costs. The growing use of secure online portals for submitting and tracking performance bank guarantees is more beneficial for small and medium-sized enterprises (SMEs), who might not have used the services previously due to the complexity and high cost of offline processes.

Regional Segment Analysis of the Global Performance Bank Guarantee Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

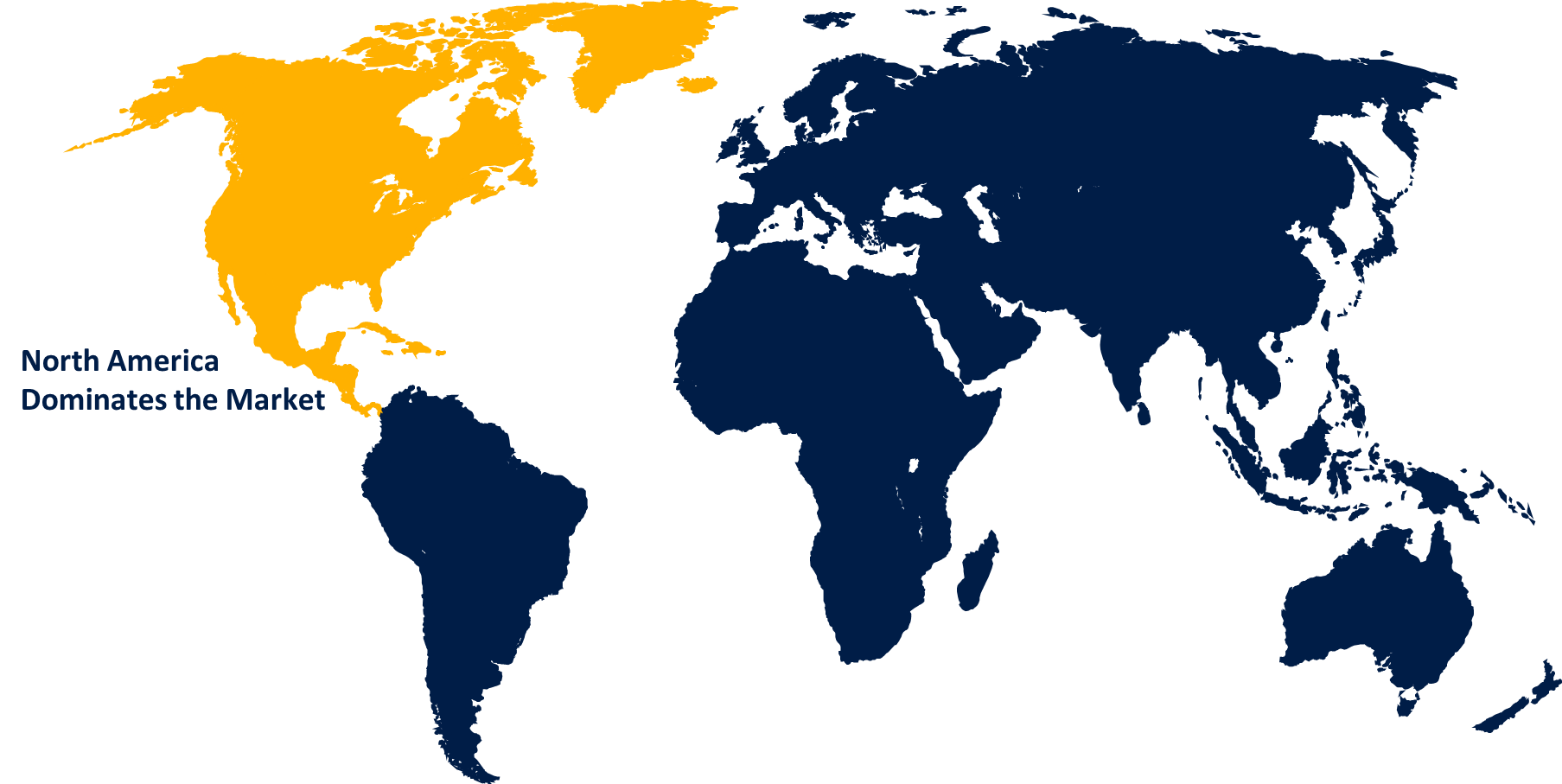

North America is anticipated to hold the largest share of the global performance bank guarantee market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global performance bank guarantee market over the predicted timeframe. The presence of key market players who frequently require performance guarantees and the well-established financial infrastructure boosts the segmental growth. The United States drives the regional market due to its financially strong economy and domestic and international trade. The tech and manufacturing industry needs continuous investments, fuelling the demand for performance bank guarantees. Also, regulatory frameworks in the region are favorable for the issuance and enforcement of these guarantees. The advanced technological adoption in the financial sector improves the efficiency and accessibility of performance guarantees, solidifying North America's leading position in the market.

Asia-Pacific is expected to grow at the fastest pace in the global performance bank guarantee market during the forecast period. This rapid growth is driven by the accelerating foreign trade, exports, and rise in foreign investments in the region, particularly in rapidly developing countries like India, China, and Japan. The increase in foreign direct investments and the manufacturing and construction activities create a healthy environment for performance guarantees. Furthermore, the region's growing small and medium-sized enterprises (SMEs) benefit from supportive government policies and easier access to premium financial services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global performance bank guarantee market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Goldman Sachs

- United Overseas Bank Limited

- Macquarie Group Limited

- Barclays

- HDFC Bank Ltd

- Citigroup

- Federal Bank

- Wells Fargo & Company

- Standard Chartered

- HSBC Group

- JPMorgan Chase & Co

- UBS Group AG

- Deutsche Bank

- Bank of America

- DBS Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, the Delhi High Court bench of Justice Rajiv Shakdher and Justice Amit Bansal held that a force majeure event specifically an Act of God beyond the control of the concerned party doesn't require retention of performance bank guarantee.

- In February 2023, Public sector Indian Overseas Bank launched the facility of issuance of e-BG (Electronic Bank Guarantee) scheme in association with the National e-Governance Services Ltd.

- In January 2023, India’s largest lender State Bank of India (SBI), launched e-Bank Guarantee (e-BG) facility by joining hands with National e-Governance Services Limited (NeSL). With the advent of e-BG, this function is replaced by e-stamping and e-signature.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global performance bank guarantee market based on the below-mentioned segments:

Global Performance Bank Guarantee Market, By Application

- Small and Medium Enterprise

- Large Enterprise

- Others

Global Performance Bank Guarantee Market, By Type

- Tender Guarantee

- Financial Guarantee

- Advance Payment Guarantee

- Foreign Bank Guarantee

- Others

Global Performance Bank Guarantee Market, By Service Deployment

- Online

- Offline

Global Performance Bank Guarantee Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?