Global Perovskite Solar Cell Market Size, Share, and COVID-19 Impact Analysis, By Structure Type (Planar Perovskite Solar Cells and Mesoporous Perovskite Solar Cells), By Product Type (Rigid Perovskite Solar Cells and Flexible Perovskite Solar Cells), By Method (Solution Method, Vapor-Deposition Method, and Vapor-Assisted Solution Method), By End-User (Aerospace, Industrial Automation, Consumer Electronics, Energy, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Energy & PowerGlobal Perovskite Solar Cell Market Insights Forecasts to 2032

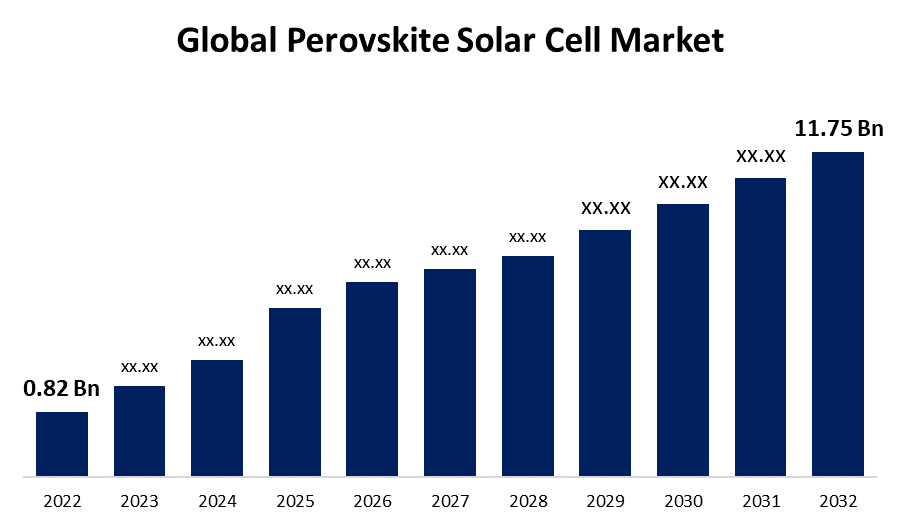

- The Global Perovskite Solar Cell Market was valued at USD 0.82 Billion in 2022.

- The Market is growing at a CAGR of 30.5% from 2023 to 2032

- The Worldwide Perovskite Solar Cell Market is expected to reach USD 11.75 Billion by 2032

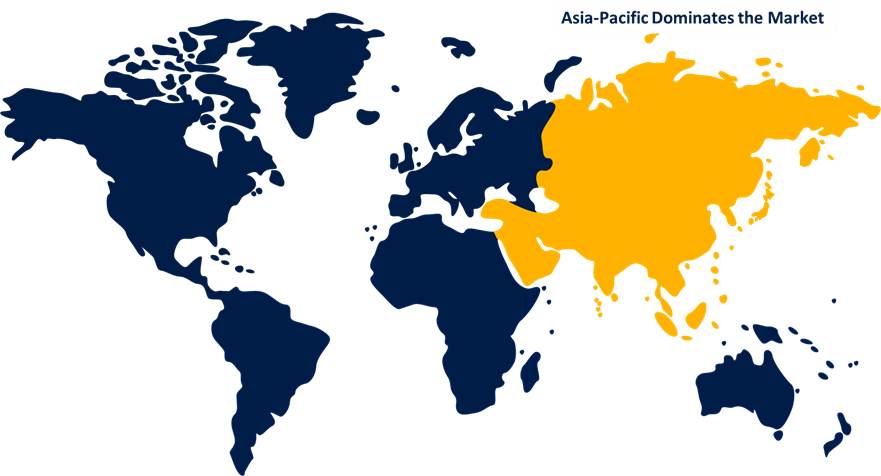

- Asia-Pacific is expected to have the highest growth during the forecast period

Get more details on this report -

The Global Perovskite Solar Cell Market is expected to reach USD 11.75 Billion by 2032, at a CAGR of 30.5% during the forecast period 2022 to 2032.

Market Overview

Perovskite solar cells are a rapidly emerging class of photovoltaic devices that have gained significant attention in recent years. They are named after the perovskite crystal structure, which consists of a hybrid organic-inorganic lead halide material. These solar cells have garnered interest due to their remarkable properties, including high power conversion efficiency and low fabrication costs. Perovskite solar cells can be easily synthesized using low-temperature solution-based methods, making them a promising alternative to conventional silicon-based solar cells. They exhibit a broad absorption spectrum, allowing them to capture a larger portion of the solar spectrum. Furthermore, perovskite materials possess excellent charge transport properties, enabling efficient conversion of sunlight into electricity. Despite their potential, perovskite solar cells face challenges such as stability issues, particularly in the presence of moisture and heat. Researchers are actively working to address these limitations and improve the long-term reliability of these devices.

Report Coverage

This research report categorizes the market for perovskite solar cell market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the perovskite solar cell market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the perovskite solar cell market.

Global Perovskite Solar Cell Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 0.82 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 30.5% |

| 022 – 2032 Value Projection: | USD 11.75 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Structure Type, By Product Type, By Method, By End-User and By Region. |

| Companies covered:: | Hanwha Q CELLS, CubicPV, EneCoat Technologies, Microquanta Semiconductor, Greatcell Energy, Oxford PV, P3C, PEROVSKIA SOLAR AG, Saule Technologies., Xiamen Weihua Solar Co. Ltd. and FlexLink Systems Inc,. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The perovskite solar cell market is being driven by several key factors due to their high-power conversion efficiency is a major driver. Perovskite solar cells have demonstrated the ability to achieve efficiencies comparable to or even surpassing traditional silicon-based solar cells. This efficiency advantage makes them an attractive option for renewable energy generation. The low fabrication costs of perovskite solar cells contribute to their market growth. The manufacturing processes for these cells are relatively simple and can be carried out at lower temperatures, reducing production expenses compared to silicon-based alternatives. This cost advantage has the potential to make perovskite solar cells more accessible and commercially competitive. The versatility of perovskite materials is driving innovation in the market. Perovskite solar cells can be synthesized using different compositions and structures, enabling customization for specific applications and allowing for the development of flexible and transparent solar cells. This versatility expands the potential market opportunities for perovskite solar cells. Overall, the increasing global focus on renewable energy and the need for sustainable power sources are driving the adoption of perovskite solar cells. Governments and industries worldwide are actively seeking clean energy solutions, and perovskite solar cells offer a promising avenue for meeting these goals.

Restraining Factors

The perovskite solar cell market faces several restraints that hinder its widespread adoption. The stability and durability of perovskite materials remain a significant challenge. They are prone to degradation when exposed to moisture, heat, and light, limiting their long-term performance and reliability. The scalability of perovskite solar cell production is a concern. While low-temperature solution-based fabrication methods are cost-effective, scaling up to mass production levels without compromising quality and efficiency is a complex task. Overall, the regulatory framework and standards for perovskite solar cells are still evolving, creating uncertainty for investors and manufacturers. Addressing these restraints through ongoing research and development efforts is crucial for the successful commercialization and widespread adoption of perovskite solar cells.

Market Segmentation

- In 2022, the planar perovskite solar cells segment accounted for around 55.8% market share

On the basis of the structure type, the global perovskite solar cell market is segmented into planar perovskite solar cells and mesoporous perovskite solar cells. Planar perovskite solar cells have emerged as the leading technology, holding the largest market share in the industry. This can be attributed to several factors due to the planar perovskite solar cells offer simpler device architecture and fabrication processes compared to their counterparts, making them more commercially viable. The advancements in material engineering and device optimization have significantly improved their power conversion efficiency. Additionally, planar perovskite solar cells exhibit enhanced stability and durability, addressing concerns about the long-term performance of perovskite materials. The combination of these factors has propelled planar perovskite solar cells to the forefront, making them the preferred choice for various applications in the renewable energy sector.

- In 2022, the vapor-deposition method segment dominated with more than 47.1% market share

Based on the type of method, the global perovskite solar cell market is segmented into solution method, vapor-deposition method, and vapor-assisted solution method. The vapor-deposition method segment has established its dominance in the perovskite solar cell market by capturing the largest market share. This can be attributed to several key factors because the vapor-deposition method offers precise control over the deposition process, enabling uniform and high-quality perovskite film formation. This leads to enhanced device performance and efficiency. The vapor deposition techniques such as thermal evaporation and sputtering facilitate the deposition of perovskite layers on a wide range of substrates, including flexible and rigid materials. This versatility expands the potential applications of perovskite solar cells. Additionally, vapor deposition methods enable scalability and large-scale production, making them suitable for commercial manufacturing. The robustness and reproducibility of the vapor deposition process further contribute to its dominance in the market. As a result, it continues to be the preferred method for fabricating perovskite solar cells.

Regional Segment Analysis of the Perovskite Solar Cell Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific held the largest market with more than 45.2% revenue share in 2022.

Get more details on this report -

Asia-Pacific currently holds the largest market share in the perovskite solar cell industry for several reasons because the region has a robust and expanding solar energy market, driven by countries such as China, Japan, and South Korea. These nations have made significant investments in renewable energy infrastructure and have implemented favorable policies and incentives to promote the adoption of solar technologies. Asia-Pacific has a large population and growing energy demand, creating a substantial market for clean and sustainable energy solutions. Perovskite solar cells offer a promising alternative due to their high efficiency and potential for low-cost production. Furthermore, the region's strong manufacturing capabilities and technological expertise provide a competitive advantage in the production and deployment of perovskite solar cells. The presence of established supply chains and a skilled workforce further supports the growth of the market in Asia-Pacific.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global perovskite solar cell market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Hanwha Q CELLS

- CubicPV

- EneCoat Technologies

- Microquanta Semiconductor

- Greatcell Energy

- Oxford PV

- P3C

- PEROVSKIA SOLAR AG

- Saule Technologies.

- Xiamen Weihua Solar Co. Ltd

- FlexLink Systems Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, Microquanta Semiconductor has recently unveiled plans to construct a perovskite solar power plant in Quzhou, located in Zhejiang Province, China. Spanning an area of 250 acres, this solar facility is expected to have a capacity of 12 MW.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global perovskite solar cell market based on the below-mentioned segments:

Perovskite Solar Cell Market, By Structure Type

- Planar Perovskite Solar Cell

- Mesoporous Solar Cell - Better Efficiency

Perovskite Solar Cell Market, By Product Type

- Rigid Perovskite Solar Cell - Better Efficiency

- Flexible Perovskite Solar Cell

Perovskite Solar Cell Market, By Method

- Solution Method

- Vapor-Deposition Method

- Vapor-Assisted Solution Method

Perovskite Solar Cell Market, By End-User

- Aerospace

- Industrial Automation

- Consumer Electronics

- Energy

- Others

Perovskite Solar Cell Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?